LNTH trade ideas

$LNTH Potential Healthcare sector leader NASDAQ:LNTH holds a negative net debt to ebitda ratio, with a forward p/e ratio around 16. Revenue growth was up over 18% for the TTM, and operating margin was around 40% compared to ~15% for healthcare companies in the drug manufacturing industry.

Technically, there is a potential wedge forming, though I can see a breakout bounce off of the .382 fib coming too. Strength showing relative to the S&P.

LNTH longI am long LNTH here, the company simply has outstanding revenue and earnings growth. They have Moat in the sense that they hold key radiologic products that are needed for a variety of patients. The pump and dump looks like a hedge fund, also with RFK taking health seat I believe the overreaction is apparent for many healthcare companies. The weekly stochastic RSI is bottomed and we see a hugely widening BBWP. I think we consolidate in the prior range highlighted by the rectangle, then up and to the right.

$LNTH From wild to tamed period NASDAQ:LNTH has been exhibiting tame behaviour now that the uncertain period during down trend has caused unnerving traders to buy and sell. It has reversed with strong earnings recently and now is on the uptrend forming the 2nd #Goldencross. I am selling my house so to speak to go all in. LOL.

Lantheus ST Cup & Handle?I think Lantheus may be worth a look here. A six month chart indicates a nicely formed cup and handle formation recently. It jumped up on February 22nd, after turning in a good quarterly report. Looking at a longer term chart (a few years) it could be a nice double bottom LT.

All bets are OFF, with a close below $52/share.

Disclaimer: I am neither long or short Lantheus at this time. But, may initiate a position

in the future.

#LNTH potential support detectedPotential support in short or middle-term (2-5 days) based on option market sentiment IF down move.

Option will expire 18-Aug-23 but scenario should be realize before the date.

Also, we take into consideration VWAP uptrend below support area.

Option Sentiment Source: CBOE exchange

We do the best research as we can to find new opportunities in the massive amount of information every day to help you make data-driven trading decision.

Please feel free to leave any comments you have and like this idea if you agree with us. Any feedback or comments will be read. We appreciate it all!

Bullet Catch Pattern. LNTH At Short Zone With Excellent R/R. Normally I use pure price action to make my trades. This however, is a pattern I've noticed based on some of my best trades over the past year with probably about an 80-90% strike rate when I find one.

So let's call it the "Bullet Catch Pattern".

You notice that over a large number of candles, price has done a slow, steady reversal in either the upward or downward direction. In this case, it's a short setup so it's a slow downward curve from the high.

In this case, there is an inverse cup that is 10 candles wide, and an impulse move (the bullet) that is 4 candles wide. The number of candles isn't important, but the catch should be significantly wider than the bullet. It's the ratio that matters.

Also, in this case, we see that trend has shifted down as evidenced by the candle body close below the orange line. I can't stress how important this is. If you don't fully understand trend and when it's invalidated, check out Tradersumo's video on it on Youtube.

So, despite the impulsive bullet move up, we now have two reasons to believe it will terminate at the high or just above it, and will reverse to find a new local low.

The stop loss is shown here in a conservative place for the safest reward/risk. But, if the r-r is really good, I will often widen my stop as the best entries on these occur in the liquidity zone just above the high, and since these setups have pretty good odds of playing out as expected, I'm willing to sacrifice some r-r and possible slippage in exchange for the best entry. You could also improve the r-r at the higher fill above the ATH by moving the entire red zone and stop loss up slightly above the high, but you risk not getting filled.

I managed to get a literal perfect Google short entry on Feb. 2, 2022 despite the news being super bullish. They beat earnings that day and the market simply filled my short just above all time high, which were there because the bullet catch pattern was pretty clear. Pull up a chart and look at that daily candle. It's a perfect example of an above the catch fill. I happened to open up that chart at the perfect moment, saw the bullet catch and smashed a short at was is still the all time high.

