HTZ trade ideas

$HTZ Hertz - Second Leg UpMassive move after Ackman’s 20% stake news sent NASDAQ:HTZ flying over +100%. Price filled the gap and looks ready to retest the previous resistance zone near $9 (marked).

I’m staying cautious into May 12 earnings (after market). Historically, Hertz tends to fade post-earnings. Safer to wait for the dust to settle.

Potential setup:

Entry: Watch for a breakout + retest of $7.20–$7.50

First target: $9 zone

Risk level: Below $5.50 (invalidates setup)

Confidence: Medium (depends on post-earnings reaction)

RSI recovering from neutral, but no FOMO here. Patience wins. I’ll update if conditions change.

HTZ short idea?NASDAQ:HTZ HTZ is underperformjng the market In a large way today.

With interest rates falling & the IWM rallying to the upside this is a bearish divergence occurring for this ticker.

If HTZ can't rally with the positive conditions it likely means this stock will continue to see some selling pressure.

Understand this is a high risk high flying stock that can have outsized moves.

Anti-Ackman trade HTZNot only is it technically a wrong move, but fundamentally stupid! Does stupid Ackman really think that with other countries protesting tourism to the US because of sanctions, and every US Customs POE agent turning global citizens away only because they found some bad remarks about Tucker Frump, we will have a summer travel explosion so HTZ will benefit?? How dumb is he?

Charging Stations, Reduced Rates and Politics.With the future of the car industry looking dark and bright at the same time, HTZ has been over sold and bullied hard since its last pump with tesla ect.

My long term target I know it will hit is $8 over the next year.

I rarely call on meme stocks but no one is seeing this one coming ;)

HTZ UP AROUND 22% TODAY. ACTIVIST INVESTOR BOUGHT $46.5M SHARES!HERTZ (HTZ) Surged nearly 22% today. A recently report revealed "Activist" Investor Bill Ackman had acquired $46.5 million shares . Should you hop on the bullish trend? Or will price cool off once the hype is over? What are your thoughts?

Disclaimer: Not Financial Advice

HAPPENING NOW?! HERTZ CUP AND HANDLE BREAKOUT 1D CHART?HERTZ (HTZ) Price rose significantly to $4.26 on the 1 Day chart. Is this a sign of an impending bullish breakout? My personal target opinion for bullish movement is $5.50. Will this be a major bullish turning point for Hertz? Or will it be a easy grab for traders running short positions?

HERTZ (HTZ) Rental Company Bullish Today Despite Tariff FearsHertz (HTZ) was up +12% before falling slightly before closing. It appears the rental company, known for their rental cars may be keeping investors interested even with President Trump's "Liberation Day". Could this be a bullish pick for 2025?

$HTZ RecoveryEveryone is bearish on Hertz since the last CEO really messed up on his bet on EV's. He was not wrong just really really early. I believe since the new management is in that we will see the company be "saved" and the price of the security will also increase. Hertz is not a bad company just made a really foolish investment that almost cost them the company. I will update soon.

HERTZ Stock Chart Fibonacci Analysis 010525Trading idea - Entry point > 3.7/61.80%

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 3.7/61.80%

Chart time frame: C

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% Resistance

C) 61.80% Support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provide these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

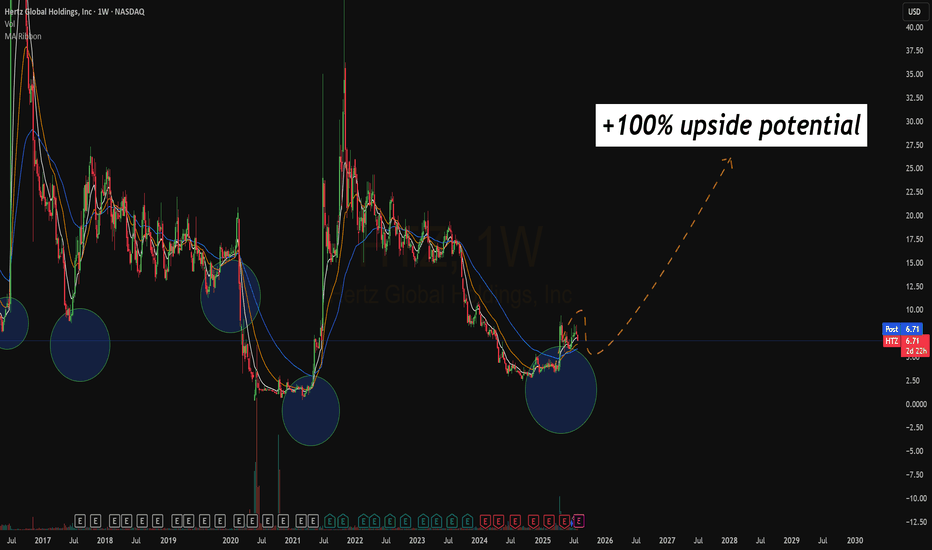

Hertz on a Long-Term RideHertz (HTZ) is showing strong bullish momentum, with a gap forming around the $3.50 level. Historically, Hertz has bottomed at these low levels multiple times, including during the 2009 financial crisis and the COVID-19 era, reinforcing the significance of this support. A break above the $6.95 resistance would signal further strength, positioning the stock to aim for the long-term target at the $27.10 gap resistance. This setup presents an attractive risk-to-reward ratio, with downside risk managed through a stop-loss at $1.93.

As a major player in the global rental car market, Hertz is poised to benefit from the rising demand for rental and shared mobility services. With an expanding fleet that includes electric vehicles and partnerships focused on sustainability, Hertz aligns with evolving market trends, bolstering its long-term growth potential.

This combination of technical momentum, historical support, and strategic positioning makes $27.10 a feasible target for long-term investors looking for growth.

NASDAQ:HTZ

HTZ Hertz Global: The Top Penny Stock Choice Among Hedge FundsOver the past year, insiders at Hertz Global Holdings Inc. (NASDAQ: HTZ) have been purchasing shares, with CEO Wayne West leading the way. His largest acquisition was a $1.1 million purchase at $4.46 per share.

The stock is now trading at only $3.03!

For a speculative trade, I would consider the $3 strike price calls expiring this Friday, priced at a $0.20 premium.