Meta Platforms (META) Shares DeclineMeta Platforms (META) Shares Decline

Shares of the US tech giant Meta Platforms (META) hit a record high last week, climbing above $780 following the release of a strong earnings report:

→ Earnings per share (EPS) came in at $7.14, significantly exceeding the forecast of $5.88.

→ The company also outperformed expectations on key metrics related to advertising growth.

→ Additionally, the media has highlighted the growing importance of AI technology to Meta’s business.

However, shortly after reaching an all-time high, META shares began to show bearish momentum.

Technical Analysis of the META Chart

On the four-hour chart, the following signals are visible:

→ A bearish engulfing pattern formed on Thursday;

→ A bearish gap appeared at Friday’s market open, followed by a continuation of the downward move.

This represents a notable pullback from the historical peak — potentially indicating that the initial bullish reaction to the earnings report has faded. The share price decline suggests a correction from overbought territory, as confirmed by the RSI indicator.

The $740 level appears to be a key support zone — previously acting as major resistance before the breakout. Bulls could also find support from the median line and the lower boundary of the ascending channel that has been developing since mid-May.

Given this context, a scenario in which bulls attempt to resume the uptrend within the ascending channel cannot be ruled out, especially considering the company’s strong fundamentals and the presence of multiple technical support levels.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

META trade ideas

7/30/25 - $meta - And u think they'll miss?7/30/25 :: VROCKSTAR :: NASDAQ:META

And u think they'll miss?

- we continue to collect data pts that the consumer is spending like a drunken sailor and somehow the market still wants to bid the trash meme stocks that will burn cash until kingdom come

- amazon prime day

- dubious/ but still... government data

- yesterday... visa... booking

- we've seen the "oh look at NYSE:DECK , we thought people stopped buying shoes" reaction

- the reality is... the wealth effect has had a bit of a boomerang in my estimation from mar/apl stonk lows to new highs and "all normal" (big quotes)

- so as the king funnel to driving all this conversion, great tools... i don't think zuck's capex and hiring spending is really going to drive the big picture here on results. a strong ads result pays for all this spending... in what, a quarter?

- so no i don't have a crystal ball. but i'm surprised a lot of HQ names that are consumer-adjacent (esp such a dominant portal to the universe-META) aren't ripping into results and it's a harder call.

- this one is a buy into results

- it's a dip buy on a miss

- and it's a buy, probably, even if the stock rips

$1000 by year end is my best guess

V

META Earnings Trade Setup — July 30 (AMC)

## 🧠 META Earnings Trade Setup — July 30 (AMC)

📈 **META (Meta Platforms Inc.)**

💥 **Confidence**: 85% Bullish

💡 **Play Type**: Pre-earnings call option

📊 **Fundamentals + Flow + Setup = High Conviction Swing**

---

### 📊 FUNDAMENTALS SNAPSHOT

✅ **Revenue Growth**: +16.1% YoY

✅ **Profit Margin**: 39.1%

✅ **Gross Margin**: 81.8%

📈 **8/8 EPS Beats** — Avg Surprise: +13%

🧠 **Digital Ad Rebound + AI Integration = Growth Engine**

🟢 **Score: 9/10**

📌 Bottom line: Elite execution + consistent guidance beats

---

### 🔥 OPTIONS FLOW CHECK

💰 **Call Walls**: \$720 / \$730

📈 **Call/Put Skew**: Bullish tilt

🔎 **IV Rank**: 0.65 — High enough for a move, not extreme

📈 **Market Expectation**: \~6% move

🟢 **Score: 8/10**

📌 Institutional flow leans long — smart money eyes upside

---

### 📉 TECHNICAL SETUP

📍 **Price**: \~\$700

📉 RSI: 34.34 → OVERSOLD

📉 20D MA: \$713.27 (near-term bounce target)

📌 Support: \$692.50 | Resistance: \$720

🟡 **Score: 7/10**

📌 Post-consolidation rebound setup into earnings

---

### 🌎 MACRO CONTEXT

💡 Growth + AI names in focus

📢 Communication Sector → Risk-On Rotation

📌 META riding digital ad/AI secular trends

🟢 **Score: 8/10**

📌 Macro tailwinds match company strengths

---

## 🎯 TRADE IDEA

**META 08/01 \$730 CALL**

💵 Entry: \$10.00

🎯 Target: \$30.00 (300% ROI)

