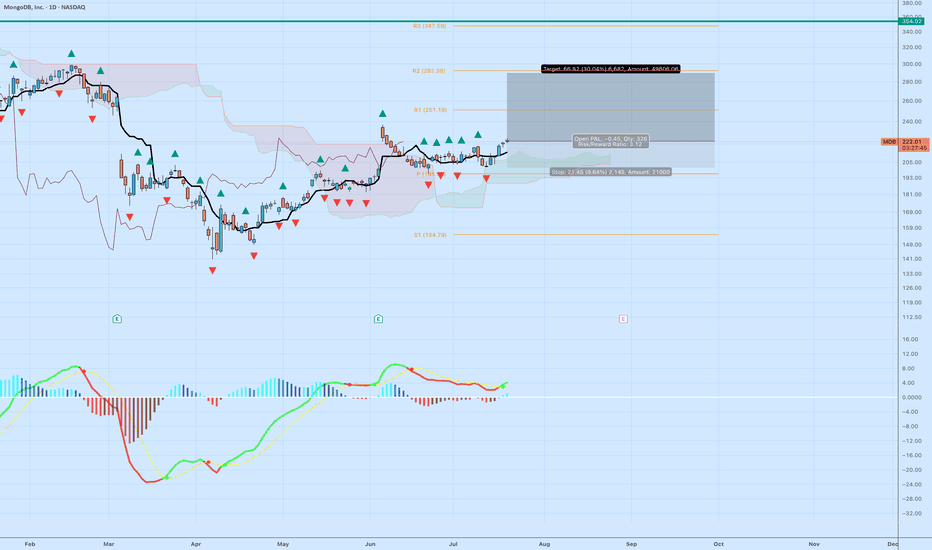

MDB – Clean Ichimoku Breakout with MACD + Fractal ConfirmationMongoDB (MDB) is setting up for a high-probability swing trade. Price has cleanly broken above the Ichimoku cloud, supported by bullish structure and a MACD crossover. This move is reinforced by upward fractal confirmations just below recent highs.

Why I like this trade:

Price broke above the cloud with Tenkan and Kijun support

Bullish MACD crossover with rising histogram

Multiple bullish fractals printed on higher lows

Target aligns with pivot resistance near $292

Stop placed just below structure to manage risk

Trade Details:

• Entry: $221.93

• Stop: $219.45

• Target: $291.93

• Risk/Reward: 3.12

• Timeframe: Daily

• Position: Long 326 shares

MongoDB remains one of the dominant players in the NoSQL and developer-first cloud database space. Strong fundamentals and high institutional adoption make this a name worth watching as it pushes into a potential breakout zone.

MDB trade ideas

MDB · 4H — Ascending Triangle Breakout Toward $224 → $231MDB · 4H — Ascending Triangle Breakout Toward $224 → $231

Setup Breakdown

Ascending triangle breakout: Price has been coiling just under $212 while making higher lows since mid-June.

This 4H candle confirms a bullish breakout with solid volume, suggesting a fresh momentum leg is underway.

The triangle projects a measured move toward $224–$225, with room to extend into Fib confluence at $231.

---

🎯 Target Zones

Target Level Reason

Target-1 $224.62 (50% Fib) Measured-move projection from triangle base to breakout + minor resistance shelf.

Target-2 $231.28 (61.8% Fib) Prior breakdown area + strong Fibonacci confluence + low-volume area on VPVR.

---

🛠️ Trade Plan

Component Level

Trigger Confirmed breakout above $212 — long bias active.

Retest Entry Watch for a bullish retest of $212–213 (former resistance turned support).

Stop-loss Close < $209 = breaks rising structure.

TP-1 $224 — take 50–70%, trail stop.

TP-2 $231 — final exit unless volume surges.

---

⚠️ Risk Notes

Earnings scheduled July 25 (AMC) — options market may begin pricing in volatility.

If no follow-through above $218, consider scaling out early.

Volume must stay strong to sustain through the VPVR gap zone.

---

✅ Idea Checklist

Bullish breakout from defined structure

Volume profile favors continuation

Clean Fib-based targets with low resistance ahead

Risk clearly defined below $209

Earnings awareness in place

---

> Disclaimer: This analysis is for educational purposes only and not financial advice. Always trade your own plan and manage risk appropriately.

Safe Entry Zone MDBPrice Reached good Support Level.

Waiting for Buyers to step-in in Case no Buying Power Showed -Up we will be targeting Green Zone As Safest Entry Zone and Strongest Support level.

