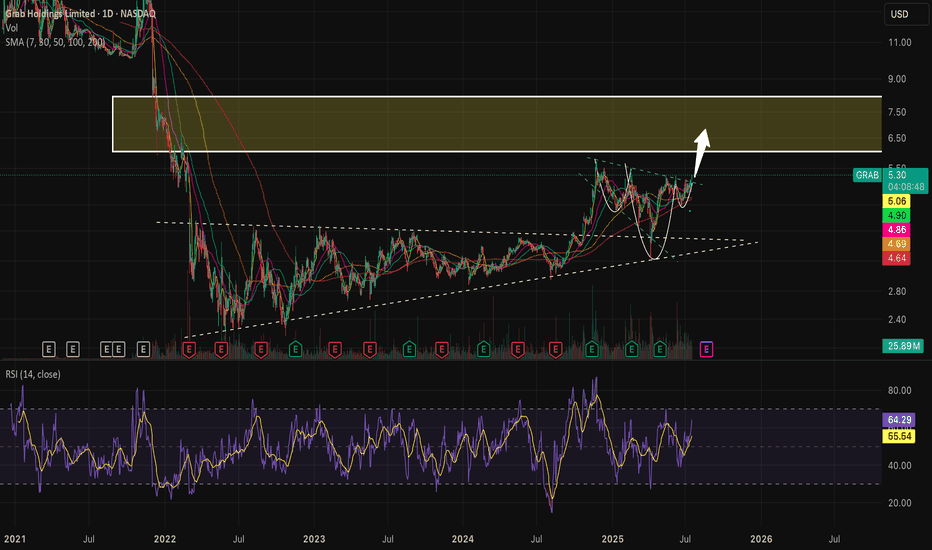

GRAB 1W: Two Years of Silence — One Loud BreakoutGRAB 1W: When stocks go quiet for two years just to slap bears across both cheeks

The weekly chart of GRAB shows a textbook long-term accumulation. After spending nearly two years in a range between $2.88 and $4.64, the price is finally compressing into a symmetrical triangle. We’ve already seen a breakout of the descending trendline, a bullish retest, and the golden cross between MA50 and MA200. Volume is rising, and the visible profile shows clear demand with little resistance overhead.

The $4.31–$4.64 zone is key. Holding this level opens the path to $5.73 (1.0 Fibo), $6.51 (1.272), and $7.50 (1.618). The structure is clean, momentum is building, and this accumulation doesn’t smell like retail — it smells institutional.

Fundamentally, GRAB is a leading Southeast Asian tech platform combining ride-hailing, delivery, fintech, and financial services. Yes, it’s still unprofitable (–$485M net loss in 2024), but revenue is growing fast, recently crossing $2.3B. Adjusted EBITDA has been improving steadily, and the company holds $5.5B in cash equivalents with minimal debt — giving it excellent liquidity and expansion flexibility.

Valued at ~$18B, GRAB operates in the world’s fastest-growing digital market, with increasing institutional exposure from players like SoftBank and BlackRock. The 2-year base hints at smart money preparing for the next big move.

Tactical plan:

— Entry: by market

— Targets: $5.73 → $6.51 → $7.50

— Stop: below $4.00 or trendline

If a stock sleeps for 2 years and forms a golden cross — it’s not snoring, it’s preparing for liftoff. The only thing left? Don’t blink when it moves.

GRAB trade ideas

$GRAB ready for the launch to $6-8 range- NASDAQ:GRAB market leader in south east asia with diversified business in a growing economy has massive TAM and strong tailwinds i.e economy of scale.

- it provides you to diversify your portfolio with emerging markets.

- NASDAQ:GRAB was consolidating and now is ready for the impulsive move to its new range of $6-8 where it might consolidate further to challenge the all time highs.

Grab - About to Launch?I like what i'm seeing here on the Grab chart, it's grabbed my attention. It very much reminds me of the way the Robinhood chart looked around $8, before it began an epic return to all time highs. Does Grab have the potential to become a multi bagger? Let's examine the chart..

In Phase A the early IPO investors either took huge losses or became bag holders. This is typical of many charts I have analysed. The stock price dropped almost 90%.

We are now in Phase B, the accumulation phase. 1212 days of sideways action, the stock has not broken out of this range in a long time. But there is positive signs as the previous range is now holding as support.

