NCNA could double from here Target 0.2$🚀 Why NuCana plc (NCNA) NASDAQ:NCNA Could Double from Here

📉 Attractive Valuation & Technical Setup

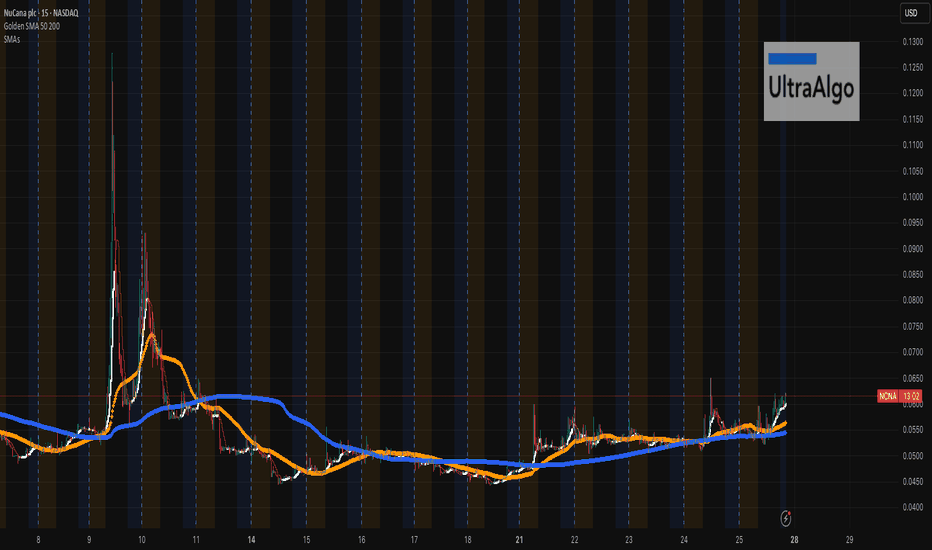

Trading around $0.052–$0.053, NCNA is holding strong near key support.

Recent volume spikes and price bounces off moving averages suggest growing buying interest.

A breakout above resistance could send NCNA soaring toward double its current price.

💉 Biotech Catalysts

Upcoming clinical trial results, approvals, or partnerships could trigger sharp jumps.

Biotech stocks often rally hard on positive news, especially low-priced ones like NCNA.

📊 Market Sentiment & Volume

Volume surges indicate potential accumulation by institutions or investors.

Strong fundamentals and possible deals could boost confidence further.

🎯 Price Targets

A move toward $0.10–$0.11 (about 2x current price) is feasible with positive momentum or news.

Summary: NCNA’s solid technical base, promising biotech catalysts, and increasing volume may drive a substantial rally—potentially doubling soon.

NCNA trade ideas

$NCNA Breakout Fueled by Ultra BullNASDAQ:NCNA just snapped out of its low-volume drift with a clean breakout after dual Ultra Bull signals stacked near consolidation support. Prior Ultra Bull triggers delivered explosive upside — could history repeat? Momentum’s building fast — keep it on your radar.

UltraAlgo flagged it early – super easy to track setups like this. Spike (buy) in the works. Not a fan of penny stocks, but if you get into this one use trailing stop loss!

$NCNA – Classic Bull Flag Forming! Breakout & Clinical CatalystPotential upside of 600%

Chart Setup (1‑Hr):

📈 Massive gap‑up on strong volume—ideal bull flag “pole.”

⚠️ Downward‑sloping consolidation channel = textbook bull flag.

🔥 Volume tapering during consolidation—often precedes sharp breakouts.

🚀 Approaching breakout near channel resistance (~$0.14), with 50‑ema & trendline support converging.

🎯 Technical Targets:

Near term: $0.20 (gap fill/resistance)

Measured move: ~$0.50 if breakout sustains

🧬 Fundamental Trigger – Clinical Readouts Imminent:

NuCana is expecting two key data updates in late 2025:

NUC‑7738 expansion trial (melanoma, post-PD‑1 failure) – top-line results due Q4 2025

finance.yahoo.com

NUC‑3373 Phase 1b/2 combination data (solid tumors + pembrolizumab) expected later this year

ir.nucana.com

These catalysts are on the horizon, and positive results could ignite a sharp pre-event ramp—especially in a low‑float biotech like NCNA.

🧠 Why This Matters

Bull flag + Fundamental setup = ideal trade structure: technical breakout, followed by a fundamental trigger.

