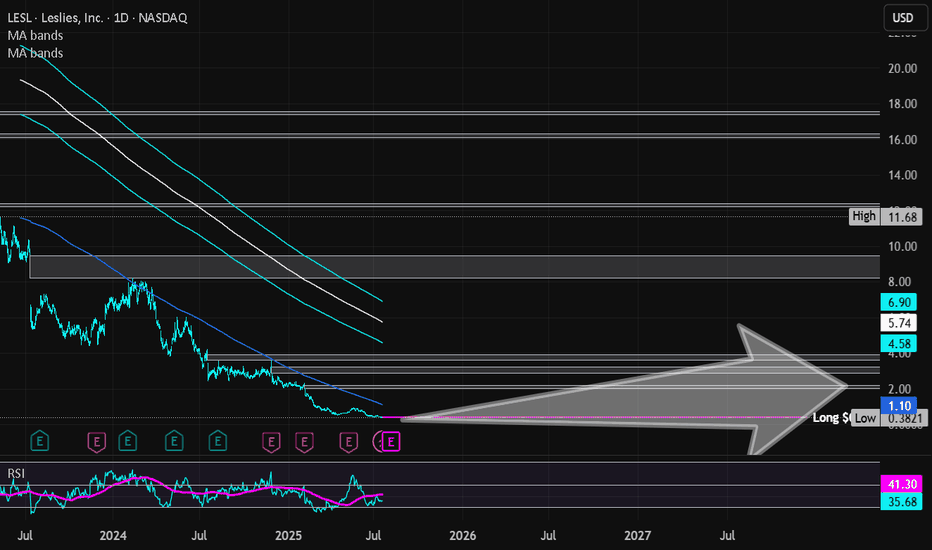

Leslies Inc | LESL | Long at $0.41**VERY risky trade - 25% or more risk of bankruptcy**

Leslies NASDAQ:LESL is a direct-to-consumer pool and spa care brand in the U.S., selling chemicals, equipment, and services. The stock dropped 88.86% last year due to weak demand, flat revenue, shrinking gross margins from stock write-downs, higher rent, shipping costs, and an earnings miss (-$0.25 vs. -$0.244). High debt, market share losses to e-commerce, and a competitive pool supply market also contributed.

On a positive note, the company generated $1.33 billion in revenue for fiscal year 2024. New leadership has entered the picture, cost-cutting is starting to happen, and summer season may boost pool sales. While 2025 is still projected to be a rough year, revenue is forecasted to grow 6.4% in 2026 and 2027 and earnings are likely to turn positive (based on company statements). While this is a *highly risky* play and there are absolutely better companies out there, I think there is a chance this ticker may get some steam in the near future. 7% short interest, 176 million float.

Thus, at $0.41, NASDAQ:LESL is in a personal buy zone.

Targets into 2027:

$1.00 (+143.9%)

$2.00 (+387.8%)

LESL trade ideas

LESLIE'S Puts and Sales Leslie's is a retail company who has recently been abused with an overload of puts and insider selling.

Insiders have sold an estimated $425840216 of shares with some key individuals such as the CEO selling 20% and 24% of his shares. Common theme is most insiders sold 20-24% of there holdings.

There as been decreases in calls and major increases in put options. Marketbeat states that Traders acquired 12,669 put options which is a 6500% increase.

The company has recently beaten some earnings forecasts such as its EPS and revenue.

Note. Leslies is currently in a channel between 50 day SMA and support level and the stock is dominated by Institutions ownership with very little retail ownership.

$LESL Cup with Handle Break-Out?$LESL Was brought to my attention on investors.com. It was featured as stock of the day on May 2 and is expected to far well post pandemic due to the large number of pools built during the lock-downs. Leslie Pools have been in business for over 50 years and have a solid track record. Since this was not on my radar I missed what I like to use as an early entry breaking the downtrend line on the handle of the cup. I now have an alert set at $30.03 as it moves (if it does) above a recent high in the handle. Proper entry would be the top of the cup as it breaks-out. Ideas, not investing / trading advice.

from earningswhispers.com

May 5

Leslie's Beats

Leslie's (LESL) reported a 2nd Quarter March 2021 loss of $0.02 per share on revenue of $192.4 million. The consensus estimate was a loss of $0.10 per share on revenue of $148.7 million. The Earnings Whisper number was for a loss of $0.08 per share.

The company said it expects fiscal 2021 earnings of $0.65 to $0.70 per share on revenue of $1.25 billion to $1.27 billion. The company's previous guidance was earnings of $0.55 to $0.60 per share on revenue of $1.175 billion to $1.195 billion and the current consensus earnings estimate is $0.59 per share on revenue of $1.19 billion for the year ending September 30, 2021.

Do we have a cup with handle for LESL?I see a pretty good looking cup with handle pattern for LESL. This isn't a William O'Neil IBD perfectly drawn chart, but not all cup/handles have to follow the rules exactly. Volume dropped off during the handle. Touch to the 50dma on 5/12. Moving averages are now in an uptrend. RSI, MACD and STOCH all trending up as well. Today's price broke through the 20dma and closed above it. I'm looking for a full candle above the 20dma. I'd also be looking for big volume to come in on a breakout day around $29.76. For some reason 5/25 sounds about right for a breakout. Due your own due diligence. This is not financial advice. Be well.

Summer pool play LESLGo long LESL. Play on pools and increased home-ownership/pool installations over the pandemic. The upward channel has remained intact despite the market-wide correction. Could be a good trade for the summer and possibly beyond depending on how the company performs and the quality of the earnings/growth reported since it did just recently start trading publicly.

The current chlorine shortage and pent-up demand for more pools will give Leslie's pricing power. It is also under-owned based on RSI with MACD looking ready to bottom-out and head up for a bullish MACD cross.

$LESL is giving a GREAT IPO LONG opportunity todayIPO intraday trading strategy idea

Leslie's is the largest and most trusted direct-to-consumer brand in the U.S. pool and spa care industry.

The share price is rising and gonna continue this trend today.

The demand for shares of the company still looks higher than the supply.

These and other conditions can cause a rise in the share price today.

So I opened a long position from $21,30;

stop-loss — $20,30;

take-profit — $24,30.

Do not view this idea as a recommendation for trading or investing. It is published only to introduce my own vision.

Always do your own analysis before making deals. When you use any materials, do not rely on blind trust.

You should remember that isolated deals do not give systematic profit, so trade/invest using a developed strategy.

If you like my content, you can subscribe to the news and receive my fresh ideas.