Waiting for a buy trigger.Google stock is at a good spot where it could make a strong upward move. At this price level, we see multiple confluences both in terms of trend and from the perspective of indicators and oscillators. So, if it manages to break through this level, the price could move nicely.

GOOG trade ideas

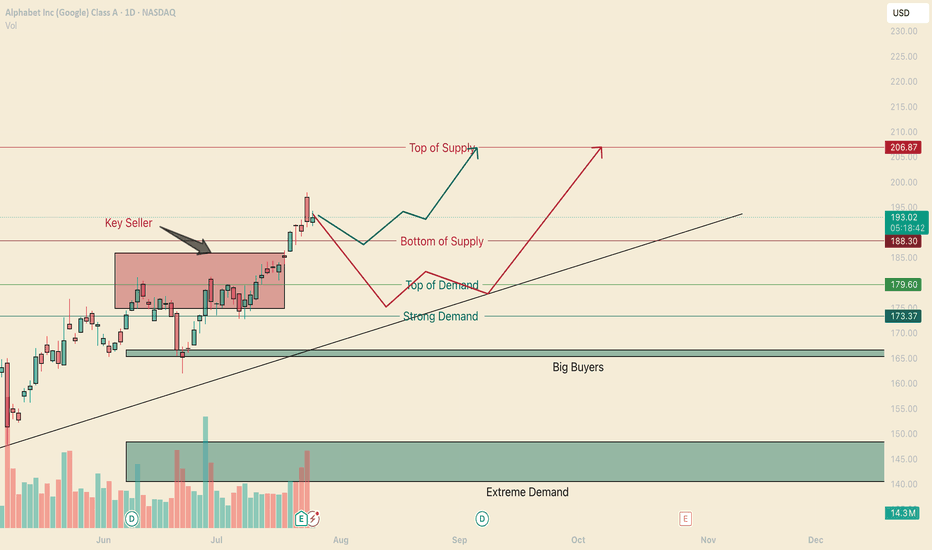

Google Buyers Entered Seller Territory.Hello, I am the Cafe Trader.

To finish off our series of the MAG 7 we have GOOGL up next.

If you have been keeping up, I will offer insight into Long term and short term interest. Google has taken out a key sellers on July 21st, and also closed inside the supply zone. This is very bullish, bulls have not got much pushback from the bears, suggesting this could test the highs again, and prime itself for a breakout.

Long term price guide helps you align a buy area with your conviction. I will update the price as of friday's close (today)

Long Term

Aggressive: $179 - If we close today above the bottom of supply line, then I would suggest this aggressive price adjust to 187.50

Fair Sentiment $166 - 173 - Between the big buyers and the strong demand. Also having the trend to support adds a 3rd strength.

Extreme Deal $140-148 - If you can catch a deal here, best to snatch it up. Alot of Big money wil be doing the same.

Short Term

weakness in the supply area is suggesting a run to the top. Trying ot get in here can be tricky. Since today is friday, the close is extremely important to see how our next week will be framed. So here I have 2 Bullish scenarios to help you find opportunity for GOOGL.

Green Scenario

Yes its possible it will run strait up into the top of supply, as a trader, you don't want to be that buyer just yet. I wouldn't personally feel great about trading the green line scenario without seeing a real buyer step into the market. So if we can Find a real buyer, we will play off of them and rirde to the top.

No entry or price targets on this one yet.

Red Scenario

This scenario has a real buyer, and personally I think is a safer trade to take (as of right now). With this squeeze that's happening, there is a good chance at some point there will be buyers getting exhausted and shorts getting a grip on this. This is why I would not buy "top of demand" but would look to get close as I could to the strong demand. and then a ride back to the "Top of Supply"

Entry: 175

Stop: 170

Partial Profit: (when the sellers step in, thats our first TP)

Target: 206

That's a wrap on our MAG 7 series, Happy Trading and we will see you next time.

Next week we are going to chart out Crypto, if you have any specific suggestions you want to see me chart, comment below.

@thecafetrader

GOOGL Eyeing Gamma Squeeze to $202? Jul 31GOOGL Eyeing Gamma Squeeze to $202? Smart Money Sets the Trap!

🔍 GEX & Options Flow Insight

GOOGL is trading around $196 and sitting just under the 2nd Call Wall at $197.5, with a visible Gamma Wall / Resistance around the psychological $200 level. Here's how GEX is positioned:

* Call Walls:

* 📍 $197.5 → Current hot zone (2nd CALL Wall — 91.21%)

* 📍 $200.00 → Highest Positive NET GEX / Gamma Resistance

* 📍 $202.5 and above → Extreme GEX buildup with potential squeeze fuel

* Put Support:

* 🚨 $188.41 → Strong PUT Support (−16.52%)

* 🔻 Below that: Risk increases toward $187.5 (major demand zone)

* Volatility Context:

* IVR 15.8 and IVx Avg 31.1 → IV is relatively low

* Calls Outweigh Puts (12.6%) → Bullish GEX skew

* Green GEX, Green Sentiment, Long Gamma Zone Active

✅ Option Trading Suggestion:

Bias: Moderately bullish with potential for gamma-driven breakout

Strategy: Debit Call Spread or Naked Call if aggressive

* Entry Idea: Buy GOOGL 195C / Sell 200C (or 202.5C) for Aug 2 or Aug 9 expiration

* Risk: Tight invalidation below 194.50 (under price structure)

* Target: $200–202.5 (Gamma Wall exhaustion)

Why this works: Price is coiled just under a heavy call wall. If GOOGL pushes above $197.5 with volume, gamma hedging can amplify the move to $200+ — where dealers are net short calls and may have to buy shares to hedge.

🧠 Technical Analysis (1H Chart)

Market Structure:

* ✅ Bullish Break of Structure (BOS) confirmed on July 29

* ⚠️ Change of Character (CHoCH) seen on July 30 with a mild pullback

* Currently trading inside a rising channel, respecting trendline support

Trendline:

* Upper trendline rejection seen at ~198

* Lower channel support aligning near 195–195.5

Smart Money Concepts (SMC):

* Order Block Zone formed around 195.75–195.97 = current support

* Premium/Discount zone separation validates possible retest and continuation

* Purple Box = Supply Zone → Sellers active below 198.50

🔄 Price Action & Key Levels

* Support Zones:

* 📌 195.75–195.97 → Order block + Trendline

* 📌 194.91 → Minor support + fib confluence

* 🚨 191.56–190.85 → Liquidity pocket below CHoCH

* Resistance Zones:

* 🚩 197.5–198.5 → Call Wall + Prior swing highs

* 🔼 200.0–202.5 → Gamma squeeze zone / possible parabolic move

📉 Bearish Reversal Zone

If GOOGL fails to reclaim 197.5 or gets rejected again at 198.5:

* Expect retracement toward 195.7 → 194.91

* Breakdown below 194.91 → Opens test of CHoCH zone and fills inefficiency to 191–192 range

🔁 Summary Thoughts

* GOOGL is consolidating near a high-conviction breakout zone.

* GEX flow favors bullish continuation with strong gamma clustering above.

* Smart Money has already swept liquidity and flipped structure; bulls are in control if they defend the OB.

* Scalpers can long dips to 195.75 with stop under 194.91, targeting 198–202.