🛑 Stop: \$5.00 (50% loss cap)

⏰ Entry: Pre-close on July 30 (AMC earnings)

📏 Size: 1 Contract (Risk \$1,000 max)

### ⚖️ Risk/Reward

* Max Risk: \$1,000

* Target Profit: \$3,000

* IV Crush Protection: **Exit within 2 hours post-earnings**

---

## 📌 WHY IT WORKS

✅ Meta beats 8 straight quarters

✅ Fundamentals elite

✅ Bullish options stack

✅ Oversold tech setup

⚠️ Risk? Always — but *structured speculation wins* 📐

---

📣 Tag someone who trades earnings like a sniper 🎯

\#META #EarningsPlay #OptionsTrading #IVCrush #CallOptions #TechStocks #AIStocks #TradingView #DigitalAds #SwingTrade #StructuredRisk

Meta surprises to the upside & strengthens its leadership in AIBy Ion Jauregui – Analyst at ActivTrades

Meta Platforms (TICKER AT: META.US) has posted strong quarterly results that significantly exceeded market expectations, driven by its solid positioning in artificial intelligence, advertising monetization, and the resilience of its digital ecosystem.

Key Financial Highlights

In the second quarter of 2025, Meta reported revenues of $38.72 billion, representing a 15% year-over-year increase, beating consensus estimates by over $1 billion. Net profit reached $13.46 billion, with an adjusted EPS of $5.22, reflecting strong operating leverage.

The advertising segment remains the main growth driver, but revenue gains from generative AI services and enterprise solutions powered by Meta AI and Llama 3, its proprietary language model, were also noteworthy. Meanwhile, Reality Labs, although still operating at a loss, managed to contain its deficits and improve efficiency, while preparing for upcoming product launches linked to the metaverse.

The company maintains a robust cash position with over $58 billion in liquidity, and announced a new $25 billion share buyback program, reinforcing its commitment to shareholder value creation.

Fundamental Analysis

Meta is solidifying its strategic transition into a tech conglomerate focused on AI, personalized advertising, and immersive environments. Despite ongoing regulatory challenges in the U.S. and Europe—having yielded this time to Brussels—the company has maintained strong growth in daily active users (DAUs) and monthly active users (MAUs) across its core platforms: Facebook, Instagram, and WhatsApp.

Consistent investment in AI infrastructure and data centers, coupled with an improved operating margin now at 39%, positions Meta among the most efficient players in the tech sector.

Technical Analysis

From a technical standpoint, Meta is currently trading around $717, following a near 50% rally since April. The daily chart shows a clear uptrend with higher lows in place since November 2022.

The RSI stands at approximately 56.34%, indicating strength without entering overbought territory.

The 50-, 100-, and 200-day moving averages remain aligned in a bullish formation.

The next resistance level is at the all-time high of $747.90; a breakout could pave the way toward $800 in the short term.

The key support level lies at $689, where the 100-day moving average and recent price action converge.

The Point of Control (POC) sits around $590, marking the base of the previous upward move and the recent golden cross that triggered the current rally.

Conclusion

Meta continues to affirm its leadership in the tech sector—not just as a social media powerhouse, but as a key player in the development and implementation of AI-based solutions. Revenue diversification, cost control, and a solid financial structure reinforce its position in an increasingly competitive market. While macroeconomic volatility and regulatory pressures remain, the combination of technical momentum and strong fundamentals suggests the bullish trend could continue.

*******************************************************************************************

La información facilitada no constituye un análisis de inversiones. El material no se ha elaborado de conformidad con los requisitos legales destinados a promover la independencia de los informes de inversiones y, como tal, debe considerarse una comunicación comercial.

Toda la información ha sido preparada por ActivTrades ("AT"). La información no contiene un registro de los precios de AT, o una oferta o solicitud de una transacción en cualquier instrumento financiero. Ninguna representación o garantía se da en cuanto a la exactitud o integridad de esta información.

Cualquier material proporcionado no tiene en cuenta el objetivo específico de inversión y la situación financiera de cualquier persona que pueda recibirlo. La rentabilidad pasada y las estimaciones no sinónimo ni un indicador fiable de la rentabilidad futura. AT presta un servicio exclusivamente de ejecución. En consecuencia, toda persona que actúe sobre la base de la información facilitada lo hace por su cuenta y riesgo. Los tipos de interés pueden cambiar. El riesgo político es impredecible. Las acciones de los bancos centrales pueden variar. Las herramientas de las plataformas no garantizan el éxito.

