INTEL BUY 2030Claro, aquí tienes el texto completamente limpio, sin negritas ni símbolos especiales:

---

Preliminary Projection: Intel's Potential Workforce Transformation (2025–2030)

As Intel continues its restructuring and integrates more AI-driven systems into its operations, significant changes are expected in its workforce distribution. The following outlines an estimate of the potential job displacement or transformation due to artificial intelligence by 2030.

Area: Manufacturing

- Percentage of total employees: 35% (approximately 40,000)

- Percentage potentially replaceable by AI: 70%

- Estimated replaceable jobs: 28,000

Area: Administration

- Percentage of total employees: 20% (approximately 23,000)

- Percentage potentially replaceable by AI: 55%

- Estimated replaceable jobs: 12,500

Area: Engineering

- Percentage of total employees: 30% (approximately 34,000)

- Percentage potentially replaceable by AI: 20%

- Estimated replaceable jobs: 6,800

Area: Sales and Marketing

- Percentage of total employees: 15% (approximately 17,000)

- Percentage potentially replaceable by AI: 40%

- Estimated replaceable jobs: 6,800

Total estimated jobs that could be automated or transformed by AI: approximately 54,000, representing around 47 percent of Intel’s current workforce.

---

Key Intel Facilities Focused on AI-Driven Automation

Ohio, USA – Ohio One Campus

Investment: Over 28 billion dollars

Purpose: To become the world’s largest chip manufacturing hub for AI by 2027

Key technologies: Advanced automation, digital twins, and AI systems to optimize production and operational efficiency

Source: Reuters

Hillsboro, Oregon, USA – D1X Factory

Function: Research and development center for next-generation manufacturing technologies

Key technologies: AI-powered predictive maintenance, computer vision, and real-time analytics to improve efficiency and quality

Source: Intel Newsroom

These facilities reflect Intel’s strategic transition toward leading in both semiconductor innovation and intelligent manufacturing. The company’s integration of artificial intelligence across its industrial operations is expected to drive productivity, reduce costs, and reshape its employment structure.

---

¿Quieres que lo convierta ahora en PDF, en PowerPoint o en algún diseño tipo folleto?

INTC trade ideas

INTEL CORPORATIONIntel’s stock has been falling sharply due to a combination of poor financial performance, strategic challenges, and market pressures, which have shaken investor confidence significantly.

Key Reasons for Intel’s Stock Decline

Weaker-than-Expected Earnings and Profitability Issues

Intel reported disappointing earnings in 2024, with sales declining 2% year-over-year to $53.1 billion and gross margins under pressure. The company’s foundry business, a critical growth area, saw sales fall from $18.9 billion in 2023 to $17.5 billion in 2024. Analysts expect continued margin headwinds and limited revenue growth opportunities in the near term, which weighs heavily on the stock.

Cost-Cutting and Dividend Suspension

To address financial challenges, Intel announced a $10 billion cost-reduction plan, including cutting 15,000 jobs and suspending dividend payments starting Q4 2024. While necessary to preserve liquidity and fund restructuring, these moves have alarmed investors, signaling deeper operational issues and reducing shareholder returns.

Leadership Changes and Strategic Uncertainty

CEO Pat Gelsinger was replaced by Lip-Bu Tan in March 2025 amid ongoing struggles. The new leadership faces the difficult task of turning around the foundry business and improving Intel’s competitiveness in AI chips and manufacturing. However, uncertainty about the effectiveness of these efforts has dampened investor enthusiasm.

Lagging Behind Competitors in AI and Manufacturing

Intel has been slow to capitalize on the AI boom compared to rivals like Nvidia, which has surged ahead with AI-focused chips. Additionally, Intel’s manufacturing technology lags behind Taiwan Semiconductor Manufacturing Company (TSMC), limiting its ability to produce cutting-edge chips cost-effectively. This has led to market share losses, especially in PC CPUs, where AMD is gaining ground.

Geopolitical and Market Risks

Rising US-China tensions and new Chinese tariffs on semiconductor imports pose risks to Intel’s revenue, given its exposure to the Chinese market. Moreover, concerns about the semiconductor supply chain and the viability of Intel’s joint ventures with TSMC add to investor uncertainty.

