CLOV trade ideas

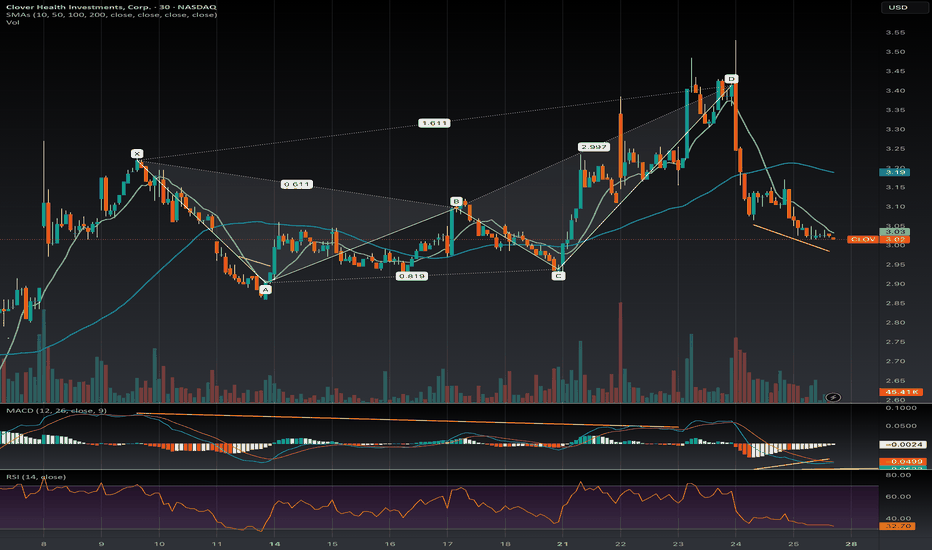

$CLOV Short Term Bearish Gartley NASDAQ:CLOV is forming a Bearish Gartley pattern with the D point projected at $3.10, nearing a potential reversal as of Monday, July 21, 2025. The RSI at 68.46 is close to overbought territory, adding support to the possibility of a bearish move if confirmed below $3.10. Keep an eye on a break below $3.10 with increased volume.

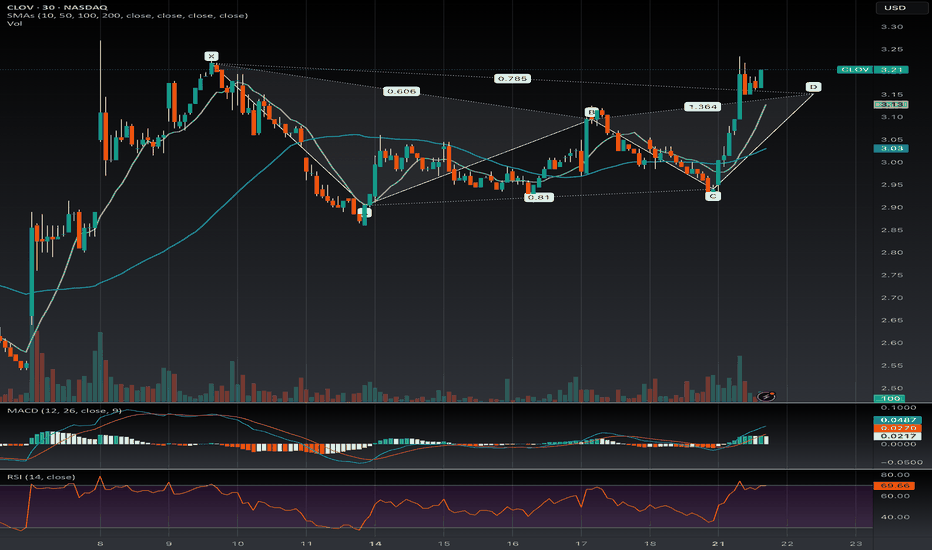

$CLOV - Bullish Divergence 30MClover has had strong downtrend movement on no news. Bullish divergence is forming on the 30M. If divergence confirms possible test of 50 SMA and consolidation before we see the next the next trend. Retail trader discovery of Counter Part Health's partnerships with Humana through subdomains could put a potential bottom and reverse the trend prior to earning. But will retail be enough to reverse course? Institutions want to see $2.20, $1.91

