MVST, beginning of the new lithum hype? With ongoing US-China trade war, one of the key issues resides on lithium battery technology . Lithium technology is brought up as a national security concern . This is a tailwind for the industry .

Now let's get to the technicals.

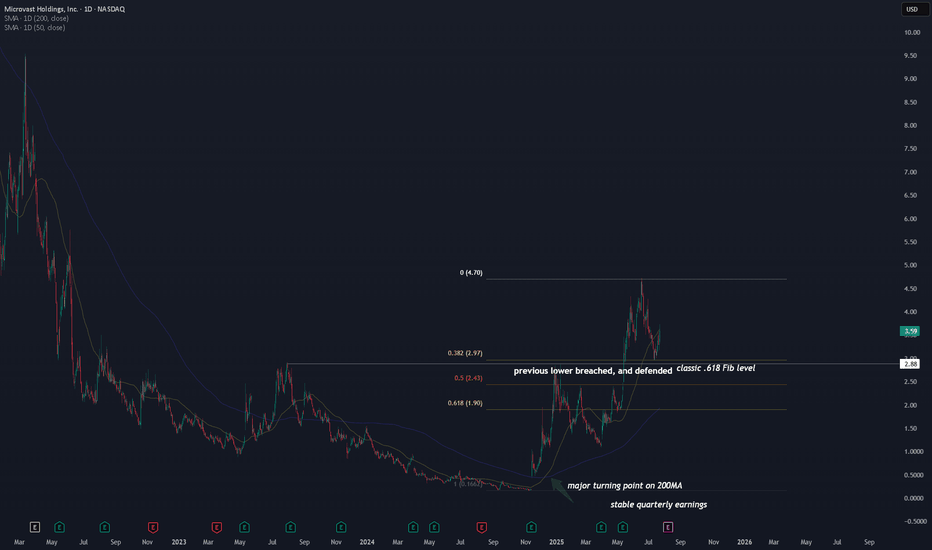

A major turning point on the 200MA . We haven't seen this happening since Dec 2020, when the stock first went public.

$3.00 key level is tested three times . This is not just a .618 Fib level, but the previous cycle high in 2023.

First test happened during Dec 2024, which it failed. Second time we saw the stock blew through this key level on May 2025. Lastly we saw a solid defense on this level on July 2025. If this level were to hold, the upside can be very high .

In addition to the technical side, the company is generating $100M revenue with neutral/break-even earnings this year, up from $60-80M in 2023 and 204. A steady increase in revenue , while not losing much from earning perspective.

This places NASDAQ:MVST at a tipping point . All it needs is some tailwinds from the new geopolitical conflicts , and we will see either an increase in revenue (scale up) or an improvement in profitability. Or both. If that were to happen, MVST will skyrocket.

I am watching and monitoring this stock as right now, I am expecting to add MVST to my portfolio once I see further confirmation.

MVST trade ideas

MVST: How Far Can It Soar? What Are the Chart Signals Telling UsFrom the weekly (1W) price chart of Microvast Holdings, Inc. (MVST) stock, we can observe significant developments indicating potential upward price movement in the future.

Breaking Through Strong Resistance (Yellow Zone):

Previously, MVST's stock price was under pressure and repeatedly failed to break above the "yellow zone." This is evident from the three red arrows indicating multiple unsuccessful attempts. This zone, therefore, served as a strong and highly significant resistance level in the past.

However, recent price action clearly shows that the price has successfully broken through this yellow zone. This is a highly positive signal, indicating a shift in momentum. It is anticipated that once this old resistance is breached, the yellow zone will transform into a crucial "support level" in the future, helping to prevent the price from easily falling back below it.

Clearing Selling Pressure from Bag Holders:

Historically, the price once touched the area marked by the "circle" before sharply declining. The probable reason for this was a large number of investors who had bought the stock at higher prices and had been "holding at a loss" (bag holders) for a long time. They decided to "sell off" to realize profits when the price recovered, or to cut their losses. This type of selling is a common phenomenon when a stock recovers from its lows.

Current Positive Signals:

The current ability of the price to break above the yellow zone, after the selling pressure from these long-term holders has largely been absorbed, indicates that significant buying interest has returned and is now stronger than the selling pressure.

How Far Can MVST Soar?

With this break above a significant resistance and the growing buying momentum, the chart displays a potential target at the 4.20 USD level, which is substantially higher than the current price. Nevertheless, investors should also monitor the trading volume to confirm the strength of this upward trend and consider other fundamental factors of the company before making investment decisions.

