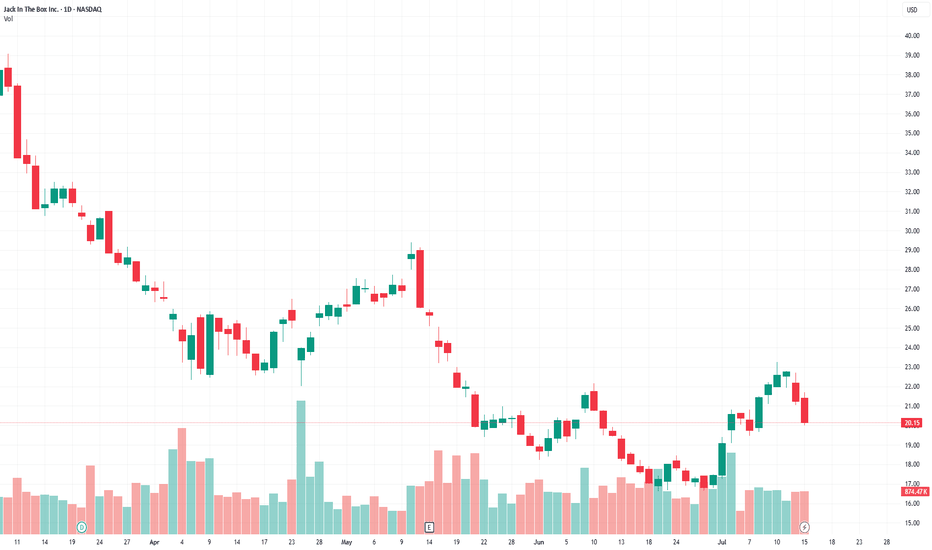

Jack in the Box | JACK | Long at $18.48Jack in the Box NASDAQ:JACK has taken a massive hit to its stock price since its peak in 2024 at just over $124 a share. It's currently trading around $18 and has entered my "crash" simple moving average zone. More often than not, this area signifies a bottom (or future bounce), but I view it more as a consolidation area to accumulate shares. Float = 18M; short interest = 19%...

Looking at NASDAQ:JACK fundamentally, this isn't the healthiest of restaurant companies. It is using a high level of debt to finance its operations and a high dividend yield of 9.28%. The company's revenue and profits have been slowly declining since 2023, as well. However, after 2025, the company anticipates a slow turnaround to begin. It will be closing 80-120 restaurants across the U.S. in 2025, which is a positive to help the company moving forward. NASDAQ:JACK also just got a new CFO and they are (at least from an outsider's view) attempting to change to generate share value. At this share price, I believe the company is in dire straits to get some investor confidence back. It's a strong name with long history.

While the stock price may hit true resistance at just under $17, NASDAQ:JACK is in a personal buy zone at $18.48. Targets are set low due to economic uncertainty.

Targets:

$23.00 (+24.5%)

$25.00 (+35.3%)

JACK trade ideas

Jack in the Box (JACK)Consumer Discretionary - Restaurants

Buy the dip: strategic plan, a number of shorts and the institutional interest.

Supporting Arguments

Strategic transformation program.

Large number of shorts and high dividend yield.

Interest of a large investor.

Jack in the Box, Inc. (NASDAQ: (JACK) operates of two chains of quick-service and fast-casual restaurants, with a total number of 2,600. The Jack in the Box segment offers a classic burgers. The Del Taco segment focuses on both Mexican and American. The company was founded in 1951 and is headquartered in San Diego, CA.

Investment Thesis

Strategic transformation plan. The company grew its revenue at a double-digit rate in 2021–2023, but since last year, revenue has been declining. The debt burden has begun to grow and has reached a critical level of more than $1.7 billion, or 5.1x LTM EBITDA. Amid the problems, the CEO resigned.

The company announced a restructuring plan, which includes closing 150–200 unprofitable restaurants, and selling the Del Taco chain entirely to reduce debt by $300 million is not ruled out. It is also planned to increase online sales from the current 12.5% to 25%. The EBITDA margin of the online segment is planned to increase to 15%.

A large number of short positions and a dividend. Short interest is 4.48 million shares, or about 25% of shares in free float and 5 average daily trading volumes. Closing the short may lead to a strong short-term increase in quotes. The dividend yield is about 6%, however, due to the need to save, it cannot be ruled out that the company will cut the dividend in the near future.