* Avoid calls above 202.5 unless new GEX builds show extended flow.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

GOOGL Slips into Bearish Gamma Territory. 8/1GOOGL Slips into Bearish Gamma Territory — Eyes on $190 Defense or Slide to $187.50

🔍 GEX & Options Flow Insight (1st Image Analysis)

GOOGL has broken down from its recent consolidation and is now testing the $190–$192 gamma support band. The GEX profile shows heavy negative gamma just below current price, increasing the risk of accelerated selling if $190 fails.

* Call Walls & Resistance:

* 📍 $194.91–$196.53 → First resistance zone

* 📍 $197.85 → Highest positive NET GEX / Gamma Wall

* 📍 $202.50+ → Out of immediate range unless a strong reversal occurs

* Put Walls & Support Zones:

* 🛡️ $190.50 → Current gamma pivot

* 🚨 $187.50 → 2nd Put Wall / Hard gamma floor

* 📉 Below $187.50 opens the door to $185–$182

* Volatility Insight:

* IVR 18.9, IVx Avg 32.5 → Slightly elevated IV

* Call flow 11.2% → Bearish leaning

* GEX sentiment: 🔴🔴🔴 = Negative gamma environment → more volatility to downside

✅ Option Trading Suggestion:

Bias: Bearish unless reclaiming $194+

Strategy: Bear put spread

* Entry Idea: Buy 190P / Sell 185P for Aug 2 or Aug 9 expiry

* Invalidation: Close above $194.91

* Target: $187.50 → $185

Why this works: Dealers in negative gamma hedge by selling into weakness, which can accelerate moves lower. Losing $190 likely brings $187.50 quickly into play.

🧠 Technical Analysis (1H Chart) (2nd Image Analysis)

Market Structure & SMC:

* 🟥 CHoCH confirmed after rejection from $197.85 supply

* ❌ Price broke BOS support from $194.91 area

* Trading in a descending structure toward $190 support

Trendline Dynamics:

* Broke short-term uptrend

* Now respecting a lower parallel channel toward $187.50

SMC Zones:

* 🟩 Demand Zone: $190.50–$187.50 → First defense zone

* 🟥 Supply Zone (Purple Box): $194.91–$197.85 → Immediate resistance

🔄 Price Action & Key Levels

* Support:

* ✅ $190.50 → Current hold line

* ✅ $187.50 → Gamma floor

* 🚨 Below $187.50 → $185 → $182

* Resistance:

* 🚩 $194.91 → First reclaim level for relief rally

* 🚩 $196.53–$197.85 → Supply + Gamma Wall

🧭 Scalping / Intraday Trade Setup

🟥 Bearish Setup (Preferred):

* Entry: Failed bounce at $194–$195

* Target 1: $190.50

* Target 2: $187.50

* Stop: Above $196

🟩 Bullish Reversal Setup:

* Entry: Strong reclaim of $196.50 with volume

* Target 1: $197.85

* Target 2: $200+

* Stop: Back under $194

🔁 Summary Thoughts

* GOOGL has shifted from neutral to negative gamma, favoring continued downside pressure.

* $190.50 is the short-term line in the sand — losing it risks a swift trip to $187.50.

* Any bounce into $194–$196 is likely to face selling pressure unless backed by volume and a gamma flip.

🚨 Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk accordingly.

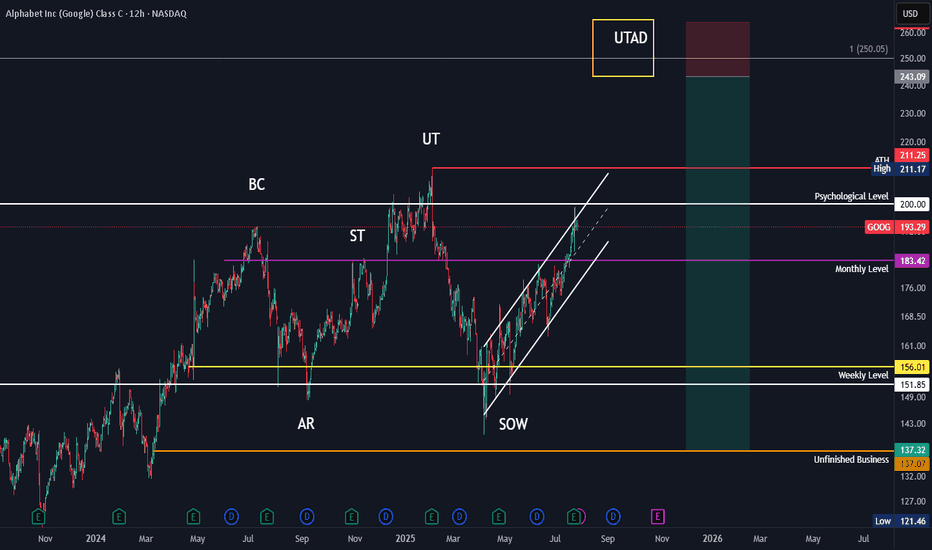

Alphabet (GOOGL) Stock Chart Analysis Following Earnings ReleaseAlphabet (GOOGL) Stock Chart Analysis Following Earnings Release

Earlier this week, we highlighted the prevailing bullish sentiment in the market ahead of Alphabet’s (GOOGL) earnings report, noting that:

→ an ascending channel had formed;

→ the psychological resistance level at $200 was of particular importance.

The earnings release confirmed the market’s optimism, as the company reported better-than-expected profits, driven by strong performance in both its advertising and cloud segments.

In his statement, CEO Sundar Pichai noted that AI is positively impacting all areas of the business, delivering strong momentum.

The company is expected to allocate $75 billion this year to expand its AI capabilities.

As a result, Alphabet (GOOGL) opened yesterday’s trading session with a bullish gap (as indicated by the arrow). However, as the session progressed, the price declined significantly, fully closing the gap.

This suggests that:

→ the bulls failed to consolidate their gains, allowing the bears to seize the initiative;

→ the ascending channel remains valid, with yesterday’s peak testing its upper boundary;

→ such price action near the $200 level reinforces expectations that this psychological mark will continue to act as resistance.

It is possible that the positive sentiment following the earnings report may weaken in the near term. Accordingly, traders may consider a scenario in which Alphabet’s (GOOGL) share price retraces deeper into the existing ascending channel. In this case, the former resistance levels at $180 and $184 may serve as a support zone.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

GOOGL Forecast – Dual AI Model Confirmation📊 GOOGL Forecast – Dual AI Model Confirmation

🔹 Posted by WaverVanir | VolanX Protocol

NASDAQ:GOOGL is showing strong bullish structure backed by both Smart Money Concepts (SMC) and AI model consensus.

🧠 VolanX AI Protocol Forecast (30-Day)

🎯 Target: $223.08 (+13.3%)

📈 Accuracy: 98.2%

📉 Drawdown: 0.00% (Backtested)

🧮 Sharpe Ratio: 7.70

🔵 Rating: Strong Buy

📉 WaverVanir DSS Model (Sentiment Score: 83)

🔸 30-Day Target: $198.47

🔸 Micro pullback expected before resuming uptrend

🔸 Ideal for refining short-term entries

🔍 SMC Structure:

BOS + CHoCH Confirmed

Premium zone at $197.94 cleared

1.236 Fib target: $201.83

1.618 Fib confluence: $207.92

Trajectory path = $223.08 if liquidity extends

📌 Strategy:

Entry: ~$196.95

TP1: $200.89

TP2: $223.08

SL: $188.80

R:R ~ 3.2:1

📢 Signal powered by WaverVanir DSS + VolanX Protocol

This is institutional-grade AI meets market structure.