Conclusion:

The overall chart analysis suggests that MVST is transitioning from a stagnant trend to a clear upward trend. The breakthrough of significant resistance and the reduction in selling pressure from long-term holders position MVST for potential appreciation to higher price levels in the near future.

MVST - Bearish Head & Shoulders Breakdown Targeting $2.25–$2.75A classic Head and Shoulders pattern has formed on MVST's daily chart, with a clear neckline break to the downside. This technical setup suggests bearish momentum in the short term, with a likely price target between $2.25 and $2.75.

This zone also aligns with a prior consolidation area and dynamic support. I expect the stock to potentially find a bottom in this area. If MVST can deliver strong Q2 earnings in August, a bullish reversal from that demand zone could follow.

Microvast setting new 3-year highsMicrovast beat earnings in May of this year and reported positive earnings for the first time, shocking investors and sending the stock soaring above its previous resistance highlighted by the yellow trendline. As you can see it has been forming bullish consolidation above the trendline which now is seeming to act as support. There is also hidden bullish divergence on the RSI which I've highlighted. Great time to get into a really cheap stock that has much more upside to go should they continue to report positive earnings.

Market Update - 6/8/2025• Friday was a solid day, lots of strength especially in the energy, quantum computing and recently construction/industrial names

• A bit concerning is that breadth is very high already which tends to be followed by corrections, but we've been in a correction in small caps for almost a month now

• Good sign to see small caps outperforming large caps on Friday

• Gold and TLT are selling off, so that also confirms risk on mode

• Plus the strength in construction and retail names and the weakness in healthcare names are also pointing towards a risk on mode environment

• Will risk 0.5-0.75% of my account over the next weeks

MVST poised for another massive runupMVST Valuation Doesn’t Make Sense

emoji:DDNerd:

🄳🄳

emoji:DDNerd:

Let’s put things into perspective. Consider KULR, a stock I’ve been bullish on for years (I'm also the KULR subreddit admin). KULR, with $40 million in annual revenue, has a market cap of $300 million. Meanwhile, MVST, with $400 million in revenue and already profitable, is only valued at $390 million. A profitable company trading at less than its annual revenue is a rare opportunity in today’s market.

Why I’m Extremely Bullish on MVST

Revenue & Profitability: MVST recently reported $101.4 million in Q3 revenue, a 26.6% YoY increase. Their gross margin rose to 33.2% (from 22.3%), and they achieved a net profit of $13.2 million—proof that they’re not just growing but doing so profitably.

Industry Comparison: Comparing to KULR again, a market cap-to-revenue ratio of 7.5x would imply MVST deserves a market cap of $3 billion—a 10x from its current valuation. This isn’t just a hypothetical; I’ve seen this happen before with KULR, which 15x’d within a year. (And still giving.)

Growth Potential: MVST’s 2024 revenue is projected to grow 15-18% YoY, supported by a strong gross margin target of 25-30%. The company’s focus on next-gen battery technologies like solid-state batteries positions it well for sustained growth.

Short-Term Catalysts to Watch

Q4 Earnings: MVST guided Q4 revenues to $90-$95 million. If profitability continues, expect a significant re-rating of the stock.

Long-Term R&D Success: Their work on silicon-based cells and ESS solutions can open new revenue streams.

Market Realization: Historically, the market has corrected misvaluations like this. Dismissive attitudes, similar to what I saw with KULR early on, often precede massive price movements.

Technical Price Analysis

Current Levels: MVST is trading at $1.20, far below its book value. Support levels are forming around $1, with resistance near $1.40.

Potential Upside: If MVST trades at a fair value reflecting its fundamentals, the $10 target isn’t far-fetched. The price could consolidate briefly before breaking out, driven by earnings momentum.

Addressing Bearish Concerns

Some have raised concerns about near-term dilution or declining sequential revenues. While an offering might impact the stock in the short term, MVST’s profitability ensures any capital raised will fuel growth, not just sustain operations. Sequential revenue declines are normal in seasonally affected industries and don’t undermine long-term trends.

Conclusion:

I’m long on MVST. Just as KULR proved skeptics wrong, I believe MVST will too. Its fundamentals are too strong for this valuation to persist. At today’s prices, it’s not just a buy—it’s an opportunity to get in on a stock with 10x potential before the market wakes up.

Let’s discuss—are you bullish, bearish, or somewhere in between?