Meta - The breakout in question?🪓Meta ( NASDAQ:META ) is retesting major structure:

🔎Analysis summary:

After Meta perfectly retested a major previous support trendline in 2022, the trend shifted bullish. We have been witnessing an incredible rally of about +700% with a current retest of the previous all time highs. Time will tell but a bullish breakout remains quite likely.

📝Levels to watch:

$750

🙏🏻#LONGTERMVISION

Philip - Swing Trader

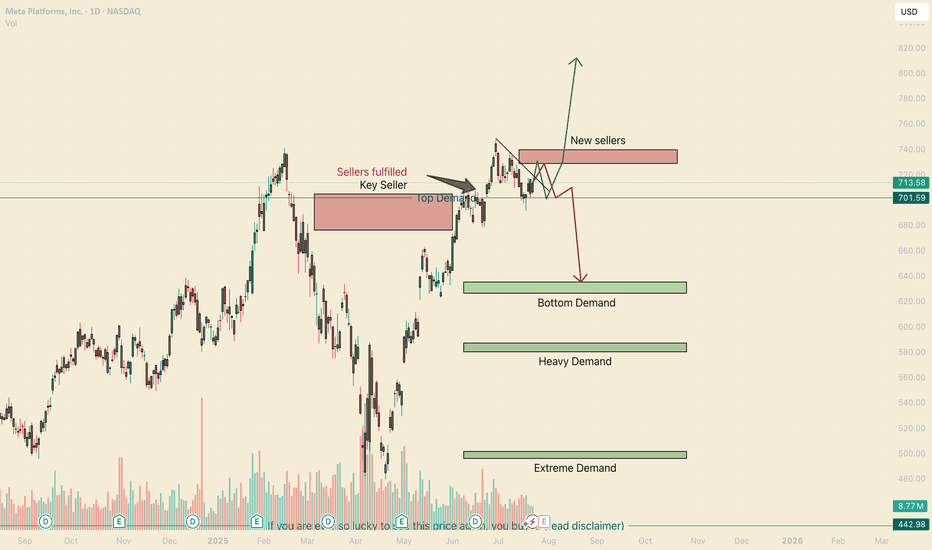

META Double Top? Think Again. Hello, my name is The Cafe Trader.

As part of our MAG 7 Series, we tackle META next on the list.

This article is for:

– Long-Term Investors

– Long-Term Hedges

– Swing Traders

– Options Traders

⸻

Brief Notes:

1. Meta is going all-in on AI, integrating it across all platforms (Instagram, Facebook, WhatsApp…).

2. 97% of Meta’s revenue still comes from ads. They’ve rebounded strongly from Apple’s policy changes—thanks in large part to AI targeting.

3. Meta is thinking long-term with AR/VR.

4. International user growth has exploded.

Conclusion: Bullish winds continue to blow behind META.

⸻

Long-Term Levels

• Aggressive Buy = $701.59 → Marked as “Top of Demand.” This is where aggressive buyers are looking to add.

• Good Value = $626–$635 → Marked “Bottom of Demand.”

• STEAL = $496–$501 → Marked “Extreme Demand.”

Why not buy at the ‘Heavy Demand Zone’?

Great question. If bears take out those buyers above this zone, it suggests something major has shifted in sentiment around META.

Even though there’s heavy demand here, I’d want to observe how sellers approach the area. You’ll likely get multiple chances to enter if buyers defend it. But if it breaks down, the best pricing lies at “Extreme Demand.”

For long-term holders looking to hedge downside, I suggest a Bear Put Spread or outright puts. More on this under the Red Scenario Options.

⸻

For Traders

Let me be real—this chart is tricky.

The V-shaped recovery signals strong bullish interest. That insane rally took out a major seller, further fueling the bulls.

That said, how we pulled away from the previous ATH (all-time high) shows weakness—low buying interest, followed by a real seller stepping in.

So yeah, I’m mixed on sentiment. But I’m confident in identifying liquidity and managing exits fast.

⸻

Two Scenarios

✅ Green Scenario

– Stock:

The bounce off “Top of Demand” is a strong bullish signal. Bears will be under pressure around $729, though I expect one more rejection before we break through.

