CLSK trade ideas

$CLSK / 2hThe expected decline by 30% in wave (c) of ((y)) may have started its way down today, and it would be tracing out in a five-wave sequence over couple of weeks ahead.

NASDAQ:CLSK 's initial target remains intact >> 6.27

>> The ultimate target would be around 5.92.

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hEventually All Waves Settle!!

CleanSpark might well conclude the entire correction in its wave B, on converging the Fibonacci levels ( level 1.38 where wave B would retrace to 1.38 of the expanding diagonal wave A and level 1 on the Fib channel ).

So, further decline by 30% would likely lie ahead over couple of the weeks.

NASDAQ:CLSK 's initial target remains intact >> 6.27

The Ultimate Target >> 5.92

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 2hCleanSpark ended the week by continue to decline that should have started in middle of the week. As illustrated on the chart above, further decline by 15% is expected now, that it will be taking time in couple of weeks ahead. And the final Fib-expansion target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 2hCleanSpark worked the week in sideways so far. The nine-wave triangle in wave (b) still remains in very late stage.

Today Its wave ((D)) of the ongoing triangle wave e has fallen, and expected its wave ((E)) of e to go its way up tomorrow.

( the labels in two degrees that mentioned above not shown on this frame.)

Note >> According to the prior NASDAQ:CLSK 's analysis on the same frame, the triangle pattern as wave (b) protracted into a nine waves triangle, which in sub-wave e should have developed itself in a triangle pattern.

Finally, the following decline by 23% would lie ahead >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 2hAs illustrated on the 2h-frame above, CleanSpark seems to have remained yet in process of the correction in wave (b).

Technically, the triangle pattern as wave (b) may protracts into a nine waves triangle, which in sub-wave e might be developed itself in a triangle.

The following decline by 20% would likely lie ahead >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hCleanSpark seems to have poised for further decline by 17% in ongoing wave (c), as illustrated on this 4h-frame above.

NASDAQ:CLSK might well conclude the entire correction in its wave B, on converging the

Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ). And the ultimate target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

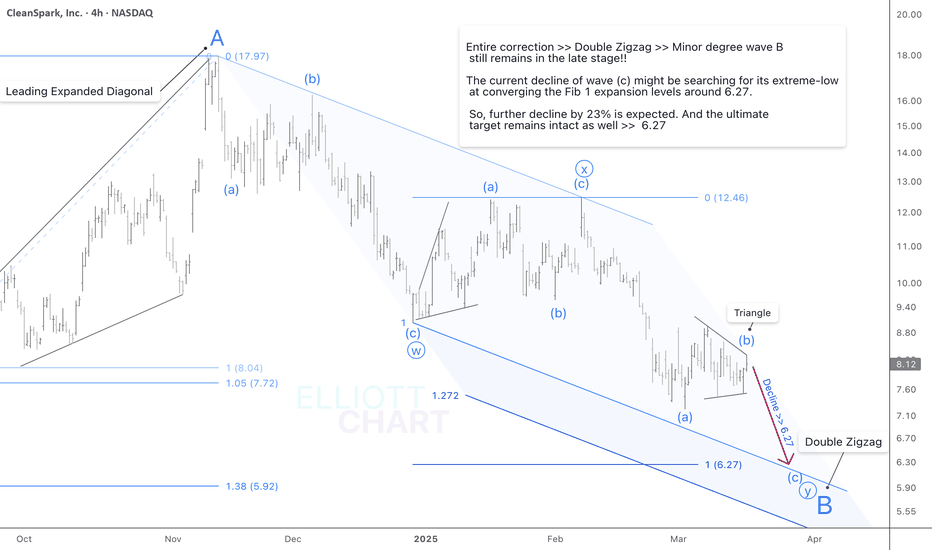

$CLSK / 4hThere is no change in the overall CleanSpark 's analysis in my 4h-frame. The entire correction in Minor degree wave B still remains in the late stage.

As illustrated on the chart above, It seems that the correction in wave (b) has developed in a triangle so far instead the prior zigzag. And so, following decline by 23% is expected in this week!

NASDAQ:CLSK might well conclude the entire correction in its wave B, on converging the

Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ). And the ultimate target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hThere is no change in the NASDAQ:CLSK 's analysis in my 4h-frame. The entire correction in Minor degree wave B still remains in the late stage.

NASDAQ:CLSK might well conclude the entire correction in its wave B, on converging the

Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ) in couple of weeks ahead.

Currently, further decline by 20% is expected. And the ultimate target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hThere is no change in the NASDAQ:CLSK 's analysis in this frame. The entire correction in Minor degree wave B still remains in the late stage.

NASDAQ:CLSK might well conclude the entire correction in its wave B, on converging the

Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ) in couple of weeks ahead.

Currently, further decline by 18% is expected. And the ultimate target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

AMERICA'S BITCOIN MINER: CLEANSPARKThe chart for Ethereum Futures is showing a promising inverse head and shoulders pattern. This indicates a potential turnaround for the struggling bitcoin mining industry. It appears that miners are behaving more like altcoin investors rather than taking a leveraged stance on Bitcoin. This shift suggests that their fortunes are more closely tied to the performance of Ethereum rather than Bitcoin itself.

Here’s what you should be aware of: CleanSpark (#CLSK), is set to be added to the S&P SmallCap 600 index on March 24.

This index features smaller publicly traded companies in the U.S. that have a market cap exceeding $1 billion and fulfil certain financial requirements.

