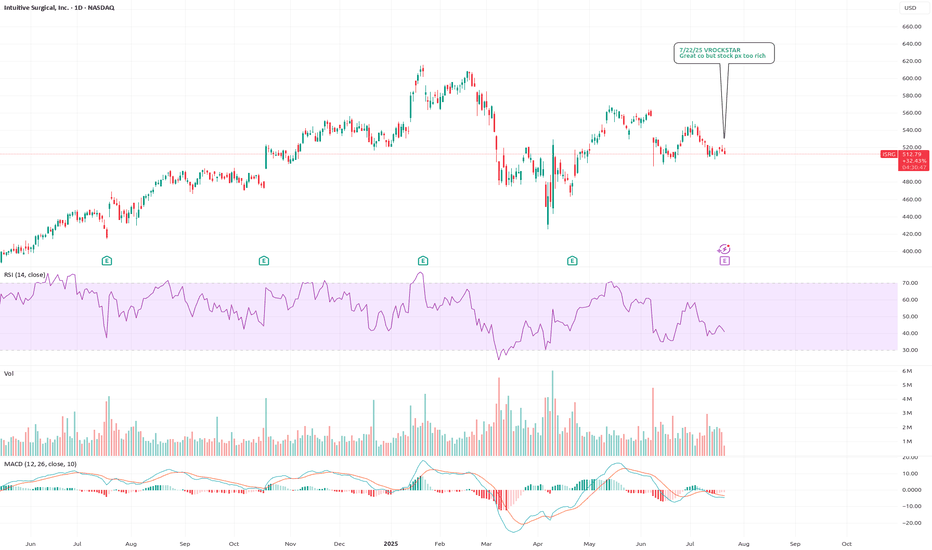

7/22/25 - $isrg - Great co but stock px too rich7/22/25 :: VROCKSTAR :: NASDAQ:ISRG

Great co but stock px too rich

- high multiples forgivable given rare leadership role

- "robotics and AI in high value healthcare industry"

- the valuation and growth aren't necessarily "too" expensive like memes pltr, cvna, sym, joby, qubt, qbts, rgti etc. etc.

- with that being said, idk at what poing i'd dip buy this

- and HC sector has been at tough beta, so if it dipped, i'd probably need to cut it immediately

- so i'd guess result is +ve, stock goes green, but i'd also feel like i need to trim/ take profits and can't just easily hold it (again given above factors)

- i pass on a lot of things, the setup just doesn't work for me this EPS

V

ISRG trade ideas

ISRG Daily Chart: Anticipating a Bounce from Key Demand Zone Overview:

ISRG has been in a recovery phase since its lows in early April, establishing an upward trend. However, after hitting significant resistance in May, the stock has entered a corrective pullback. This chart outlines a potential long setup, waiting for a strategic entry at a confluent demand zone.

Key Observations & Levels:

1. Post-April Recovery: Following a sharp decline, ISRG initiated a strong recovery in early April, demonstrating clear higher highs and higher lows (represented by the initial green zig-zag line).

2. Supply/Resistance Zones (Red Boxes):

o Upper Resistance (600 - 620): This zone represents a significant overhead supply from previous highs in February/March. It is the primary target for any significant bullish move. The chart specifically highlights "Target 600" (601.23).

o Intermediate Resistance (550 - 570): This zone acted as strong resistance in May/early June, leading to the current pullback. Price failed to sustain above this level, signaling a need for a deeper correction before a sustained push higher.

3. Demand/Support Zone (Green Box: ~480 - 500):

o This is the critical "buy zone" highlighted on the chart. It aligns with previous support levels and a potential area where strong buying interest emerged. The chart specifies an entry point around 488.77. This is where we anticipate buyers to step in and reverse the current short-term bearish momentum.

4. Current Price Action & Potential Path (Dotted Line):

o ISRG is currently trading around 512.82, in a clear pullback from the intermediate resistance. The dotted line indicates a possible path where the price might consolidate or even attempt a small bounce before ultimately heading lower to tag the key demand zone. This suggests a patient approach, waiting for the price to reach the optimal entry area.

