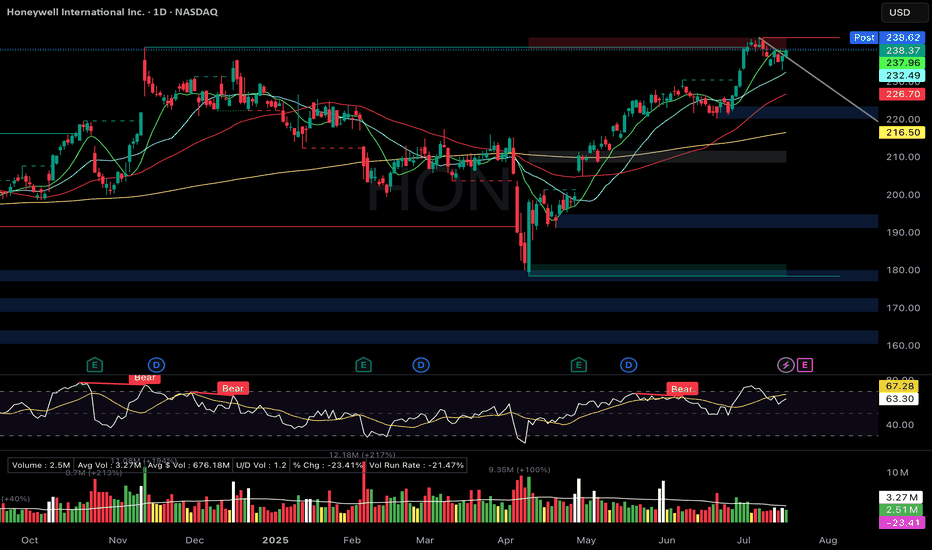

HON Bull flag + hammer off 21EMAHON – Honeywell

Setup Grade: A

• Entry: $238.12 (7/17)

• Status: Active

• Trailing Stop: $6.85 (2x ATR)

• Setup: Aerospace/defense leader. Bull flag + hammer off 21EMA. RSI ~63.

• Target: $256 (measured move). ATH = $242.77

• Plan: Hold through breakout → blue sky setup.

• Earnings: July 24

HON trade ideas

$HON Honey are you well NASDAQ:HON looking strong. Weekly chart is in a clear Stage 2 uptrend, now consolidating near all-time highs.

The 4-hour chart is holding key support around the $230-$233 level, with the Stochastic oscillator turning up from oversold territory. A decisive break above the $240 resistance could signal the next major leg higher.

#Honeywell #TechnicalAnalysis #Trading #Stocks

Honeywell: Quantum Leap or Geopolitical Gambit?Honeywell is strategically positioning itself for significant future growth by aligning its portfolio with critical megatrends, notably aviation's future and quantum computing's burgeoning field. The company demonstrates remarkable resilience and foresight, actively pursuing partnerships and investments designed to capture emerging market opportunities and solidify its leadership in diversified industrial technologies. This forward-looking approach is evident across its core business segments, driving innovation and market expansion.

Key initiatives underscore Honeywell's trajectory. In aerospace, the selection of the JetWave™ X system for the U.S. Army's ARES aircraft highlights its role in enhancing defense capabilities through advanced, resilient satellite communication. Furthermore, the expanded partnership with Vertical Aerospace for the VX4 eVTOL aircraft's critical systems positions Honeywell at the forefront of urban air mobility. In the realm of quantum computing, Honeywell's majority-owned Quantinuum subsidiary recently secured a potentially $1 billion joint venture with Qatar's Al Rabban Capital, aiming to develop tailored applications for the Gulf region. This significant investment provides Quantinuum with a first-mover advantage in a rapidly expanding global market.

Geopolitical events significantly influence Honeywell's operational landscape. Increased global defense spending presents opportunities for its aerospace segment, while trade policies and regional dynamics necessitate strategic adaptation. Honeywell addresses these challenges through proactive measures like managing tariff impacts via pricing and supply chain adjustments, and by realigning its structure, such as the planned three-way breakup, to enhance focus and agility. The company's strategic planning emphasizes leading indicators and high-confidence deliverables, bolstering its ability to navigate global complexities and capitalize on opportunities arising from shifting geopolitical currents.

Analysts project strong financial performance for Honeywell, forecasting substantial increases in revenue and earnings per share over the coming years, which supports expected dividend growth. While the stock trades at a slight premium to historical averages, analyst ratings and institutional investor confidence reflect positive sentiment regarding the company's strategic direction and growth prospects. Honeywell's commitment to innovation, strategic partnerships, and adaptable operations positions it robustly to achieve sustained financial outperformance and maintain market leadership amidst a dynamic global environment.