I liked the original entry at “Top of Demand.” If entering again, I’d wait for a crack below that zone and watch the close—if we recover and close above it (especially if the dip was deep), that’s a strong signal to re-enter.

Target: take partial or full profits around $729. Hold the rest for highs or a breakout.

– Options:

If you can grab the 715 Calls with 3–5 days out for under $4.50, this setup could easily hit 2–3R.

Even better if you can get closer-to-the-money contracts for cheaper.

⸻

❌ Red Scenario

– Stock:

I believe this “new seller” is a fabricated seller—likely to get squeezed.

But if no new buying interest shows up to challenge that seller, we could see pressure on “Top of Demand” and a legit correction, maybe even a broader consolidation range.

Next few days will reveal the strength of buyers.

If no aggressive buying steps in, I like the short setup, targeting “Bottom of Demand” for TP.

– Options:

Long-Term Holders:

Use 2–3% of your META share value on a Bear Put Spread or put options.

If using puts, get 2–3 weeks of time. Go as close to the money as your risk allows.

Active Traders:

This could move fast if it plays out. If you can grab a 710 Put with 3–5 days for under $1.00, hold until a big red candle (3–5%) forms.

If it keeps dragging down, roll into a new contract the following week.

⸻

Follow for more analysis and updates — and as always,

Happy Trading.

📲 @thecafetrader

META watch $779 then 798: Dual Golden fib barrier to 800 round META earnings blew away the analyst expectations.

Surged into dual Golden fibs at $779.61 then 797.90

This "high gravity" zone will likely hold price for a bit.

.

See "Recent Publications" for previous charts ------------>>>>>>>>>

Such as this one that caught an HUGE BREAKOUT

Hit BOOST and FOLLOW for more such PRECISE and TIMELY charts.

=========================================================

.

META: Eyeing a Breakout. Aug.5META: Eyeing a Breakout — GEX Supports Upside Momentum 🚀

Technical Overview

META has been showing consistent bullish recovery off the $691–$707 demand zone, climbing back into its rising channel. Price is now approaching a critical resistance cluster between $784–$790, where prior rejection and current GEX resistance converge.

GEX Insights

Options GEX shows the highest positive NETGEX at $790 — also aligning with the 2nd CALL Wall (91.31%). This means option dealers are heavily short calls at this level, creating a potential gamma squeeze scenario if price breaks and holds above it. Additional CALL interest extends toward $800–$820, suggesting upside expansion if momentum follows through. On the downside, GEX Put Support sits near $698–$707, reinforcing the major swing low zone as strong support.

1H Price Action Structure

* Strong bounce from channel midline support.

* Higher lows and higher highs forming, signaling bullish continuation.

* Resistance test ahead at $784–$790; breakout here may trigger stop runs and call delta hedging.

15M Short-Term View

* META is coiling under resistance with minor intraday pullbacks.

* Watching for breakout above $784 for aggressive scalps toward $790+.

* Failure here could trigger a retest of $770–$775 short-term support.

Options Trade Suggestion Based on GEX

* Bullish Play: Consider call spreads targeting $790–$800 if price clears and holds above $784 with volume.

* Risk Zone: If price fails to hold $770, momentum weakens and $750 becomes the next key support.

* Bearish Hedge: Put spreads only if rejection at $784–$790 is confirmed with breakdown through $770.

My Thoughts

GEX positioning clearly favors upside into $790 as long as $770 support holds. If META triggers the gamma breakout, the move could accelerate toward $800 quickly. Keep in mind that $790 is both a magnet and a ceiling — watch the breakout volume closely.

Directional Bias: Bullish leaning — favor long setups above $784.

Disclaimer: This analysis is for educational purposes only. Always do your own research and manage risk before trading.

META: Testing Alternative Interconnection TypeResearch Notes

Given expression like this:

Fractal Corridors can be used for horizontal perspective of the same pattern manifestation. Alternative frames of reference exposes how historic swings of various magnitude in some way wire the following price dynamics. www.tradingview.com helps to seek a matching commonality in angles of trends which gives a hint how structure evolves in multi-scale perspective.

I use both when it comes to working with complex waves and making interconnections through fibonacci ratios.

To define emerging wave's limits (probable amplitude), I'll test classic rule of Support/Resistance shift in fibs. (When resistance becomes support or vice versa)

By theory it means a trendline can also shift like that.