Trade Plan:

This setup is based on the anticipation of a strong bounce from the defined demand zone:

• Entry Zone: Wait for price to enter the 480 - 500 demand zone. The chart's proposed entry is precisely at 488.77.

• Stop-Loss: A tight stop-loss is placed below the demand zone at 457.71. This level represents a clear invalidation point for the bullish thesis, as a break below it would indicate further downside pressure.

• Target: The primary target for this long setup is the 600 - 620 overhead resistance zone, specifically marked at 601.23. This offers a favorable risk-to-reward ratio.

Scenario:

The most probable scenario outlined is that ISRG will continue its current correction, potentially with some minor bounces, until it reaches the strong demand zone between $480 and $500. From there, we anticipate a significant rebound, aiming to challenge the $600 target.

Invalidation:

A sustained daily close below $457.71 would invalidate this bullish setup, suggesting that the current downtrend is stronger than anticipated and could lead to further significant declines.

Conclusion:

ISRG presents a compelling long opportunity if it continues its pullback to the robust demand zone around

480−500. Patience is key to capturing this potential reversal for a move towards the $600 target. Always manage your risk accordingly.

Disclaimer:

The information provided in this chart is for educational and informational purposes only and should not be considered as investment advice. Trading and investing involve substantial risk and are not suitable for every investor. You should carefully consider your financial situation and consult with a financial advisor before making any investment decisions. The creator of this chart does not guarantee any specific outcome or profit and is not responsible for any losses incurred as a result of using this information. Past performance is not indicative of future results. Use this information at your own risk. This chart has been created for my own improvement in Trading and Investment Analysis. Please do your own analysis before any investments.

Køb af Intuitive SurgicalAbout the Company:

Intuitive Surgical Inc. is an American company that is a global leader in robotic-assisted surgery. They are best known for their da Vinci Surgical System, which enables surgeons to perform minimally invasive operations with high precision.

Business Model:

Intuitive Surgical primarily generates revenue through:

Sales of surgical robotic systems (da Vinci platform)

Disposable and consumable products (instruments and accessories for procedures)

Service contracts (maintenance and support for hospitals and clinics)

Technical Analysis:

On the monthly chart, the stock is currently testing the 50-day moving average. It remains in a solid upward trend.

Looking at the weekly chart, the stock has experienced a 20% correction from the peak, which corresponds to a 61% retracement based on Fibonacci levels.

Furthermore, it has held above historical support around 470. If it breaks below this level, the next support is around 360.

RSI is currently oversold, indicating a potential buying opportunity. Historically, when RSI was near oversold levels and support was rejected, it provided good entry points.

OBV (On-Balance Volume) has shown an upward trend in recent trading days. A rising OBV following an upward price movement typically confirms strong buying interest.

Key Metrics:

P/E ratio stands at 76, slightly high compared to the industry average.

Revenue has increased by 46% since 2021, while EBITDA has grown by nearly 32%.

EPS has risen from 4.79 to an expected 6.54, indicating increased shareholder value.

Analyst Ratings:

Currently, 33 analysts cover Intuitive Surgical:

Buy: 22

Hold: 10

Sell: 1

On average, analysts believe Intuitive Surgical should be priced at DKK 626, with a target price range between 350 and 711. This implies an average upside of 27%.

Trade Strategy:

Entry price: 493

Stop-loss: 450

Take-profit: 600

Risk/reward ratio: 2.62

ISRG in Buy ZoneMy trading plan is very simple.

I buy or sell when at three of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow spikes beyond it's Bollinger Bands

* Stochastic Momentum Index (SMI) at near oversold overbought level

* Price at Fibonacci levels

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone below bottom of channels

Stochastic Momentum Index (SMI) at oversold level

Money flow momentum is spiked negative and under at bottom of Bollinger Band

Entry at $516.82

Target is upper channel around $593

ISRG: Back to a Key Zone, Great Risk/Reward EntryISRG just dropped into the same area where it consolidated from August to October before making its run toward all-time highs. You can wait for a close above the 200 EMA, but I’ve been waiting for this one for a long time—so I’m starting to work my way in.