Disclosure: I’m heavily invested in MVST and KULR.

MVST Bullish Trade Setup: Key Levels to Watch!📈

**Entry**: **$1.52** – Price has broken out above consolidation, signaling bullish momentum. 🚀

**Stop Loss**: **$1.40** – Protect against invalidation below support. ✋

🎯 **Targets**:

- **T1**: $1.71 – First key resistance and profit zone. 🛑

- **T2**: $1.94 – Extended upside potential. 💰

**Key Details**:

📊 Breakout from a triangle pattern confirms bullish momentum.

📈 Price action near $1.52 offers a strong risk-reward ratio for long trades.

**📌 Strategy**:

- 🟢 Enter long at $1.52.

- 🔒 SL below $1.40.

- ✅ Take profits at $1.71 (T1) & $1.94 (T2).

**Why This Matters**:

⚠️ MVST is showing clear bullish signals, making this an attractive setup for breakout traders.

**Conclusion**:

A breakout at $1.52 with targets at $1.71 and $1.94 confirms bullish momentum. Don't miss this setup! 🚀🔥

#Trading #MVST #StockMarket #BullishSetup #RiskReward #StockAnalysis #ProfittoPath

1 Billion shares volume on +400% runner MVSTMVST is up +400% on 1 Billion shares volume today alone, flagging, possible push to new highs into last 2 hours of the day and could even double or triple from here during after hours / premarket gap up if uptrend continue supporting because this volume is massive and if shortsellers start covering... oh boy

Microvast DCA opportunity emergingFor NASDAQ:MVST , wait till a day after the quarterly results are out (01 Apr 24). If the price is heading down from that date and the resistance level, then wait until either the RSI is at 30 or the price reaches $0.55. And then start DCA for a long term hold.

If after the quarterly results the price starts a flag pattern, see the trend of the RSI and start the DCA if it reaches 30 if the RSI trend is downwards. Otherwise, if the RSI trend is also sideways, begin DCA.

If after the quarterly results the price breaks through the resistance then start DCA then. Depending on the candlestick patter might be best to wait 3 days to see if the price falls but then if the pattern and volume is strong then the move might be a large one and best to start DCA immediately.

MVST to $4.5 (160%)My reading is :

1- Primary : it is in the 3rd Elliott wave

2- Minor : finished the 1st wave of the primary 3rd

finished the 2nd wave of the primary 3rd

Forecasting :

Conservatively: it may go to the upper bound of the channel $4.5(160%)

Unconservative: $6.4 (280%)

The information is not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendation.

MVSTMicrovast Holdings, Inc

Hi Folks,

This stock belong the the EV + Battery sector

MVST has a quite interesting chart pattern.

• A big move in the past 1-3 months anywhere from 30%-100% the rally last for a few days to weeks.

• Stock is going to catch up the ema 200

• Orderly consolidation with higher lows & tightening range:

• RDM, VCP

• Stocks surfs the rising EMA 10 or the EMA 20, and sometimes the EMA 50

• Volumes are significative compared to previous phase

Let's keep it shortlisted

$MVST ready to break out of falling wedge patternMicrovast clarkesville will be opened in September bringing in much more revenue & announcement of the new Kentucky factory this week.. trading at 350m market cap while assets alone sit at about $1b this stock is is about to break out of the falling wedge pattern it has been in since june at last year.

Careful LONG MVSTThis meme-stock, hyped by reddit feel badly. But it is a real company, making and selling real stuff and is heavily into R&D with batteries. Im not all too FA-minded so i leave it at that.

On the daily chart we have some nice bullish RSI divergence. Looks like it will break out. potentially an easy 30% from here, as for a longer term hold, i havn't made my mind up yet for the targets.

Buy low, sell high. right? There is still quite some short intrest for this stock. Which also means that there are quite some buyers (because the shorters need to buy the stock). Seeing that the price dropped a fait amount, shorters might take profit and it will propell the stock higher.

It is also testing it's 21dMA. 3 times now. Like its knocking on the door before coming in :).

Could also fall further. depending on what happens, i will probably only add to my position, not sell because the upside potential.

MVST: Long once againAfter the previous rally, we again tanked down.

I think we are low enough to go long again. Making a double bottom it seems, perhaps still early to call.

Again there is a bullish RSI divergence.

We are now 3.30 and my target is the 200 dMA which stands now around 6.8 so i believe 70-100% is doable from this level.

Re-evaluate thereafter. There could be some panic selling but keep those nerves under control :).