In our case this can be applied as:

Fibocnacci Structure:

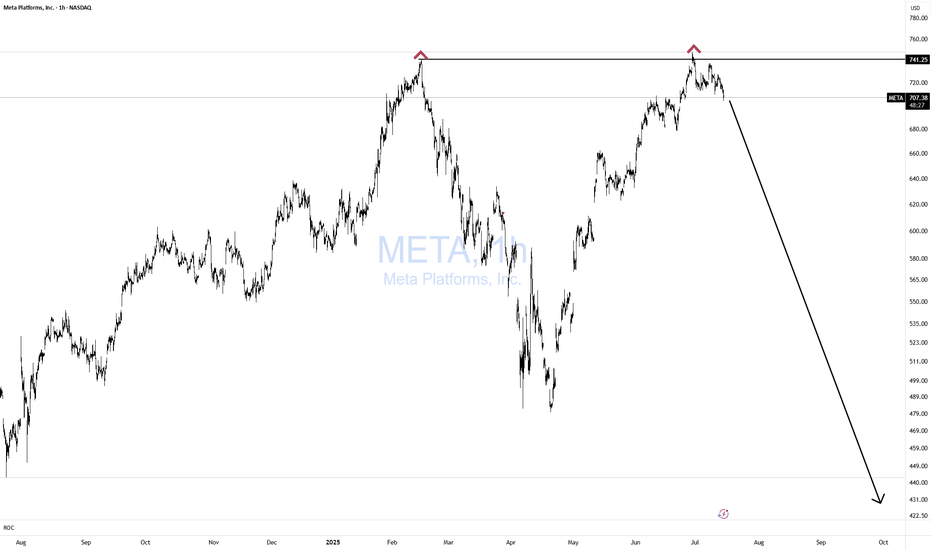

Incoming 40% correction for FacebookOn the above 10 day chart price action has rallied 500% since October 2022. It is somewhat unfortunate to see so many long ideas at the moment.

Motley Fool August 8th:

“Here's how Meta could achieve a $2 trillion valuation within three years, and if it does, investors who buy the stock today could earn a 67% return.”

Very misleading.

Why bearish?

Failed support. It is very clear to see, price action has broken through support and confirmed it as resistance. You can see this more clearly on the Log chart below.

Regular bearish divergence. Multiple oscillators now print negative divergence with price action across a 50 day period.

On the monthly chart below a hanging man candle print can be seen. Although the candle does not confirm until the end of the month there is a clear indication of buyer exhaustion. This is an important trend reversal indication.

Is it possible price action continues to rise? Sure.

Is it probable? No.

Ww

Log chart

Monthly hanging man candlestick

META CANT KEEP THE HULK DOWN!!!!META has been consolidating for a few weeks now, but it's still in this bull flag that looks like it might break out soon, hopefully before earnings on Wednesday, July 30. I love technical analysis on charts, and this inverse head and shoulders pattern has been effective on most semiconductor names lately. We will know for sure next week.

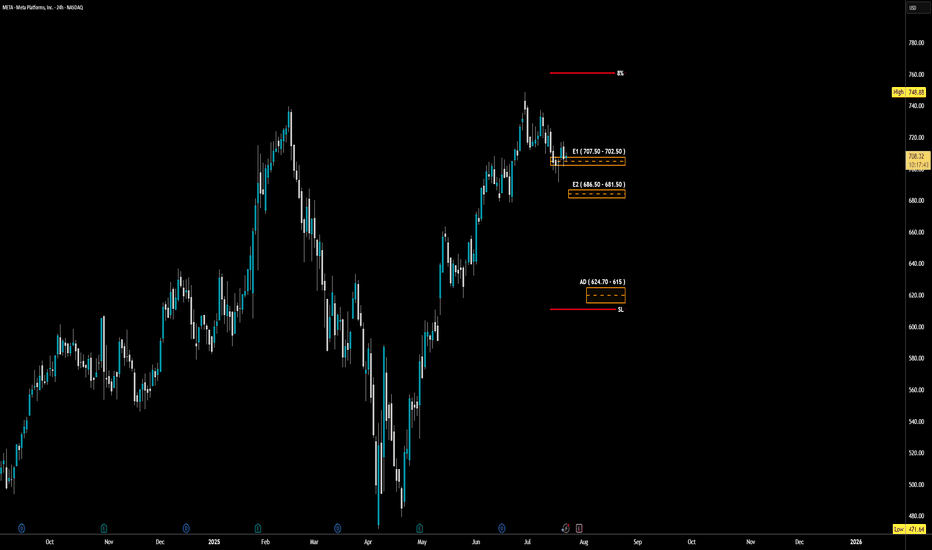

META - LONG Swing Entry PlanNASDAQ:META - LONG Swing Entry Plan

Entry Zone 1: $707.50 – $702.50

→ Open initial position targeting +8% from entry level.

