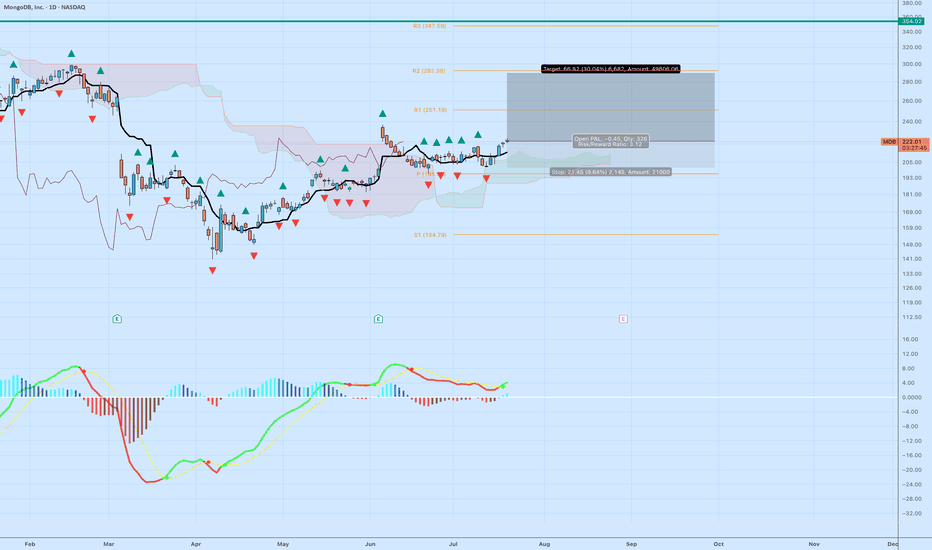

MDB – Clean Ichimoku Breakout with MACD + Fractal ConfirmationMongoDB (MDB) is setting up for a high-probability swing trade. Price has cleanly broken above the Ichimoku cloud, supported by bullish structure and a MACD crossover. This move is reinforced by upward fractal confirmations just below recent highs.

Why I like this trade:

Price broke above the clou

Key facts today

MongoDB Inc. (MDB) shares rose 3.2%, ending an eight-day winning streak with a 17% gain, driven by optimism around its AI strategy and increased bullish options activity.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−1.13 USD

−129.07 M USD

2.01 B USD

78.55 M

About MongoDB, Inc.

Sector

Industry

CEO

Dev C. Ittycheria

Website

Headquarters

New York

Founded

2007

FIGI

BBG0022FDRY8

MongoDB, Inc. engages in the development and provision of a general-purpose database platform. The firm's products include MongoDB Enterprise Advanced, MongoDB Atlas, and Community Server. It also offers professional services including consulting and training. The company was founded by Eliot Horowitz, Dwight A. Merriman, Kevin P. Ryan, and Geir Magnusson Jr. in November 2007 and is headquartered in New York, NY.

Related stocks

MDB · 4H — Ascending Triangle Breakout Toward $224 → $231MDB · 4H — Ascending Triangle Breakout Toward $224 → $231

Setup Breakdown

Ascending triangle breakout: Price has been coiling just under $212 while making higher lows since mid-June.

This 4H candle confirms a bullish breakout with solid volume, suggesting a fresh momentum leg is underway.

The t

Safe Entry Zone MDBPrice Reached good Support Level.

Waiting for Buyers to step-in in Case no Buying Power Showed -Up we will be targeting Green Zone As Safest Entry Zone and Strongest Support level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One

Safe Entry ZoneCurrent price Movement Up.

Price at Strong Resistance 1D Red Zone.

The 1D Green Zone Act As Strong Support level in case the Red Zone not Broken and Re-test or previous support Green Zone.

Each P.High (Previous High) acts as strong resistance level watch out for any selling pressure at these level

MDB MongoDB Options Ahead of EarningsIf you haven`t exited MDB before the selloff:

Now analyzing the options chain and the chart patterns of MDB MongoDB prior to the earnings report this week,

I would consider purchasing the180usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $4.95.

If these op

6/4/25 - $mdb - Too ambiguous for me here6/4/25 :: VROCKSTAR :: NASDAQ:MDB

Too ambiguous for me here

- my impression this eps season is more consumer-linked co's r struggling more, or unwilling to guide

- but B2B types, esp those that serve some layer of the AI stack (including energy - so i mean *all* layers) are finding themselves wil

MongoDB (MDB) Stock Analysis – Bearish Trend with Potential ReveBearish Case

Breakdown Below $223.52: Key support lost, confirming a downtrend.

RSI (32.65): Near oversold but no rebound yet.

Stochastic (5.60): Oversold but no bullish crossover.

Downside Targets:

$187.65: Next support.

$135.15: Major historical support if further decline continues.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MDB is featured.

Software stocks: US companies at our finger tips

49 No. of Symbols

See all sparks

Frequently Asked Questions

The current price of MDB is 241.37 USD — it has increased by 3.03% in the past 24 hours. Watch MongoDB, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange MongoDB, Inc. stocks are traded under the ticker MDB.

MDB stock has risen by 11.97% compared to the previous week, the month change is a 14.04% rise, over the last year MongoDB, Inc. has showed a −2.53% decrease.

We've gathered analysts' opinions on MongoDB, Inc. future price: according to them, MDB price has a max estimate of 395.00 USD and a min estimate of 170.00 USD. Watch MDB chart and read a more detailed MongoDB, Inc. stock forecast: see what analysts think of MongoDB, Inc. and suggest that you do with its stocks.

MDB stock is 5.56% volatile and has beta coefficient of 1.78. Track MongoDB, Inc. stock price on the chart and check out the list of the most volatile stocks — is MongoDB, Inc. there?

Today MongoDB, Inc. has the market capitalization of 19.72 B, it has increased by 0.18% over the last week.

Yes, you can track MongoDB, Inc. financials in yearly and quarterly reports right on TradingView.

MongoDB, Inc. is going to release the next earnings report on Aug 28, 2025. Keep track of upcoming events with our Earnings Calendar.

MDB earnings for the last quarter are 1.00 USD per share, whereas the estimation was 0.67 USD resulting in a 49.78% surprise. The estimated earnings for the next quarter are 0.67 USD per share. See more details about MongoDB, Inc. earnings.

MongoDB, Inc. revenue for the last quarter amounts to 549.01 M USD, despite the estimated figure of 528.12 M USD. In the next quarter, revenue is expected to reach 553.97 M USD.

MDB net income for the last quarter is −37.63 M USD, while the quarter before that showed 15.83 M USD of net income which accounts for −337.75% change. Track more MongoDB, Inc. financial stats to get the full picture.

No, MDB doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 5.56 K employees. See our rating of the largest employees — is MongoDB, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. MongoDB, Inc. EBITDA is −143.70 M USD, and current EBITDA margin is −9.43%. See more stats in MongoDB, Inc. financial statements.

Like other stocks, MDB shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade MongoDB, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So MongoDB, Inc. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating MongoDB, Inc. stock shows the sell signal. See more of MongoDB, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.