Let’s see if the magic is still here and if we can make a push for $1,000. 🚀

Intuitive Surgical (ISRG): Techno-Fundie PullbackFundamentals:

**I want to own a piece of a company comparable to CFLT (Confluent). And it turns out that Intuitive Surgical (ISRG) is the right one.

Technicals:

Daily chart pullback back into support. I am putting a tentative stop loss at 500 and a target at 700. Then, hold when it reaches there.

Daily:

Intuitive Surgical (ISRG) LongIntuitive Surgical Inc. (ISRG), is the pioneer behind the revolutionary da Vinci Surgical Systems, is transforming the landscape of minimally invasive surgery. With its cutting-edge robotic platforms, ISRG enables precision, efficiency, and enhanced patient outcomes, making it a leader in the medical technology sector.

From a market performance perspective, ISRG has delivered impressive returns, demonstrating strong investor confidence. The stock has appreciated **55.45% Year-to-Date, 28.04% in the last 3 months, and a solid 10.94% in the past month. These figures reflect the company's robust financial health, innovation-driven growth, and favorable market sentiment, positioning ISRG as a standout performer in the healthcare sector.

Trade Idea:

ISRG appears to have completed a corrective ABC wave as the stock bounces off a strong demand zone (~$506–$522).And the stock is likely transitioning into a new impulsive Elliot wave sequence (Wave 1).

Trade Setup:

Entry: Near $522 (confirmation of demand zone holding).

Stop Loss: Below the DZ @ $500.55 (a break invalidates the bullish setup).

Take Profit Levels: (Profit Areas projected from the previous Elliott wave):

TP1: $579 (~10% gain).

TP2: $616 (~18% gain).

TP3: $658 (~25% gain).

Remmember,

“The trend is your friend until it bends at the end.” – Ed Seykota

________________________________________

Disclaimer:

This analysis is for educational purposes only and does not constitute financial advice. Trading involves significant risk of loss. Always perform your own analysis and consult a financial advisor before making trading decisions.

Speculative Madness: The Market’s Bubble Stocks Some stocks areSpeculative Madness: The Market’s Bubble Stocks

Some stocks aren't just overvalued—they're in full speculative bubble mode. Fundamentals? Irrelevant. When euphoria takes over, rationality disappears.

Here’s my list of bubble stocks that scream unsustainable pricing:

SBUX, T, PLTR, BMY, PYPL, NFLX, GS, ISRG, ARM, C, SHOP, BSX, SPOT, UBS, IBKR, RELX, CEG, CRWD, MSTR, MMM, DASH, COF...

And let’s not forget the obvious: TSLA, META, AMZN, AVGO, GOOGL, JPM, MA, V, WMT.

Honestly, the entire banking sector, brokers, and tech are in bubble territory.

What the hell is going on with this market? Why are algos just buying, buying, buying, squeezing all the shorts?! Unbelievable.

The dump will be insannnnnnnne!!! 🚨

LONG ISRG?The company has delivered solid numbers, and while their outlook for the year is somewhat cautious, analysts remain bullish. This aligns well with my trading style. I plan to enter with a tight risk setup, scaling out partially when the daily RSI reaches overbought levels, but holding the majority of the position to capture larger moves.

ISRG Down 2% in Premarket Trading Despite Beating ExpectationsIntuitive Surgical, Inc. (ISRG) experienced a 2% dip in premarket trading on Friday despite reporting robust fourth-quarter earnings that exceeded analysts’ expectations. The medical device company, known for its revolutionary da Vinci surgical robots, continues to showcase its dominance in the minimally invasive surgery market. Here’s a detailed look at the company’s performance, supported by fundamental and technical insights.

