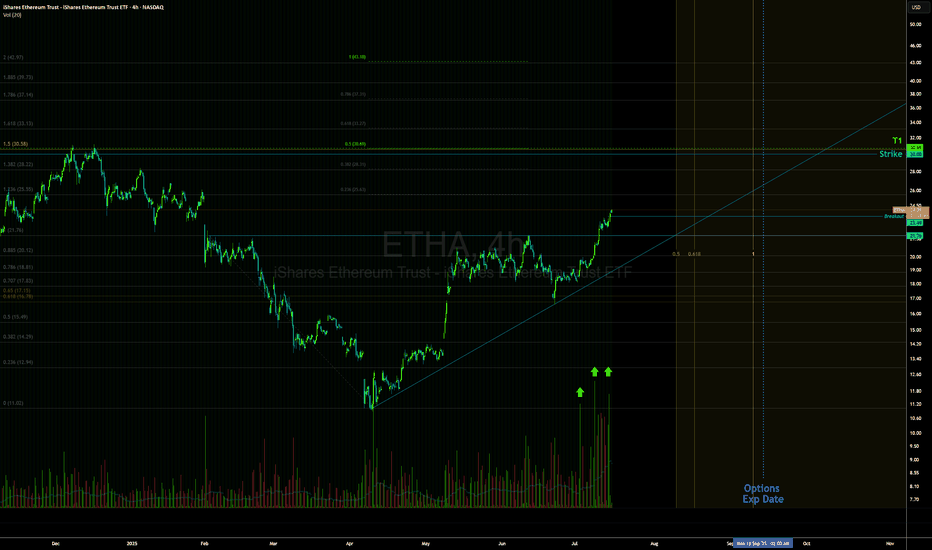

Ethereum Rally (?) : Strong Infusion with Volume RequiredEthereum can make a very strong rally of at least 35-40 percent.

And so the same goes for the Ishares Ethereum Trust ETF. (ETHA ETF)

But it needs to break the pennant.

And we need to observe strong volume.

Also, if we stay above the 50 and 200 period moving averages while this is happening, good things can happen.

Still, I am neutral until we break the pennant.

ETHA trade ideas

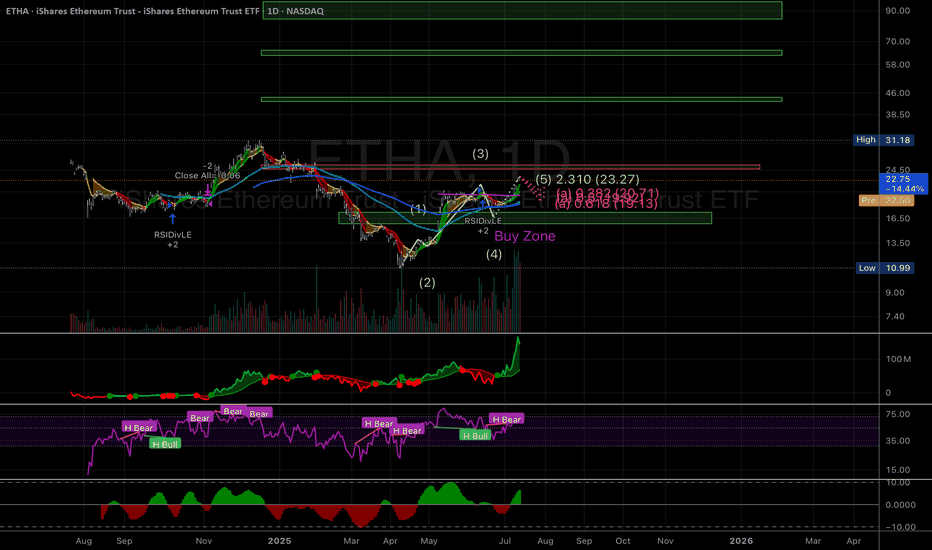

$ETHA: ETH ETF about to explode higher...For now, ETF buyers are down since inception, but that is about to change.

The Trend Navigator algo is flashing a buy signal today, as weekly flashes a Time@Mode signal.

(obligatory to mention that the Trend Navigator algo is up 30% ish in this chart in the same period)

A lot of people are either sidelined or looking to exit the market right as it's about to trend up steadily for months it seems. Don't be like them and hodl.

Best of luck!

