ENPH Earnings Trade Setup – JULY 22, 2025

🔋 ENPH Earnings Trade Setup – JULY 22, 2025

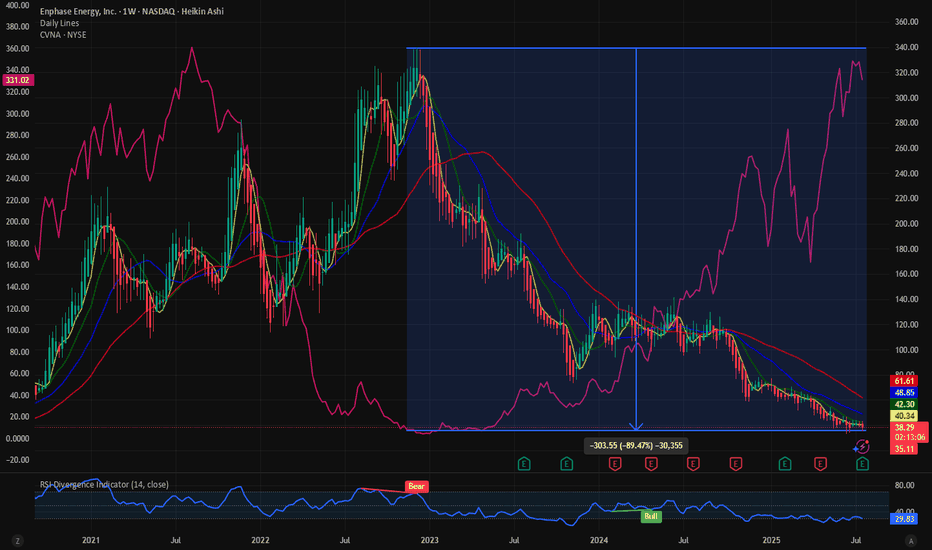

🌘 Enphase Energy: Oversold or More Pain Ahead? Bearish Setup in Play

⸻

📉 1. FUNDAMENTALS SNAPSHOT

📈 Revenue Growth: +35.2% (TTM) – strong, but…

❌ Recent EPS Misses: -3.17%, -15.21% → Poor execution

💥 Margins:

• Net: 10.4%

• EBITDA: 15.9% → Compressio

Key facts today

Enphase Energy's CEO revealed a new fourth-generation battery with 30% more energy density and reduced installation costs, with a fifth-generation model expected next year.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

1.31 USD

102.66 M USD

1.33 B USD

125.85 M

About Enphase Energy, Inc.

Sector

Industry

CEO

Badrinarayanan Kothandaraman

Website

Headquarters

Fremont

Founded

2006

FIGI

BBG001R3MNY9

Enphase Energy, Inc. is a global energy technology company, which engages in the business of designing, developing, manufacturing, and selling home energy solutions that manage energy generation, energy storage, control, and communications on one intelligent platform. It operates through the following geographical segments: the United States, the Netherlands, and Others. The company was founded by Raghuveer R. Belur and Martin Fornage in March 2006 and is headquartered in Fremont, CA.

Related stocks

$ENPH:Clean energy stock and messy chart. Short squeeze incomingThe clean energy stocks are in a serious drawdown. NASDAQ:ENPH has a very messy stock. The stock has seen almost 88% of its value wiped out over the last 2 years. But is it the end of clean energy and stocks? With the new administration in place the clean energy stock has been in a bearish pattern

The last leg down?Enphase is holding on for it's life here, if support is lost then we could be heading towards my final target of $17-20. This stock has been a disaster. We had a 5 wave move up, then an abc correction. We are still in the final leg of wave c, nobody knows where it will end.

I have kept an eye on th

Jade Lizard Trade Idea for a 6/20 ExpirationNASDAQ:ENPH , Jade Lizard Trade

+1 $44 Call 6/20 Buy

-1 $43 Call 6/20 Sell

-{share price: $60.45}-

-1 $35 Put 6/20 Sell

Credit to open: ~$200

IF assigned on short put, then you own 100 shares @ an avg cost of $33/share.

IF the share price is at or above $44/share on 6/20 @ close, then pr

Looking long for ENPH a possible leap! OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can c

Expect ENPH breakout by EOY 2025. Buy <$60Trends:

- LT parallel channel shown marks some key trendlines for the company since IPO

- LT falling wedge intersects the bottom of this channel H2 2025 --> a buying opportunity above $50. If that breaks, falling wedge ends around $35, a 30% downside (or 40% vs today's price).

- The early 2023 peak

Enphase power and Amazon comparison from 1999

The similarities are very striking from Amazon's IPO into the 1999 Dot Com speculative bubble and the bust afterwards. History could be repeating itself. This is the EV/Solar bubble. The tech revolution is already played out. Now the S curve will be solar panels on everyone's homes and commercia

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

ENPH5139644

Enphase Energy, Inc. 0.0% 01-MAR-2028Yield to maturity

7.84%

Maturity date

Mar 1, 2028

ENPH5139638

Enphase Energy, Inc. 0.0% 01-MAR-2026Yield to maturity

6.82%

Maturity date

Mar 1, 2026

See all ENPH bonds

Curated watchlists where ENPH is featured.

Frequently Asked Questions

The current price of ENPH is 35.41 USD — it has decreased by −0.30% in the past 24 hours. Watch Enphase Energy, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Enphase Energy, Inc. stocks are traded under the ticker ENPH.

ENPH stock has fallen by −9.41% compared to the previous week, the month change is a −7.55% fall, over the last year Enphase Energy, Inc. has showed a −69.49% decrease.

We've gathered analysts' opinions on Enphase Energy, Inc. future price: according to them, ENPH price has a max estimate of 80.00 USD and a min estimate of 19.80 USD. Watch ENPH chart and read a more detailed Enphase Energy, Inc. stock forecast: see what analysts think of Enphase Energy, Inc. and suggest that you do with its stocks.

ENPH reached its all-time high on Dec 5, 2022 with the price of 339.92 USD, and its all-time low was 0.65 USD and was reached on May 18, 2017. View more price dynamics on ENPH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ENPH stock is 2.46% volatile and has beta coefficient of 0.44. Track Enphase Energy, Inc. stock price on the chart and check out the list of the most volatile stocks — is Enphase Energy, Inc. there?

Today Enphase Energy, Inc. has the market capitalization of 4.64 B, it has decreased by −7.44% over the last week.

Yes, you can track Enphase Energy, Inc. financials in yearly and quarterly reports right on TradingView.

Enphase Energy, Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

ENPH earnings for the last quarter are 0.69 USD per share, whereas the estimation was 0.62 USD resulting in a 10.77% surprise. The estimated earnings for the next quarter are 0.61 USD per share. See more details about Enphase Energy, Inc. earnings.

Enphase Energy, Inc. revenue for the last quarter amounts to 363.15 M USD, despite the estimated figure of 359.35 M USD. In the next quarter, revenue is expected to reach 360.20 M USD.

ENPH net income for the last quarter is 37.05 M USD, while the quarter before that showed 29.73 M USD of net income which accounts for 24.63% change. Track more Enphase Energy, Inc. financial stats to get the full picture.

No, ENPH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 2.78 K employees. See our rating of the largest employees — is Enphase Energy, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Enphase Energy, Inc. EBITDA is 270.85 M USD, and current EBITDA margin is 12.37%. See more stats in Enphase Energy, Inc. financial statements.

Like other stocks, ENPH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Enphase Energy, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Enphase Energy, Inc. technincal analysis shows the sell today, and its 1 week rating is strong sell. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Enphase Energy, Inc. stock shows the sell signal. See more of Enphase Energy, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.