Valuation and Investor Sentiment

Intel’s price-to-book ratio is near multiyear lows (~0.8), reflecting market skepticism about its asset utilization and future profitability. Its return on equity has declined steadily, contrasting with competitors that have benefited from the AI surge. Despite undervaluation, the stock’s poor recent performance and bleak near-term outlook continue to pressure the price.

Summary

Factor Impact on Intel Stock

Weak earnings and margin pressure Significant negative

Job cuts and dividend suspension Negative, signals financial stress

Leadership change and strategy uncertainty Adds volatility and risk

Falling behind in AI and manufacturing Loss of market share, investor concern

Geopolitical tensions and tariffs Adds downside risk

Low valuation but poor ROE Indicates undervaluation but cautious sentiment

Conclusion

Intel’s stock is falling badly due to disappointing financial results, strategic challenges in manufacturing and AI, cost-cutting measures that unsettle investors, and geopolitical risks. While the company is attempting a turnaround under new leadership, uncertainty about the success of these efforts and continued competitive pressures keep investor confidence low. The stock’s valuation reflects these concerns, and a sustained recovery will depend on Intel’s ability to improve profitability, regain market share, and capitalize on AI and foundry opportunities

Intel on the verge of a 80% plummet to $5** The months ahead **

After decades of semiconductor dominance, Intel faces unprecedented threats to its business model. AI computing revolution, manufacturing missteps, and relentless competition from AMD and NVIDIA have created what some analysts call "a potential death spiral" for the tech giant.

The floor could be much lower than anyone realises, especially as the 2 month candle draws to a close in 14 days.

On the above 2 month chart price action has closed under 30 years of legacy support. A trend line that gave up support on July 2024. That was shortly after publishing the “Incoming 60% correction for Intel Corporation” idea (below).

Buckle up, we’re now looking at a 80% correction to $5.

Why? Market structure has been comprehensively destroyed. For whatever reason, America does not want the rest of the world purchasing its products… internal orders only! This decision coupled with internal demand collapse creates the death spiral. Orders shall resume once the the protectionist experiment has come to pass, but until then, our greatest teacher.. history.. tells us nothing good will come from this experiment on businesses dependant on the world marketplace.

Double tops in price, especially parted by some months, together with a confirmed bear flag are particularly powerful. Take the collapse of the Finnish bank OmaSp (below). Despite the negatively commentary, (really good contrarian confirmation!), the collapse to the floor follows.

Is it possible price action ignores all the hullabaloo and reclaims legacy support? Sure.

Is it probable? No.

Ww

“incoming 60% correction for Intel Corporation”

Finnish Bank OmaSp collapse

INTC Trade LevelsI like this set up for affordable and stable LEAP's. If price can break above the range, we will see a run to 31.

INTC's fundamentals are still a bit iffy, BUT the chip industry is hot. This would make a great sympathy play- I'd lean towards buying equity over options contracts.

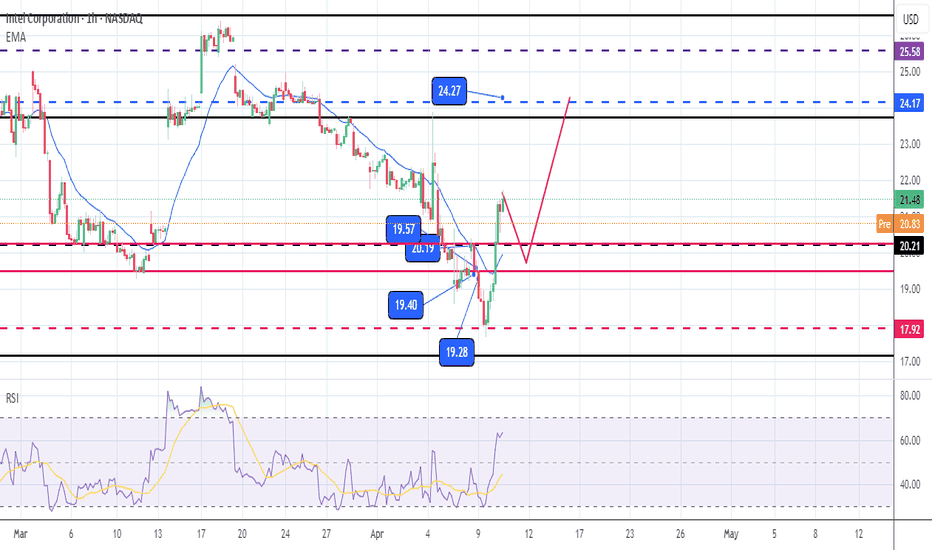

For Day Trades- expect price to range between 18-22 going into the 4/25 expiry

Support to Buy Intel-All stocks rallied after Trump declared a pause on tariffs. Intel is showing good momentum and may continue to rise.The support On My chart is a good support to going long if the price make a pullback. Invalid if The Price break the support area. This is not a buy call, just sharing idea. Thanks