GO was another ticker that gave the pattern on the weekly giving a perfect entry. Apple was another one I caught a perfect entry on on Aug. 15, 2022. And as I typed this, I noticed one on the Russ that I just took on the 15 minute chart that just played out perfectly. Price was above the catch and it was just a liquidity grab, so I entered there where I assumed the market makers' short orders were.

If you see this pattern anywhere, DM me. Especially on the weekly or monthly time frames. I love when it wicks above the catch like it did on Google that day. You couldn't ask for a better entry.

Let me know below if you have any questions about this pattern and how to use it.

---Watch the following Ticker! as of 2023/4/6---

I extracted MACD Golden-X tickers from from the ones having relatively higher O'neil ratio.

LNTH

OVLY

STVN

TPH

VRTX

*Note:

IBD tells "Market in confirmed uptrend(Green sign)"

VIX shows 19.97. VIX<20

Almost no impact of FOMC, CPI, Jobless rate this week.

LNTH right direction as business and the price could improveLNTH recently purchased cancer drugs license which are in the Phase 1 with FDA, that look promising. The company raised some cash through senior convertible notes. Quarterly revenue grew 134% YoY to $239.3mm, driven by strengths across the portfolio.

Management raised Q4 and FY22 guidance to the upside from the top-bottom lines. Last ER looks like: Lantheus Non-GAAP EPS of $0.99 beats by $0.16, revenue of $239.29M beats by $11.41M.

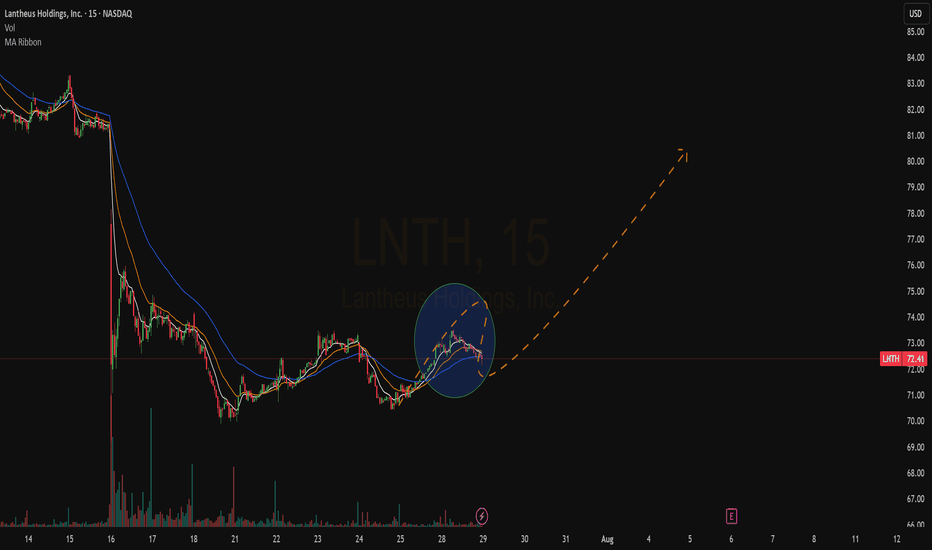

The stock price retraced to its long term support zone and could start move up towards 80$ area.

$LNTH Breaking Above Resistance on Volume$LNTH Breaking above a resistance area today on higher-than-normal volume. We are only 45 minutes in and traded 633,000 shares. 10-day average is 1,066,000. Trying a starter position here. I’ll put my stop on a close under the 8 EMA which pretty much coincides with the low of day. Let’s see what happens. Ideas, not investing / trading advice.

LNTH Long IdeaUptrend on weekly and daily. HH HL HH HL. Expecting a bounce off the zone where it's currently at, as it closed as a hammer on the daily. A lot more open interest and volume on the call side. The only thing I don't like is the spread on the options isn't too tight. Trim as it hits the next zone and my main pt is the top of the last higher high.

LNTH Power Play gets tight and offers entryLNTH Power Play(High tight Flag) gets tight and offers entry. It has a nice shakeout that helps the pattern because it was wedging. This is a very competitive industry with low margins but the price action is very powerful so giving the benefit of the doubt.