Cheers,

Ivan Labrie.

Ethereum $ETHA ETF Daily Chart Fibonacci SupportEthereum NASDAQ:ETHA ETF Daily Chart Fibonacci Support

🚨 **Ethereum CRYPTOCAP:ETH ETF Daily Chart Update** 🚨

📊 **Fibonacci Support at 0.786 Holding Strong!**

Ethereum’s ETF chart is showing resilience at the **0.786 Fib retracement level**, a key support zone. If this level holds, we could see a bullish reversal soon! 📈🔥

🔹 **Key Levels to Watch:**

✅ 0.786 Fib Support: Strong bounce potential

🚀 Possible breakout targets: Next resistance levels ahead

⚠️ Breakdown? Keep an eye on volume & market sentiment

Are you bullish or bearish on CRYPTOCAP:ETH ? Drop your thoughts below! 👇📢

#Ethereum #ETHETF #CryptoTrading #Fibonacci #CryptoAnalysis

ETHA | Ethereum RoadmapWhat is the Blue Box?

The Blue Box represents a carefully identified price range where ETHA's price is likely to exhibit significant reactions. These reactions could result in reversals, consolidations, or breakout opportunities. This zone is identified using technical analysis tools such as historical support/resistance levels, Fibonacci retracements, and institutional trading patterns.

Why Focus on the Blue Box?

High Probability Zone: The Blue Box often represents a confluence of factors, making it a high-probability area for price action to react.

Key Decision Area: Traders and institutions typically place orders near these zones, leading to volatility and actionable setups.

ETF-Specific Behavior: As ETHA is tied to Ethereum's performance, its reaction within these zones often correlates with broader market sentiment for Ethereum.

Defining the Blue Box for ETHA

Price Context:

Identify recent swing highs and lows on the ETHA chart.

Use these levels to anchor a Fibonacci retracement, focusing on 0.618–0.786 or 0.5–0.618 zones.

Volume Clusters:

Check for volume spikes or gaps in the volume profile that align with the box's range.

Market Dynamics:

Consider news or macroeconomic factors affecting Ethereum or ETF flows, as these can amplify reactions in the Blue Box.

I keep my charts clean and simple because I believe clarity leads to better decisions.

My approach is built on years of experience and a solid track record. I don’t claim to know it all, but I’m confident in my ability to spot high-probability setups.

My Previous Analysis

🐶 DOGEUSDT.P: Next Move

🎨 RENDERUSDT.P: Opportunity of the Month

💎 ETHUSDT.P: Where to Retrace

🟢 BNBUSDT.P: Potential Surge

📊 BTC Dominance: Reaction Zone

🌊 WAVESUSDT.P: Demand Zone Potential

🟣 UNIUSDT.P: Long-Term Trade

🔵 XRPUSDT.P: Entry Zones

🔗 LINKUSDT.P: Follow The River

📈 BTCUSDT.P: Two Key Demand Zones

🟩 POLUSDT: Bullish Momentum

🌟 PENDLEUSDT: Where Opportunity Meets Precision

🔥 BTCUSDT.P: Liquidation of Highly Leveraged Longs

🌊 SOLUSDT.P: SOL's Dip - Your Opportunity

🐸 1000PEPEUSDT.P: Prime Bounce Zone Unlocked

🚀 ETHUSDT.P: Set to Explode - Don't Miss This Game Changer

🤖 IQUSDT: Smart Plan

⚡️ PONDUSDT: A Trade Not Taken Is Better Than a Losing One

💼 STMXUSDT: 2 Buying Areas

Ethereum ETF Launch Causing Temporary Crypto Dump!Last week was the official launch of the long anticipated Ethereum spot ETF. Sadly, the markets dumped right after trading went life.

We have seen the exact same thing happen earlier this year with the BTC spot ETF launch, where the ETF lost over 26% of its value in the first 7 trading days. The Ethereum ETF is currently trading at -12% after 7 trading days.

Historically, great crypto news has ALWAYS caused some kind of dump. See the analysis below for reference:

Although we're going down, I think it's a merely temporary dump. Like mentioned in my most recent BTC analysis, I think that the green area on the chart is the perfect area to start buying in again in the hopes of a turnaround in the ETF's trading direction.

Share your thoughts on whether this analysis makes sense or not. Happy to hear what you think!