Strong Financial Performance

Intuitive Surgical reported a 25% year-over-year increase in fourth-quarter revenue, reaching $2.41 billion. This figure surpassed the consensus estimate compiled by Visible Alpha, reinforcing the company’s strong growth trajectory. Earnings rose to $686 million, or $1.88 per share, up from $606 million, or $1.69 per share, a year ago. These figures also beat analysts’ expectations, demonstrating the company’s profitability.

Operational Highlights

Procedure Growth: The number of procedures performed using da Vinci surgical devices increased by 18% year-over-year, signaling strong demand for Intuitive Surgical’s minimally invasive technology.

System Installations: The company installed 493 da Vinci systems during the quarter, compared to 415 systems a year earlier. This growth highlights the increasing adoption of its surgical solutions.

Future Outlook

Intuitive Surgical expects da Vinci procedures to grow by 13% to 16% in 2025. However, the company anticipates a 1 to 2 percentage point decline in its adjusted gross profit margin due to potential new tariffs, which could materially impact its financials.

Technical Analysis

Despite the strong earnings report, NASDAQ:ISRG shares fell by 2% in premarket trading. The stock’s overbought condition, indicated by an RSI of 75 as of Thursday’s close, suggests a potential for short-term correction.

- Gap Down Pattern: Historically, gap-down patterns in NASDAQ:ISRG stock have been filled, hinting at a possible rebound in the coming sessions. This historical behavior aligns with the broader market’s tendency to correct temporary gaps.

Key Support and Resistance Levels

- Support: Immediate support lies at the 38.2% Fibonacci retracement level, which could act as a cushion in case of further price correction.

- Resistance: The pivot point is situated above the 1-month high, presenting a significant barrier for upward momentum.

Moving Averages

The stock is trading above its 50-day, 100-day, and 200-day moving averages, underscoring its bullish trend in the medium to long term. This alignment of key moving averages strengthens the case for continued upside potential.

Market Context

- All-Time High: NASDAQ:ISRG shares closed at an all-time high on Thursday, marking a 62% gain over the past year. This performance underscores investor confidence in the company’s long-term prospects.

- Sector Strength: The growing adoption of robotic surgical systems positions Intuitive Surgical as a leader in the medical device industry, benefiting from the broader trend toward minimally invasive procedures.

Conclusion

Intuitive Surgical’s robust financial results and operational milestones underscore its leadership in the surgical robotics market. While the current dip in premarket trading reflects short-term market dynamics, the stock’s strong technical indicators and historical performance suggest a potential rebound.

Investors should monitor key support and resistance levels, along with updates on tariff developments, to assess the stock’s trajectory. With a bullish continuation pattern likely in play, NASDAQ:ISRG remains a compelling option for long-term growth-oriented investors.

ISRG Intuitive Surgical Options Ahead of EarningsIf you haven`t bought ISRG before the rally:

Now analyzing the options chain and the chart patterns of ISRG Intuitive Surgical prior to the earnings report this week,

I would consider purchasing the 595usd strike price Calls with

an expiration date of 2025-2-21,

for a premium of approximately $19.15.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Intuitive Surgical, Inc. (ISRG) | Chart & Forecast SummaryKey Indicators on Trade Set Up in General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Active Sessions on Relevant Range & Elemented Probabilities;

* Asian(Ranging) - London(Upwards) - NYC(Downwards)

* Weekend Crypto Session

# Trend | Time Frame Conductive | Weekly Time Frame

- General Trend

- Measurement on Session

* Support & Resistance

* Trade Area | Focus & Motion Ahead

# Position & Risk Reward | Daily Time Frame

- Measurement on Session

* Retracement | 0.5 & 0.618

* Extension | 0.786 & 1

Conclusion | Trade Plan Execution & Risk Management on Demand;

Overall Consensus | Neutral

Buy

Upward bullish channel maintained

New all time high set by upward break from bullish channel

Upward gap

Recent earnings release was positive with revenue and earnings beating forcast by 1.94% and 15.45% respectively.

Analysts from Citi group price target 512

consider buying and holding for this.

