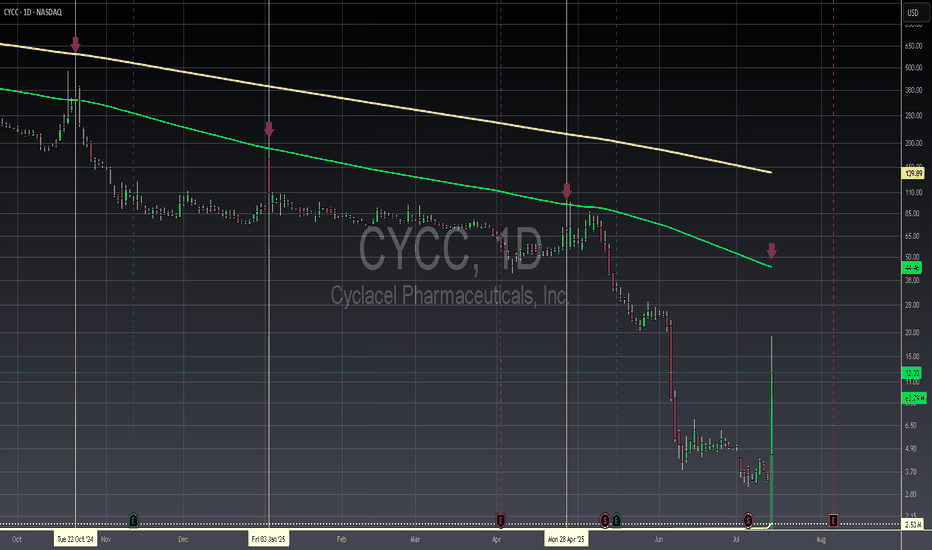

CYCC - Daily - Steer clearIf a company is being forced to split just to stay in line with exchange regulations, that's a huge warning sign right there—it's a clear indication to avoid investing. Secondly, consider this: a company that's been around since 1996 and still can't crack a $50 million market cap? That screams problems with their leadership. Financially, while there was a notable bump in net income between 2023 and 2024, it's not nearly enough to suggest they'll be consistently profitable, especially when you look back at how they were basically hemorrhaging cash from 2020 to 2023. And here's another kicker: despite some improvement in free cash flow since 2022, their cash and equivalents are almost entirely gone. This suggests they might just be shifting expenses around, which is never a good sign. Finally, while it might look like it's targeting the 100 moving average, you've got to ask yourself if you're truly willing to take the hit if it doesn't go your way. If the answer is no, then you're already on your way to being a smarter trader. Move on, there's absolutely nothing special happening here.

Not financial advice, always do your due diligence

Leave a like👍 and/or comment💬.

We appreciate and value everyone's feedback!

- RoninAITrader

CYCC trade ideas

CYCCThe stock held up well in a weak market environment on Friday. Cyclacel Pharmaceuticals Inc (NASDAQ: CYCC) broke resistance, but it was during the first 15 minutes of the day, which is not a good time to trade. The stock ended the day at the previous day's closing price of 7.11, and registered an intraday range of 6.97 and 7.75. A close abv 7.60 is important to continue the rebound toward 8.95. Oppenheimer analyst Kevin DeGeeter initiated coverage of Cyclacel Pharmaceuticals yesterday with an Outperform rating and 17 price target. This is for patient traders. If you're not patient, go to the casino.

CYCC Announces at-the-market $7 Million Strategic InvestmentCyclacel Pharmaceuticals Announces at-the-market $7 Million Strategic Investment by Fundamental Investor Acorn Bioventures

Cyclacel Pharmaceuticals has entered into a definitive securities purchase agreement with Acorn Bioventures, LP, a biotech-focused fundamental investor.

- Strategic investment from single biotech-focused institutional investor -

- Enables clinical development of both fadraciclib and CYC140 in hematological malignancies and solid tumors -

Acorn Bioventures has agreed to purchase in a registered direct offering 485,912 shares of common stock and 237,745 shares of newly designated Series B Preferred Stock (convertible into shares of common stock at a ratio of 1:5), and in a concurrent private placement, warrants to purchase 669,854 shares of common stock, for aggregate gross proceeds of approximately $7 million.

The warrants will be exercisable beginning twelve months following the date of issuance, will expire on the five-year anniversary of the date of issuance, and have an exercise price of $4.13 per share.

finance.yahoo.com

interesting set upNumerous things interest my curiosity on CYCC. First. 50ma just crossed 100 ma on the 30 min. In past this has been followed by a spike. Volatility is lowest it have been as far back I as could go, this thing wants to explode. Up or down I don't know. This thing seems to have found a bottom, I mean its coming off an offering and R/S so no wonder its bottoming. Buy volume on each recent up tick has increased, assuming more people are seeing what I'm seeing. I have taken a small portion, cautiously, always like to hear others opinions. Show me what I am missing.

CYCC - Resistance breakout long CYCC was in our watch list from ages back, and it started to make a move now. Ideal opportunity would be getting into it a few days back. Now we would be watching for a perfect entry opportunity.

* Trade Criteria *

Date First Found- April 4, 2018

Pattern/Why- Resistance breakout long

Entry Criteria- Looking for entry

Exit Criteria- N/A

Stop Loss Criteria- N/A

Indicator Notes- Sharp rise in the Money flow index

Special Note- Very good financial ratios (Quick Ratio: 6.5, Current Ratio: 6.5)

Please check back for Trade updates. (Note: Trade update is little delayed here.)

On Watch for Wednesday, November 22Close above the 50 day EMA could be the beginning of the gap fill. Targeting $2.27 first with resistance on the way @ $2.01 and $2.13. Looking for the gap fill @ $2.94 on the break of $2.27. Tight stop below $1.80 and a looser stop below $1.70. Watch List @ TraderPix.com

CYCC 7% Short Float / strong support - accumulating / Fill GapCCYC has been accumulating for a month and have started to make higher lows. PR this month and conference has helped with visibility. This week pop helpful to put it back on radar. Low risk/Great Rewards to fill gap

RSI / MACD is not overbought and has turn positive zone. Small pop at 2.13 which hit 50dma 1.97. I think this will start to accumulate as long as there is a strong support level at 1.70 area. Once it breaks above 1.97 -- I think it will start to trend higher. Short Float 7.67% which will help price move higher.

Idea:

1. Buy Stop above 2.15 (needs volume)..

or

2. Start accumulating within 1.67 - 1.75 area. SL at 1.53

CYCC - Flag formation Long from $5.33 to $7 areaCYCC seems a wonderful flag formation. It has very good upside potential as it is reversing from longterm support & showing strong upward momentum.

Trade Criteria

Entry Target Criteria- Break of $5.33

Exit Target Criteria- $6.83 & higher

Stop Loss Criteria- $4.67 or $4.83 (Aggressive Stoploss)

You can check detailed analysis on CYCC in the trading room/ Executive summary link here-

www.youtube.com

Time Span- 2:30"

Trade Status: Pending