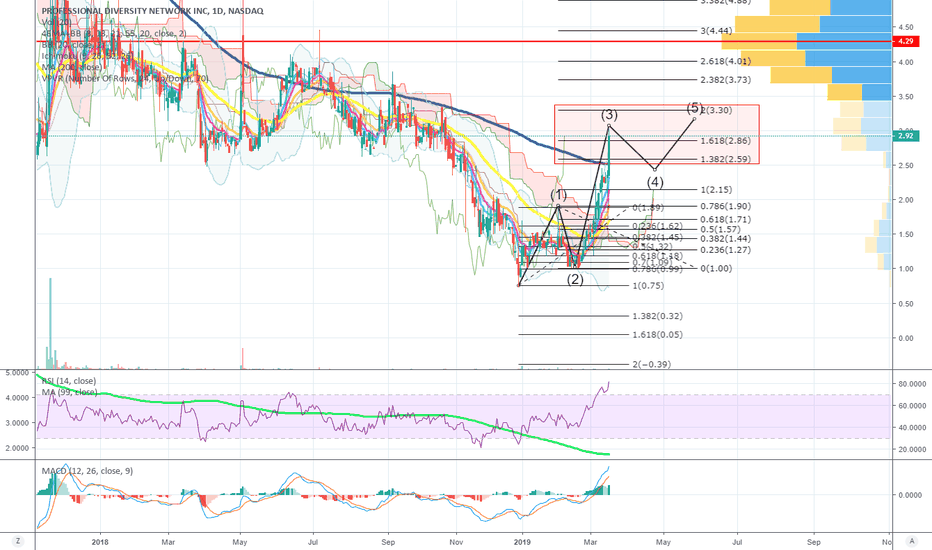

IPDN 1W Network Shortage Recently r/s and still in macro wave (5) down. While there may be some price action between $1.62->$2.09 ultimately it will result in closing the gap lower and under $1 to which they may split again to maintain compliance.

Professional Diversity Network, Inc. operates online and in-person networks that provide access to networking, training, educational and employment opportunities for diverse professionals. It operates through four segments: Professional Diversity Network (PDN Network), National Association of Professional Women (NAPW Network), RemoteMore, and Corporate Overhead. The PDN Network segment consists of online professional networking communities with career resources tailored to the needs of various cultural groups. The NAPW Network segment refers to women-only professional networking organization. The RemoteMore segment connects companies with developers with less effort and friction, and software developers to get jobs regardless of their location. The Corporate Overhead refers to operating expenses. The company was founded by Rudy Martinez on October 3, 2003 and is headquartered in Chicago, IL.

IPDN trade ideas

IPDN 2MProfessional Diversity Network, Inc. operates online and in-person networks that provide access to networking, training, educational and employment opportunities for diverse professionals. It operates through four segments: Professional Diversity Network (PDN Network), National Association of Professional Women (NAPW Network), RemoteMore, and Corporate Overhead. The PDN Network segment consists of online professional networking communities with career resources tailored to the needs of various cultural groups. The NAPW Network segment refers to women-only professional networking organization. The RemoteMore segment connects companies with developers with less effort and friction, and software developers to get jobs regardless of their location. The Corporate Overhead refers to operating expenses. The company was founded by Rudy Martinez on October 3, 2003 and is headquartered in Chicago, IL.

Professional Diversity Network bounced off rock bottom. IPDNGoals 1.05, 1.14. Invalidation at 0.82.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in green with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe

$IPDN: SmlCap play - Potential 60-130% upside from today's closesee easy and self explanatory boxes on chart for Entry, Exit and Stop loss zones. Never chase any stock.

Not for any recommendation, Just an Idea. Like it >> Click 👍/comment, and follow.

I closed 3 trades today (NAKD-82% in 30 days, GRTS-31% in 10 days , SXTC-30% in 23 days)

IPDNProfessional Diversity Network, Inc. (NASDAQ:IPDN) failed to continue its bearish correction on Friday showing inclusive relative strength. On the daily chart above we can see that the price is now testing the major key resistance level indicating a critical phase. A break above the resistance could trigger further bullish pressure testing 3.3/3.40 region and could potentially end this large sideways trading range. Go long before it explodes higher.

IPDN Announces Partnership with Phala NetworkProfessional Diversity Network, Inc. Announces Partnership with Phala Network to Develop Privacy-Protecting Blockchain Application

We are excited to partner with Phala Network to explore potential integration of substrate-based, confidential smart contract blockchain technology into our PDN network, which could potentially enhance our delivery rate and protect network users’ and clients’ privacy from data-mining

finance.yahoo.com

On Watch for Friday, November 17Wasn't able to close above the 50 day EMA on yesterday's spike but the bulls managed to do it today. Seen this pattern ahead of big moves many times. Possible test of the 200 day EMA in the next few days. Targeting $4.64 tomorrow with resistance on the way around $4.28. Tight stop could be set below the 50 EMA around $3.66 or $3.10 for the looser stop.

Watch List @ TraderPix.com