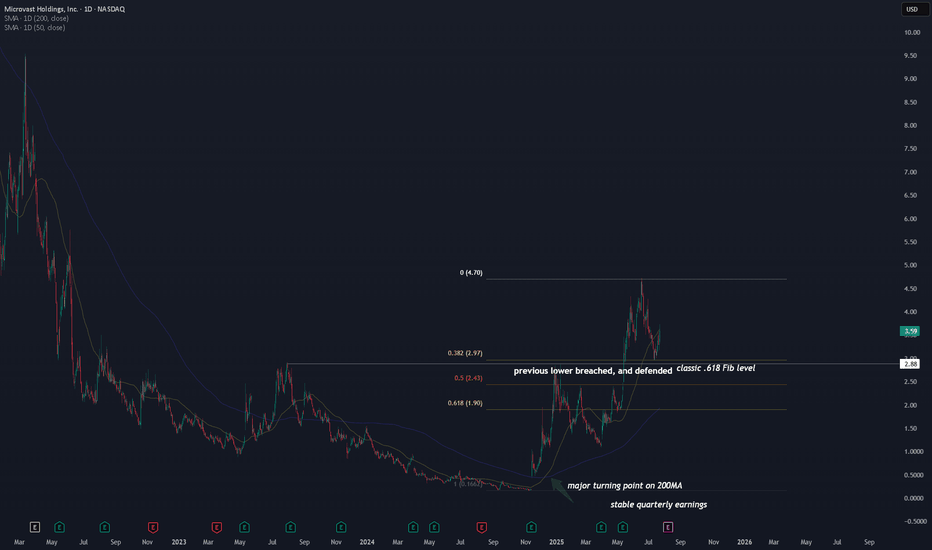

MVST, beginning of the new lithum hype? With ongoing US-China trade war, one of the key issues resides on lithium battery technology . Lithium technology is brought up as a national security concern . This is a tailwind for the industry .

Now let's get to the technicals.

A major turning point on the 200MA . We haven't seen this

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.42 USD

−195.46 M USD

379.80 M USD

193.62 M

About Microvast Holdings, Inc.

Sector

Industry

CEO

Yang Wu

Website

Headquarters

Stafford

Founded

2006

FIGI

BBG00NKS36M4

Microvast Holdings, Inc. is an advanced battery technology company. It engages in the business of designing, developing, and manufacturing battery components and systems primarily for electric commercial vehicles and utility-scale energy storage systems. The company was founded by Yang Wu on October 12, 2006 and is headquartered in Stafford, TX.

Related stocks

MVST: How Far Can It Soar? What Are the Chart Signals Telling UsFrom the weekly (1W) price chart of Microvast Holdings, Inc. (MVST) stock, we can observe significant developments indicating potential upward price movement in the future.

Breaking Through Strong Resistance (Yellow Zone):

Previously, MVST's stock price was under pressure and repeatedly failed to

MVST - Bearish Head & Shoulders Breakdown Targeting $2.25–$2.75A classic Head and Shoulders pattern has formed on MVST's daily chart, with a clear neckline break to the downside. This technical setup suggests bearish momentum in the short term, with a likely price target between $2.25 and $2.75.

This zone also aligns with a prior consolidation area and dynamic

Microvast setting new 3-year highsMicrovast beat earnings in May of this year and reported positive earnings for the first time, shocking investors and sending the stock soaring above its previous resistance highlighted by the yellow trendline. As you can see it has been forming bullish consolidation above the trendline which now is

Market Update - 6/8/2025• Friday was a solid day, lots of strength especially in the energy, quantum computing and recently construction/industrial names

• A bit concerning is that breadth is very high already which tends to be followed by corrections, but we've been in a correction in small caps for almost a month now

• G

MVST poised for another massive runupMVST Valuation Doesn’t Make Sense

emoji:DDNerd:

🄳🄳

emoji:DDNerd:

Let’s put things into perspective. Consider KULR, a stock I’ve been bullish on for years (I'm also the KULR subreddit admin). KULR, with $40 million in annual revenue, has a market cap of $300 million. Meanwhile, MVST, with $400 mill

MVST Bullish Trade Setup: Key Levels to Watch!📈

**Entry**: **$1.52** – Price has broken out above consolidation, signaling bullish momentum. 🚀

**Stop Loss**: **$1.40** – Protect against invalidation below support. ✋

🎯 **Targets**:

- **T1**: $1.71 – First key resistance and profit zone. 🛑

- **T2**: $1.94 – Extended upside potential. 💰

1 Billion shares volume on +400% runner MVSTMVST is up +400% on 1 Billion shares volume today alone, flagging, possible push to new highs into last 2 hours of the day and could even double or triple from here during after hours / premarket gap up if uptrend continue supporting because this volume is massive and if shortsellers start covering.

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Curated watchlists where MVST is featured.

Frequently Asked Questions

The current price of MVST is 2.72 USD — it has decreased by −4.73% in the past 24 hours. Watch Microvast Holdings, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Microvast Holdings, Inc. stocks are traded under the ticker MVST.

MVST stock has fallen by −10.12% compared to the previous week, the month change is a −16.46% fall, over the last year Microvast Holdings, Inc. has showed a 629.22% increase.

We've gathered analysts' opinions on Microvast Holdings, Inc. future price: according to them, MVST price has a max estimate of 5.00 USD and a min estimate of 3.00 USD. Watch MVST chart and read a more detailed Microvast Holdings, Inc. stock forecast: see what analysts think of Microvast Holdings, Inc. and suggest that you do with its stocks.

MVST reached its all-time high on Feb 1, 2021 with the price of 25.20 USD, and its all-time low was 0.15 USD and was reached on Nov 7, 2024. View more price dynamics on MVST chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

MVST stock is 11.44% volatile and has beta coefficient of −0.71. Track Microvast Holdings, Inc. stock price on the chart and check out the list of the most volatile stocks — is Microvast Holdings, Inc. there?

Today Microvast Holdings, Inc. has the market capitalization of 982.53 M, it has decreased by −4.05% over the last week.

Yes, you can track Microvast Holdings, Inc. financials in yearly and quarterly reports right on TradingView.

Microvast Holdings, Inc. is going to release the next earnings report on Aug 7, 2025. Keep track of upcoming events with our Earnings Calendar.

MVST earnings for the last quarter are 0.06 USD per share, whereas the estimation was −0.01 USD resulting in a 700.00% surprise. The estimated earnings for the next quarter are 0.01 USD per share. See more details about Microvast Holdings, Inc. earnings.

Microvast Holdings, Inc. revenue for the last quarter amounts to 116.49 M USD, despite the estimated figure of 106.00 M USD. In the next quarter, revenue is expected to reach 106.77 M USD.

MVST net income for the last quarter is 61.79 M USD, while the quarter before that showed −105.44 M USD of net income which accounts for 158.60% change. Track more Microvast Holdings, Inc. financial stats to get the full picture.

No, MVST doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 5, 2025, the company has 2.25 K employees. See our rating of the largest employees — is Microvast Holdings, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Microvast Holdings, Inc. EBITDA is 46.94 M USD, and current EBITDA margin is 1.38%. See more stats in Microvast Holdings, Inc. financial statements.

Like other stocks, MVST shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Microvast Holdings, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Microvast Holdings, Inc. technincal analysis shows the sell today, and its 1 week rating is neutral. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Microvast Holdings, Inc. stock shows the buy signal. See more of Microvast Holdings, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.