LSCC trade ideas

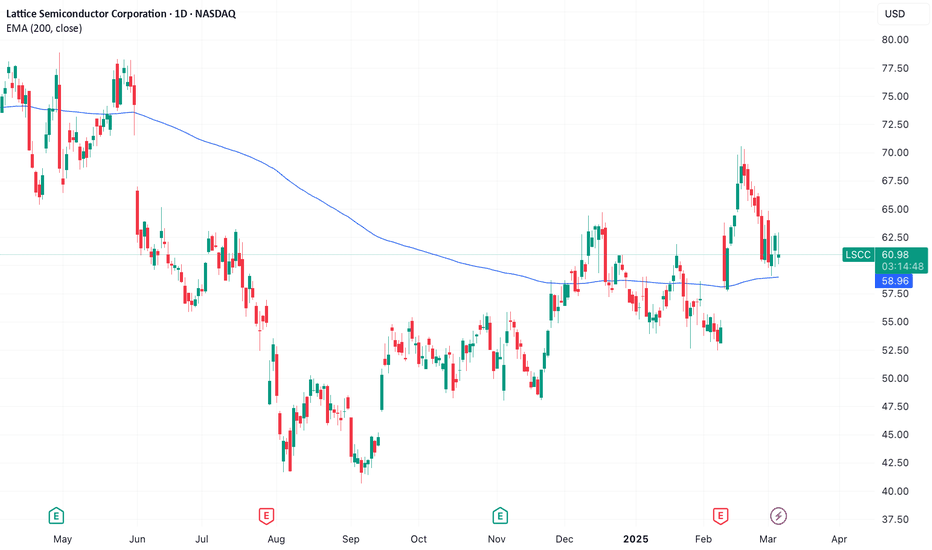

Lattice Semiconductor Break Above Downtrend LineLattice Semiconductors recently breakout long term down trend line and have possibility to move higher.

Our Strategy Indicator triggered buying opportunities few days ago and price recently sustain within buying zone.

If the price can maintain above breakout resistance, there is high possibility that it can go higher once overall index recover.

LSCC | Bull Flag Forming | LONGLattice Semiconductor Corp. engages in the business of developing technologies that are monetized through differentiated programmable logic semiconductor products, system solutions, design services, and licenses. The firm also offers silicon-based and silicon-enabling products, evaluation boards, development hardware, and related intellectual property licensing, services, and sales. The company was founded in 1983 and is headquartered in Hillsboro, OR.

Speculative LONG in LSCCI've placed a speculative limit order to enter LSCC long. The reasons:

The price formed a double-bottom pattern in August and September, which was broken to the upside.

After reaching the last high on September 27th, the price corrected downwards, making nearly a 50% price retracement.

The moving averages have made a bullish crossover. The 50-day SMA now supports the price movement and has turned upwards.

LSCC - June 24 Qullamaggie Breakout and Episodic Pivot- Larger Trend is aligned to our trade direction

- Price is moving into 12:30 weak.

Price concept is if it cannot hold the momentum from 9.30pm - 12.30am. Then the lunch drop from 12.30-1.30am will accelerate the break down

Qulla Breakout & EP (Discretionary & Systematic) 🚀

Swing Trend Strategy focused on Breakouts based on repeated momentum and Episodic Pivots based on unexpected news/fundamentals that is not properly priced in. The entery requirements are always price consolidation and tightening

Lattice Semiconductor: Navigating Through Cyclical HeadwindsLattice Semiconductor Corporation (NASDAQ: NASDAQ:LSCC ) continues to thrive despite near-term cyclical industry headwinds. The company's recently reported fourth-quarter and full-year 2023 results not only showcase impressive financial performance but also underscore its strategic vision and unwavering commitment to innovation.

Lattice Semiconductor ( NASDAQ:LSCC ) reported fourth-quarter revenue of $170.6 million, marking a resilient performance in the face of industry challenges. Despite a slight year-over-year decrease in quarterly revenue, the company achieved a remarkable 12% increase in full-year revenue, reaching $737.2 million. Such consistent growth reflects Lattice's strong market positioning and customer momentum.

