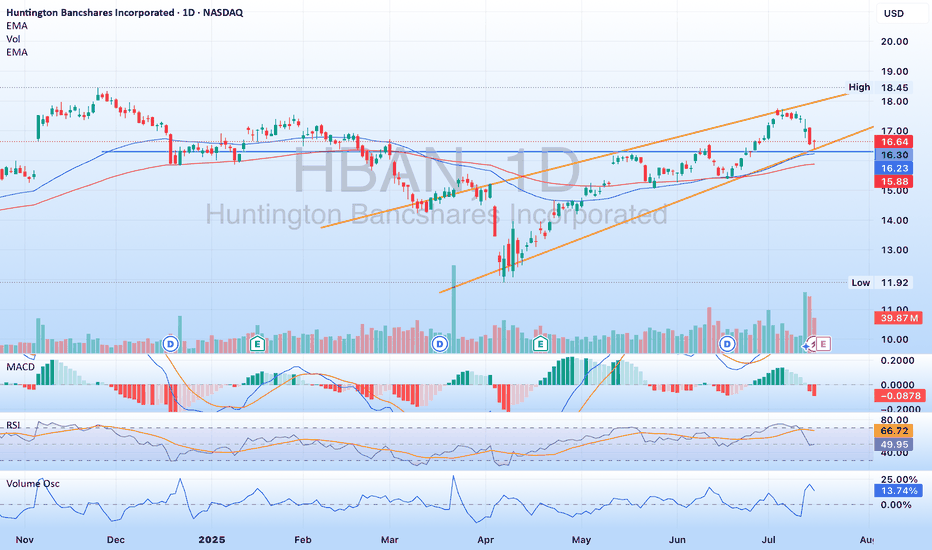

$HBAN - well positioned to continue on its pathNASDAQ:HBAN has been in a rising channel since April, and is no touching the lower band of the channel. His area also includes some previous resistance turned support, as well as some movement paces. NASDAQ:HBAN recently announced they are acquiring Veritex ( NASDAQ:VBTX ) which will strengthen their mark in Texas. Please note NASDAQ:HBAN is releasing earnings July 18th. A good report should see the stock moving towards the upper band of the channel, maybe break through it.

HBAN trade ideas

HBAN BULLISH TRIANGLE The daily chart of Huntington Bancshares Incorporated (HBAN) shows a well-formed ascending triangle pattern, indicating potential for further bullish movement, especially if the stock can break through its current resistance zone around $15.00. Here's a detailed analysis based on the key technical signals:

Key Observations on the Daily Chart:

Ascending Triangle Formation:

The price action has been consistently forming higher lows (HL) while hitting a resistance level around $15.00. This ascending triangle pattern is typically a bullish continuation signal.

Resistance Zone and Old Highs:

The stock is testing the $15.00 - $15.08 resistance zone, which aligns with old highs from January 2022. If HBAN breaks above this area, it could trigger a strong move upwards, potentially towards the next resistance levels.

Bullish Momentum:

The recent bull wicks marked on the chart are showing that buyers have stepped in on dips, suggesting strong buying pressure below $14.70. This is supportive of the overall bullish trend.

RSI:

The RSI is at 60.01, which is in a healthy, bullish zone but not overbought. This gives the stock room for further upside before hitting overbought levels.

MACD:

The MACD has a slight bullish crossover, with the signal line below the MACD line. This indicates the potential for a continuation of upward momentum, though it is still relatively flat. A more pronounced upward MACD move would further confirm bullishness.

Volume:

Volume has been slightly declining during this consolidation phase, typical before a breakout. Watch for a volume spike when price breaks either side of the triangle, as it would confirm the move.

New Support for Huntington Bank?Huntington Bancshares isn’t an actively traded name, but its chart may have some potentially interesting patterns this week.

First is the level around $12.19, its highest weekly close last summer. HBAN jumped above that price in mid-December before testing it in January and again this month. Old resistance may have become new support.

Second is the series of higher weekly lows as it held $12.19.

Third, the 50-day day simple moving average (SMA) had a “golden cross” above the 200-day SMA in mid-December. That may suggest that the longer-term trend has grown more bullish.

Finally, narrowing Bollinger Band Width highlights the stock’s tightening range. Will that price compression give way to expansion?

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options and futures. See our Overview for more.

Important Information

Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures or cryptocurrencies); therefore, you should not invest or risk money that you cannot afford to lose. Online trading is not suitable for all investors. View the document titled Characteristics and Risks of Standardized Options at www.TradeStation.com . Before trading any asset class, customers must read the relevant risk disclosure statements on www.TradeStation.com . System access and trade placement and execution may be delayed or fail due to market volatility and volume, quote delays, system and software errors, Internet traffic, outages and other factors.

Securities and futures trading is offered to self-directed customers by TradeStation Securities, Inc., a broker-dealer registered with the Securities and Exchange Commission (“SEC”) and a futures commission merchant licensed with the Commodity Futures Trading Commission (“CFTC”). TradeStation Securities is a member of the Financial Industry Regulatory Authority, the National Futures Association (“NFA”), and a number of exchanges. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services under federal and state money services business/money-transmitter and similar registrations and licenses.

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a member of NFA. When applying for, or purchasing, accounts, subscriptions, products and services, it is important that you know which company you will be dealing with. Visit www.TradeStation.com for further important information explaining what this means.