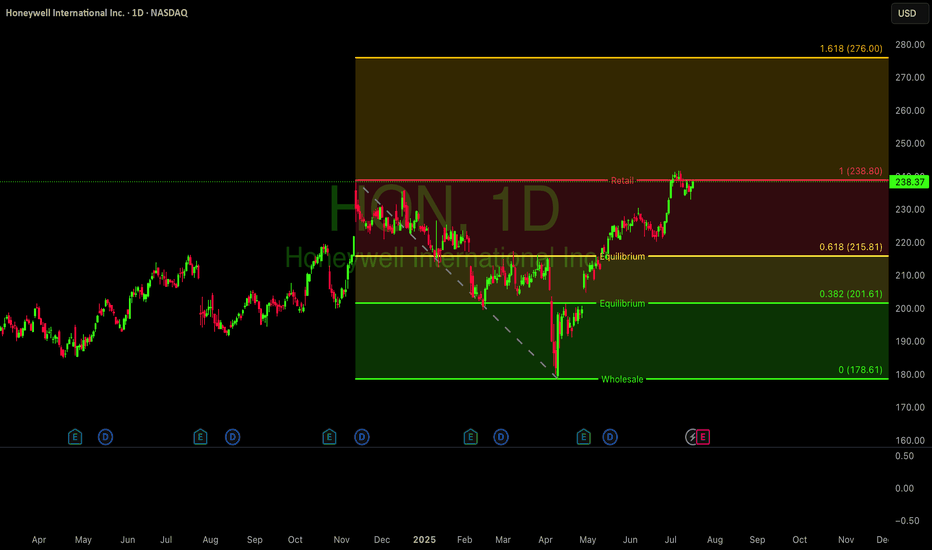

HONEY won't fall down the WELL! Bottom is nearNASDAQ:HON - HoneyWell

- Uptrend since COVID (2020)

- At the bottom of the channel

- Massive Volume Shelf

- Key Support/ Resistance Area (S/R)

- Wr% at Green Support Beam

To me the downside looks limited here. When this ship turns it probably goes to $300🎯

Not financial advice

Bullish Alert: Honeywell (HON) Targets $253.76 – 12% Upside Honeywell International Inc. (HON) shows strong bullish momentum, with higher highs and higher lows confirming a continued uptrend. The price is on track to reach the critical resistance level at $253.76, representing a potential 12% upside from current levels. Each pullback has been met with strong buyer support, keeping the bullish structure intact. With sustained momentum and clear breakout potential, this is a powerful signal for further gains.📈🔥

Honeywell International Inc. | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Honeywell International Inc.

- Triangle Secundary Bias | Support&Resistance

- Entry Bias Hypothesis | Double Formation

* 012345(0&1) | Triangle Infliction

- Retracement Center | Uptrend

- 012345(0&1) | Wedge Structure

* Triple Formation | Demand=Previous Trend

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

Honey well may trend into new high in times to comeNASDAQ:HON is a long-term play as positive price action is looking at a renewed uptrend. First, the stock has broken strongly above the bearish gap resistance zone accompanied by high volume. 2nd long term MACD histogram has started to turned positive and oversold signal by the mid-term stochastic is back after confirming the oversold signal.

Weekly chart shows clearly long-term bullish signal such as the resistance zone has been tested multiple times and has been weakened. Furthermore, 14-weekly period RSI is rising, confirming the bullish momentum and ADX is bottom out and rising. DM+ is above the 25-level.

The 3 Reasons Why You Should Buy This StockOn mainstream media

you may have heard that this stock hit a downgrade

and hence was not a good buy to consider all.

First , you should not short

this NASDAQ:HON stock price

Second , try not to use too much margin

when trading this stock price.

Third , create a system that will help you understand

trend analysis..

This is why in this chart we are using

something called the rocket booster strategy

This strategy has 3 Steps:

Step#1: The price has to be above the 50 EMA

Step#2: The price has to be above the 200 EMA

Step#3: The price has to gap up in a trend.

If you try your best to understand

the re-entry of trading systems then you

will be in a better place to understand trading

the capital markets.

Remember to rocket boost

this content to learn more.

Disclaimer: Trading is risky please learn risk

management and profit-taking strategies.

Baby buy HON for the holidays Ticker: HON

Key data:

* Market cap: $144.24b

* Dividend yield: 2.04%

* PE: 25.04

Execution metrics:

* Entry:$222.02

* TP: $226.09

* SL: $202.28

Profit paths:

* Buy shares at market open

* Nov01 222.5/215 Bull Put

Technical Support:

* Money flow: Positive

* POI: 2 ATR

* Justification: Consolidation at demand. Closing higher. MA supporting bulls.

Fundamental Support:

* Analyst 1Y target: $228.70

* Next earnings: Oct 24 2024

* Justification: net income increasing QoQ, revenue, short + long term assets > liabilities

Boring old HON is not as boring as you thinkHON happens to be oversold. But I didn't choose it for that reason. I chose it mostly to teach a couple of lessons about trading. I won't probably be updating this idea daily though, because I'm not trading it and I have too many other things to keep track of already. I will try to check in on it once a week or so.

So why did I choose HON? If you asked 100 traders to pick a stock to trade, I'd bet tons of money ZERO would pick HON. It's as sexy as a nun in a parka. For years all it did was go up every day and paid dividends. Yawn.

For the last 45 months it has done nothing from a buy and hold perspective. Literally. It has gone down exactly 23 CENTS. Its 5 year Beta is 1.03. Boringggggg.

