DAVE trade ideas

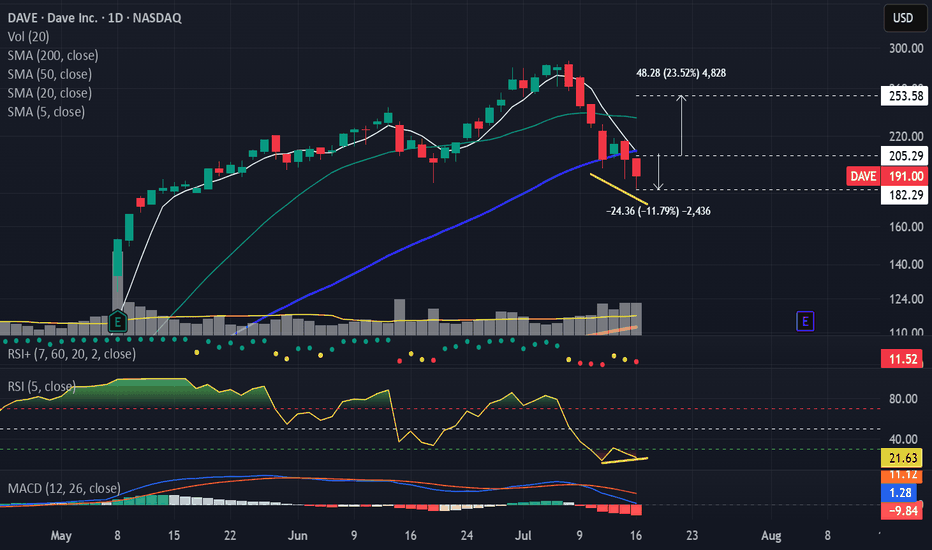

Breakout in Dave Inc...Chart is self explanatory. Levels of breakout, possible up-moves (where stock may find resistances) and support (close below which, setup will be invalidated) are clearly defined.

Disclaimer: This is for demonstration and educational purpose only. This is not buying or selling recommendations. Please consult your financial advisor before taking any trade.

New Setup: DAVEDAVE : I have a swing trade setup signal. I'm looking to enter long if the stock can manage to CLOSE above the last candle high(BUY). If triggered, I will then place a stop-loss below (SL) and a price target above it(TP-50%,move SL to breakeven), then using the close below the 10SMA as my trailing stop loss. **Note: The above setups will remain valid until the stock CLOSES BELOW my set stop-loss level(3).

$DAVE A Mobile Banking Game ChangerDave Inc. (NASDAQ: DAVE) is a fintech company looking to improve the financial health of its users through its suite of products. While DAVE stock lost more than 92% of its value since its SPAC listing back in January, many investors are bullish the stock could be poised for a rebound thanks to the company’s services and products. Meanwhile, some investors are speculating DAVE stock could be a potential short squeeze candidate following the stock’s recent 50% run. With the company preparing to release its Q2 financials next week, DAVE stock could be one to watch in anticipation.

DAVE Fundamentals

As the company is aiming to help its members improve their financial health, DAVE provides users with a suite of innovative financial products to allow them to achieve this target. Through its Insights budgeting tool, DAVE assists members with managing their budgets. This allows members to manage their income and expenses between paychecks in a smarter way and avoid liquidity issues that could cause them to overdraft.

DAVE’s app also helps its members improve their income by offering new job opportunities to them through its Side Hustle service. To facilitate this, DAVE is in partnerships with leading employers so that members could quickly submit their applications to improve their financial health. With this in mind, the Side Hustle product helped members generate more than $157 million since its launch in 2018.

At the same time, DAVE invented a free overdraft and short-term credit alternative – Extra Cash – that allows members to advance up to $500 to their account and avoid fees. Since many Americans rely on overdraft to maintain a positive balance between paychecks, DAVE’s revolutionary product has been successful in attracting new users to the company’s banking app. With this in mind, the Extra Cash product attracted several financial backers to the company including Mark Cuban, The Kraft Group, and Norwest. In light of this, DAVE stock could be poised for major growth in the future since the company is backed by institutions and celebrities of this caliber.

Meanwhile, DAVE offers a full-service digital checking account through its partnership with Evolve Bank and Trust where members can access these accounts for a $1 monthly membership fee. In this way, members can access these accounts in addition to receiving automated budgeting and the ability to build up their credit scores by reporting rent and utility payments to credit bureaus. Through all of these products, DAVE is one of the most popular fintech apps – attracting more than 11 million users since its launch in 2017. Considering this major growth in such a little time, DAVE stock is emerging as an intriguing play in the highly competitive fintech market.

Looking to increase its offerings, DAVE entered into a strategic partnership with West Realm Shires Services, Inc – the owner and operator of FTX US – where both companies will work to expand the digital assets ecosystem. Through this partnership, DAVE’s members will be able to create accounts with FTX to place and settle orders for eligible cryptocurrencies using the DAVE app with FTX acting as DAVE’s exclusive crypto services provider. In light of this partnership, DAVE could be on track to further increase its members since it would be appealing to the several crypto enthusiasts.

