FANG trade ideas

Short $FANG - 1D TFI shorted $FANG yesterday. Price closed below DC20 on 6th November, MA50 is below MA200. RSI, MACD are bearish.

Weekly MA50 has crossed MA200 and price closed below DC20 a few weeks ago. RSI, MACD are bearish.

TP is next major support above 55.48.

SL is monitored depending price action in the upcoming weeks. Currently I would think IF 1D candle closes above MA50 and DC20. So it is a dynamic SL with time.

Current RR is not that favorable based on the above however continuation of the trend is quite likely and current price action suggests further down.

Any comments are more than welcomed! Thank you and please trade carefully and with money only you can afford to lose.

www.etoro.com

FANG - Short for 35%: Current Price @ 84, PT at 55FANG - (Nasdaq) - Short for 35%: Current Price @ 84, Price Target (PT) = 54

Diamondback Energy, Inc., an independent oil and natural gas company, focuses on the acquisition, development, exploration, and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas.Oil is likely to fall this week.

Great Head and Shoulders pattern.

It might retest the neckline again, but then it's coming back own, fo sho!

Take profits at 77, 66, then all out at 55.

If FANG > 106, breakout and go longWith WTI oil > $60 a barrel, I'm sure there's computer algorithms (based off futures or derivatives or whatever) that will buy oil-based equities. I like FANG and WPX in this space. Hopefully FANG can break out of the resistance of 106 level.

If close > 106, I like the upside here.

FANG possible reversalFANG has been trading in the same channel for a while now, making this opportunity even more attractive, I will be keeping an eye on it for a possible reversal.

Although the stock looks great, the RSI and MACD don't look that great, so it could continue its current trend (down).

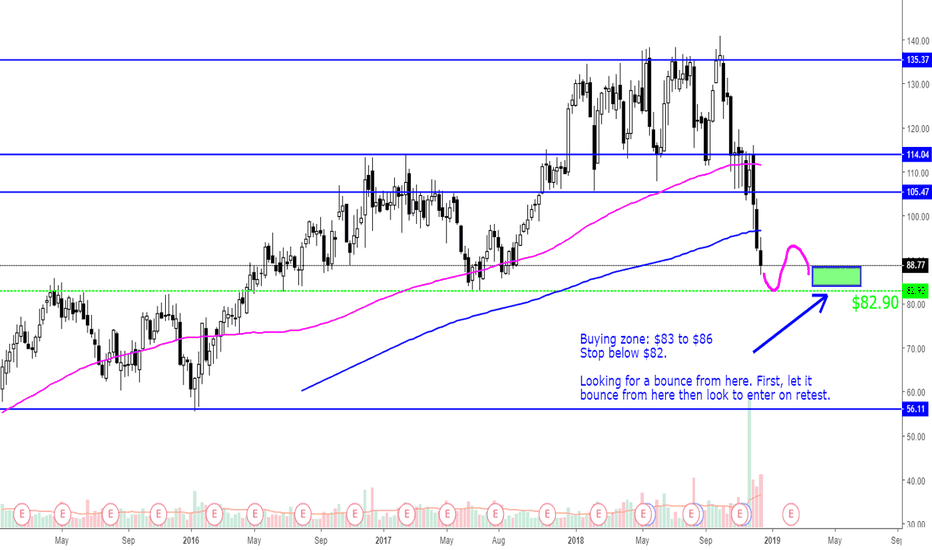

her FANGS strike deep into your pockets! (2)This chart looks technical, it made a bullish ABCD pattern to the upside and then proceeded to consolidate this past year. when the market started falling down into the abyss fang had to follow. Since going public in 2013 FANG gained 700% therefore i am not looking for a long term value buy instead a short term counter bounce trade

Timing = 1 ( i think the market is overdue for a bounce )

Volume = 0 ( The volume has been huge on this selloff and it doesnt appear to be slowing down )

Group strength = -1 (Energy sector looks super weak and that worries me)

Entry = 1 ( i like this entry below current price bc of the great volume on the selloff)

Fractal = 1 (fractals support a reversal )

$FANG - Dat sloppy toppy Pun intended, but this is easily one of my more scrambled, messy / sloppy posts. Seen this pattern before, just can't tell which is more suitable? Feel free to check out $BIDU or $FDS to copy / paste bar patterns ($FDS is due for new up-side high) while $BIDU is back towards low (but potential to see more up-side, again). My long target would be 223% $137-$138, so I'll be watching for a potential short entry after some exhaustion to break that resistance. Short A1 target would preferably be right around $121.50 - $124.50 where 55 (low) MA would be to possibly catch it as support, & eventually go back through the whole process again of a surge then plummet like we've seen $BIDU to do lol. Feel like I've seen setups like this all week lol. Regardless, break of $121.50 & I'd be sketched to get back long. If all else works out, I'd hop back in as a bull.

FANG - Bullish Weekly Put SpreadPurchasing a put with a lower strike price than the written put provides a bullish strategy. Trade will be doing this coming week.

Stock: FANG

Current Price: 113.86

Short Put

WRITE

Option: 15th Jun $115.00 PUT

Price per option: $ 2.85

Contracts: #1 x 100

Total cost: $285

Long Put

BUY

Option: 15th Jun $110.00 PUT

Price per option: $ 0.83

Contracts: #1 x 100

Total cost: $83

Spread: Net debit/credit: $2.02 (net credit) x 100 = $202.00

Maximum risk: $298 at a price of $110 at expiry

Maximum return: $202 at a price of $115 at expiry

Breakevens at expiry: $113.00

ascending base complete, Flag pattern on FANGOn my May 23 post, I explained the build up of FANG's Ascending Base pattern (). Since then, it's completed, breaking out on June 3 and continuing to its target shown in light blue on the graph. FANG now appears to be forming a Flag pattern, which tends to continue the previous trend (up) after breaking out of the flag pattern.

FANG has held pretty strong at $87.50 support during this consolidation time frame from June 17 to present, even with some extremely heavy down volume days. This consolidation has allowed RSI and MACD to reset a bit from its overbought conditions.

I expect a few more days of consolidation, perhaps until the end of next week. At that point, I expect a breakout to the upside. If a breakout occurs, I'll open a larger long position.

FANG is also generally influenced by the NASDAQ. If the NASDAQ falters, it could cause FANG to breakout from the Flag to the downside.

FANG distributionLooks like a big distribution day in FANG. Price has been following a channel pretty much since it IPO'd in late 2012. It broke the channel to the upside on 6/11, and is currently near the 1.382 channel fib, but was not able to close above it. With vol 3x normal and today's close basically unchanged from yesterday's close, this could be a signal of a reversal.

The run up from 71.50 on 5/29 has had several dojis/spinning tops, but they didn't have the volume with them.

I'm looking for price to work back down into the channel and possibly all the way back to the 50% point around $76-78 over the next month or so.