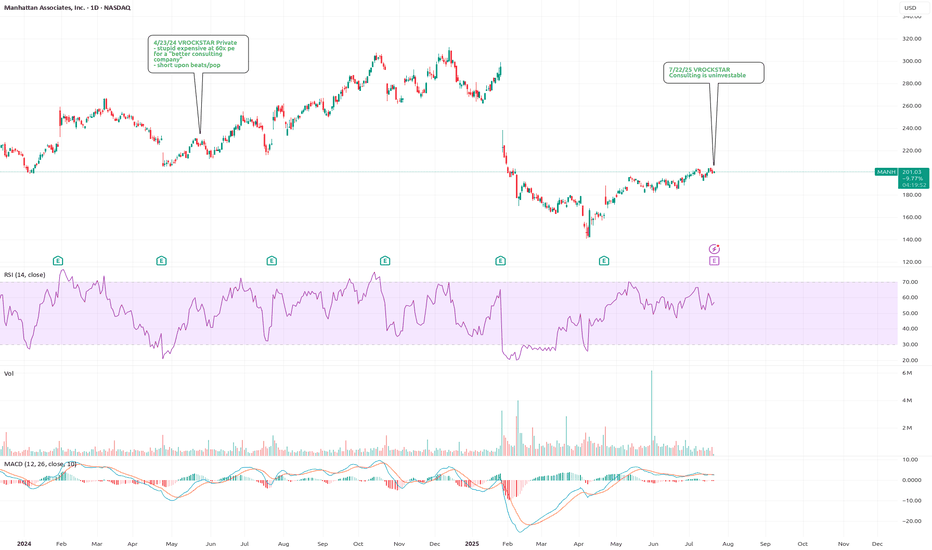

7/22/25 - $manh - Consulting is uninvestable 7/22/25 :: VROCKSTAR :: BOATS:MANH

Consulting is uninvestable

- AI will gut this useless industry. I can discern this from using enough AI tools long enough. not interested in your "but muh integration moat bs". it's fafo, prefer u don't have to fafo pnl

- so while it might not be a short here (

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

3.63 USD

218.36 M USD

1.04 B USD

59.64 M

About Manhattan Associates, Inc.

Sector

Industry

CEO

Eric A. Clark

Website

Headquarters

Atlanta

Founded

1990

FIGI

BBG000BFV758

Manhattan Associates, Inc. engages in the business of developing, selling, deploying, servicing, and maintaining software solutions designed to manage supply chains, inventory, and omnichannel operations for retailers, wholesalers, manufacturers, logistics providers, and other organizations. It operates through the following geographical segments: North and Latin America, Europe, Middle East, and Africa, and Asia Pacific. The company was founded by Deepak Raghavan in October 1990 and is headquartered in Atlanta, GA.

Related stocks

Manhattan Associates stock Chart Fibonacci Analysis 050125Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 170/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

MANH to $244My trading plan is very simple.

I buy or sell when price tags the top or bottom of parallel channels.

I confirm when price hits Fibonacci levels.

So...

Here's why I'm picking this symbol to do the thing.

Price at bottom of channels (period 100 52 & 26)

Stochastic Momentum Index (SMI) at overs

Manhattan Associates (MANH)Asset Class: Stocks

Income Type: Daily

Symbol: MANH

Trade Type: Long

Trends:

Short Term: Down

Long Term: Up

Set-Up Parameters:

Entry: 273.88 (at the Breakout)

Stop: 260.94

TP 312.72 (3:1)

Trade idea:

A price pin into a daily demand zone formed by a rally-base-rally with Fair Value Gap , enter

4/23/24 - $MANH print4/23 - stupid expensive 60x pe and just a "better" consulting company but probably beats lazy estimates in a "good" tape and would be a good short upon 1) beat and 2) pop into the coming months. good luck longs... either use this as exit liquidity if you've done the work or realistically you should

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of MANH is 211.28 USD — it has increased by 0.10% in the past 24 hours. Watch Manhattan Associates, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Manhattan Associates, Inc. stocks are traded under the ticker MANH.

MANH stock has fallen by −4.39% compared to the previous week, the month change is a 8.67% rise, over the last year Manhattan Associates, Inc. has showed a −13.75% decrease.

We've gathered analysts' opinions on Manhattan Associates, Inc. future price: according to them, MANH price has a max estimate of 250.00 USD and a min estimate of 205.00 USD. Watch MANH chart and read a more detailed Manhattan Associates, Inc. stock forecast: see what analysts think of Manhattan Associates, Inc. and suggest that you do with its stocks.

MANH reached its all-time high on Dec 12, 2024 with the price of 312.60 USD, and its all-time low was 0.88 USD and was reached on Oct 8, 1999. View more price dynamics on MANH chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MANH stock is 4.59% volatile and has beta coefficient of 1.42. Track Manhattan Associates, Inc. stock price on the chart and check out the list of the most volatile stocks — is Manhattan Associates, Inc. there?

Today Manhattan Associates, Inc. has the market capitalization of 13.06 B, it has increased by 0.11% over the last week.

Yes, you can track Manhattan Associates, Inc. financials in yearly and quarterly reports right on TradingView.

Manhattan Associates, Inc. is going to release the next earnings report on Oct 28, 2025. Keep track of upcoming events with our Earnings Calendar.

MANH earnings for the last quarter are 1.31 USD per share, whereas the estimation was 1.13 USD resulting in a 16.24% surprise. The estimated earnings for the next quarter are 1.18 USD per share. See more details about Manhattan Associates, Inc. earnings.

Manhattan Associates, Inc. revenue for the last quarter amounts to 272.42 M USD, despite the estimated figure of 263.72 M USD. In the next quarter, revenue is expected to reach 271.82 M USD.

MANH net income for the last quarter is 56.78 M USD, while the quarter before that showed 52.58 M USD of net income which accounts for 7.98% change. Track more Manhattan Associates, Inc. financial stats to get the full picture.

No, MANH doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 8, 2025, the company has 4.69 K employees. See our rating of the largest employees — is Manhattan Associates, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Manhattan Associates, Inc. EBITDA is 282.12 M USD, and current EBITDA margin is 25.70%. See more stats in Manhattan Associates, Inc. financial statements.

Like other stocks, MANH shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Manhattan Associates, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Manhattan Associates, Inc. technincal analysis shows the neutral today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Manhattan Associates, Inc. stock shows the buy signal. See more of Manhattan Associates, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.