Remember that this is a low float stock meaning less number of shares are available, thus any small positive news can result in a buying frenzy and a massive squeeze to the upside. Classic example is KALA (Kala Pharmaceuticals which rallied 800% in 2023

✅ Trade Plan

Action Target / Level

Entry On breakout above $0.14–0.15 with volume

Target First: $0.25 → Surge to $0.60 if catalyst is strong

Stop‑Loss Below channel support (~$0.11)

Bottom line: NASDAQ:NCNA is forming a textbook bull flag and is set up for a breakout ABOVE 0.2. With clinical trial results due SECOND HALF 2025, this trade could see significant upside before the headline.

Why NuCana (NCNA) Stock Might Rally

NuCana (NCNA) has seen a significant surge in its stock price, jumping 77.69% in a single trading session. Here are a few reasons why NCNA might continue its upward momentum:

Recent Financial Improvements – NuCana reported reduced Q1 2025 losses, signaling potential financial stabilization.

Clinical Developments – The company has been making progress in its cancer treatment pipeline, with promising results from its NUC-3373 trials.

High Trading Volume – The stock has experienced unusually high trading activity, which can indicate strong investor interest and momentum.

Market Sentiment – Positive news surrounding NuCana’s business updates and financial results has contributed to increased investor confidence.

NuCana Stock Surges 185% on Promising Melanoma Treatment ResultsNuCana plc (NASDAQ: NASDAQ:NCNA ) saw its stock skyrocket by 185% after presenting final data from its Phase 2 NuTide:701 study at the European Society for Medical Oncology (ESMO) Congress. This significant surge comes after a tough stretch for the company, especially following disappointing results from its colorectal cancer treatment. Investors are optimistic about the company’s potential, but does this rally indicate a sustainable uptrend? Let's explore the fundamental and technical aspects of NASDAQ:NCNA to assess the stock's future potential.

A Breakthrough in Melanoma Treatment

NuCana’s recent surge is largely driven by positive data from its Phase 2 study on NUC-7738, in combination with Merck’s Keytruda (pembrolizumab), for treating metastatic melanoma patients who have been resistant or relapsed after prior PD-1 inhibitor therapy. In a small 12-patient cohort, the combination therapy showed remarkable efficacy:

- 75% of patients achieved disease control, including two partial responses.

- One patient, who had relapsed after two prior PD-1-based treatments, saw a **55% reduction in tumor volume.

- 7 out of 12 patients experienced progression-free survival of over five months, which is impressive compared to the median progression-free survival of just 2-3 months with the current standard treatments for this patient group.

These data highlight the potential of NUC-7738 to sensitize PD-1-resistant tumors, a major breakthrough in the melanoma treatment landscape. Hugh Griffith, NuCana's CEO, expressed excitement over the results, noting the promising signals from NUC-7738 combined with pembrolizumab and its potential to extend progression-free survival in patients with poor outcomes from existing therapies.

This positive news follows the company’s decision to discontinue its NuTide:323 study for colorectal cancer, which led to a sharp decline in investor confidence earlier. However, the success of NUC-7738 in resistant melanoma has revived hope, with the company's strong potential to tap into new cancer therapies.

Technical Analysis: Is NASDAQ:NCNA 's Rally Sustainable?

From a technical perspective, NASDAQ:NCNA has rebounded sharply from its all-time low, showing a massive **183% surge**. However, while the upward momentum is strong, investors need to be cautious of potential pullbacks and overbought conditions.

- RSI (Relative Strength Index): The RSI is currently at **58**, signaling that the stock is approaching overbought territory. Typically, an RSI over 70 suggests an overbought market, where a correction or profit-taking might occur. Although the current level does not suggest immediate danger, it’s important to monitor this metric as the stock continues to climb.

- Falling Trend Channel: Despite the recent surge, NASDAQ:NCNA has been on a **long-term downtrend**, caught in a falling trend channel for several months. The stock had been oversold for an extended period, which might have attracted bargain hunters and speculators once the positive data hit the market. The current breakout is a significant departure from this trend, but the question remains whether this is a temporary surge or the start of a sustained reversal.

- Key Support and Resistance Levels: The recent surge places NASDAQ:NCNA in uncharted territory. Immediate support may be found near the **$4.50-$5.00 range**, which was resistance prior to the breakout. If the rally continues, resistance is likely around the **$7.00-$7.50 level**, which aligns with historical highs and could serve as a psychological barrier.