We broke out of a triangle pattern from the lows and appear to be putting in higher highs and higher lows on the daily time frame. This suggests that interest is returning to this stock and buyers are accumulating. We have broken out of the previous range and back tested the golden pocket as support. Grab will have to hold $5 as support, if that does happen then could be more upside to come. I'd like to see more volume come in and a breakout from this wedge before going long.

Not financial advice, do what's best for you.

GRAB — Breakout Confirmation and Strong Upside PotentialGrab Holdings (GRAB) is currently forming a promising technical setup supported by a breakout from long-term consolidation. After printing a strong low and breaking out of a multi-year range, the price action confirms a bullish reversal with clear structure.

Technical Analysis

– Trendline breakout and bullish market structure shift

– Price is consolidating above the breakout level, forming a continuation zone

– Valid entries: market execution above $4.50 or limit orders near $4.00 support

– First profit target: $6.60 (around 40% growth)

– Second target: $10.15 (over 100% from entry)

The setup suggests increasing bullish momentum. A clean consolidation above previous resistance strengthens the case for a breakout continuation toward $6.60 and potentially $10.15.

Fundamental Backdrop

Grab is a Southeast Asian tech leader operating across ride-hailing, food delivery, and digital payments. The company continues to reduce losses, improve margins, and expand its fintech arm. With rising digital adoption in the region and a shift toward profitability, GRAB is gaining investor attention. Its most recent earnings report showed improving revenue trends and narrowing net losses — a strong signal of long-term sustainability.

Conclusion

Grab Holdings presents a well-aligned opportunity from both a technical and fundamental perspective. With a clear structure, breakout confirmation, and fundamental turnaround, this setup fits both swing and midterm investment strategies. Risk management is still key — stops should be placed below consolidation lows or key structure levels.

If buyers were to GRAB shares now volume will be the key.Overall uptrend starting from Sept 2024 still intact multiple attempts above 5$ to no avail next is a retest and its looking ripe for a next leg up extension into a higher price range.

Needs more buying volume.. if this doesn't change then price will stay within this range

which its been trapped in this zone since Nov 2024.

$GRAB Long Term Trade IdeaTaxi and delivery service stocks all look bullish at the moment. Lyft and Grab are both a couple of my favorite longer term swing trade/investment plays just based off risk/reward and how beaten down both the stocks are.

If shown patience this trade could work wonders. I like it a lot because it gets me a little exposure to assets outside the U.S. and from a chart perspective its hard not to love a setup like this.

1. The buy side volume shown here is the highest its ever been for the stock by a long shot.

2. Price has been in a descending wedge type formation for several months now and is attempting to make a breakout, though this month's candle still has a lot of time left.

3. That hammer candle, especially considering it being printed on the 1M timeframe, is incredibly bullish in my eyes.

This chart reminds me a lot of NYSE:BABA but a bit earlier in its breakout stages. To me it is clear that accumulation has been taking place for over 2 years now and a big markup is upon us.

I have 3 take profit areas marked based off a few different Fibonacci levels I like that also have confluence with supply/demand dynamics present on the chart.

multiple daily/weekly candles below $4 could be a a good stop loss area as that would invalidate a lot of the bullish structure. Based off the current price this provides you with a minimum 2.75x RR trade and a maximum of 7x RR.

My average price is $4.25. Any pullbacks below $4.50 I will be looking at as great buying opportunities.

Will do my best to update this idea periodically over the next year or so.