One of the standout aspects of Lattice Semiconductor's ( NASDAQ:LSCC ) performance is its impressive margin expansion. The company reported a GAAP gross margin of 69.8% for the full year 2023, representing a 130 basis points expansion compared to the previous year. Similarly, its non-GAAP gross margin expanded to 70.4%, reflecting operational efficiency and effective cost management strategies. Such robust margin expansion speaks volumes about Lattice's ability to optimize its operations and drive profitability even in challenging market conditions.

Moreover, Lattice Semiconductor's ( NASDAQ:LSCC ) focus on shareholder value creation is evident through its expanded share repurchase program. With authorization to repurchase up to an additional $250 million of its outstanding common stock through the end of December 2024, the company reaffirms its commitment to delivering long-term value to its shareholders. The consistent repurchase of shares over thirteen consecutive quarters underscores management's confidence in the company's future prospects and financial strength.

Innovation lies at the heart of Lattice Semiconductor's ( NASDAQ:LSCC ) success story. The company's inaugural Developers Conference attracted over 5,000 registrations and featured keynote addresses from industry giants such as BMW, Meta, and NVIDIA. Furthermore, its collaboration with NVIDIA resulted in the introduction of a new reference design platform aimed at accelerating the development of high-performance edge AI applications. Such partnerships and product innovations underscore Lattice's ability to stay at the forefront of technological advancements and cater to evolving market demands.

Looking ahead, Lattice Semiconductor ( NASDAQ:LSCC ) remains optimistic about its future prospects despite the prevailing industry uncertainties. The company expects first-quarter revenue to range between $130 million and $150 million, demonstrating confidence in its ability to navigate through short-term challenges. Additionally, with a projected gross margin percentage of 69% plus or minus 1% on a non-GAAP basis, Lattice continues to prioritize operational efficiency and profitability.

In conclusion, Lattice Semiconductor's ( NASDAQ:LSCC ) fourth-quarter and full-year 2023 results highlight its resilience, innovation, and commitment to driving long-term shareholder value. Despite facing cyclical industry headwinds, the company's robust financial performance, margin expansion, and strategic initiatives position it well for sustained growth and success in the dynamic semiconductor market. As Lattice Semiconductor ( NASDAQ:LSCC ) continues to push the boundaries of innovation and expand its market presence, investors can remain confident in its ability to deliver value in the years to come.

LSCC, Uptrend based on AlgoSignal StrategyThe current point exhibits promising upward signals according to my algorithmic system, meeting various criteria. These include rising trading volume, an upward trend indicated by prices above EMA20 and EMA50, and the closing price surpassing VWAP. As a result, the present conditions suggest a potential upward trend.

$LSCC gapping to new highs amidst global semiconductor warfareThis week I bring your attention to this stock: gapping up to new 52 week and all time highs and on a sustained, healthy uptrend.

This is perfect for a momentum play: I would enter here @ 93.7 with a target of 123.3 and a stop just below the 50 day moving average @ 78.87.

Please manage your risk.

$LSCC Bullish Earnings Pullback Base Break$LSCC This chart is a near perfect base and break on Feb 1, 2023, with big volume and more volume on follow thru. Then a base on base just prior to earnings with another base break on earnings with big volume. Then the usual profit taking / shakeout pulling back to the breakout area. I started a position on Feb 28 when price went thru the pullback base and I was underwater by close but did not get stopped out as it held the most recent lows. I added again on Mar 2 with another break above pullback baseline. I then added today on follow thru from that base break. I’ll look to take ½ off at R-1 area and wait for it to base again around that area and add back on a confirmed pullback, if that happens. Ideas, not investing / trading advice.

LSCC daily - bullish ONLY if breakout of the symmetrical trianglLSCC is a bullish/strong fundamental stock therefore would be tarded only on a long position

LSCC daily is in a symmetrical triangle which if breakout accused would be pretty bullish. The issue is on 18 Jan we had a shooting star reversal candle, and then the next day a red candle to confirm it which is bearish.

