Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−863.45 M USD

1.92 B USD

272.51 M

About CoreWeave, Inc.

Sector

Industry

CEO

Michael Intrator

Website

Headquarters

Livingston

Founded

2017

FIGI

BBG011ZTRJ21

CoreWeave, Inc. engages in the powers of the creation and delivery of the intelligence that drives innovation. It offers a solution used by organizations of all sizes that require sophisticated AI computing, from the largest of enterprises to small, well-funded start-ups. The company was founded by Michael Intrator, Brian Venturo, and Brannin McBee on September 21, 2017 and is headquartered in Livingston, NJ.

Related stocks

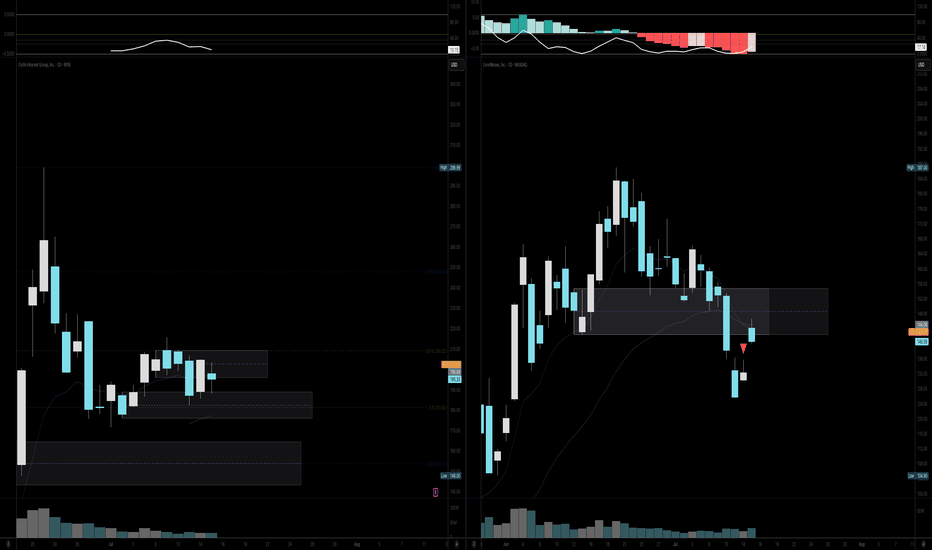

Short-term Bear Case for CRCLHello Traders!

As part of my weekly equity trade analysis, I will be uploading my recordings of what I am seeing and intending to trade for the week. A quick summary of what's in the video is as follows:

- CRCL is a high beta stock that seems to not be moving in tandem with its peers as of late