#GOOGL #VolanX #WaverVanir #AITrading #SmartMoneyConcepts #SMC #Fibonacci #SwingTrade #Forecast #TradingView #StockSignals #InstitutionalAlpha #DecisionSupport #MachineLearning #DSS

Google: A compelling buy at the current priceHello,

As Warren Buffett famously said, "Be fearful when others are greedy, and greedy when others are fearful." This mindset is particularly relevant right now with Alphabet Inc.

Despite being a company whose products we use daily—and will likely rely on even more in the future—Alphabet's stock recently declined following comments from Apple’s Eddie Cue regarding a drop in Safari search traffic. This has sparked concerns about Google's dominance in search and its ad revenue streams. Analysts are also highlighting growing competition from AI-driven platforms such as OpenAI, Grok, and Perplexity, raising questions about the future growth of Google Search.

While the headlines may seem discouraging, we remain confident in Google’s enduring leadership in the search space, underpinned by its unmatched scale, infrastructure, and user base. We also believe the market continues to underestimate how far ahead Google truly is in artificial intelligence.

In our view, this dip represents a strategic buying opportunity for long-term investors. Below is our in-depth analysis of Alphabet and why we believe it remains a strong investment.

Alphabet, Inc is a holding company, which engages in the business of acquisition and operation of different companies. Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Google Services generates revenues primarily from advertising; fees received for consumer subscription-based products such as YouTube TV, YouTube Music and Premium, and NFL Sunday Ticket, as well as Google One; the sale of apps and in-app purchases and devices.

KEY NOTES FROM THE Q1 2025 EARNINGS CALL

Revenue up to $ 90.23 Billion (Q1 2024: $ 80.54 Billion)

Operating income for quarter one 2025 at $ 30.61 Billion (Q1 2024: $ 25.47 Billion)

Net income for quarter one 2025 at $ 34.54 Billion (Q1 2024: $ 23.66 Billion)

Diluted Earnings per share closed at $ 2.81 as at 31st March 2025 (2024: $ 1.89). Alphabet’s Board of Directors declared a quarterly cash dividend of $0.21 representing a 5% increase from the previous quarterly dividend of $0.20.

Cash and cash equivalents remained flat as of the end of March 31 2025 at $ 23.26 Billion (2024: $ 23.47 Billion)

Google advertising continues to do the heavy lifting for the alphabet business contributing $ 66.89 Billion of the total $90.23 Billion. Google Services includes products and services such as ads, Android, Chrome, devices, Google Maps, Google Play, Search, and YouTube. Of this amount, the breakdown is as below

•Google search & other: $ 50.70 Billion

•Youtube ads: $ 8.93 Billion

•Google Network: $ 7.26 Billion

Other services offered by the platforms contributed revenues as below

Google subscriptions, platforms & devices: $ 10.38 Billion

Google cloud: $ 12.26 Billion

Other bets: $ 450 million. Other Bets is a combination of multiple operating segments that are not individually material.

Hedging gains: $ 260 million

The company announced a share buyback program of up to $70 billion of its class A and class C shares. The buy backs will be executed through open market purchases or through privately negotiated transactions.

Business Opportunities/Strengths

Alphabet’s advertising business is firmly embedded in digital advertising budgets, allowing it to capitalize on the ongoing growth in digital ad spending.

The significant cash flows from advertising enable Alphabet to reinvest in growth areas like Google Cloud, AI-enhanced search, and innovative ventures such as Waymo. (Waymo is Alphabet's autonomous driving technology subsidiary, focused on developing self-driving cars and related technologies.)

With a strong foothold in the public cloud market, Alphabet has a substantial opportunity as a major provider for enterprises transitioning to digital platforms.

Risks to consider

Although Alphabet is working to diversify, text-based advertising remains its primary revenue source, presenting a concentration risk.

Ongoing investments in emerging, sometimes unproven technologies through its Other Bets segment continue to strain cash flows.

Increasing regulatory scrutiny of Alphabet's search dominance worldwide could lead to significant market disruptions through structural reforms.

Recommendation

We view Alphabet as a solid business with diverse solutions ranging from advertising, cloud business and driverless cars as well. While we acknowledge that the antitrust cases have continued to make headlines, we encourage investors to remain invested and focused on the business’s strengths. The business has unique products that will have the ability to remain leaders for a very long period of time. Android is the operating system for the majority of the world’s smartphones with more than two-thirds of all smartphones in the world running it. Virtually all smartphones, other than those manufactured by Apple, run on Android. We see this remaining as a google strength for a very long time. The Google Play Store’s unmatched ecosystem creates significant barriers for competing operating systems, limiting their access to critical applications. The recent correction on US technology companies provides us with a solid buying price for some of these great companies. Alphabet alone corrected by about 31% and has since bounced back.

We see the current price as a great entry price for long term investors based on both technical and fundamental analysis with a target price of $ 203.

$GOOG Eyes Breakout Above $198Currently at $197.12, NASDAQ:GOOG is trading above both its 50-period SMA (~$196.00) and 200-period SMA (~$192.50) on the 30-minute chart. The trend remains bullish with support holding firm at $192.50, and bulls are watching closely as the price flirts with resistance near $198.75. This steady grind higher signals strength and trend continuation. Using UltraAlgo Optimizer to catch the next gorgeous set-up — charting tomorrow’s giants with UltraAlgo

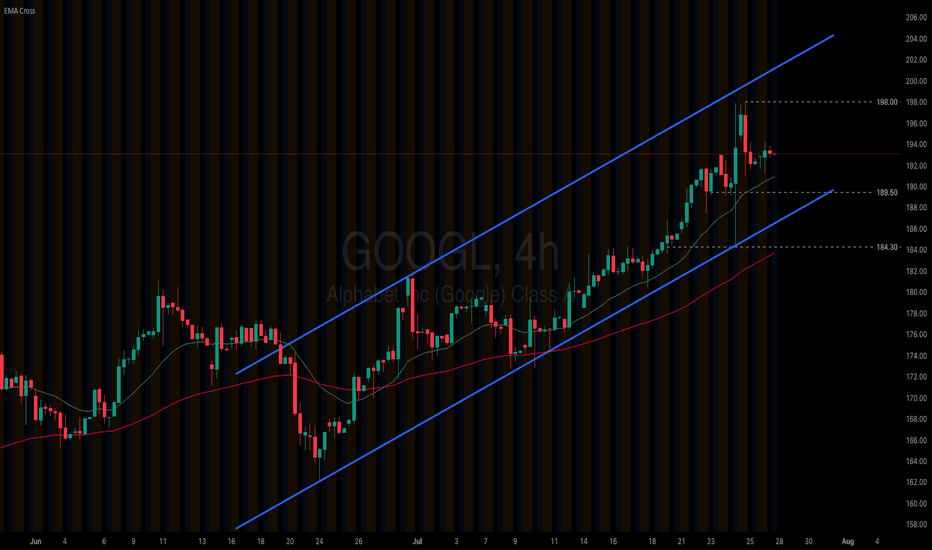

Alphabet (GOOGL) extends its rally on upbeat 2Q earnings

US equities continue to post record highs, driven by stronger-than-expected 2Q earnings and optimism over ongoing trade agreements. Alphabet’s (GOOGL) Q2 results reaffirmed the accelerating pace of AI-led growth. The company’s cloud revenue surged 32% YoY, up from 28% in 1Q, and it raised its full-year capex guidance from $75B to $85B.