Note: 1- Potentional of Strong Buying Zone:

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

Safe Entry ZoneCurrent price Movement Up.

Price at Strong Resistance 1D Red Zone.

The 1D Green Zone Act As Strong Support level in case the Red Zone not Broken and Re-test or previous support Green Zone.

Each P.High (Previous High) acts as strong resistance level watch out for any selling pressure at these levels.

We have two scenarios must happen at The Mentioned Zone:

Scenarios One: strong buying volume with reversal Candle.

Scenarios Two: Fake Break-Out of The Buying Zone.

Both indicate buyers stepping in strongly. NEVER Join in unless one showed up.

2- How to Buy Stock:

On 15M TF when Marubozu Candle show up which indicate strong buyers stepping-in.

Buy on 0.5 Fibo Level of the Marubozu Candle, because price will always and always re-test the imbalance.

MDB MongoDB Options Ahead of EarningsIf you haven`t exited MDB before the selloff:

Now analyzing the options chain and the chart patterns of MDB MongoDB prior to the earnings report this week,

I would consider purchasing the180usd strike price Puts with

an expiration date of 2025-6-6,

for a premium of approximately $4.95.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

6/4/25 - $mdb - Too ambiguous for me here6/4/25 :: VROCKSTAR :: NASDAQ:MDB

Too ambiguous for me here

- my impression this eps season is more consumer-linked co's r struggling more, or unwilling to guide

- but B2B types, esp those that serve some layer of the AI stack (including energy - so i mean *all* layers) are finding themselves willing to neck out and/or provide a more willy wonka speech

- so while valuation isn't really enticing to me, and you guys know that's what makes or breaks my investment decisions/ even on EPS - UNLESS there's some obvious catalyst... i'm a pass here at 1% fcf and >100% of it being SBC on a stock that's been beaten badly

- so gun to my head i'd probably go long (if there are no neutrals, only buy or sell, learn that!). but sometimes the most important option beyond buy, sell and "hold" (whatever that even means) is "do nothing". and here i am watching only.

V

MongoDB (MDB) Stock Analysis – Bearish Trend with Potential ReveBearish Case

Breakdown Below $223.52: Key support lost, confirming a downtrend.

RSI (32.65): Near oversold but no rebound yet.

Stochastic (5.60): Oversold but no bullish crossover.

Downside Targets:

$187.65: Next support.

$135.15: Major historical support if further decline continues.

Bullish Case

Oversold Conditions: If RSI drops below 30, a reversal bounce could occur.

Trendline Support: Long-term trendline near $180 could trigger a bounce.

Short-Covering Potential: Reclaiming $223-$235 may drive a push to $256-$267.

Selling Pressure: High volume at $223-$235, reclaiming is crucial for bulls.

Strong Support: I likely at $180-$187.

50-day MA ($267) below 200-day MA ($322) – death cross confirms downtrend.

Shorter EMAs declining, reinforcing bearish bias.

Short-term bias: Bearish unless price stabilizes above $223.

Key levels to watch:

Downside: $187 → $180 → $135.

Upside (if reversal happens): $223 → $235 → $267.

Trading Strategy:

Bulls: Look for support confirmation at $180-$187.

Bears: Watch for rejection at $223-$235 to continue short bias

3/6/25 - $mdb - Becoming interesting <$2003/6/25 :: VROCKSTAR :: NASDAQ:MDB

Becoming interesting <$200

- returning to the scene of the crime

- we're about 5-6x sales, what's a turn between friends

- big SBC is what always keeps me meh on software unless i know it well... but they put up decent results/ guide "pass" let's say - we've seen worse

- got unlucky reporting on a day like today, so factor that in

- i'd suggest if the fake and gey jobs report tmr sends us in a tailspin (who know tbh what's good, what's bad etc.)... and you see this bite the dust into tmr and in a follow up next week we've probably reached a floor

- i'm not in a hurry to buy it , but let's respect that gap from late '22

169.69 in honor of the edgelord elon and i jump in

stay safe out there my friends. environment sucks, we r all Neo in final boss mode. stay alive, no hero moves. know what you own. size manage. this too shall pass.

V

$MDB: MongoDB Inc. – Data Dynamo or Overreaction Bust?(1/9)

Good evening, tech fiends! 🌙 NASDAQ:MDB : MongoDB Inc. – Data Dynamo or Overreaction Bust?