ISRG - Smooth FlightOn May 22nd of this year, we identified the beginning of a colossal appreciation in the stock, which we titled "ISRG - Back to the Top.

" Today, the alignment and compression of FiboNuvens signal an increased probability that it will continue cruising on this wonderful "Smooth Flight."

A 3:1 risk-reward ratio with a short stop-loss point are the attractive features of this operation.

If this projection is confirmed and a partial realization occurs at the first target, the stop loss should be moved from its initial position to the same line where the position was opened.

This way, the journey towards the final target will proceed with reduced risk of losses and preservation of partial gains achieved so far.

Let's see what happens here!

Follow us to receive notifications of new trades, as well as frequent updates on ongoing trades.

Finally, if you agree with the idea or found it useful, give it a BOOST so it can reach more people!

Intuitive Surgical is Set to Release its Quarterly 2024 ResultsIntuitive Surgical is set to release its Quarterly 2024 results, highlighting its significant impact on the healthcare industry. The company's innovative robotic systems have transformed surgery, leading to a remarkable 22,000% increase in stock price over its lifetime.

Now an industry giant with a market capitalization of $161 billion, questions about Intuitive Surgical's long-term growth and stock investment potential abound.

Intuitive Surgical, founded in the mid-1990s, provides robotic systems that enhance minimally invasive surgeries, helping surgeons reduce errors, improve mobility, and achieve better patient outcomes with smaller incisions. Over 60,000 surgeons have trained on its da Vinci system, and as of Q2 2024, the company has over 9,800 installed systems, with a 14% year-over-year growth in installations.

Investors value two main aspects of Intuitive Surgical's business: the reliance on system maintenance, which has increased recurring revenue from 71% in 2016 to 83% last year, making cash flow more predictable, and substantial growth potential outside the U.S., with only 3,818 of an estimated 165,000 global hospital sites currently using their systems.

However, the stock's substantial rise poses concerns about whether this growth is already accounted for in its valuation. Over the past decade, Intuitive Surgical shares ( NASDAQ:ISRG ) have appreciated nearly 800%, resulting in heightened market expectations that may lead to a difficult reset if future results fall short.

Analysts anticipate average earnings growth of 17% annually over the next three to five years, which may not be sufficient to justify the stock’s forward price-to-earnings (P/E) ratio of 69. With a PEG ratio nearly at 4, this suggests that the stock is overvalued relative to its expected growth.

Despite its recent upward trend since November 2023, indicated by a balanced Relative Strength Index (RSI) of 53, the stock is presently deemed too expensive for investors seeking strong returns. Therefore, while Intuitive Surgical ( NASDAQ:ISRG ) shows promising long-term growth potential, it may be wise to consider it as a target for investment when shares drop below current levels.

Intuitive Surgical (ISRG) Analysis Market Leadership:

Intuitive Surgical NASDAQ:ISRG , the leader in robotic-assisted surgery with its da Vinci system, is poised for substantial growth. The increasing adoption of robotic surgeries, currently under 5% of potential procedures, presents a significant opportunity. Additionally, the aging global population boosts demand for minimally invasive surgeries, favoring Intuitive Surgical's market position.

Analyst Projections:

Analysts project a median upside of 13% to 25% over the next year. For investors seeking steady returns and a strong healthcare business with a solid competitive moat, ISRG is an excellent choice.

Investment Outlook:

Bullish Outlook: We are bullish on ISRG above the $350.00-$355.00 range.

Upside Potential: With a target set at $540.00-$550.00, key growth drivers include the ongoing adoption of robotic surgeries and favorable demographic trends.

📊🤖 Monitor Intuitive Surgical for promising investment opportunities! #ISRG #RoboticSurgery 📈💼

ISRG - Back to the topAn increase in the probability of appreciation towards the latter was detected by means of the time divergence between Ethos oscillators. Approximation and alignment of multitimeframe Fibo Clouds support the operation.

Updates on this and other trades will be published in due course.