Alphabet (GOOGL) remains firm within its ascending channel. The price solidly holds above both EMAs, indicating the potential extension of bullish momentum. If Alphabet (GOOGL) holds above EMA21, the price may gain upside traction toward the previous high at 198.00. Conversely, if Alphabet (GOOGL) breaks below the support at 189.50, the price could retreat to the next support at 184.30.

Head and Shoulders on $GOOGL right before earnings?- NASDAQ:GOOGL perhaps good news are already priced in?

- No positions on NASDAQ:GOOGL but interestingly it has given both bears and bull something to consider?

- Spectating what happens next!

- Interesting setup, bulls eyeing 200+ and bears targeting low 160s

- Good luck

Alphabet - The textbook break and retest!📧Alphabet ( NASDAQ:GOOGL ) will head much higher:

🔎Analysis summary:

If we look at the chart of Alphabet we can basically only see green lines. And despite the recent correction of about -30%, Alphabet remains in a very bullish market. Looking at the recent all time high break and retest, there is a chance that we will see new all time highs soon.

📝Levels to watch:

$200

🙏🏻#LONGTERMVISION

Philip - Swing Trader

Momentum Watch: GOOG Entry ZoneNASDAQ:GOOG – Trend Continuation Setup

The price has been trending within a clean ascending channel since April 2025.

After a pullback toward the midline and Bollinger basis, price is showing potential support.

Setup:

• Entry: $175 (conceptual)

• Stop: $165.5 (below channel)

• Target: $208 (upper boundary)

• Risk/Reward: 3.51

Stochastic is retracing but remains above key support zone.

As long as the channel holds, expecting continuation toward $200–208 by late September.

⚠️ Market remains under pressure following July 9th events, which could increase short-term volatility across tech.

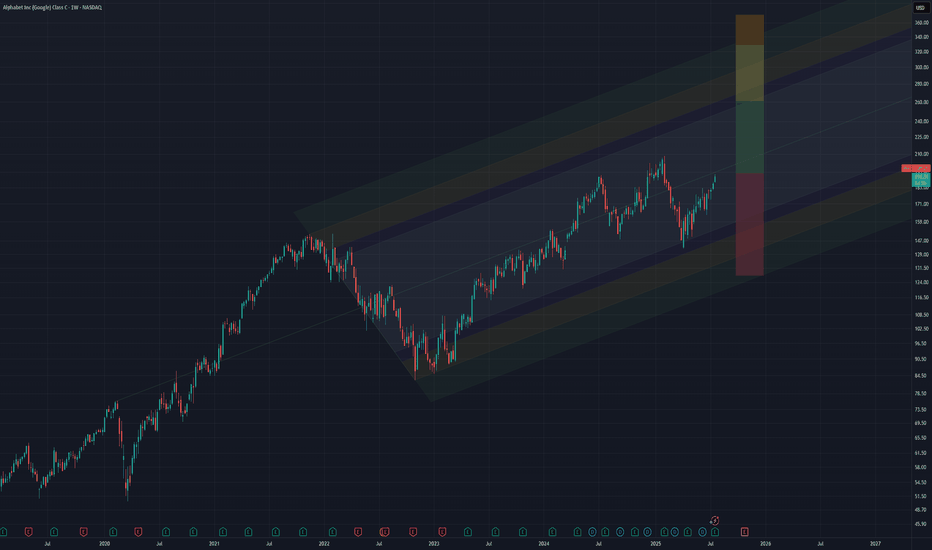

EOY based on yesterday's earnings and the flywheel effect# Alphabet's Accelerating Flywheel: Q2 2025 Earnings Validate the Strategy

technicals grounded in an anchored pitchfork hinged on the pre-covid levels (covid bottom just makes the path too aggressive for EOY) and fib retracements of the 2022 bear market decline. General and simple targets since moving averages aren't providing much clarity. Single stock analysis is even more voodoo than large sector indexes, so I'll focus on fundamentals instead:

## The Flywheel In Action: Q2 2025 Results

Alphabet's blowout Q2 2025 earnings provide concrete evidence that their integrated AI flywheel is already spinning faster. **Revenue grew 14% to $96.4 billion, crushing expectations**, while the company raised its 2025 capital expenditures from $75 billion to **$85 billion**—a bold investment that initially spooked some investors but actually signals the flywheel's acceleration.

### Why the $85 Billion Capex Increase is Strategic Genius

The additional $10 billion isn't just spending—it's **strategic reinvestment in the flywheel's core components**:

**Infrastructure Dominance:** Google Cloud revenue surged 32% to $13.6 billion, now approaching a $50+ billion annual run rate. The capex increase funds the massive data centers and TPU clusters needed to serve exploding AI demand.

**Competitive Validation:** Even OpenAI, Google's biggest AI rival, is now renting Google's TPU chips to power ChatGPT—choosing Google's proprietary hardware over Nvidia GPUs for cost-effective inference. This partnership alone validates the integrated hardware-software advantage.

**Market Leadership:** With AI Overviews reaching 2+ billion users (up from 1.5B last quarter) and Gemini hitting 450+ million users, Google is proving it can deploy AI at unprecedented scale while generating immediate revenue.

## The Core Flywheel System

**The Engine:** World-class AI research (DeepMind, Google AI) creating increasingly capable models that serve as tools for invention, not just products. Gemini's rapid user growth proves the models are competitive.

**The Fuel:** Search and YouTube revenue provides patient capital for long-term moonshots, while diverse data from billions of users continuously improves AI models. Q2's strong advertising performance ($64B+) funds the entire system.

**Custom Hardware Advantage:** Proprietary TPUs optimized for their AI software create faster, more efficient training and inference than competitors using general-purpose chips. OpenAI's adoption proves TPUs offer superior cost-performance.

**The Multiplier:** Quantum computing research that could eventually solve problems impossible for classical computers, creating step-change advantages in materials science and optimization.

## AI Integration Across the Ecosystem: The Ultimate Moat

Alphabet's true competitive advantage lies in **embedding AI across their existing billion-user platforms**, creating compound defensibility:

**Search Dominance:** AI Overviews now appear in 2+ billion monthly searches across 200+ countries, fundamentally changing how users interact with information while maintaining Google's search monopoly. Users increasingly expect AI-powered results, making switching costs even higher.

**Productivity Lock-in:** Gmail's Smart Compose, Google Docs' AI writing assistance, and Sheets' intelligent data analysis create sticky enterprise and consumer habits. Once teams adopt AI-enhanced workflows in Google Workspace, migration becomes exponentially more difficult.

**Developer Ecosystem:** Google's coding tools (Colab, Android Studio) now feature AI pair programming, while languages like Go and Dart benefit from AI-optimized development. This creates a generation of developers trained on Google's AI tools.

**Educational Moat:** Chromebooks in schools now include AI tutoring and personalized learning, creating habits among students who will become tomorrow's decision-makers. Google for Education's AI features make alternative platforms seem primitive.

**Entertainment Integration:** YouTube's AI-powered recommendations, creator tools, and content moderation have become so sophisticated that creators and viewers alike can't imagine the platform without them. This strengthens YouTube's dominance over TikTok and other competitors.

**Mobile and Browser Dominance:** Android and Chrome's AI features (Smart Reply, intelligent autofill, predictive text) create seamless experiences that competitors struggle to match without Google's data advantages.

