CROX trade ideas

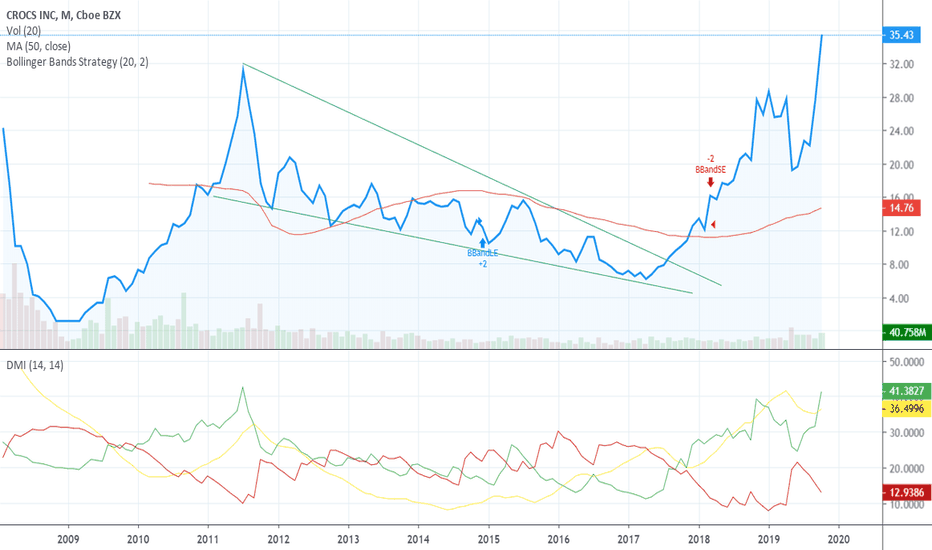

Crox INC has been a huge winner up 48%, let it run.As previous target have been hit we say just let it run.

Short interest remains high at 15.31% squeeze will continue.

Crocs, Inc. engages in the design, development, manufacturing, worldwide marketing, sale and distribution of casual footwear, apparel, and accessories for men, women, and children. It operates through the following segments: Americas, Asia Pacific and Europe, Middle East & Africa (EMEA). The Americas segment consists of the revenues and expenses related to product sales in North and South America. The Asia Pacific segment includes the revenues and expenses related to the product sales in Asia, Australia and New Zealand. The EMEA segment contains the revenues and expenses related to the product sales in Europe, Russia, Africa and the Middle East. The company was founded by Scott Seamans, George B. Boedecker, Jr. and Lyndon V. Hanson III in 2002 and is headquartered in Niwot, CO.