CLOV Clover Health Investments Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CLOV Clover Health Investments prior to the earnings report this week,

I would consider purchasing the 4usd strike price Calls with

an expiration date of 2026-1-16,

for a premium of approximately $1.42.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CLOV Long Trade Setup (30-Min Chart) !### 🚀 **📈🔥**

🔍 **Stock:** CLOV (NASDAQ)

⏳ **Timeframe:** 30-Min Chart

📈 **Setup Type:** Bullish Breakout

### 📍 **Trade Plan:**

✅ **Entry Zone:** **$4.30 - $4.39** (Breakout from Symmetrical Triangle)

🚀 **Take Profit 1 (TP1):** **$4.59** (Key Resistance)

🚀 **Take Profit 2 (TP2):** **$4.86+** (Extended Target if momentum continues)

🔻 **Stop-Loss (SL):** **$4.23** (Below trendline support for risk control)

📊 **Risk-Reward Ratio:** Favorable for a bullish continuation 📉📈

---

### 🔹 **Technical Analysis & Setup:**

✅ **Pattern:** **Symmetrical Triangle Breakout** 📈

✅ **Support Zone:** Strong buyer interest around **$4.30 - $4.39 (Yellow Zone)**

✅ **Breakout Confirmation Needed:** Price should hold above $4.39 with strong volume

✅ **Momentum Shift Expected:** Breakout above resistance signals **potential trend continuation**

---

### 🔥 **Trade Strategy & Refinements:**

📊 **Volume Confirmation:** Look for **increased buying volume** above $4.39 📈

📉 **Trailing Stop Strategy:** Once price reaches **TP1 ($4.59), adjust SL higher** to lock in profits

💰 **Partial Profit Booking:** Take **partial profits at TP1** and let the rest ride towards **TP2 ($4.86+)**

⚠️ **Watch for Fake Breakouts:** If price **falls below $4.30**, reconsider the setup

---

### 🚀 **Final Thoughts:**

✅ **Bullish Continuation Expected – High probability of breakout** 📈

✅ **Strong Support at $4.30 - $4.39 – Ideal entry for risk-reward optimization** 💰

✅ **Momentum Shift Possible – A push above $4.59 could drive CLOV to $4.86+** 🚀

📊 **Trade Smart & Stick to Your Plan!** 🏆🔥

Would you like any refinements or additional insights? 🚀📈

---

### 🔗 **Hashtags for Engagement:**

#LongTrade #StockTrading #CLOV #TechnicalAnalysis #DayTrading #SwingTrading #MomentumTrading #ChartPatterns #PriceAction #BullishBreakout #TradeSetup #StockCharts #TradingView #StockSignals #TradingPlan #MarketAnalysis #RiskReward #SupportAndResistance #ProfitToPath #TradeSmart #WealthBuilding #TradingSuccess

CLOV Trade Setup – Key Levels! 📊

SL (Stop-Loss): $4.49 🔴

Entry: $4.67 🟡

T1 (Target 1): $4.89 🟢

T2 (Target 2): $5.13 🟢

👉 Watch for breakout confirmation with volume and manage your risk! 💹

#CLOV #StockTrading #TechnicalAnalysis #BreakoutTrade #SupportAndResistance #TradingStrategy #StockMarket #SwingTrading #ChartPatterns #DayTrading #RiskManagement #MarketAnalysis

CLOV Trade Setup: Entry at $3.05, SL at $2.96!This chart highlights a CLOV trade setup on the 30-minute timeframe. The entry point is at $3.05, with a stop-loss (SL) set at $2.96 to manage risk. The setup targets a potential breakout above the descending trendline, aiming to test key resistance levels:

Target 1 (T1): $3.14

Target 2 (T2): $3.25

The strategy ensures a favorable risk-to-reward ratio while capitalizing on potential upward momentum. This setup focuses on technical analysis for precise entry and exit points.