## Near-Term Flywheel Accelerators

**Physical AI & Robotics:** Moving from digital-only AI to robots that can perceive and manipulate the physical world. Waymo has now driven 100+ million autonomous miles, generating unique physical-world training data.

**AI Biology:** DeepMind's protein folding breakthroughs and Isomorphic Labs' drug discovery pipeline could create massive pharmaceutical revenues while advancing the core AI engine.

**AI Materials Science:** Already discovering thousands of new materials that could dramatically improve batteries, semiconductors, and other hardware across all ventures—feeding back into better TPUs and infrastructure.

## The Compounding Network Effects

**Data Flywheel:** More users → More training data → Better AI models → Better products → More users. AI Overviews now drive 10%+ more queries for the types of searches that show them.

**Revenue Flywheel:** AI success → Higher cloud/advertising revenue → More R&D investment → Better AI → Market expansion. Google Cloud's 32% growth funds continued AI leadership.

**Talent Flywheel:** Best AI infrastructure → Attracts top researchers → Better models → More ambitious projects → Attracts even better talent. The recent $2.4B Windsurf acquisition shows Alphabet winning the talent war.

**Infrastructure Flywheel:** More AI demand → Larger TPU deployments → Better hardware optimization → Lower costs → More competitive offerings → More demand.

**Ecosystem Lock-in:** AI features across Gmail, Docs, YouTube, Search, and Android create switching costs that compound across products. Users don't just leave Google Search—they'd have to abandon their entire digital workflow.

## The Strategic Moat Widens

While competitors excel in individual areas, Alphabet's advantage comes from **deep integration creating compound effects**:

- **Capital Moat:** The $85B capex commitment (13% increase from 2024) exceeds most competitors' total revenues

- **Integration Moat:** OpenAI using Google TPUs despite being competitors proves the hardware-software integration is unmatched

- **Scale Moat:** 2+ billion AI Overview users and $50B+ cloud run rate create network effects competitors can't replicate

- **Ecosystem Moat:** AI embedded across Search, Gmail, YouTube, Android, Chrome, and Workspace creates compounding switching costs

- **Innovation Velocity:** Time from AI research to deployed products at billion-user scale continues compressing

## The Key Insight

The Q2 earnings reveal that Alphabet isn't just building an AI company—**they're building the infrastructure that accelerates invention itself**. Each breakthrough feeds back into the system: new discoveries generate revenue that funds more research, create better tools for the next breakthrough, and attract top talent.

More importantly, they're embedding AI so deeply into users' daily workflows—from Gmail to YouTube to Search—that switching becomes not just inconvenient but practically impossible. When your email, documents, entertainment, and information all work seamlessly together through AI, why would you ever leave?

The $85 billion capex increase signals management's confidence that they're approaching "escape velocity"—where their innovation rate becomes impossible for competitors to match. While others debate AI spending, Alphabet is already demonstrating profitable AI deployment at unprecedented scale while simultaneously investing in the next acceleration phase.

**The Bottom Line:** Alphabet's integrated flywheel of AI research, proprietary hardware, massive data, and patient capital is creating an innovation velocity that competitors are finding increasingly difficult to match. But their true moat is embedding AI so deeply into billions of users' daily habits that the entire Google ecosystem becomes indispensable—and the Q2 results prove this strategy is already working.

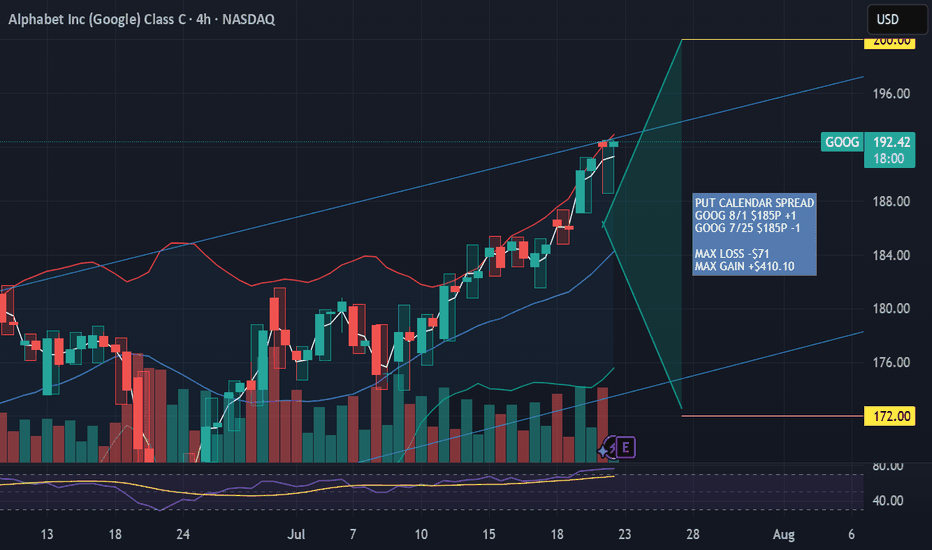

GOOG Put Calendar Spread July 22, 2025GOOG has earnings upcoming and is in the top Bollinger band, daily RSI is 74. With a price target of $185 this trade is profitable between $200 and $172 providing a large target window in a short timeframe. Trade will be a

PUT CALENDAR SPREAD

GOOG 8/1 $185P +1

GOOG 7/25 $185P -1

MAX LOSS -$71

MAX GAIN +$410.10

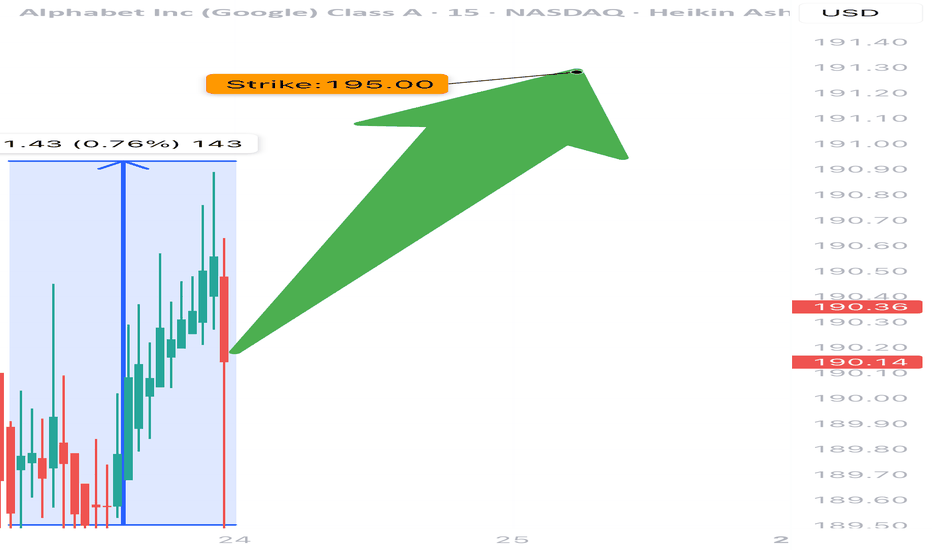

GOOG Earnings Setup (2025-07-23)

📈 GOOG Earnings Setup (2025-07-23) 🚀

🔥 STRONG BULLISH BIAS – 85% Confidence

Alphabet (GOOG) is set to report after market close. Here’s why this setup is 🔥:

⸻

📊 Fundamental Highlights:

• 💸 TTM Revenue Growth: +12.0%

• 🧾 Profit Margin: 30.9%

• 💯 Earnings Beat Rate: 8/8 last quarters

• 📈 EPS Est: $8.95

• 🎯 Forward P/E: Attractive in the AI-dominant market

👉 Score: 9/10

⸻

🔍 Options Market Flow:

• 🚀 Heavy Call buying at $195 strike

• 💰 Implied Move: ±5.12%

• 🛡️ Light Put hedging at $190 shows cautious optimism

• 📉 IV Rank: 0.75 (Elevated but tradable)

👉 Score: 8/10

⸻

🧭 Technicals:

• 🔺 RSI: 73.32 (strong momentum)

• 🔼 Above 50/200 MA

• 🔵 Support: $190.00

• 🔴 Resistance: $200.00

👉 Score: 8/10

⸻

🌍 Macro/Sector Tailwinds:

• 🌐 AI & Ads tailwind still fueling growth

• 📡 Sector leadership + resilient biz model

👉 Score: 9/10

⸻

🛠️ Trade Idea (High Conviction)

🔹 Ticker: NASDAQ:GOOG

🔹 Direction: CALL

🔹 Strike: $195.00

🔹 Expiry: 07/25/2025

💵 Entry Premium: $3.95

🎯 Target Premium: $11.85 (200%)

🛑 Stop: $1.98 (50%)

📅 Entry: Before 07/23 Close (Pre-Earnings)

⸻

📌 Risk-Reward

• Max Loss: $395 per contract

• Target Gain: $1,190 per contract

• Break-even: $198.95

• ⏳ Time-sensitive: Close post-earnings if flat (avoid IV crush)

⸻

🚨 Summary

💥 GOOG looks primed for an upside breakout. Strong fundamentals + bullish technicals + aggressive options flow make this a top-tier earnings play.

🔔 Watch $195–$200 zone post-earnings.

💬 Drop your thoughts 👇 — are you playing GOOG this earnings?

Alphabet (GOOGL) Stock Approaches $200 Ahead of Earnings ReleaseAlphabet (GOOGL) Stock Approaches $200 Ahead of Earnings Release

According to the Alphabet (GOOGL) stock chart, the share price rose by more than 2.5% yesterday. Notably:

→ the price reached its highest level since early February 2025;

→ the stock ranked among the top 10 performers in the S&P 500 by the end of the day.

The positive sentiment is driven by expectations surrounding the upcoming quarterly earnings report, scheduled for release tomorrow, 23 July.

What to Know Ahead of Alphabet’s (GOOGL) Earnings Release

According to media reports, Wall Street analysts forecast Alphabet’s Q2 revenue to grow by approximately 11% year-on-year, with expected earnings per share (EPS) of around $2.17 — up from $1.89 a year earlier. Notably, the company has consistently outperformed estimates for nine consecutive quarters, setting a positive tone ahead of the announcement.

Despite the optimism, investors are closely monitoring two key areas:

→ Cloud computing competition , where Google Cloud contends with Microsoft Azure and Amazon AWS;

→ Growing competition in the search sector , linked to the rise of AI-based platforms such as ChatGPT.

In response, Alphabet is significantly increasing its capital expenditure on AI infrastructure, planning to spend around $75 billion in 2025. These investments are aimed at both defending its core search business and advancing the Gemini AI model, while also strengthening Google Cloud’s market position.

Technical Analysis of Alphabet (GOOGL) Stock

Since April, GOOGL price fluctuations have formed an ascending channel (marked in blue).

From a bullish perspective:

→ the June resistance level at $180 has been breached and may soon act as support;

→ previous bearish reversals (marked with red arrows) failed to gain momentum, suggesting sustained demand is pushing the price higher.

From a bearish standpoint, the price is approaching:

→ the psychological level of $200, which has acted as a major resistance since late 2024;

→ this barrier may be reinforced by a bearish gap formed in early February.

Strong results from the previous quarter, combined with optimistic forward guidance from Alphabet’s management, could provide bulls with the confidence needed to challenge the $200 level.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Open AI building it's own Browser- Open AI building it's own Browser. They have the talent to build it.

- Apple buying Perplexity AI

- MARKETSCOM:GOOGLE chrome isn't the best. I find Firefox better than Chrome but that's subjective. There's no stickiness in web browsers honestly. It's just that there are no good options.

- Recently, Google chrome added some weird looking AI summarizer on top which must be reducing number of organic hits to the website.

- I'm bullish long term but bearish short term. Open AI is really disruptor and has strong talent density better than Google in my opinion.

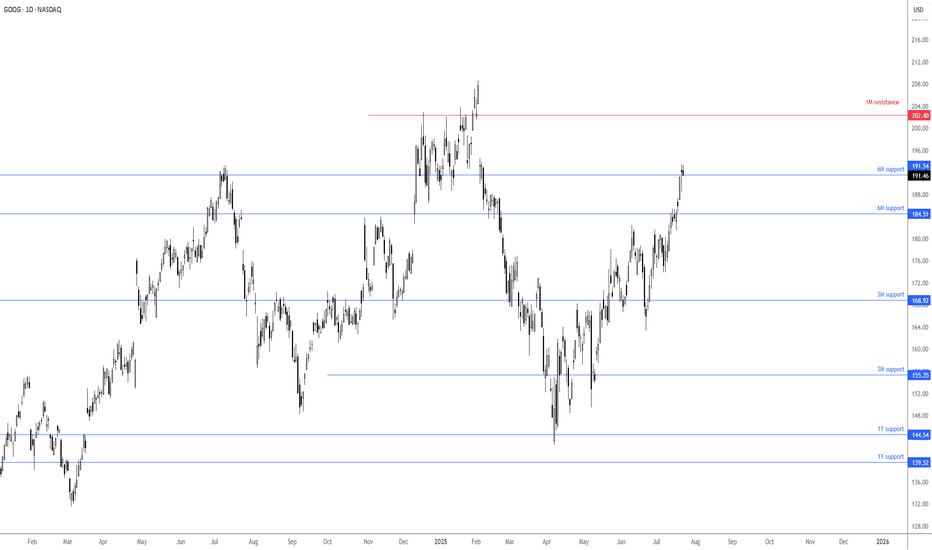

Google trading north of support ahead of earnings!Ahead of today’s Q2 earnings release, you can see the price of Alphabet is trading just above a 6M support at US$191.54. Finding acceptance north of this support level could prompt buyers to change gears and potentially target a 1M resistance level at US$202.40. If price makes it above here, you will likely see the Stock challenge all-time highs of US$208.70, formed in early February this year. Failure to hold above US$191.54, nevertheless, could see price action target 6M support at US$184.51.

FP Markets Research Team.