-

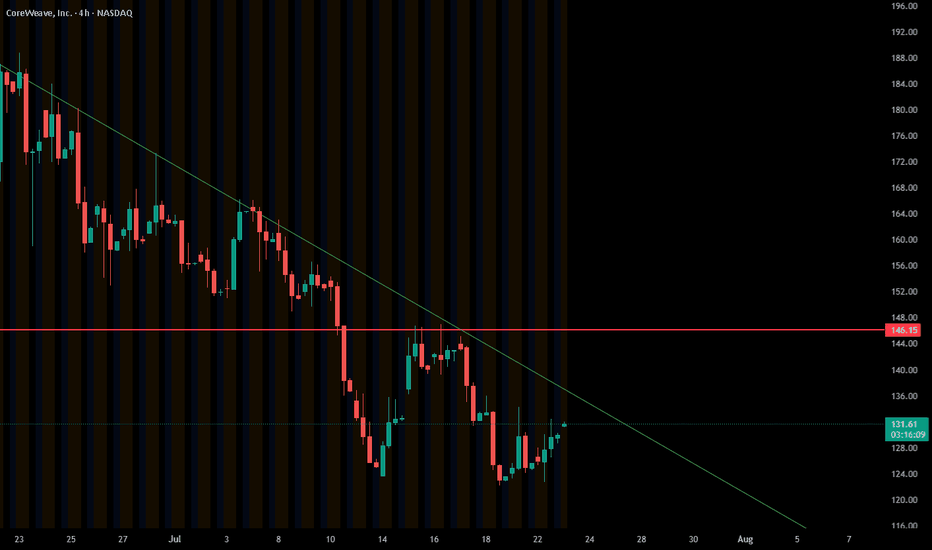

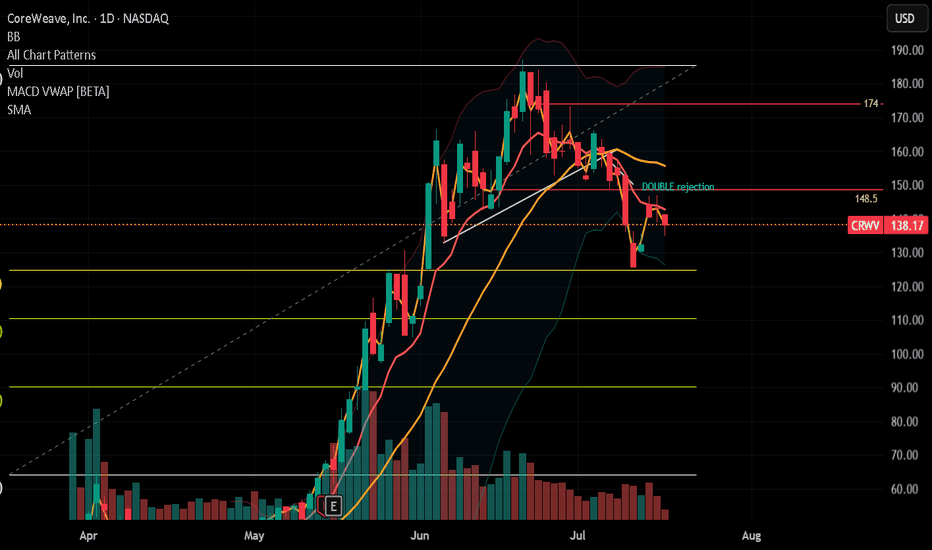

CRWV - THE MOMENT OF TRUTH📰 CoreWeave (CRWV) — Technical & Macro Update

Ticker: CRWV | Chart Timeframe: 30-min | Current Price: $115.62

Sector: AI Infrastructure / Data Centers

Date: July 26, 2025

⚡ Market Recap

CoreWeave was in the spotlight this week following two key developments:

🏗️ $7 Billion Lease Deal: Entered two

Weekly Equities Trade Idea: CRCL Puts (Update)Hello Traders!

I'm providing an update to the CRCL trade idea from Monday July 14th. Here's what I'm watching:

- Price to open within the range from Tuesday July 15th

- Potential imbalance resolve from Monday July 14th at $204.70

- If price breaks Friday July 11th's high at $206.80 the trade is in

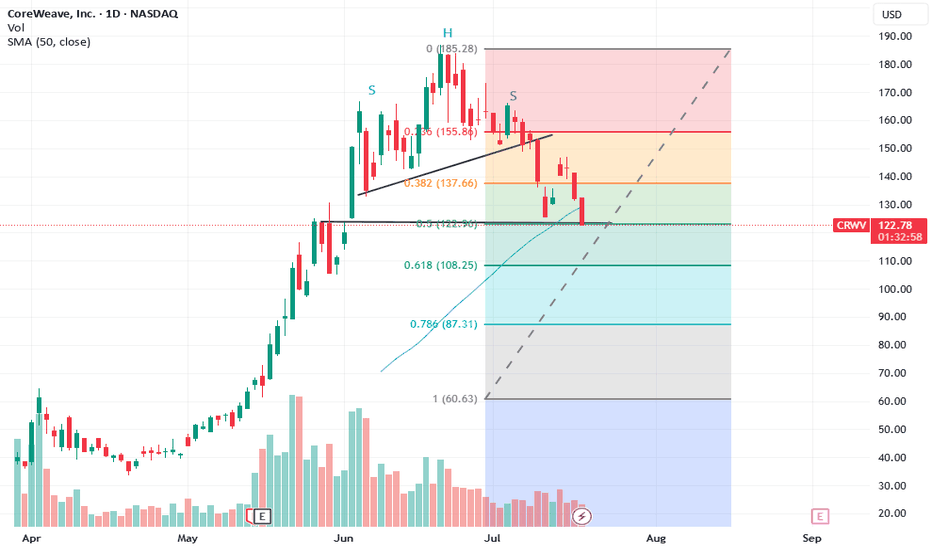

WHAT GOES UP MUST COME DOWN wants to close daily gap at $123.66CRWV forms ‘Head and Shoulders’ on the daily over the past month. The breakout to $180s is all I saw a month ago…but now a reversal has started to $123.66 and maybe to $111.95 as the worse case scenario. My daughter made me hold on to this one like she did on Nvidia. She was right on that one….but s

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Frequently Asked Questions

The current price of CRWV is 115.62 USD — it has decreased by −3.65% in the past 24 hours. Watch CoreWeave, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange CoreWeave, Inc. stocks are traded under the ticker CRWV.

CRWV stock has fallen by −12.75% compared to the previous week, the month change is a −35.05% fall, over the last year CoreWeave, Inc. has showed a 196.46% increase.

We've gathered analysts' opinions on CoreWeave, Inc. future price: according to them, CRWV price has a max estimate of 185.00 USD and a min estimate of 32.00 USD. Watch CRWV chart and read a more detailed CoreWeave, Inc. stock forecast: see what analysts think of CoreWeave, Inc. and suggest that you do with its stocks.

CRWV reached its all-time high on Jun 20, 2025 with the price of 187.00 USD, and its all-time low was 33.52 USD and was reached on Apr 21, 2025. View more price dynamics on CRWV chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

CRWV stock is 5.05% volatile and has beta coefficient of 0.02. Track CoreWeave, Inc. stock price on the chart and check out the list of the most volatile stocks — is CoreWeave, Inc. there?

Today CoreWeave, Inc. has the market capitalization of 56.43 B, it has increased by 3.43% over the last week.

Yes, you can track CoreWeave, Inc. financials in yearly and quarterly reports right on TradingView.

CoreWeave, Inc. is going to release the next earnings report on Aug 12, 2025. Keep track of upcoming events with our Earnings Calendar.

CRWV earnings for the last quarter are −0.83 USD per share, whereas the estimation was −0.12 USD resulting in a −616.40% surprise. The estimated earnings for the next quarter are −0.23 USD per share. See more details about CoreWeave, Inc. earnings.

CoreWeave, Inc. revenue for the last quarter amounts to 981.63 M USD, despite the estimated figure of 857.10 M USD. In the next quarter, revenue is expected to reach 1.08 B USD.

CRWV net income for the last quarter is −314.64 M USD, while the quarter before that showed −51.37 M USD of net income which accounts for −512.48% change. Track more CoreWeave, Inc. financial stats to get the full picture.

No, CRWV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

Like other stocks, CRWV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade CoreWeave, Inc. stock right from TradingView charts — choose your broker and connect to your account.