[INTC] Crashing to $1-$5—Bankruptcy Ahead?Intel has underperformed recently, trapped in a bear market since 2019 while broader equities soared. Since 2000, shareholders have seen no gains—even with dividends included—leaving long-term investors increasingly frustrated. A market-wide 2008-style crash (see related ideas) could push Intel toward total collapse.

The business is struggling too. Intel missed the AI boom entirely, its Foundry division is faltering, and revenues are shrinking. Before 2020, it posted annual earnings of $10–$20 billion; over the past year, it recorded $10 billion in losses. With $105 billion in net equity—mostly tied to hard assets that are tough to liquidate without losses—Intel’s financial cushion could erode quickly if more problems surface.

Will It Go Bankrupt?

Bankruptcy is possible but improbable. As a critical chip producer, Intel is too vital to U.S. interests to fail outright. I predict a government bailout, though shareholders would likely be wiped out.

TECHNICAL ANALYSIS

Since its bull market ended in 2000—25 years ago—Intel has been locked in consolidation. Now, the price is breaking down on high volume.

It’s trading below the 200-month moving average (MA200 Monthly), a key long-term support level that confirms a bear market.

The consolidation resembles an Elliott Wave ABC correction, with Wave B peaking in 2020. Since then, the price has declined in what appears to be an impulsive Wave C, forming an Ending Diagonal.

When prices break downward from Ending Diagonals—especially alongside a 25-year consolidation breakdown, as is likely here—the move is often swift and severe.

If the price exits both the consolidation and the Ending Diagonal, there’s virtually no support until the $4–$5 range. A market-wide crash could drive it as low as $1.

At it again INTC - LONGGood Morning,

INTC what a fun trade, I have ran 3 profitable runs since December with INTC.

Investors do not seem to want to let go of the 19$ support zone. This is a great sign and as you can see from the many many bottoms, it wants to start moving up again.

Volume is still bearish......however showing bullish divergence since December. This continuous squeeze is building momentum for a nice movement upwards.

As always with SWING trading, aim small miss small.

Enjoy

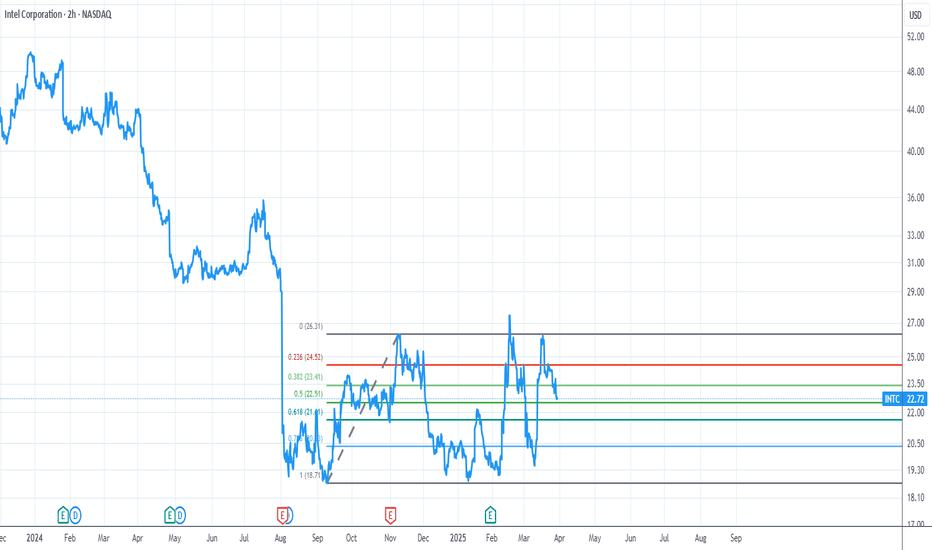

Intel - This Stock Is A Goldmine!Intel ( NASDAQ:INTC ) perfectly respects all structure:

Click chart above to see the detailed analysis👆🏻

Over the past couple of years Intel clearly established a significant downtrend, dropping about -70% after we saw the previous all time high. This bearish pressure is now ending though and if Intel manages to create a bullish reversal break and retest, a new uptrend is starting to form.

