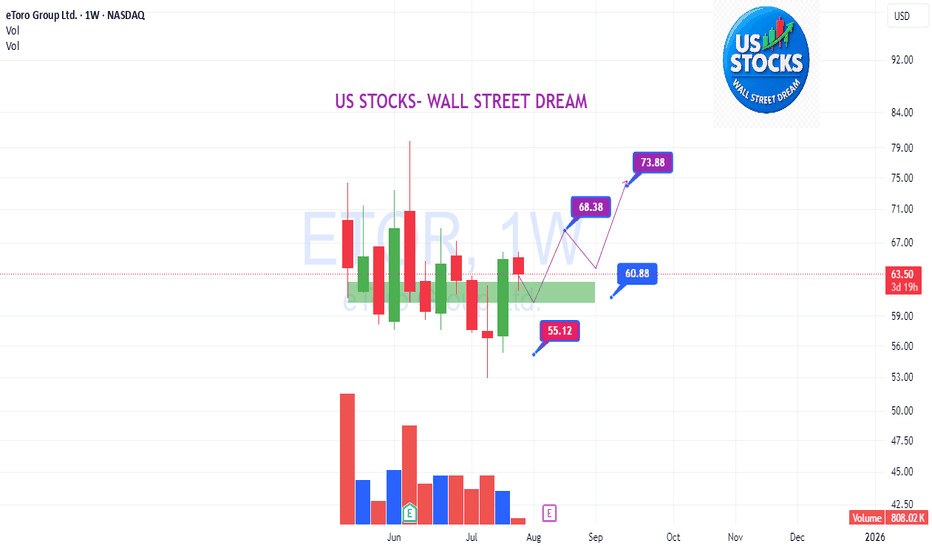

ETOR trade ideas

ETOR : Entry after IPOKind of social trading platform.

Etoro Platform also uses artificial intelligence.

I researched that it also allows trading of crypto assets.

$10B SPAC initiative canceled in 2022.

We re approaching mid 2025 .

Current market cap: around $5-5.3B.

Ground for progress may be present in good market conditions.

While institutions bought at $52, individuals were most likely able to buy above $70.

This was a great misfortune.

Very high opening of the IPO caused sharp sales, but holding for the medium term may be beneficial.As I briefly mentioned above, parameters that will bring momentum to stock may occur.

Constantly looking at the screen so much in such instruments can create a huge sense of panic and failure.

Target price: 90.00 - 94.00

Stop: 50.00

Amount: 1/3 of your portfolio's financial technology stocks ( e.g)

Risk - Reward Ratio > 2.80

Regards.

Is ETORO overvalued or undervalued at 60$?

IPO Performance and Valuation:

-IPO Pricing: eToro priced its IPO at $52 per share, above the anticipated range of $46–$50, raising approximately $620 million and achieving a valuation of around $4.2 billion.

-Market Debut: On its first trading day, eToro's shares surged, opening at $69.69 and closing at $67, pushing its market capitalization to approximately $5.5 billion.

Financial Metrics:

-Revenue and Profit: In 2024, eToro reported revenues of $931 million and a net income of $192 million, marking a significant turnaround from a net loss of $21 million in 2022.

-Valuation Multiples: At the IPO price of $52, eToro's valuation was about 4.5 times its 2024 revenue and approximately 23.4 times its net income. At the current share price of $62.07, these multiples increase to roughly 5.8 times revenue and 28.6 times net income.

Comparative Analysis:

Industry Peers: Compared to peers like Robinhood, which trades at higher multiples, eToro's valuation appears moderate. However, it's essential to consider differences in business models, market presence, and growth trajectories.

Considerations:

-Growth Prospects: eToro's expansion into new markets and product offerings could justify higher valuations if growth targets are met.

-Regulatory Environment: The company has faced regulatory challenges in various jurisdictions, which could impact future operations and profitability.

Disclaimer:

This is just my personal opinion and not professional financial advice. Any investment decisions you make are entirely your responsibility. I am not a licensed financial advisor, and I do not guarantee the accuracy or completeness of the information provided. The figures mentioned may be inaccurate, outdated, or subject to change — so please do your own research and due diligence before making any financial decisions. Investing involves risk, and any losses incurred are at your own risk.

etoro (new listing)stock listing of ETORO to NASDAQ, I've heard of this company. Most of the time when a company that most people have heard of is listed there is a higher chance of the company doing well. As of right now the price is only in the red since the date of listing. The listing price was supposed to be around $46-$50 so officially the stock market, as usual, is not showing the truth; based on being compared to cryptocurrency prices. The listing shows that the price started at a peak which was probably after a bunch of pre-market trades happened and bumped the price up. That was not the true entry IPO list price.