Entry Zone 2: $686.50 – $681.50

→ If price dips further, average down with a second equal-sized entry.

→ New target becomes +8% from the average of Entry 1 and Entry 2.

Edit Zone (Aggressive Demand): $624.70 – $615.00

→ If reached, enter with double the initial size to lower the overall cost basis.

→ Profit target remains +8% from the new average across all three entries.

Risk Management:

Stop Loss:

Risk is capped at 12% below the average entry price (calculated across all executed positions including the Edit Zone).

Position Sizing Approach:

Entry 1: 1x

Entry 2: 1x

Edit Zone: 2x

→ Total exposure: 4x

→ Weighted average determines final TP and SL calculations.

______________________________________

Legal Disclaimer

The information provided in this content is intended for educational and informational purposes only and does not constitute financial, investment, or legal advice or recommendations of any kind. The provider of this content assumes no legal or financial responsibility for any investment decisions made based on this information. Users are strongly advised to conduct their own due diligence and consult with licensed financial advisors before making any financial or investment decisions.

Sharia Compliance Disclaimer: The provider makes no guarantees that the stocks or financial instruments mentioned herein comply with Islamic (Sharia) principles. It is the user’s responsibility to verify Sharia compliance, and consultation with a qualified Sharia advisor is strongly recommended before making any investment decisions

META EARNINGSMETA is consolidating below resistance at 720, with visible absorption just under 710. Institutional activity shows active PUT selling at 700 and directional BUY CALLs around 715–720. This suggests accumulation and potential upside pressure.

If price closes above 715 this week, a breakout toward 725–730 becomes likely, especially ahead of earnings. Support remains firm at 700, with a deeper level at 620 if rejection occurs.

Upside target: 745

Downside target: 700, then 620 if broken

#META #globaltrade #investment #investing #stockmarket #wealth #realestate #markets #economy #finance #money #forex #trading #price #business #currency #blockchain #crypto #cryptocurrency #airdrop #btc #ethereum #ico #altcoin #cryptonews #Bitcoin #ipo