Levels to watch: $25

Keep your long term vision,

Philip (BasicTrading)

Intel Next Scenario MoveIt obvious the stock Rejected at 4h Red Zone which act as Strong Resistance that Intel cant go above despite recent good news.

we have three scenarios:

for sure all require patient the stock at current price may go anywhere its gambling rather than trading at this price.

Scenario One: the stock price go above 4h Red Zone which act as strong resistance, after re-test the zone its "buy signal after confirmation".

Scenarios Two: the stock will re-test the nearest support level at the Previous High (P. High)

@ 22.40$ roughly at this price we wait for "buy signal after confirmation".

Scenario Three: Re-Test the Institutional Candle price level at 19.80$ since the stock is side-ways movement and still not breaking this forever zone this option is highly valid !

Note: "buy signal after confirmation" Means that:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

Long Intel Corporation (INTC) – Long-Term Investment ThesisAs of April 2025, Intel (INTC) is trading around $22, revisiting a long-term multi-decade support zone between $15–$23, last tested during the 2008 financial crisis and early 2010s consolidation.

The chart reflects:

A historic resistance zone from the early 2000s that turned into strong support over the past 15+ years.

Current price action suggests long-term accumulation near a high-probability reversal area.

Technically, Intel is trading at a major cyclical low — a zone that historically preceded extended bull runs.

Why I’m Going Long Intel

Undervalued Levels: Intel has retraced significantly from its 2021 highs (~$68), now trading at nearly 1/3 of its peak, offering attractive value relative to fundamentals and peers.

Strong Historical Support: Price is sitting within a key demand zone not seen since the early 2010s, indicating strong institutional interest in this range.

Long-Term Recovery Potential: With ongoing investments in foundry services, AI chips, and strategic partnerships, Intel is positioning for a turnaround.

Asymmetric Risk/Reward: Limited downside (support holds) versus massive upside if Intel regains relevance in the AI and semiconductor race.

Investment Outlook

This is a long-term hold based on:

Technical conviction from historical support zones.

Belief in Intel’s fundamental turnaround story.

The stock’s undervalued nature relative to industry leaders like Nvidia and AMD.

Intel Golden TimeFundamental and Technical Analysis of Intel (INTC) Stock

Fundamental Analysis

1. Financial Performance: Intel is one of the largest semiconductor manufacturers in the world. However, in recent years, it has faced challenges, including a loss of market share to competitors like AMD and NVIDIA.

2. Industry Outlook: The semiconductor industry continues to grow, but Intel has lagged behind in advanced chip manufacturing, particularly in comparison to TSMC and Samsung in the 3nm segment.

3. Profitability & Revenue: Intel’s revenues have been volatile, and profit margins have been under pressure. Its large investments in manufacturing plants may lead to long-term profitability.

4. Macroeconomic Factors: A slowdown in the tech industry, reduced global demand for personal computers, and rising interest rates could impact Intel’s performance.

Technical Analysis

1. Support and Resistance Levels:

Key Support: Around $22, which is close to the current price level.

Key Resistance: In the $30-$35 range if the price starts to recover.

2. Overall Trend:

The stock has been in a downtrend, having dropped significantly from its all-time high of around $70.

The $22 level appears to be a strong historical support.

3. Indicators:

The RSI is likely in the oversold zone, indicating a possible reversal.

Moving averages probably confirm a bearish trend.

Conclusion

Fundamentally, Intel is in a rebuilding phase, but it still faces stiff competition from AMD and NVIDIA.

Technically, the stock is near a critical support level, meaning a rebound is possible, though the overall trend remains bearish.

For long-term investors, further analysis of Intel’s fundamentals is necessary. For short-term traders, confirmation of a price reversal at this support level is crucial before entering a trade.

Great Uncertainty with a Dramatic Twist: Intel’s Recent ShakeupIn a surprising move last December, Intel CEO Pat Gelsinger abruptly stepped down following a tense board meeting that revealed growing dissatisfaction with his turnaround strategy. The sudden exit—on a quiet Sunday—left the tech world stunned and set off a chain of dramatic leadership changes.