MongoDB’s Q4 crushed it with $548.4M revenue, but a soft FY2026 outlook tanked the stock. Is this a market meltdown or a golden buy? Let’s unpack the chaos! 🔍

(2/9) – PRICE PERFORMANCE 📊

• Q4 FY2025: Revenue hit $548.4M, up 20% YoY 💰

• Earnings: EPS $1.28 smashed $0.66 estimate 📏

• Context: Stock dropped 16-20% post-guidance 🌟

It’s a rollercoaster—strong now, shaky later! ⚡

(3/9) – MARKET POSITION 📈

• Market Cap: No exact price today, but historically robust 🏆

• Core: MongoDB Atlas, 71% of revenue, up 24% YoY ⏰

• Trend: AI data demand’s sizzling, per market buzz 🎯

A leader in the database jungle! 🌐

(4/9) – KEY DEVELOPMENTS 🔑

• Earnings Beat: Q4 topped forecasts, Mar 5 release 🔄

• Guidance Flop: FY2026 revenue at $2.24-$2.28B, below $2.32B 🌍

• Bonus: Snagged Voyage AI for $220M, boosting AI play 📋

Thriving, yet spooked the herd! 🌈

(5/9) – RISKS IN FOCUS ⚡

• Guidance Woes: Non-Atlas demand fading 🔍

• Market Jitters: 16-20% after-hours plunge 📉

• Rivals: Cloud giants eyeing database turf ❄️

Rough seas, but storms pass! 🌧️

(6/9) – SWOT: STRENGTHS 💪

• Q4 Power: $548.4M revenue, $1.28 EPS 🥇

• Atlas Surge: 24% growth, debt-free balance 📊

• AI Edge: Voyage AI buy fuels future 🔥

A beast with brains and brawn! 🏋️♂️

(7/9) – SWOT: WEAKNESSES & OPPORTUNITIES ⚖️

• Weaknesses: FY2026 growth dips to 12.6% 📉

• Opportunities: AI boom, Voyage AI integration 📈

Can it turn panic into profit? 🧐

(8/9) – 📢MongoDB’s Q4 rocked, but guidance flopped—your vibe? 🗳️

• Bullish: Rebound to glory soon 🦅

• Neutral: Holding steady, wait it out ⚖️

• Bearish: More pain ahead, sell off 🐾

Drop your take below! 👇

(9/9) – FINAL TAKEAWAY 🎯

MongoDB’s Q4 flexes muscle at $548.4M 📈, but FY2026 gloom spooked the market 🌫️. Dips are our playground—DCA treasure awaits 💎. Snag ‘em cheap, rise like legends! Hit or miss?

$MDB to $350+ with vector database + gen AI as tailwind!- NASDAQ:MDB is investing in R&D and recently noticed that they have developed their solution for vector database www.mongodb.com

- This will be a strong tailwind for the company. In generative AI, one needs to store large embedding in a low latency databases which could efficiently be looked up. By default, no-sql databases are good for these use cases.

- Pinecone is one of the best in this space, NYSE:ESTC had one but now NASDAQ:MDB is catching up and looks really promising.

- P/EV multiple is very reasonable for $MDB.

- PT : 350+

Time to Enter MDB Again?On Thursday afternoon, the King Trading Momentum Strategy signaled alongside eleven other alerts that day, followed by five more on Friday. This activity doesn’t exactly scream “bearish” to me, but the market has a way of keeping you on your toes! With markets once again approaching all-time highs, I’ve been treading cautiously. My positions have been limited to just a few, with low allocation sizes in TNA, ADBE, PYPL, and XYZ.

When I looked at MongoDB (MDB), I found myself wondering why it was hammered after posting a double beat on earnings and providing decent guidance. It turns out the recent drop was primarily driven by the announcement that Michael Gordon, MongoDB's Chief Operating Officer and Chief Financial Officer, will be stepping down on January 31, 2025. Is this reaction overblown? After all, the company delivered a strong earnings report.

That said, MDB seems to have planted its bull flag in the ground. Even if this news creates headwinds, there’s a possibility it could retrace back to the 38% Fibonacci level. Even if the broader market eventually pulls MDB lower, this setup suggests an 8% potential upside, and I’ve set an initial take profit at 5% with a 3% stop loss. If this can hit the take profit, I will sell half to protect the trade and then set a trailing stop loss of 1.5% on the remainder, trying to sell of much of it as possible on the way up!

Unless Monday brings a complete washout due to fears surrounding the Fed meeting on Wednesday or the PCE data on Friday, I’ll likely use the typical morning volatility as an opportunity to enter this trade. Let’s see how this one plays out!

