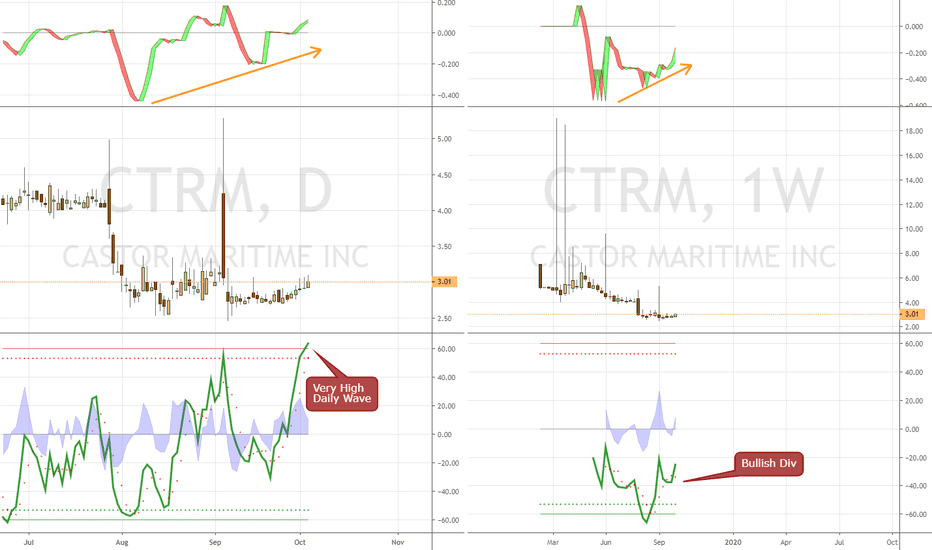

LONG DRY BULK SHIPPERS | CTRMHello all,

Now that you are reading the chart on CTRM is looking prime as a swing. Today the penny market sold slightly with the rest of the market. This drop slightly but recovered at the end of the day. I don’t think will will drop below .60 after the dip today it go bought back up. Looking to take this to +$1.00

If there are any questions let me know I can help.

C

CTRM trade ideas

Will Get Pumped Soon. Near The Bottom Of It's Range. No VolumeOne of those Greek drybulk shipping stocks. A new one on the block.

Thalassa Investment Co. S.A.(of the Democratic Republic of Liberia) owns 1,124,094 common shares

Universe Shipping Inc.(Republic of Marshall Islands) owns 235,200 common shares

Common shares outstanding is currently 2,400,000

" We are incorporated in the Republic of the Marshall Islands, which does not have a well-developed body of corporate law, and as a result, shareholders may have fewer rights and protections under Marshall Islands law than under a typical jurisdiction in the United States".

Shareholders' Equity: $9,474,582

6/28/19 We have entered into an equity distribution agreement with Maxim Group LLC pursuant to which we may issue and sell up to an aggregate of $10,000,000 of our common shares. Maxim Group LLC may sell our common shares by any method permitted by law deemed to be an "at-the-market" offering (F-3 approved by the SEC on June.21st for 100 million). Commission equal to 3% of the aggregate gross proceeds

Doesn't get more obvious than this....

Our Chairman, Chief Executive Officer and Chief Financial Officer, Mr. Petros Panagiotidis, may be deemed to beneficially own, directly or indirectly, all of the 12,000 outstanding shares of our Series B Preferred Stock. The shares of Series B Preferred Stock each carry 100,000 votes.

1.2 billion votes.............Better believe the SEC will be watching this closely. There is a huge risk of a trading halt. This guy is sloppy, and clearly doesn't care about subtleties. If it starts to go supernova, like 200% or more, immediately sell. Even 150%. Don't push your luck

$CTRM Bases at Support for Next Leg Up PPS Target Still $8.00+Algoritmic Entities Brought Castor down to the $6.00 support earlier today and bounced it off it nicely after which NSDQ known for driving the stock up or down accumulated shares at that level and begun slowly pushing the stock up on bid. I do believe she is ready for the next leg up and have accumulated all I could.

Remember the stock started trading on the NASDAQ in Feb of this year and has already had 4 major spikes. I anticipate another one should be coming within the week given the Baltic Dry Index has been on a tear since Feb.

I also anticipate more updates from the company since it is newly trading and just launched their major ship in March.

Happy Trading!!!

$CTRM Turning $6.50 Resistance into Support Heads towards $8.50$3.96 Mil in Revenues $980K In Net Income $9.6 Mil in total assets for 2018 with only 149K in total liabilities for 2018

O/S: 2,400,000

Float: 500,000

1. New contract recently for 11k a day in revenue for 8 months

2. 50% of the O/S is locked

3. Restrictions on owning more than 14% of the O/S implemented by management to protect shareholders.

4. Low float 500,000 O/S 2.4 mil

5. Freshly brought on to the NASDAQ Feb 11th.

6. The huge pop from $4.89 to $18.99 on the 11th of March was more than likely due to the recent contract news. Then flippers sold it back down to bottom at $4.00 where it’s steadily increased back up.