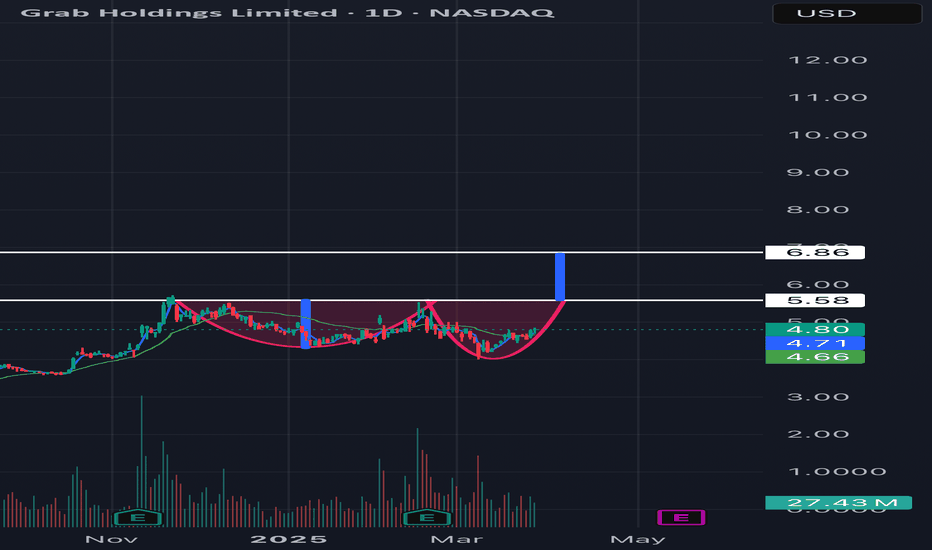

“Grab Stock Nears Breakout: Cup and Handle Eyes $6.86 Target”Grab Holdings (GRAB) stock is currently developing a cup and handle pattern on its daily chart, a bullish technical formation indicating potential for a significant rally. This pattern, marked by a rounded cup followed by a consolidating handle, suggests building momentum. A breakout above the key resistance level of approximately $5.58 could trigger a sharp upward move, targeting around $6.86 based on the pattern’s projected rise. This setup positions Grab stock for a potential skyrocketing surge, making it an intriguing opportunity for traders as it nears this critical breakout point.

Grab Holdings (GRAB) – Turnaround Phase BeginsGrab appears to be entering a clear turnaround phase based on its latest financials. Revenue continues to grow, and more importantly, the company has achieved positive EBITDA and Free Cash Flow (FCF) for the first time in 2024.

Key Highlights

Revenue growth: $675M (2021) → $2.8B (2024 TTM), 4x increase

EBITDA turns positive: from -$1.5B to +$93M

Operating Cash Flow (OCF) turns positive: +$852M

Free Cash Flow (FCF) positive: +$739M

Net debt significantly reduced: $2.18B → $364M

Cash position strong: $2.96B in cash & equivalents

Risks & Watch Points

Net income remains negative: -$105M

Equity is decreasing, potentially limiting future investment flexibility

Highly sensitive to macro risks (pandemic, recession)

Fintech division (GXS Bank) growth may bring credit risk

Grab is expected to begin realizing its profit-generating potential starting this year

The recent weekly candle tested the previous structure and could serve as a key reference point for trading.

Premarket Analysis: GRAB - Grab Holdings LimitedGrab Holdings just rebounded strongly off this $4.05 Support Level that was established back in Oct. 2025 while also releasing news of Grab partnering with Tech Firms to assess ithe mpact of autonomous vehicles in South Asia. With this trade, we will be looking for a $4.50 retest and bounce back to $4.80.

Entering around $4.10-$4.12, anything below that and above $4.05 would provide a potential 15-20% Swing Trade, placing a stop loss at $3.88 to secure our 3:1 Risk Reward Ratio.

$GRAB yourself some GAINS!NASDAQ:GRAB yourself some GAINS!

The longer the base, the higher the space!

Lots of retail and super investors buying this name.

A train that goes in motion stays in motion...

- Wr% is in motion to the Green Support Beam.

Typically, this name would probably pull back with the direction of the Wr%, BUT... this stock is getting hyped up by a lot of super investors and retail investors right now. I think this week we will see a large move upward as HYPE creates FOMO which takes the stock HIGHER!

Staying patient here...

Not financial advice

$GRAB - One of the best DCA opportunity! PT : $7-10- NASDAQ:GRAB is no brainer buy sub $5 and ride it till $7-10

- It's like NYSE:UBER of south east asia.

- If you believe that in upcoming years, income per capita in south east asia will grow then you are investing in the right company!

- This stock provide me diversification outside of US and allows me to capture the network effect of growing economy be it via inflation or actual income per capita.

- NASDAQ:GRAB is blue chip stock for south east asians. Their fund managers, public will likely add it in their retirement savings account.

- Passive inflows alone will lift the market cap of the company.

- NASDAQ:GRAB will be double digits. It's just matter of when!