Being included in this index may enhance CleanSpark’s visibility, boost its trading volume and liquidity, and draw in more institutional investors.

CleanSpark is the second crypto miner to be added to the index after peer Marathon Digital was added to the list last year.

Companies in the index typically benefit from increased trading volume and improved liquidity, making their shares more accessible to a broader pool of investors.

"CleanSpark's inclusion enhances visibility within the investment community," CEO Zach Bradford said in the announcement. “Our inclusion enhances visibility within the investment community and gives us an opportunity to demonstrate the value of being a pure play, vertically integrated Bitcoin mining company and making exposure to our model more broadly available."

CleanSpark operates bitcoin mining facilities across the U.S., focusing on energy efficiency and cost-effective power sources. The company has expanded its operations over the past year with the acquisition of peer GRIID Infrastructure.

$CLSK / 3hAs illustrated on the 4h-frame above, NASDAQ:CLSK 's correction in Minor degree wave B still remains in very late stage!

As anticipated on the structure of current decline in double zigzag wave ((y)) the correction in wave (b)'s quite done, and the following decline in its wave (c) would be expanding in a five-wave impulse likely in couple of weeks ahead.

Currently, further decline of wave (c) would lie ahead( by 24%), and the ultimate target remains intact as well >> 6.27

NASDAQ:CLSK might well conclude the entire correction in its wave B, on converging its

Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ).

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hNASDAQ:CLSK 's the entire correction in Minor degree wave B is in very late stage!

As anticipated on the structure of the current decline in double zigzag as wave ((y)), the correction in Minor degree wave (b)'s quite done, and the following decline in wave (c) has started as well. Currently, further decline( likely by 20%) of wave (c) lies ahead, and so the ultimate target remains intact >> 6.27

NASDAQ:CLSK might well conclude the entire correction in wave B, on converging its Fib- expansion levels( level 1, where the ongoing wave ((y)) would equal the wave ((w)) & level 1 on the Fib channel ).

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hThere is no change in the 4h-frame's analysis. The NASDAQ:CLSK 's volatility might be expanding in a three-wave structure as a counter-trend rally in Minuette degree wave (b), which is prior to decline by 30% in the same degree wave (c) of y(circled) of B.

And the ultimate Fib-expansion target remains intact as well >> 6.27

NASDAQ:CLSK will likely end the week slightly higher, that would be the third wave of retracing up in wave (b).

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hThere is no change in the 4h-frame's analysis. The NASDAQ:CLSK 's volatility might be expanding in a three-wave structure as a counter-trend rally in Minuette degree wave (b), which is prior to decline(by 30%) in the same degree wave (c) of y(circled) of B.

And the ultimate Fib-expansion target remains intact as well >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4h

The correction in Minor degree wave B would remain in the late stage, the current decline of its wave ((y)) is still on going.

With considering that wave y(circled) would be expanded in a three-wave structure

zigzag, further decline (by 20%) in the following wave (c) lies ahead in few weeks.

The Ultimate Fib-Expansion Target >> 6.27

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hNASDAQ:CLSK has worked marching in place in the last 3 days, closing the week by 20% decline as well and it seems to have poised for further decline over the few coming weeks.

>> The following decline towards the Fib-extension level surrounding 6.26 lies ahead.

And also an ultimate target might be around >> 5.92, where Minor degree wave B will achieve the 1.38 Fib retracing level of the expanded diagonal wave A, with respecting an expanded flat correction as the ongoing wave (X).

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4hAs depicted well on this 4h frame, NASDAQ:CLSK would be likely poised for further decline which will achieve the Fib-expansion level at 6.26 where the ongoing wave ((y)) equals the same degree wave ((w)). And so it should be hold under the early-Feb high at 12.47, during the remaining process of current decline that might be over probably in late March.

>> The further target is 5.92 ( Not expected to me! )

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / DailyThe continuing decline in NASDAQ:CLSK and exceeding 100 percent of diagonal wave A would suggest to morph into an ABC flat formation as the ongoing correction in wave (X), instead of the previous ABC zigzag. So the Minor degree wave B of (X) would remain in its late stage, and continuing to decline in its wave ((y)) is expected in few weeks ahead.

>> Wave B of a flat formation usually retraces between 100 and 138 percent of wave A. But in this case the entire wave structure implies to be ending the current decline NOT to extreme low. So the expected target would be pointed well above the Fib expansion level at 6.26.

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 4h

The anticipated market selloff in NASDAQ:CLSK today, may have ended entire expanded flat correction as wave ii(circled). And so starting to turning the trend >> UP as early as coming week is expected now.

Redline >> Exceeding the December low at 9.02, would open the wave structure to differing interpretations.

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / 15mIt seems that an ending diagonal is expanding as final decline on wave (c).

Based upon this wave analysis a final decline in the diagonal's 5th wave

in a three-wave structure is expected as well. And it might be very soon, in coming hours.

>> Red Line >> Exceeding 10.28 would indicate to turning the trend to UP!

#CryptoStocks #CLSK #BTCMining #BTC

$CLSK / HourlyThere is no change in NASDAQ:CLSK 's wave/ trend analysis in hourly frame. The ongoing flat correction in Minute degree wave ii (circled) might be over this week.

Decline of the 5th wave of impulsive wave (c) will likely continue to finding the support surrounding 0.786 retracement level and the expected target remains intact at 9.66.

#CryptoStocks #CLSK #BTCMining #BTC