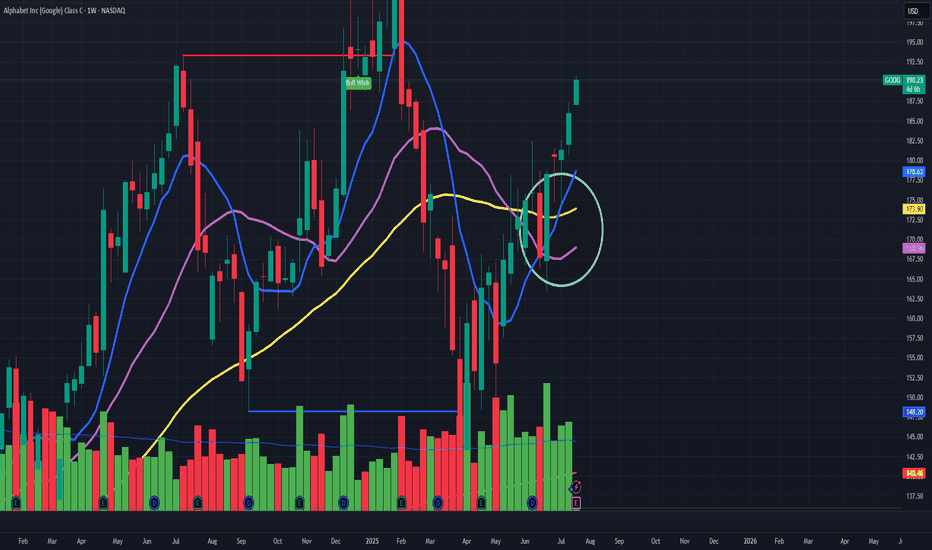

With price near $190 and strong volume, $200+ looks imminent.🔥 NASDAQ:GOOGL Weekly Chart Signals a Golden Cross

Alphabet’s (GOOG)9-week MA is crossing the 20 and 50-week MA—classic bullish setup. With price near $190 and strong volume, $200+ looks imminent.

💡 Why It’s Climbing:

- AI breakthroughs (Gemini, DeepMind)

- Google Cloud gaining traction

- Big tech rotation + investor flow

📈 Golden crosses like this often lead to multi-month rallies. GOOG’s chart is flashing green.

Earnings Incoming: July 23, 2025 (After Market Close)

Alphabet (GOOG) is set to report Q2 earnings this week, and expectations are high:

- EPS Forecast: $2.14 per share, up 13% YoY

- Revenue Estimate: $79.2B, an 11% increase from last year

- Key Drivers: AI momentum (Gemini, DeepMind), Google Cloud growth, and strong YouTube ad performance

💡 With a golden cross forming and earnings likely to show double-digit growth, GOOG could get the catalyst it needs to break past $200.

GOOG - Possible Break OutHello Everyone,

Happy Sunday to All.

I would like to make a quick Analyse on GOOG. When i was scanning the stocks,i reliazed that this could be a possible breakout and could be a opportunity to buy.

This looks like a breakout and i am expecting to Re-test trend line which price level 175 $.

Then first target is 190-192 which is approx %8 - 10 above from 175.

If it will restest and hit the 175 , this could be good entry point.

If not then first target is 190-192 which is approx %5 above current price level.

Long Term , of course Google is Google no doubt to jump in every price points :)

For me, short term i would wait 175 and put my order to that price , then wait for next moves.

This is just my thinking and it is not invesment suggestion , please do not make any decision with my anaylsis.

Have a lovely Sunday and good start a Week

Silicon Valley Shaken by China’s Free AI OffensiveSilicon Valley Shaken by China’s Free AI Offensive

By Ion Jauregui – Analyst at ActivTrades

Artificial intelligence is undergoing its first major geopolitical fracture. While OpenAI strengthens its infrastructure by renting servers from Google Cloud, China’s advance with free generative models threatens to redefine the balance of power in the sector. Names like Qwen, InternLM, Yi, Baichuan, ChatGLM, or Ernie Bot (from Baidu), as well as initiatives backed by Tencent, Alibaba or iFlytek, are emerging strongly. Many of these open-source models already match — and in some tasks outperform — DeepSeek and compete with giants like GPT-4. A new global chessboard is being drawn with direct consequences for Alphabet, owner of Gemini and the same cloud service now supporting its main rival.

Google’s parent company has once again bared its teeth. Alphabet published second-quarter 2025 results that comfortably beat market expectations. Revenues are rising, profitability is solid, and its financial strength allows it to buy back shares at a dizzying pace. But behind all the shine, one shadow remains: its bet on artificial intelligence, Gemini, still hasn’t taken off compared to ChatGPT — and now faces a tsunami of free AI coming from China.

China’s Free AI Offensive: Intelligence for All (Without Paying)

The latest developments unveiled by Beijing are setting off alarms in Silicon Valley. Models like InternLM2, Qwen2, and Yi are not only distributed freely but show results equivalent or superior to paid models in key natural language tasks. Trained with massive corpora and backed directly or indirectly by the state, these AIs are designed to scale in universities, startups, and local companies, replacing Western software at no cost and with open licenses. The open-source ecosystem, combined with a local (albeit limited) chip market, allows China to reduce dependence on the West while exporting influence to emerging markets like Central Asia, Africa, or Latin America.

Xi Jinping Hits the Brakes… or Does He?

Since Xi Jinping’s speech calling for “moderation” in public investment in sectors like AI or electric vehicles, the message seems more like an attempt to control bubbles than halt progress. The president was clear: “Not the entire country should be building cars or processing data.” With irony, he labeled local governors as “three-pat officials”: one on the head to get the idea, one on the chest to sell it, and one on the backside to run when it blows up. Elegantly Brutal Comment. Behind the humor lies a serious backdrop: inflated bubbles, centers without qualified staff or functioning chips, and falsified sales data. This isn’t surprising given China’s price wars in the auto sector and shady practices inflating sales through vehicles insured before actual purchase, which has triggered a wave of new regulations and controls. This war has spread to AI, with centers being built without skilled personnel or working chips. According to Xi, unchecked growth is not worth it if it means excessive corporate and state debt.

OpenAI Rents Google Servers: Strategic Move or Dependence?

In an unexpected twist, OpenAI has started using Google Cloud infrastructure. The paradox is clear: Google, a direct rival with Gemini, is now supporting the race leader. The move seems pragmatic: OpenAI needs scale, and Google has one of the world’s most powerful cloud networks. This could translate into meaningful revenue for Alphabet, at the cost of ceding leadership perception in AI.

From a strategic standpoint, integrating into OpenAI’s service ecosystem could win Alphabet a long-term technological and economic victory by boosting cloud revenues and indirectly funding Gemini.

Alphabet Analysis (GOOGL)

🤖 Gemini, the Eternal Contender?

The paradox is clear: by using Google Cloud — one of the world’s most powerful cloud services — OpenAI generates income for Alphabet. Meanwhile, Alphabet still struggles to differentiate itself in generative artificial intelligence. Gemini continues searching for its place. Despite being one of Alphabet’s boldest bets, its progress has been slow and adoption lukewarm, and it hasn’t yet delivered significant returns on its own. Gemini has yet to achieve massive direct monetization. While integrations with Google Workspace — Gmail, Docs, and the Android ecosystem — are gaining visibility, user perception is still dominated by OpenAI. And now, with the emergence of free Chinese AIs, Gemini may be pushed aside even in markets where Alphabet aimed to lead digital transformation, like India, South America, or parts of Eastern Europe.

This alliance with OpenAI may have a mixed impact: positive on revenues, but negative for perceptions of technological leadership. Meanwhile, the market is watching open-source models like Qwen2, InternLM2, and Yi from China — all free — gain traction in sectors once reserved for the West. In the short term, this may seem like a trade-off, but from a strategic viewpoint, it could be one of Alphabet’s key long-term business moves. Alphabet has historically invested in competitors and made key acquisitions to reinforce its ecosystem — this could be one of those strategic bets, helping to fund Gemini’s path toward long-term tech leadership. Especially considering that in Q1, it increased R&D spending — particularly in AI and quantum computing — and that the cloud business must sustain its operating profitability (which grew 25% in Q1), this move could provide essential capital for this critical business vertical. Alphabet posted $33.8 billion in Q1 revenue, with total operating margins around 28%. AI as a future lever: Gemini 2.5 Pro and AI Overviews, already with 1.5 billion monthly users, could be catalysts accelerating multiple products.