In this case boring is perfect, though. This is a great stock to trade. Sideways choppiness is a dream for what I do. Drawdowns tend to be small and not last very long, so I don't need to deploy lots of capital, and the zig-zags = 🤑. The buy and holders make nothing on a stock like this over this time frame and the trend-followers lose a TON in this situation with all the whipsaws stopping them out with a loss.

But this boring company that makes thermostats, fire suppression equipment and PPE would have afforded me 119 trade opportunities in 45 months and outperformed the AAPL backtest I just posted the other day. More on the backtest results for HON later.

The other reason I love unsexy stocks (and so should you if you trade) is that they can be profitable and offer relative safety when tech, or the market in general, is floundering. The more tools in your toolbox (in this case stocks in your trading universe), the easier it is to make money trading. There is a place for boring stocks that just go sideways in my toolbox, and when you see the results you'll find out why it's a very special place.

I honestly didn't expect the results to be all that good. It was going to be a lesson about how lots of small very boring wins add up. And they were mostly small and boring. Almost 1 in 3 trades during this 45 month span made less than 1% and ZERO trades even made it to 10%.

That doesn't scream profits. But there is huge value in what I do, in the consistency it offered. With relatively short and infrequent capital-hungry drawdowns, coupled with lots of trading opportunities, the annualized profit ended up beating out AAPL. Imagine if I said HON > AAPL to most traders on this site. I'd get crucified. It's just not sexy enough for what most people here do, which is try to hit home runs. But just ask Ichiro what lots of singles can do. Sorry for the baseball reference for all you non-fans.

Trades: 119

Closed wins: 117

Open "wins": 1

Open "losers": 0 (hypothetical trade opened at the end of the day today)

That's technically a 100% win rate over 45 months. I will fight anyone who wouldn't take that.

Average gain per trade = +2.3%

Median gain per trade = +2.2%

Average holding period = 20.4 days

Median hold period = 13 days

Most common hold period = 5 days

Those average gain numbers are NOT special. Most would turn their noses up at a trade that takes a month and only makes 2.3%. Not me. Here's why.

Max number of lots held = 13

That allows capital to be freed up to work elsewhere.

Return per lot per day held = +.112%

Annualized return per lot per day held = 28.2%

I will take that return for ever and ever and ever. And you should too when you trade. 28% per year doubles your money in 2.5 years and over 10 years increases your original money 16x if it happens consistently. I'll always take better returns, but there's a lot to be said for CONSISTENT returns that keep you in the game, keep you motivated and to grow your trading capital. Hunting big wins comes with the inherent risk of big losses. A few of those losses strung together and you're looking for a second (or third) job.

Learn to love small but very consistent wins and you will be in this game for a long time.

So let's pretend I opened 1 lot at 201.64 at today's close and see where that takes us. I'm guessing up.

Honeywell eyes Pentagon space contracts with CAES acquisitionHoneywell International Inc. has announced its acquisition of the defence electronics business of CAES for 1.9 billion USD, a strategic move aimed at securing a foothold in the rapidly growing sector of military space equipment. This acquisition excludes the division of CAES that handles satellite ground terminals but includes critical electromagnetic protection technology for radio frequency equipment.

This technology positions Honeywell to offer advanced communication systems for space, sea, air, and land applications, which are resistant to interference. With Honeywell's revenues nearing 37 billion USD last year, the acquisition is not just about expanding business size but strategically acquiring technology that will enable Honeywell to compete for lucrative military contracts in the coming years.

Exploring investment opportunities, let’s analyse the stock chart of Honeywell International Inc. (NASDAQ: HON) from a technical analysis perspective:

On the Daily (D1) timeframe, Honeywell's stock has recently broken the resistance level at 211.05 USD, establishing new support at 206.00 USD. While a new resistance level has yet to be confirmed, the stock is exhibiting a strong uptrend. Should a downtrend begin, a potential downside target could be at 197.50 USD.

If the uptrend persists and the stock price rebounds off the current resistance level, there could be a buying opportunity with a short-term target of 225.00 USD. For a medium-term investment strategy, should the positive momentum continue, the stock price might rise to 235.00 USD.

—

Ideas and other content presented on this page should not be considered as guidance for trading or an investment advice. RoboMarkets bears no responsibility for trading results based on trading opinions described in these analytical reviews.

The material presented and the information contained herein is for information purposes only and in no way should be considered as the provision of investment advice for the purposes of Investment Firms Law L. 87(I)/2017 of the Republic of Cyprus or any other form of personal advice or recommendation, which relates to certain types of transactions with certain types of financial instruments.

Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69.88% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Honeywell: Nearly There!Honeywell almost made it to the resistance at $210.61, which it should overcome as part of the current magenta wave (3). However, there is still a 32% chance that the price will pull back down into our magenta Target Zone between $188.24 and $180.93. This short-term bearish alternative scenario will be triggered if HON drops below the support at $189.66 before reaching a new high.

HONEYWELLHoneywell international, inc. American multinational holding company. It provides different commercial and consumer products, engineering services, and aerospace systems to a wide range of customers, from private customers to large joint-stock companies and governments. I liked the long-term chart very much and wanted to share my opinion.