The King Trading Momentum Strategy combines the 5 EMA crossing above the 13 EMA, RSI strength, favorable momentum as measured by ADX plus evaluating recent volume changes and even something that measures breakout momentum called Beta for this one! MDB and over 100 equities are built into this script with optimal backtest take profits and stop losses and can be toggled on by simply checking a box (default they are turned off).

Scaling Up?MongoDB is showing strong bullish momentum, with a gap forming around the $163.00 level. A breakout above the $297.68 daily resistance would confirm continued strength, positioning the stock to target the $439.39 resistance. This trade setup offers an excellent risk-to-reward ratio, with a stop-loss set at $207.65 to manage downside risk.

As a leader in modern database solutions, MongoDB is well-positioned to capitalize on the growing demand for flexible, scalable, and cloud-native data management. The company’s strong developer adoption, innovative product offerings, and focus on operational efficiency make it a key player in the digital transformation era.

For a detailed breakdown of this trade, check out my YouTube video, where I dive deeper into the technical analysis and fundamentals driving this setup.

With its combination of technical momentum and robust market fundamentals, MDB offers a compelling opportunity for traders and investors aiming for $439.39.

NASDAQ:MDB

$MDB on Long Longer Timeframe looks pretty deliciousNever financial advice. Just offering perspective.

Its overall a clean setup for higher timeframes, a run back to all time highs. Lower timeframes point to a similar picture. On the Monthly, there is no bearish imbalances above until 385.86-399.88 . On the Weekly we clear 246.51-319.48 , bearish imbalance hanging above. Its possible to see a revisit to 162.53-189.88, I would say this is about 35% probable. This is more likely, if we lose 234.09.

Lastly, on the Daily. 221.50-223.22 is a bullish imbalance, that we could revisit. I personally see the lower moves as low probability but not off the table. It would be encouraging for bulls to get a close above 242.67, today.

Be aware that this analysis is on a higher timeframe of a Yearly perspective and may take time to develop.

I'll keep this post updated. :)

MDB: Daily Base Breakout with Clear Risk/Reward SetupANALYSIS:

MDB has formed a potential base after the December earnings gap down. Key technical factors align for a swing trade opportunity:

SETUP:

Base formation between 236-246 with increased volume

Clear breakout level with volume confirmation

Well-defined risk parameters with support at 238

ENTRY: 246

STOP: 238 (8 points risk)

TARGETS:

1️⃣ 254 (1R - Initial scale)

2️⃣ 265-267 (Primary target - major resistance zone)

3️⃣ 298+ (Extended target - aggressive)

TRADE MANAGEMENT:

Scale 1/3 at 1R (+8), move stop to entry

Scale 1/3 at primary target

Trail remaining position using 4H uptrend line

RISKS:

Weekly downtrend still intact

Unfilled earnings gap above

Resistance at December consolidation zone (270-280)

Always use proper position sizing and adapt the plan to your own risk management rules.

MDB - Scary Pullback Or Give UpNow THIS is a heck of a scary pullback!

But the sime time, for me it's a gift from the trading God to Enter/Re-Enter with a start position, if not already in.

Price got rejected at the 1/4 line, which I find it does often. But this doesn't mean that the party is over.

The Pitchfork/Medianlines give us the projection in time. And the white Pitchfork is pointing upwards, while the orange Pullback-Fork has a level of Support at the Center-Line.

All in all, it's a nice Long for me.

12/9/24 - $mdb - Tough to own >$300. Gl but sidelines.12/9/24 :: VROCKSTAR :: NASDAQ:MDB

Tough to own >$300. Gl but sidelines.

- Over 10x sales for ~20% top line growth? profitability climbing, but not in the way a 25-30% grower would do. TL;DR here is you need a growth SPIKE to really re-rate this thing.

- options chain pricing in quite a dramatic move. while i've gotten semi-smacked lately shorting, (though today came thru big time that allowed me to resize my PLTR and SG nicely), i'm totally fine to watch this out.

- my semi database related name is NASDAQ:BASE rn, which just reported a decent q but where stock got smacked close to what i think is close to take out value. that's hard enough to own (even tho it's smaller). so gawd bless if you're in this thing, but i'll just have to root from the sidelines.

- playing some octane on the NYSE:UBER , NASDAQ:OKTA and NASDAQ:BASE fronts... just added some NASDAQ:GAMB today. all of which i think offer MUCH better risk/reward and/or cash gen than high flying stuff like $MDB.

So gl. But i can't ride with you here b/c i'm not even sure i'd buy it lower. You can be sure i'll consider shorting an outsized 20-25% pump tho if/does happen. let's see.

V