The interest of a large investor. The company's capitalization is $420 million, it has not been so cheap since the COVID-19 pandemic, and before that in the early 2010s. Quotes have fallen almost 5 times from the maximum, which creates a good opportunity for a takeover by a large player. The Biglari Capital Corp. fund, which controls almost 10%, has already taken advantage of the stock correction and intends to increase its share. However, the Board of Directors is currently taking measures to counter a hostile takeover, hoping to cope with the crisis on its own.

We recommend to BUY a JACK shares with the target price of $935, which implies a 60 upside. To mitigate potential losses, it is advised to implement a stop-loss at $16.90.

Jack in the Box Inc. Reports Second Quarter 2024 EarningsJack in the Box Inc. ( NASDAQ:JACK ) reported Q2 2024 earnings, with same-store sales of 2.5% and Del Taco same-store sales of 1.4%. Systemwide sales were 1.6% and 1.3% respectively. The company's EPS was $1.26, while operating EPS was $1.46. The restaurant level margin was 23.6%, up 2.2% from the previous year.

Jack in the Box signed franchise development agreements in Q2 to enter Tallahassee and expand in Orlando, now having 31 restaurant commitments in Florida. Del Taco signed franchisee development agreements in Q2 for 3 restaurants to enter Greensboro, NC, and 10 additional restaurants in Atlanta. New-market restaurants opened in the past 12 months, including Mexico, averaging almost $100k weekly AUV.

Chief Executive Officer Darin Harris expressed pride in the execution of the Jack and Del Taco teams, delivering better-than-expected earnings and margin performance despite macro headwinds, pressure on low-income consumers, and California's minimum wage legislation. Sales have improved since the introduction of Smashed Jack in mid-March, and the company has a clear plan to regain same-store sales traction through a strong marketing calendar, new LTOs, and an expanded value menu throughout the remainder of 2024.

Jack in the Box performance saw a 2.5% decrease in same-store sales, with both franchise and company-owned restaurants experiencing declines in transactions. Systemwide sales decreased 1.6%. The restaurant-level margin was $23.3 million, or 23.6%, up from $20.4 million, or 21.4%, a year ago, driven primarily by additional company-owned restaurants and commodity deflation. The franchise-level margin was $71.7 million, or 40.4%, a decrease from $73.9 million, or 41.2%, a year ago.

Jack in the Box net restaurant count increased in Q2, with three restaurant openings and no restaurant closures. As of Q2 2024, the company currently has 93 signed agreements for a total of 409 restaurants, with 44 openings and 365 remaining for future development.

Del Taco's second quarter sales decreased 1.4%, with a 1.1% decline in franchise same-store sales and 1.8% decline in company-operated same-store sales. The decrease was partially offset by a lift in average check. Systemwide sales for the fiscal second quarter decreased 1.3%. The restaurant-level margin was $11.4 million, down from 17.3% a year ago, due to refranchising restaurants and increased costs for labor and utilities. The franchise-level margin was $6.1 million, or 28.9%, compared to $5.1 million, or 37.3%, a year ago.

Del Taco expanded its restaurant count in the second quarter, with three openings and no closings. The company-wide performance was also affected by the refranchising efforts, with total revenues decreasing 7.7% to $365.3 million. Net earnings were $25.0 million for the second quarter of fiscal 2024, compared to $26.5 million for the second quarter of fiscal 2023. Adjusted EBITDA was $75.7 million in the second quarter of fiscal 2024 compared to $80.6 million for the prior year quarter. Company-wide SG&A expense for the second quarter was $37.5 million, a decrease of $1.9 million compared to the prior year quarter.

The income tax provisions reflect an effective tax rate of 26.5% in the second quarter of 2024, as compared to 34.8% in the second quarter of fiscal year 2023. The Non-GAAP Operating EPS tax rate for the second quarter of 2024 was 27.1%.

Capital allocation included repurchasing 0.2 million shares of common stock for an aggregate cost of $15.0 million in the second quarter. As of the end of the second quarter, there was $210.0 million remaining under the Board-authorized stock buyback program. On May 10, 2024, the Board of Directors declared a cash dividend of $0.44 per share, to be paid on June 25, 2024, to shareholders of record as of the close of Q2.

Jack In The Box Inc. (NASDAQ:JACK) Remains Optimistic for GrowthJack In The Box Inc. (NASDAQ: JACK) released its fourth-quarter financial results on November 22, 2023. The company reported earnings of $1.09 per share, which fell short of the estimated $1.15 per share. However, the revenue exceeded expectations, reaching $372.524 million compared to the projected $372.382 million. Despite this, the revenue saw a decline of 7.5% when compared to the same period last year.