- Volume and Momentum: Trading volume has surged alongside the price increase, indicating strong buying interest. However, it’s crucial for the stock to maintain this momentum in the coming sessions. A sudden drop in volume might suggest fading interest, leading to a potential reversal.

What’s Next for NuCana?

While the technical aspects indicate that NASDAQ:NCNA is nearing overbought levels, the stock’s recent surge is supported by strong fundamentals. The company’s promising data from the NuTide:701 study positions NuCana as a potential leader in melanoma treatment, particularly for patients who have no other options after failing prior PD-1 inhibitor therapies. However, investors should remain cautious about the stock’s volatility and the possibility of profit-taking.

Despite the positive developments in melanoma treatment, NuCana still faces significant challenges. The discontinuation of the NuTide:323 study for colorectal cancer left a stain on investor confidence. For long-term investors, the question remains whether NuCana can build on its success in melanoma and expand its pipeline to other cancer treatments.

Conclusion: A Compelling but Cautious Buy

NuCana's recent rally is backed by encouraging clinical results, making it a potentially strong buy for risk-tolerant investors. However, the stock's technical indicators suggest that it could face short-term resistance as it approaches overbought territory. Investors should closely watch the stock’s price action and fundamental developments to determine whether this surge is part of a larger upward trend or merely a short-lived bounce.

While NASDAQ:NCNA has shown resilience in the face of setbacks, it remains a high-risk, high-reward play. Investors should consider taking profits as the stock approaches resistance levels or if trading volume starts to fade. As always, thorough research and close monitoring of both technical and fundamental indicators are essential to making informed investment decisions in a volatile stock like $NCNA.

NCNA reverse split pumpA reverse split pump in the small cap stock market refers to a situation where a company, typically with a low stock price, undergoes a reverse stock split in order to artificially inflate its stock price. Here's how it typically works:

Low Stock Price: Small cap stocks often have low prices per share, sometimes trading for just a few cents. This low price can make the stock less attractive to investors and may even lead to delisting from stock exchanges that have minimum price requirements.

Reverse Stock Split: To combat the low stock price and possibly meet exchange listing requirements, the company executes a reverse stock split. In a reverse split, existing shares are combined to reduce the total number of outstanding shares, thereby increasing the price per share proportionally. For example, in a 1-for-10 reverse split, every 10 shares a shareholder owns are converted into 1 share, effectively increasing the price by a factor of 10.

Pump: After the reverse split, there may be efforts to artificially boost the stock price, creating what is known as a "pump." This can involve various tactics, such as promotional campaigns, exaggerated press releases, or even coordinated buying by groups of investors. The goal is to create a perception of increased value and generate buying interest in the stock.

This NCNA Penny Stock Could Surge Over 300%, Say AnalystThis NCNA Penny Stock Could Surge Over 300%, Say Analyst

NuCana uses a phosphoramidate chemistry technology called ProTide to create a class of drugs that will surmount the limitations of the existing nucleotide analogs behind many chemotherapy drugs. NuCana’s ProTides have already been used in Gilead’s antiviral drug Sovaldi.

In May of last year, NuCana announced the restart of its Phase III trial on Acelarin, the drug candidate furthest along the company’s pipeline, as a treatment for biliary tract cancers. The study encompasses over 800 patients in 6 countries and is currently ongoing. In November, the company published data described as ‘encouraging’ from the Phase Ib study of the same drug.

While Acelarin is the flagship drug in the pipeline, NuCana has two other prospects under development. NUC-3373 is in Phase I trial as a treatment for solid tumors and colorectal cancers, and NUC-7738 is a second pathway under investigation for applications to advanced solid tumors. Of these three, the colorectal study is the farthest advanced.

5-star analyst Robyn Karnauskas sees the pipeline as key to NuCana’s investor potential.

“We believe investors have overlooked the fact that NCNA is a platform Company that we believe is validated, as defined by the production of clinical products. We like that it has brought 3 products to the clinic, including one novel drug and two improved cornerstone chemos. The data suggest to us that the platform works and can produce better chemos While investors are mostly focused on Acelarin, we believe investors should also focus on NUC-3373, another core to our platform-based thesis that has data expected in 1H2021,” Karnauskas noted.

To this end, Karnauskas puts a $22 price target on NCNA, suggesting the stock has room for 384% growth ahead of it, along with a Buy rating.

finance.yahoo.com