Moreover, DAVE received $100 million in funding from FTX ventures after entering into a convertible note purchase agreement where DAVE could issue 10 million shares to FTX ventures for $10 per share. With this funding secured, DAVE intends to pursue growth opportunities and invest in future initiatives – including crypto-related initiatives. In light of this new focus on expanding in the crypto space, DAVE stock could be a bargain at its current PPS.

Despite the company’s growing business and its pursuit of additional growth opportunities, DAVE stock is gaining momentum as a potential short squeeze play among Reddit and Fintwit investors. While DAVE’s short interest rate is only 5.5%, the stock has a considerably high dark pool short interest of 54.8% according to Fintel data. With the company planning to release its Q2 financials on August 11, DAVE stock could be one to watch closely this month to see whether a short squeeze occurs or not.

DAVE Financials

According to its Q1 financials, DAVE has $387.7 million in assets including $23.5 million in cash and $278.2 million in marketable securities which could be liquidated to cash quickly. In terms of liabilities, DAVE reported $213.3 million with only $58.7 million in current liabilities. As a result, DAVE appears to be in a strong position financially since it is able to cover all of its current liabilities. As for revenues, the company reported $42.5 million. However, these revenues were offset with DAVE’s operating costs of $65.2 million – leading to a $34.8 million net loss.

Technical Analysis

DAVE stock is currently trading at $.69 and has supports at .6679 and .5559. The stock also shows resistances near .7293, .88, and 1.004. With the stock gaining traction as a potential short squeeze candidate, DAVE stock recently climbed more than 50% overnight. While DAVE lost some of its momentum, the company’s Q2 earnings could be a catalyst to watch as the stock could rally on a positive earnings report.

In the meantime, DAVE stock is trading below its VWAP and MAs which could be a bearish signal for a drop to retest its support. In that case, this could be a good entry point for bullish investors given that DAVE stock is trading near its bottom.

Accumulation is trending downwards since DAVE’s run near $1 and the MACD is bearish. The RSI is currently holding at 47 indicating that the stock could witness a strong movement in either direction if there is high volume. As is, DAVE has an OS of 325.3 million and a float of 266.6 million.

DAVE Forecast

With more than 11 million users, DAVE is emerging as a major player in the fintech space through its products. Through these products, DAVE has been receiving interest from the likes of Mark Cuban, The Kraft Group, and Norwest who are invested in the company. In this way, many investors are bullish DAVE stock could turn profitable in the long-term. Despite the company’s growth potential in the fintech industry, DAVE stock is emerging as one of the Reddit short squeeze plays since the stock is witnessing a high dark pool short interest rate. While the possibility for a short squeeze to occur remains speculation, DAVE stock could soar if the company continues growing financially in its upcoming Q2 earnings report on August 11.

$DAVE entry PT 10 Target PT 15 and higherDave, Inc. engages in the development of a financial management mobile application to prevent bank overdrafts. It operates Dave, a financial platform that helps customers with banking, financial insights, overdraft protection, building credit, and finding side gigs. The company also provides Dave Banking, a spending account and debit card. Dave, Inc. was founded in 2017 and is based in Los Angeles, California.

Famous DAVES Fibonacci Bounce Backed By Strong News Over Jun/JulCompany Information:

Famous Dave's of America, Inc. (Famous Dave's) operates restaurants. The Company's restaurants, which offer full table service, feature wood-smoked and off-the-grill entree favorites that fit into the barbeque category. It has the Company-owned and franchise-operated restaurants in the United States, the Commonwealth of Puerto Rico, and Canada, and it operates within the industry segment of foodservice. It operates approximately 179 Famous Dave's restaurants in over 33 states, the Commonwealth of Puerto Rico and Canada, including over 44 the Company-owned restaurants and approximately 135 franchise-operated restaurants. Each restaurant features a selection of hickory-smoked and off-the-grill barbecue favorites, such as flame-grilled St. Louis-style and baby back ribs, Texas beef brisket, Georgia chopped pork, country-roasted chicken, and signature sandwiches and salads. Its restaurants offer side items, such as corn bread, potato salad, coleslaw, Shack Fries and Wilbur Beans.

Short Interest

509.56K (06/28/19)

P/E Ratio (with extraordinary items)

10.11

Analyst Target: $9

Recommendation: BUY

Resistance breakout with a GapGaps are very relevant in stock charts and technical analysis in general, this is called runaway gap and it is accompanied with a high volume. And this happen in a resistance area.

because of that the price broke a key resistance level around 6.00 and now is making a pullback testing the past resistance area that now is a new support.

Other important things here are the topping tails around the 5.80 level who show who the price was rejected in this area and that the bulls are now in control

Is more easy to recognize watching the chart only that I giving explanations of what happened

I only draw a line for identify the resistance with a circle for signaled the gap and a arrow to highlight the volume.

My intention is that the person who reads my idea immediately recognize the new course that the price is taking without trying to convince him with the use of a lot of technical glibness

Famous Dave's of America is a Consumer Services Company is Restaurant

I do not make research about the companies, I only identified reliable patterns and shared in the act

I do not know how to do financial modeling and forecasting financial this is the job of other people in a fund I do respect the decision of those who are above me because many ideas are good from the technical point of view but they do not match with the fundamentals of finance. And people in this business need more than a gap for buy a stock