During the quarter, Jack in the Box restaurant segment experienced a positive growth in same-store sales, with an increase of 3.9%. On the other hand, Del Taco same-store sales declined by 1.5%. Looking ahead to the full-year 2024, the company expects earnings per share to range between $6.25 and $6.50, falling short of the estimated $6.60.

Following the announcement, JACK shares experienced a 3.98% decrease in the after-hours session, trading at $65.91. Despite this setback, CEO Darin Harris remains optimistic about the company’s prospects in 2024. He believes there are ample opportunities to expand both brands into new markets and continue driving growth.

Overall, although Jack In The Box Inc. faced challenges in meeting earnings estimates and experienced a decline in revenue, the company remains focused on its growth strategy and is confident in its ability to capitalize on future opportunities.

JACK Analysist

The stock opened at $68.00, slightly lower than the previous day’s closing price of $68.89. Throughout the day, it traded within a range of $66.98 to $71.73. This indicates that there was some volatility in the stock price.

The trading volume for the day was 19,542 shares, which is relatively low compared to the average volume of 346,733 shares over the past three months. Jack in the Box Inc. has a market capitalization of $1.4 billion.

Looking at the company’s earnings growth, it experienced a decline of 26.17% in the previous year. However, it has managed to turn things around this year with a positive earnings growth of 4.63%. Moreover, the company is expected to continue growing its earnings at a rate of 10.81% over the next five years.

JACK IN THE BOX Price Hey my friends, JACK IN THE BOX is in a fake downtrend with high buy volume early in the session and hammer candle. The TIMEFRAME M1 we watch a marubozu with a low volume of purchase made. There is a good chance that the price will breakout and then put it away to arrive in a new one. And go to the last previous higher with an attempt to join the older points.

Please LIKE & FOLLOW, thank you!

$JACK can rise in the next daysContextual immersion trading strategy idea.

Jack in the Box operates and franchises Jack in the Box quick-service restaurants.

The demand for shares of the company looks higher than the supply.

Due to the spread of COVID-19, the company's revenue fell.

But the share price fell more and the company looks oversold.

These and other conditions can cause a rise in the share price in the next days.

So I opened a long position from $52,74;

stop-loss — $49,57.

Information about take-profits will be later.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.

Thanks for being with me!

Options on earnings callsJACK missed earnings last quarter and the price rose large. When going back several quarters on earnings days there is often a big move: when the price is stable and rising it had fallen; stable and falling it will rise. It’s currently in a stable fall with some resistance above and below.

Earnings are scheduled to announce after the closing bell, so there is more analysis to do to find the right entry point during the day. The risk is it seems to be stuck teeter-tottering, and a spread may be the more secure option play here.

$JACK Keep Climbing While $SPY Sells Off$JACK keeps looking more and more interesting. While it is hard to buy a stock that keeps making new highs, the recent price action tells us that someone is accumulating a position.

We are seeing more green days than red days in $JACK.

@Ivanoff tweeted today that something is brewing and we agree. We've been watching $JACK for some time and haven't pulled the trigger, but we are now.

Jack in the Box Inc. operates and franchises Jack in the Box quick-service restaurants. As of March 19, 2019, it operated and franchised approximately 2,200 Jack in the Box restaurants in 21 states and Guam. The company was founded in 1951 and is headquartered in San Diego, California.

As always, trade with caution and use protective stops.

Good luck to all!

JACK IN THE BOX, scares they shorts. Thankfully NASDAQ:JACK and NYSE:SHAK have taken the spotlight from BYND meat for the right reasons. It happens that people dont want a vegetable infused protein burger that much, traditional burger lovers have obviously not relented, PRAISE THE LORD.

If you fancy getting in on the trade maybe wait for the weekly resistance to break, plenty of upside awaits.

$JACK Hoping for Bullish break from wedge. After premium products drove down comparable sales in the first seven weeks, Jack in the Box, in the middle of the first quarter of the current financial year has shifted to a more value-based approach. The new strategy, which will continue for the remainder of the year, arrested the slide in comp sales with minimal or no impact on the gross margin. This weeks earnings could bring a nice surprise and jump in price.

Company Description

Jack in the Box, Inc. engages in operating and franchising a chain of quick-service and fast-casual restaurants. It operates through the Jack in the Box Restaurant segments. The Jack in the Box Restaurant segment offers a broad selection of distinctive products including burgers like Jumbo Jack burgers, and product lines such as Buttery Jack burgers including the Brunchfast menu.