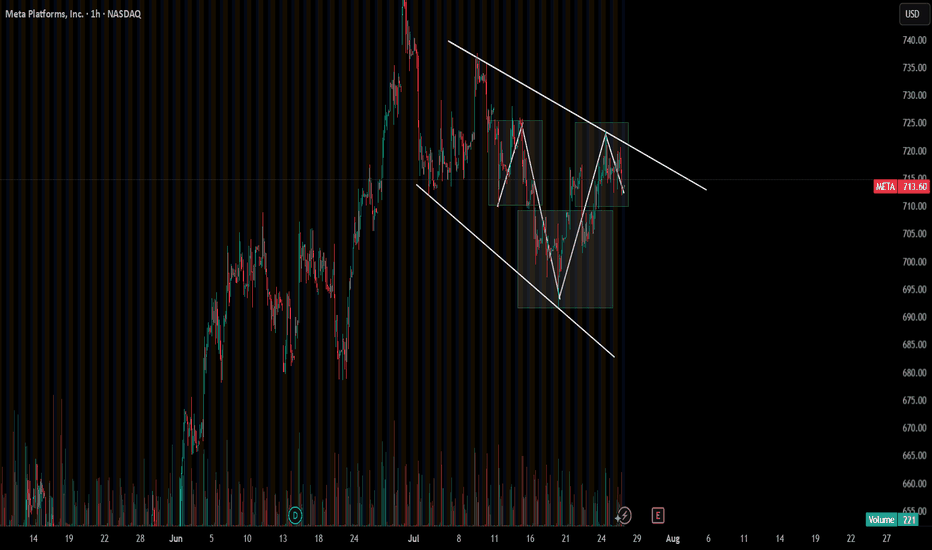

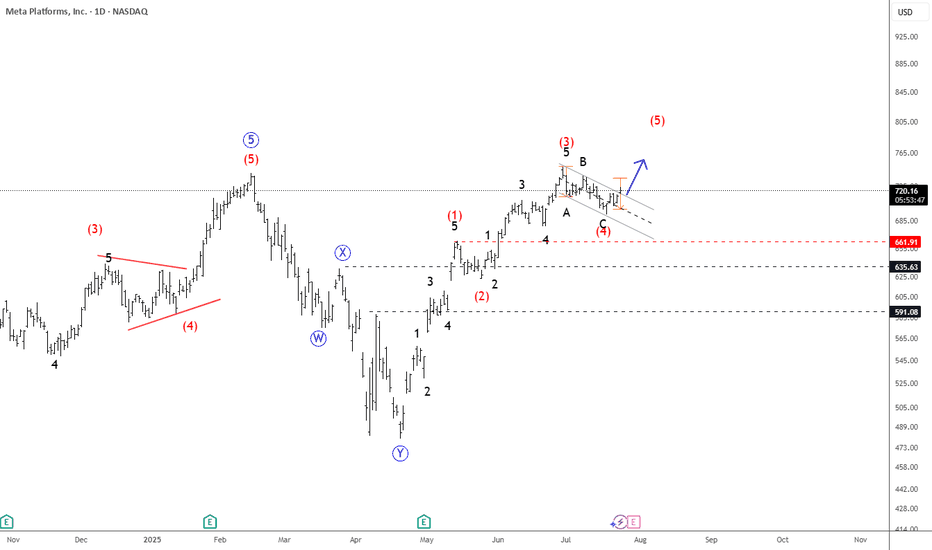

META Slows Down For A Correction Within UptrendMeta has seen a strong recovery recently, but barely retested February highs around 740, from where we can see some nice pullback, but it appears corrective, since it’s unfolding in three waves, and forming a potential bull flag — likely wave 4. A breakout above the downward channel on a daily close could signal the start of wave 5 and a push to new highs.

However, keep a close eye on the 666.1; a break below this level would invalidate the bullish view and suggest a deeper consolidation phase may follow.

Highlights:

Direction: Up (pending breakout)

Structure: Wave 4 bull flag; wave 5 possible soon

Support: 680 / 690

Microsoft, Meta, Nvidia — Lifting Off in the AI MarketThe “Big Three” are breaking new records: #Facebook (Meta) surged to $784.39 as AI-powered targeting tools pushed ad revenues higher, #Microsoft hit $551.10 by combining rapid Azure growth with new monetization from Copilot across its ecosystem, and # Nvidia climbed to a record $183.21, driven by unwavering demand for AI computing.

Key growth drivers:

#Facebook (Meta): Markets welcomed strong ad revenue projections, outweighing concerns about capex. AI tools for ad targeting significantly improved performance.

#Microsoft: Azure’s YoY growth reached ~39%, Copilot crossed 100M monthly users, and the company committed up to $30B in upcoming AI infrastructure.

#Nvidia: Persistent demand for AI GPUs and networking gear from hyperscalers, plus a $4T valuation milestone, keeps momentum strong.

What’s fueling continued upside:

#Facebook (Meta): AI tools like Advantage+ improve audience targeting and ad creatives, while Reels and recommendation feeds increase impressions and eCPM. Large-scale investment in data centers and in-house AI models open new monetization paths. Stable rate expectations also favor growth stocks like META.

#Microsoft: Growth is driven by Azure’s ongoing expansion (~39% YoY), the second wave of cloud migration, and strong monetization via Microsoft 365 and GitHub Copilot. A $30B capex plan will expand data center capacity. A broad portfolio — Windows, Office, Gaming — supports steady margins.

#Nvidia: The AI compute supercycle is in full swing. Demand for H-series GPUs and InfiniBand networks exceeds supply. The clear upgrade roadmap (H200/Blackwell) extends through 2026, while CUDA ecosystem expansion strengthens customer lock-in. Strong cash flow and record valuation support M&A, buybacks, and accelerated development.

According to FreshForex , current price levels make #Meta and #Microsoft attractive for long positions. #Nvidia offers room for both upside and pullbacks, depending on news flow.

META : Old Peak can be TestedMeta platform has lost altitude from the channel it has formed since 2023, but has gained momentum and re-entered the channel. The possibility of testing the old peak contains a good RR rate.Of course, with a stop-loss close to the 200-period moving average.( Risk/Reward Ratio : 2.48)

Stop-Loss: 605.47

Target : 740.10