7. Filings go all the way back to April 11th of last year even though the actual ticker hasn’t been made public until last month. So I’m assuming maybe some news on the one year anniversary of when filings dropped.

Petros Panagiotidis 27, is the founder of Castor Maritime Inc. He has also served as the Chairman of the Board and has served as our Chief Executive Officer and Chief Financial Officer since our inception in September 2017. Mr. Panagiotidis has been involved in shipping and investment banking for more than 5 years, during which he has held various positions in finance, operations and management. He has graduated with a Bachelor's degree from Fordham University in International Studies and Mathematics and he earned a Master of Science degree from New York University on Management and Systems with a concentration on Risk Management.

Dionysios Makris, Secretary and Class B Director

Dionysios Makris, 37, is a lawyer and a member of the Athens Bar Association since September 2005. Mr. Makris is based in Piraeus, Greece and is licensed to practice law before the Supreme Court of Greece. He practices mainly shipping, commercial, real estate and company law and has substantial involvement both in litigation as well as in transactional work with the Macris Law Office, where he has worked since September 2011. He holds a bachelor of laws degree from the University of Athens and a Master of Arts Degree in International Relations from the University of Warwick, United Kingdom.

Georgios Daskalakis, Class A Director

Georgios Daskalakis, 28, has been a non-executive member of our Board since our establishment in September 2017. He has spent all of his professional life in the shipping industry. From May 2013 to January 2015, he was an insurance officer at Minerva Marine Inc. From January 2015 to March 2017, he served as a tanker operator at Trafigura Maritime Logistics PTE Ltd. He is currently a Commercial officer of M/Maritime Corp. in Athens, Greece. He holds a Bachelor's degree from Babson College with a concentration on Economics and Finance and Master of Science degree in Shipping, Trade and Finance from the Costas Grammenos Centre for Shipping, Trade and Finance, Cass Business School, City University of London.

Castor Maritime Inc. Announces Time Charter Contract for MV Magic P with Oldendorff Carriers Limassol, Cyprus, March 14, 2019 – Castor Maritime Inc. (NASDAQ: CTRM), (the “Company”), an international shipping company specializing in the ownership of dry-bulk vessels, today announced that, through a wholly-owned subsidiary, it has entered into a time charter contract with Oldendorff Carriers GMBH & Co KG Luebeck for its Panamax vessel Magic P.

The gross charter rate is US$ 11,250 per day, for a period of a minimum of five (5) months up to a maximum of about eight (8) months (for the first 30 days period the daily gross rate is US$ 9,000). The charter commenced on March 12, 2019.

The “Magic P” is a 76,453 dwt Panamax bulk carrier built in 2004 in Japan. All things being equal, this employment is anticipated to generate approximately US$ 1.60 million of gross revenue for the minimum scheduled period of the time charter and could reach US$ 2.60 million should employment be extended to its maximum period. We cannot guarantee that any such extension will occur.

BALTIC DRY INDEX:

As can be seen by the below image the Baltic Dry Index has crossed over on the MACD for the first time in almost a year. The PARSAR is also about to flip and it has been on a steady uptrend since February. I predict a slow and steady uptrend in it back to 1,500 by Summer and a possible break to 2,000 by EOY, which should enable Shipping stocks to 5x-10x their current PPS

$CTRM Setting Up for Its 3rd $6.00 - $18.00 move in 3 monthsChart and Volume have been substantial and 3 white soldiers have built themselves on the chart leading credence to the fact we may see a substantial move upwards next week potentially hitting the $18.00 target or $10.00 target like it has several times over the last 3 months. Bought a big chunk today.

CTRM is ahold and wait stockTrying to determine its behavior is not going to help with this unpredictable stock

It's clear that this company is new and have a good paying account. That 3 month extension will boost the stock up again. That is also key to keep watch on. As of now this contract is paying 11 thousands a day. The first month of the contract paid less but now it's making that full amount for five months straight. Probably 7 days a week!! Its clear to buy in now while it's at $5.23

$CTRM $3.9 in Revs $980K in Net Income $9.6 Mil in Assets1. Recently acquired a new contract for 11k a day in revenue for 8 months

2. 50% of the O/S is locked

3. Restrictions on owning more than 14% of the O/S implemented by management to protect shareholders.

4. Low float 500,000 O/S 2.4 mil

5. Freshly brought on to the NASDAQ Feb 11th.

6. The huge pop from $4.89 to $18.99 on the 11th of March was more than likely due to the recent contract news. Then flippers sold it back down to bottom at $4.00 where it’s steadily increased back up.

7. Filings go all the way back to April 11th of last year even though the actual ticker hasn’t been made public until last month. So I’m assuming maybe some news on the one year anniversary of when filings dropped.

8. The Baltic Dry Index has found support since the start of March and has slowly been making its way back up. I expect 1500 by Summer and the possibility of 2000 by EOY

investorshub.advfn.com