- This NASDAQ:GRAB isn't a trade for me but an investment. I don't care if it crashes by 30-50% or go up by 30-50% in next 1-2 years.

- I'm looking at a multibagger investment and aim for at least 4-5x from current level.

Grab Stage 2 BreakoutNASDAQ:GRAB is setting up for a potential breakout! Here’s why:

-Built a solid 2.5-year base, broke out, retested & held as support, then rallied explosively on high volume (strong accumulation!).

-Pullback to 0.5 Fib & 21-week EMA support, followed by a breakout of the retracement trendline. Now retesting for confirmation.

📊 Technicals:

-Daily RSI: 42 (low & primed for upside)

-Daily MACD: Positive crossover

-Squeeze indicator: Near positive squeeze

-Declining volume on pullback = bullish signal

💼 Fundamentals:

-Free cash flow > debt

-Consistent revenue growth since Q1 ‘22

-Earnings on Feb 21 = potential catalyst

NASDAQ:GRAB looks ready for the next leg up! 🚀

#Stocks #TechnicalAnalysis #GrabHoldings

Grab (GRAB): Momentum Builds After Fibonacci SupportGrab Holdings Limited (GRAB) is a leading technology company in Southeast Asia, providing ride-hailing, food delivery, and financial services through its all-in-one app. Known as the region’s “super app,” Grab helps millions of users with everyday services while expanding its reach in digital payments and mobility solutions. The company’s growth is driven by rising demand for cashless transactions, food delivery, and an expanding customer base.

GRAB recently showed a confirmation bar with rising volume, moving higher after finding new demand at the 50% Fibonacci retracement. This suggests renewed buying interest, which could signal a strong support level for traders. A trailing stop can be set using Fibonacci levels with the snap tool, helping traders manage risk in the trade.

Grab: Grabbing a RideGrab, often dubbed the "Uber of Southeast Asia," has solidified its position as a leading player in the region's rapidly growing digital economy, making it an exceptionally compelling investment. As of the latest reports, they boast a robust cash reserve of approximately $5.56 billion in cash and short-term investments, representing nearly 30% of its market capitalization. This financial strength provides a significant buffer for both growth initiatives and operational stability. From a financial perspective, Grab has consistently delivered impressive revenue growth, with projections indicating a 17-20% increase in 2024, and a potential acceleration in 2025, driven by its dominant presence in both the ride-hailing and food delivery sectors across eight Southeast Asian nations. Additionally, the company's adjusted EBITDA guidance has been upgraded by 15%, reflecting improving profitability and operational efficiency. Grab's strategic evolution into a super-app, integrating financial services such as digital payments and banking, further diversifies its revenue base, positioning the company as an attractive investment in a region poised for continued digitalization and economic growth.

The company has been strategically managing its finances by increasing its cash reserves and reducing its debt, a move that has positioned it favorably in the competitive ride-hailing and delivery market in Southeast Asia. This financial strategy is evident as Grab has been reported to have decreased its liabilities while bolstering its cash on hand, aiming for greater financial stability and operational flexibility. Simultaneously, Grab's partnership with Uber has been significant; after Uber sold its Southeast Asian operations to Grab in 2018, Uber retained a 25% stake in Grab, which not only facilitated Grab's dominance in the region but also allowed both companies to benefit from shared technology and market insights. This collaboration has been a cornerstone for Grab, enhancing its service offerings and market expansion while maintaining financial health.

$4.50 NASDAQ:GRAB

Grab Holdings (GRAB) - Set for New Highs?🔍 Analysis Overview

This chart outlines a possible Elliott Wave corrective structure on Grab's daily timeframe. The analysis focuses on the following:

Corrective Wave Pattern:

- Wave W and X appear complete, with wave Y potentially targeting the Fibonacci retracement zone.

Wave Y Target Zone:

- Primary target between 4.57 (1.236) and 4.40 (1.382), supported by the downward channel trendline.

Bullish Targets Post-Correction:

- Immediate target at 6.24, with a secondary target at 6.56, assuming the corrective structure resolves bullishly.

Risk Management:

- Stop-loss positioned at 4.35 to account for a breakdown scenario invalidating the wave count.

📊 Indicators:

- RSI and MFI suggest the possibility of further correction before resuming an upward trend, providing additional confidence in the projected wave Y completion zone.