CLOV Clover Health Investments Options Ahead of EarningsAnalyzing the options chain and the chart patterns of CLOV Clover Health Investments prior to the earnings report this week,

I would consider purchasing the 5usd strike price Calls with

an expiration date of 2025-1-17,

for a premium of approximately $0.51.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

CLOV $6.85Clover with a GAP at 6.85 for long term investing. Counting that in August the company was finally profitable for the first time after being public. I see a lot of potential for the upside. I feel like a $5-6 for now value all the way up to $10 around same time by next year. Slowly but surely going up until finally noticed.

CLOV - Potential escalating AI driven healthcare companyClover Health Investments Corp is a healthcare technology company. It focuses on empowering Medicare physicians to proactively manage chronic diseases through its proprietary software platform, Clover Assistant. This cloud-based solution provides personalized insights to physicians, enabling early detection and management of chronic conditions. Operating in two segments, Insurance and Non-Insurance, Clover Health offers PPO and HMO plans to Medicare Advantage members in multiple states through its Insurance segment. In the Non-Insurance segment, the company participates in the ACO REACH Model. The majority of revenue is generated from the insurance segment, reflecting the significance of its healthcare insurance offerings.

Clover Health (NASDAQ:CLOV) is a healthcare company that provides Medicare Advantage insurance plans and operates as a direct contracting entity of the US government. Yahoo Finance! reports three analysts covering the stock with one buy rating and two hold ratings for July 2024.

CLOV reported very strong financials for Q2 2024. While revenue grew by 7%, the net profit margin grew by 75.33%. Moreover, this quarter marks the first quarter of positive net income for the company. As a result of such good earnings, management has improved full-year guidance. The level of improvement is best seen through EBITDA projections. Originally, EBITDA guidance was between a $20 million loss and gain; now, it is between $50 and $65 million.

The company has developed Clover Assistant, an AI assistant SaaS. The assistant is meant to serve as a clinical decision-making tool for payers and providers based on the patient’s medical and financial data. Furthermore, the assistant tool allows CLOV to expand in areas that Medicare Advantage doesn’t reach. It also has the potential for one-on-one use with Medicare Advantage patients as a recurring revenue stream on a use-by-use basis. Developments with AI and an improving financial outlook make CLOV one of the healthcare stocks for investors to consider.

Recent Insider Buy of 531,700 shares worth over 1M

AI driven healthcare insurance platform

We've recently witnessed a significant overextended breakout, and there's potential for a pullback to the 2.20-2.30 zone, which could present an ideal entry point. If this pullback occurs, and we observe insiders increasing their share purchases at these levels again, it would strongly reinforce the validity of this entry strategy.

Breakout Zone: $3.50 - 3.80

Action: If the stock breaks above this area with strong volume, it might signal a continuation of the upward trend.

Overall Market Sentiment:

Currently, the market seems to be in a correction phase. It’s crucial to consider this sentiment when making trading decisions.

Resistance Points:

$3.50

$3.80

$4.40

$5.20

Surpassing these levels could signal a positive trend. Consider taking profits at these stages to realize gains.

Trading Strategy:

Take Profit (TP): Set a target at $6.50 (This could be just the beginning of an extraordinary journey ahead.)

Stop Loss (SL): Set at under $1.90 to mitigate potential losses.

Chart Analysis:

Please refer to the attached chart for detailed analysis of price trends and movements.

Trading Advisory:

Exercise caution and consider market conditions and your own risk tolerance when trading. It's advisable to conduct comprehensive research or consult with a financial advisor before engaging in trading activities.

Disclaimer: This content is for informational purposes only and should not be considered financial advice.

Clover Health StudyClover Health Study shows a potential upside gain based on the Fibonacci principals that look to keep reasonable positive success for entry and exit levels.

So if you are even 66% correct - you will win 66% - but unless you do not have time - HOLD & Wait, as you will win.

Every time you Sell You Destroy your Capital.

Use Stop Losses to preserve your Capital.

Do not rush into an Investment - watch and observe.

Do not Day Trade. Day traders cannot see the long term trend and often loose in my opinion.

Also timing the low entry points on an investment is even difficult for the professionals - so forget getting that right.

Slow but Dollar Averaging does work when you study the market and trends you will win.

Keep learning and Invested.

Regards Graham.

Thoughts - Studies - Idea's are welcome.