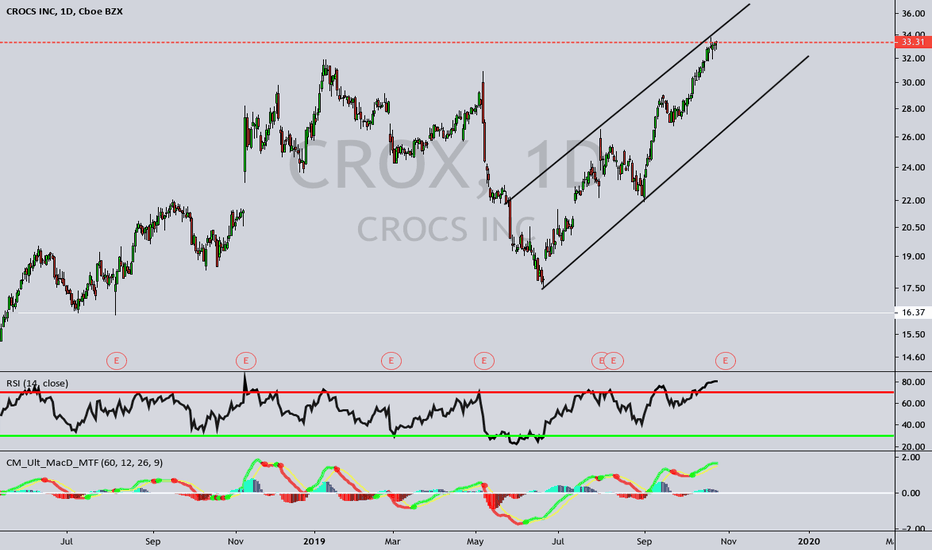

REVERSAL ON THE WAY IN CROCS DUE TO NEW PRODUCT LINECrocs Inc. CROX, +9.60% stock rose 2.4% in Friday premarket trading after Baird upgraded shares to outperform from neutral and added the shoe company to its "Fresh Pick" list. Analysts led by Jonathan Komp think the company's recent stock decline is overdone, and point to brand momentum and a strong pipeline of clogs to come as reasons for optimism. Crocs shares have taken a 31.2% tumble in 2019 while the S&P 500 index SPX, -0.03% has gained nearly 18%. "We see potential for upside to Q2 estimates and for brand heat to carry well into 2020 given a robust clog/sandal pipeline, planned additional collaborations, and emerging international opportunities," the note said. Among the items on the way are an all-terrain clog with elevated traction and premium clogs, including a pair priced at $55 "that plays to the dad shoe trend."

AVERAGE ANALYSTS PRICE TARGET $29

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

SHORT INTEREST 11.55

Crocs, Inc. engages in the design, development, manufacturing, worldwide marketing, sale and distribution of casual footwear, apparel, and accessories for men, women, and children. It operates through the following segments: Americas, Asia Pacific and Europe, Middle East & Africa (EMEA). The Americas segment consists of the revenues and expenses related to product sales in North and South America. The Asia Pacific segment includes the revenues and expenses related to the product sales in Asia, Australia and New Zealand. The EMEA segment contains the revenues and expenses related to the product sales in Europe, Russia, Africa and the Middle East. The company was founded by Scott Seamans, George B. Boedecker, Jr. and Lyndon V. Hanson III in 2002 and is headquartered in Niwot, CO.

ANALYST RATINGS

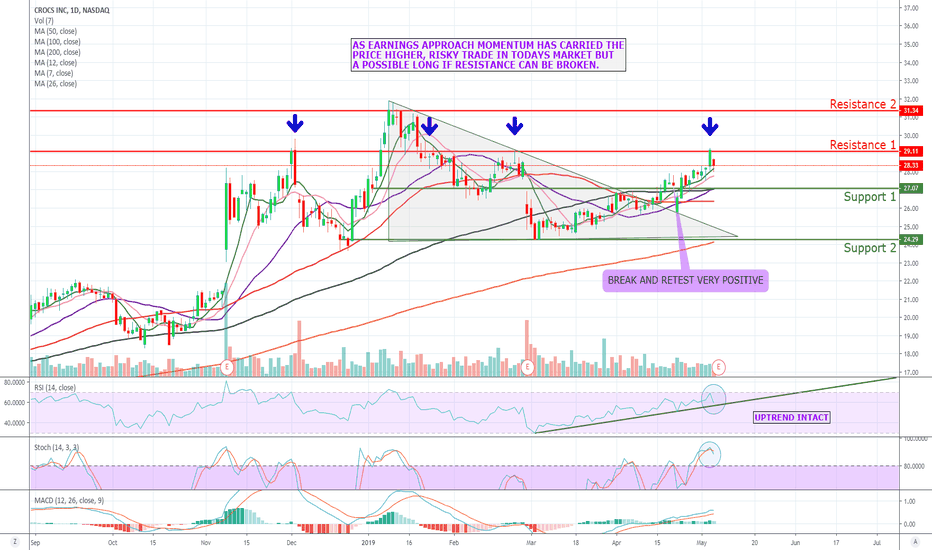

$CROX Not just the perfect fit yet. Wait for break above $29We have missed a opportunity in CROX which announces earnings tomorrow. Love the product and company but the stock has rallied into earnings and is starting to lose momentum. We will look for a entry on any pullback or on break of resistance at $29, on our watch list as summer season approaches.

Company Description

Crocs, Inc. engages in the design, development, manufacturing, worldwide marketing, sale and distribution of casual footwear, apparel, and accessories for men, women, and children. It operates through the following segments: Americas, Asia Pacific and Europe, Middle East & Africa (EMEA). The Americas segment consists of the revenues and expenses related to product sales in North and South America. The Asia Pacific segment includes the revenues and expenses related to the product sales in Asia, Australia and New Zealand. The EMEA segment contains the revenues and expenses related to the product sales in Europe, Russia, Africa and the Middle East.