$HBAN: Navigating Challenges, Paving the Way for Growth

Huntington Bancshares Incorporated (NASDAQ: NASDAQ:HBAN ) has weathered the challenges of the past year and emerged with a strategic vision for growth. In the recent fourth-quarter earnings call, the financial institution reported a year of increased deposits and loans, showcasing resilience in managing deposit beta. Despite a dip in net interest income, Huntington Bancshares has outlined ambitious plans for strategic expansion, including venturing into the Carolinas and investing in automation and data capabilities.

Key Achievements and Strategic Initiatives:

1. Deposit and Loan Growth:

Huntington Bancshares reported substantial growth in both deposits and loans, underscoring its ability to attract and retain customers in a competitive market. The company's focus on managing deposit beta demonstrates a keen understanding of market dynamics, ensuring efficient utilization of available resources.

2. Strategic Expansion into the Carolinas:

A key highlight is Huntington's strategic move to expand its footprint into the Carolinas, demonstrating a commitment to geographical diversification. The company's entry into this market is supported by the successful launch of specialty banking initiatives, showing early signs of promise and laying the groundwork for future growth.

3. Investment in Automation and Data Capabilities:

Acknowledging the evolving landscape of the financial industry, Huntington Bancshares is actively investing in automation and data capabilities. This forward-looking approach positions the company to enhance operational efficiency, meet customer expectations, and stay ahead in an increasingly digitized banking environment.

4. Fee Growth Strategies:

Huntington is not solely relying on traditional banking services; instead, it aims to drive fee growth in capital markets, payments, and wealth management. The company's projection of a 5% to 7% increase in non-interest income signifies a diversified revenue stream, mitigating dependence on interest income alone.

5. **Liquidity and Financial Strength:

Maintaining a robust liquidity position is crucial in the financial sector. Huntington Bancshares impressively holds a contingent liquidity of $93 billion, providing a safety net for unforeseen challenges. The company aims for an adjusted common equity Tier 1 (CET1) ratio within 9% to 10%, highlighting its commitment to financial strength and stability.

Challenges and Outlook:

1. Net Interest Income Dip:

The reported decrease in net interest income by 3.8% in the fourth quarter raises concerns. However, the company's outlook suggests a trough in Q1, with expectations of expansion throughout the year. Investors will be closely monitoring this metric to assess the effectiveness of Huntington's strategies.

2. Expense Management:

While revenue growth is a key focus, the company acknowledges a rise in core expenses by 4.5%. Effective expense management will be crucial in ensuring sustained profitability and supporting the company's growth initiatives.

Technical and Price Momentum:

Huntington Bancshares' technical outlook presents intriguing signals with the 50-day moving average crossing above the 200-day moving average—a potential Golden Cross. This, combined with the stock trading in the middle of its 52-week range and above the 200-day simple moving average, indicates positive price momentum.

Conclusion:

Huntington Bancshares ( NASDAQ:HBAN ) stands at a pivotal juncture, navigating challenges while actively pursuing strategic growth initiatives. Investors are cautiously optimistic, considering the stock's upward momentum and the company's resilient performance in deposits and loans. With a keen focus on geographic expansion, technological advancements, and diversified revenue streams, Huntington Bancshares ( NASDAQ:HBAN ) appears poised for a promising future in the dynamic landscape of the financial sector. As the company continues to execute its strategic plans, investors will be closely watching for further developments and indicators of sustained growth.

HBAN Huntington Bancshares Incorporated Options Ahead of EarningAnalyzing the options chain and the chart patterns of HBAN Huntington Bancshares prior to the earnings report this week,

I would consider purchasing the 110usd strike price in the money Puts with

an expiration date of 2023-10-20,

for a premium of approximately $0.87.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Looking forward to read your opinion about it.

Huntington Bank (HBAN)No position suggested.

Worth noting. that price action has retraced a recent Harmonic Bat pattern and a possible double bottom.

Currently also a Bullish harmonic Crab has evolved.

Watching ... The Harmonic Crab pattern can often extend past a ideal 1.618 extension.

A broad positive market is also needed.

As always do your own due diligence.

S.

HBAN oversold, go longBanks sold off heavily due to fed uncertainty/their announcement and T-bill market volatility, particularly regional banks like HBAN. HBAN's recent acquisition of TCF bank is just beginning to become accretive to their overall business and the bottom line. See more details on that acquisition in my prior posts linked below.

Buy this capitulation/weakness

Just received the highest rank among regional banks in the JD Power's US banking mobile app satisfaction survey for the 3rd year in a row.

HBAN - Great Place to invest 👍-One stock that might be an intriguing choice for investors right now is Huntington Bancshares Incorporated HBAN. This is because this security in the Banks - Midwest space is seeing solid earnings estimate revision activity, and is in great company from a Zacks Industry Rank perspective.

-This is important because, often times, a rising tide will lift all boats in an industry, as there can be broad trends taking place in a segment that are boosting securities across the board. This is arguably taking place in the Banks - Midwest space as it currently has a Zacks Industry Rank of 41 out of more than 250 industries, suggesting it is well-positioned from this perspective, especially when compared to other segments out there.

-Meanwhile, Huntington is actually looking pretty good on its own too. The firm has seen solid earnings estimate revision activity over the past month, suggesting analysts are becoming a bit more bullish on the firm’s prospects in both the short and long term.

-In fact, over the past month, current quarter estimates have risen from 32 cents per share to 34 cents per share, while current year estimates have risen from $1.41 per share to $1.44 per share.

-So, if you are looking for a decent pick in a strong industry, consider Huntington. Not only is its industry currently in the top third, but it is seeing solid estimate revisions as of late, suggesting it could be a very interesting choice for investors seeking a name in this great industry segment.