LSCC is above all major MA which is bullish.

Volume is smaller on the last trading day of the week than on the two days before it when the price drop therefore it is more bearish than bullish.

RSI is neutral.

MACD histogram starts to tick lower while the MACD line and signal lines are still bullish.

Overall: LSCC if breakout out of this symmetrical triangle would be very bullish. But it needs to break out of it in the next several days otherwise pattern will fail due to the lack of place inside of it. Also, the breakout must be on a much bigger volume than on Friday for example. If LSCC doesn't find enough buyers pattern will fail and we could see LSCC in a few weeks of consolidation levels.

Long trade will be triggered if it breakout of a blue dotted line.

Lattice Semiconductor Corporation (LSCC) Stock AnalysisLattice Semiconductor Corporation (LSCC) stock has displayed relative strength in the past couple of weeks. From its lows back in early October 2022, the stock has moved up by more than 40% within a span of a few weeks. The semiconductor stock not only moved up on strong price action and volume but it has also managed to keep most of its gains with a shallow pullback after its move up of only 17%. The stock found support at the 50-day moving average (red line) before moving up and breaking above the resistance at $72. The stock also possesses strong fundamentals with 3 consecutive quarters of double-digit growth year over year for both earnings and sales. This is a stock to pay attention to!

LSCC broke resistance and looking to move higher!LSCC (Lattice Semiconductor Corporation) showing signs of going higher. It recently broke out of the ascending triangle resistance around $58.38 but not with more volume than average.

Fundamentally: The company's been doing pretty well with its earnings growing consistently year-over-year.

Looking at technicals I think the price will go sideways in the coming week and may retest the $57.60 to $58.38 area as support before moving higher.

Generally I think this is a good long term hold as well since semiconductors are used everywhere.

If this breakout plays as expected the target price would be around $77.75

LSCC forming an ascending triangle!LSCC broke the decade long resistance of $41.31 in November of 2020 and has used that price as support since. After breaking its all time highs from the 2000's LSCC has been forming an ascending triangle.

As we can see LSCC was recently rejected from the $57.60 to $58.38 range which were it's recent highs and it has been using the white trend line as support.

Semiconductor stocks are hot right now and with earnings coming up LSCC may be making a break for it sooner rather than later.

Fundamentally:

* LSCCs earnings per share is expected to grow over the coming year

* It has been performing really well with an 83.63% growth over the past year.

Technically:

* Seeing the rejection from its highs, it seems like the stock may revisit the $55 or $55.40 price before making higher moves. So look for buying opportunities in that range if you're looking for a discount.

* If discounts aren't your thing, look for a buying opportunity following a daily close above $58.38

* On the contrary, a close below $55 could send the price lower to retest the support of the ascending triangle. Which would be an even better discount given how well semiconductor stocks are doing.

Target:

* If the pattern confirms and the breakout takes place, the target for this break would be in the $77.60 area.

LATTICE SEMICONDUCTOR Analysis Hey traders, LATTICE SEMICONDUCTOR is in a fake bearish composition with a high volume of sales issued and a hammer candle. Zooming in on the TIMEFRAME M1 we observed a doji with a bullish leg with a large volume of purchase made. It rebounded to test VWAP it is very plausible to test the base then the plus of the bollinger to interfere on the top of the range. To test it then a breakout of the coming range go to the second row and finish to make a new high point. With a test from the top of the second range to reach the top of the bullish channel to test it, in addition to the crossing of the symbolic number of 47.00.

Please LIKE & FOLLOW, thank you!

LSCC watch out for the shooting starLSCC had a quick bounce, dropping 6% and then gaining 5% during this weeks rotations. A move past Tuesday's high would be a positive sign. The 10d ATR (x2.7) suggests a 11.77% stop and position size of R8.49. Given the chart pattern, one might further limit risk by stepping into this position at 50%, 30%, 20% increments.

Buy Point: 40.74 - 41.48

Stop Loss: 35.94

Position Size: R8.49