A (Nearly) Perfect Quarter

Alphabet posted $93.84 billion in revenue in Q2 2025, a year-on-year growth of +10.7%. Net income reached $26.5 billion, with estimated EPS at $2.18. Operating margins improved to 34% (up from 32.4% in Q2 2024), reflecting more efficient management, while other Big Tech players have opted for cuts. One key standout was Google Cloud, which grew over 25% YoY ($12–13.1B), consolidating its profitability and strengthening its role as Alphabet’s second-largest revenue stream behind advertising.

Is Advertising Still the Engine?

Ad revenues rose by a solid +8.5%, reaching nearly $67 billion, with YouTube and Google Search leading the recovery (~$52–53B). Alphabet shows that even in disruptive times, its model continues generating cash.

Regulatory Risks

Growing antitrust pressure (Chrome, search case) with upcoming decisions could impact its business model and valuation.

Massive Buyback and Strong Cash Position

Alphabet isn’t just earning — it’s returning value to shareholders. The company announced a $70 billion share buyback, showing confidence in its future. Its cash position remains one of the strongest in the sector.

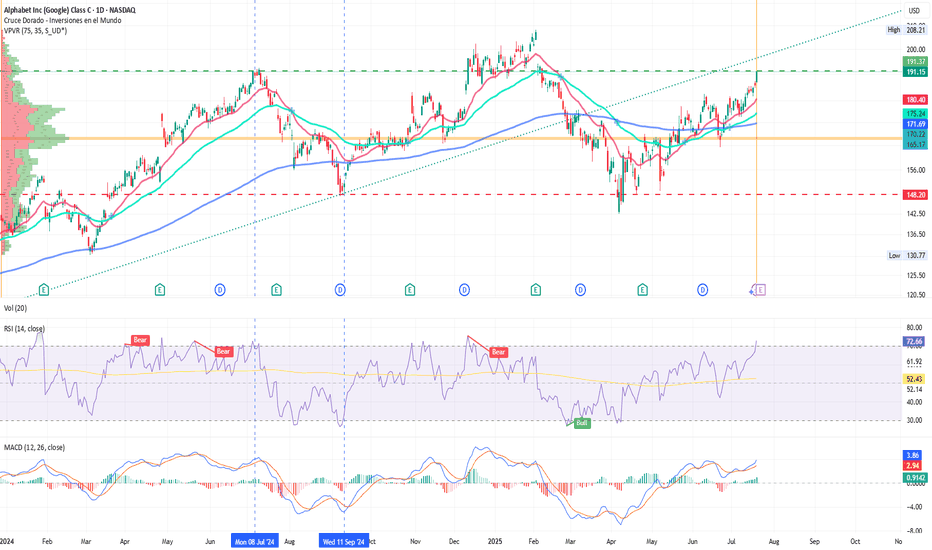

Technical Analysis (Updated)

Yesterday’s closing price was $191.37, within the consolidation zone from early 2025 that took the stock to its all-time high of $208.21. The upward channel seems to be testing a strong resistance zone, and the RSI is showing overbought conditions at 72.66%. The golden cross identified on June 30 remains intact. The strong trading zone around the point of control at $166.67 appears to act as support for the recent rally, indicating a positive bias. Key supports lie around the 200-day moving average ($172.9) and the 50-day moving average ($168). A convincing close above $194–195 may lead to further gains, while losing the $172.9–168 zone could suggest a correction due to high speculation or partial institutional sell-offs.

Conclusion: Train Wreck or Calculated Strategy?

The dominance of artificial intelligence is no longer just a game between American giants. China has entered the arena with a radical strategy: offering free, functional models to the world. The emergence of these state-backed models will force Silicon Valley to respond through moves like this one. Alphabet finds itself at a crossroads. Its financial strength and cloud business give it tactical advantages — even while renting infrastructure to its rivals — although this may dilute its presence as a developer. Still, its big AI bet appears to be advancing more slowly than many hoped. Alphabet’s strategy of participating in its rival’s business could be seen as weakness… or as a long-term masterstroke. Everything will depend on whether Gemini can reach the level of sophistication, adoption, and monetization that its ambition promises. Until then, the global AI landscape has become more complex, more competitive… and more Eastern.

*******************************************************************************************

The information provided does not constitute investment research. The material has not been prepared in accordance with the legal requirements designed to promote the independence of investment research and such should be considered a marketing communication.

All information has been prepared by ActivTrades ("AT"). The information does not contain a record of AT's prices, or an offer of or solicitation for a transaction in any financial instrument. No representation or warranty is given as to the accuracy or completeness of this information.

Any material provided does not have regard to the specific investment objective and financial situation of any person who may receive it. Past performance and forecasting are not a synonym of a reliable indicator of future performance. AT provides an execution-only service. Consequently, any person acting on the information provided does so at their own risk. Political risk is unpredictable. Central bank actions can vary. Platform tools do not guarantee success.

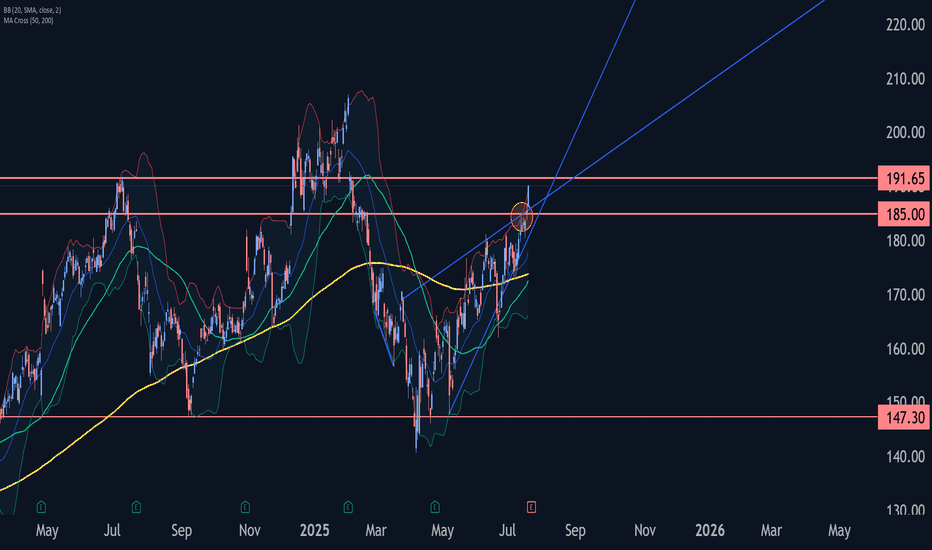

Google Wave Analysis – 21 July 2025

- Google broke resistance zone

- Likely to rise to resistance 191.65

Google recently broke the resistance zone between the resistance level 185.00 and the upper trendline of the daily Rising Wedge from the start of May.

The breakout of this resistance zone accelerated the active impulse wave C of the intermediate ABC correction (2) from the start of April.

Given the clear daily uptrend, Google can be expected to rise further to the next resistance 191.65 (target price for the completion of the active impulse wave C).