To stabilize the company, Intel temporarily appointed CFO David Zinsner and Executive VP Michelle Johnston Holthaus as interim co-CEOs. But the real twist came in March 2025, when the company announced the return of Lip-Bu Tan as the new CEO—a figure whose reappearance adds serious dramatic flair to the story.

Tan had previously resigned from Intel’s board in August 2024, seemingly stepping away from the company for good. His unexpected return just months later, this time as CEO, feels like a corporate plotline worthy of an Emmy—or even an Oscar—nomination. Adding intrigue, Tan had reportedly clashed with Gelsinger on Intel’s direction, making his comeback a powerful statement about the board’s new vision.

Meanwhile, both Gelsinger and Zinsner were named in a shareholder lawsuit filed in August 2024, alleging securities fraud tied to concealed operational setbacks. The case, however, was dismissed in March 2025 after a judge ruled there wasn’t enough evidence to prove the company misled investors.

But beyond the boardroom drama lies a more sobering concern: Intel’s financial health. To me, the situation increasingly mirrors that of Lehman Brothers before its collapse—over-leveraged, burdened by mounting obligations, and heading straight into intensifying macroeconomic and sector-specific headwinds. The semiconductor industry is cyclical, and as the winds shift, Intel may simply not be financially equipped to weather the storm.

Unless it secures a major loan or receives a government bailout, I believe Intel’s stock is significantly overvalued at its current price of $22. Based on its deteriorating fundamentals, market sentiment, and leverage risk, a fairer valuation could be as low as $2 per share. Ironically, that $2 level roughly aligns with a 30x price-to-earnings ratio—where many mature tech companies are trading—if one accounts for where Intel’s true earnings power might settle after the dust clears.

My Fibonacci levels also suggest a sharp dip toward $12 in the near term. And even if Intel does hit that level, I suspect it may only be a dead cat bounce—temporary relief before a deeper plunge.

With leadership drama, legal clouds, and financial fragility all colliding, Intel isn’t just facing a tough quarter—it’s staring down a full-blown existential crisis.

INTC Intel Price Target by Year-EndIntel Corporation (INTC) has been trading near a key technical support level, forming a triple bottom on the chart—a bullish reversal pattern that suggests a potential upside move. The stock currently trades with a forward price-to-earnings (P/E) ratio of 20.44, which reflects moderate valuation levels compared to industry peers.

Intel’s turnaround strategy, focused on rebuilding its foundry business and strengthening its position in the AI and data center markets, is starting to show signs of progress. The company’s push into advanced chip manufacturing and strategic partnerships with major tech firms have positioned it for improved revenue growth in the coming quarters.

Technically, the triple bottom pattern indicates strong buying interest at current levels, reinforcing the case for a potential breakout. Combined with the improving outlook for chip demand and Intel’s strategic shift toward AI, a price target of $28 by the end of the year appears achievable. This would represent approximately 15% upside from current levels.

Investors should monitor Intel’s progress in its foundry business and AI initiatives, as any positive developments in these areas could accelerate momentum toward the $28 target.

my favorite setup for next week!INTC looks ready for a explosive move higher in my opinion, nice consolidation after trend resistance from 2023 broke.. building support for its next move higher, push into 28-31 targets is possible short term in my opinion, if it can break that pivot level then 37-41 targets should follow 🎯

this may be my last chart of the week, if it is I hope you all had a profitable week 🤑 and i hope you have a great weekend. see you soon ✌️

INTEL CORPHI GUYS the pic above illustrates weekly path, continuation weekly sells to a false break.

The second pic illustrates daily structure to sells to clear tripple bottom weekly then we will see bulls again next month.

we are currently looking for sells on daily chart to h4,h2,h1 entries on candle close

INTC 20 Mar 2025 Analysis

INTC remains in a 158-day trading range (yellow box).

Attempt to breakout above the trading range on 18-Feb lacked follow-through buying and failed.

The recent strong move up to the March 18 high looks like a Buy Vacuum and bull leg within a trading range.

To see the definition of a Buy Vacuum, see the comment section on the tagged related post on the 20 Mar SPX analysis.

For now, because the market remains in a trading range, traders will BLSH (Buy Low, Sell High).

That means buying from around the lower third and selling in the upper third of the trading range.

Traders will continue to do this until there is a breakout from either direction with follow-through buying/selling.