NDX trade ideas

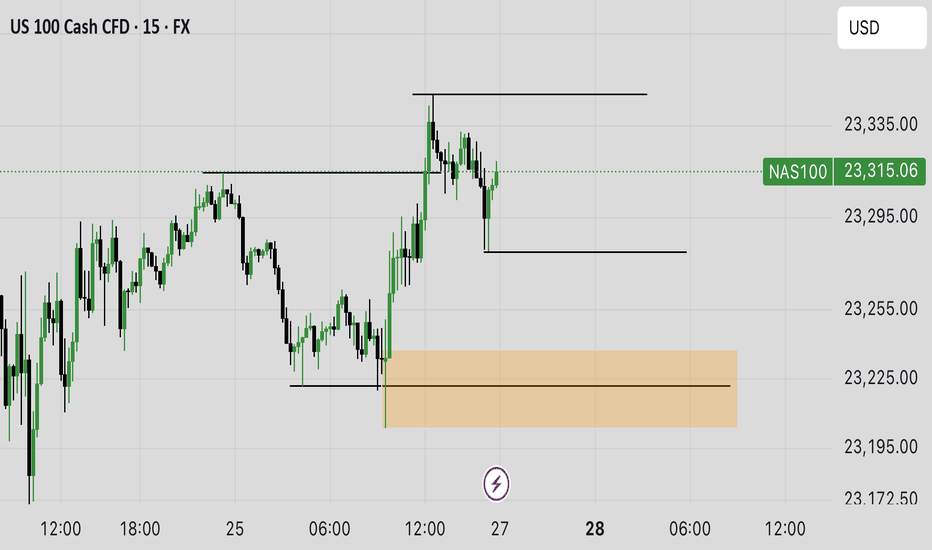

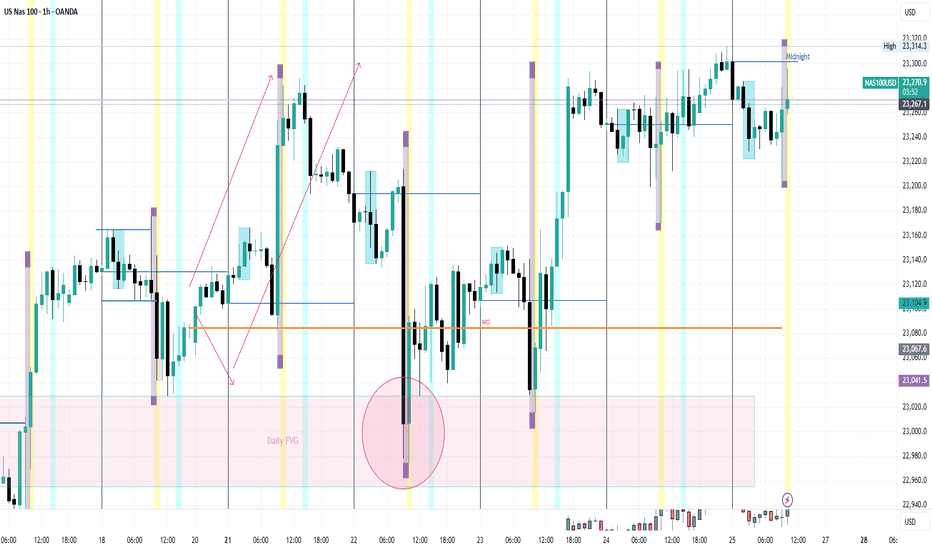

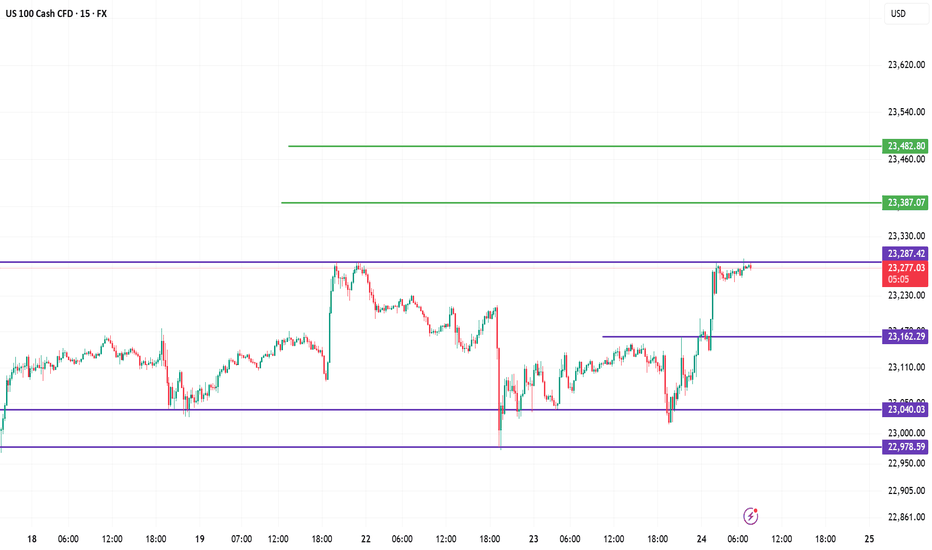

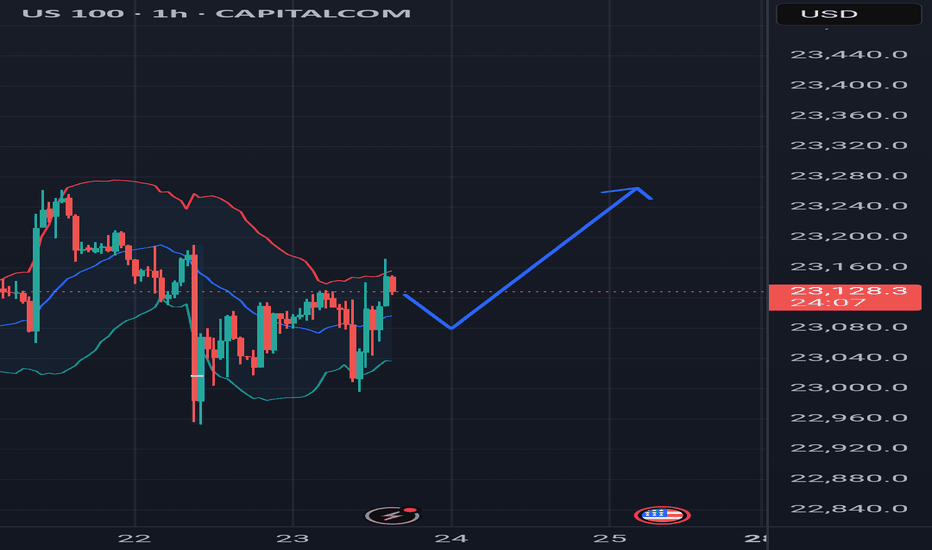

Nasdaq Index Analysis (US100 / NASDAQ):The Nasdaq index continues its medium- to long-term bullish trend, recently reaching a new high at 23,477 USD.

1️⃣ A break and close below 23,330 USD could trigger a pullback toward 23,200 USD, followed by 23,000 USD.

2️⃣ However, if the price holds above 23,480 USD, a continuation of the uptrend is expected, potentially forming a new high.

⚠️ Disclaimer:

This analysis is not financial advice. It is recommended to monitor the markets and carefully analyze the data before making any investment decisions.

US100 (NASDAQ 100 Index) – Breakout with Clear Upside ProjectionUS100 has broken out cleanly above the key resistance at 22,097.1, indicating bullish continuation. The breakout is supported by strong upward momentum, targeting the next key level around 23,441.9, as illustrated by the projected range.

Support at: 22,097.1 🔽 | 20,750.0 🔽

Resistance at: 23,441.9 🔼

🔎 Bias:

🔼 Bullish: Sustained price action above 22,097.1 keeps the bullish breakout valid, aiming toward 23,441.9.

🔽 Bearish: A drop back below 22,097.1 would invalidate the breakout, possibly pulling price toward 20,750.0.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

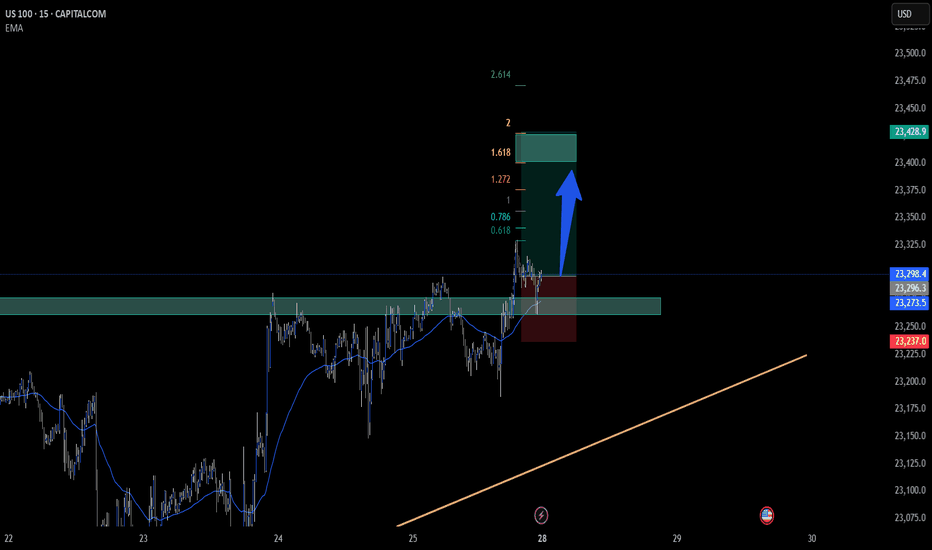

NASDAQ| Bullish Bias - Refined OB Near MitigationPair: NASDAQ (NAS100)

Bias: Bullish

HTF Overview (4H):

Strong bullish structure has been the narrative, and last week’s upside intent confirmed the move. Current action suggests price is preparing for continuation after brief consolidation.

LTF Confirmation (30M):

Structure has been refined with a key OB in play. Price is approaching mitigation, and I’ve been tracking this level closely since last week.

Entry Zone: Waiting for clear 5M shift after OB mitigation. 5M OB already tapped — now I’m watching for confirmation to execute.

Targets: 5M highs first, 30M highs if price maintains momentum

Mindset Note: Focused and flowing. No forcing — I’ve tracked this from HTF to LTF and now I’m just waiting for price to invite me in. Clarity + patience = execution.

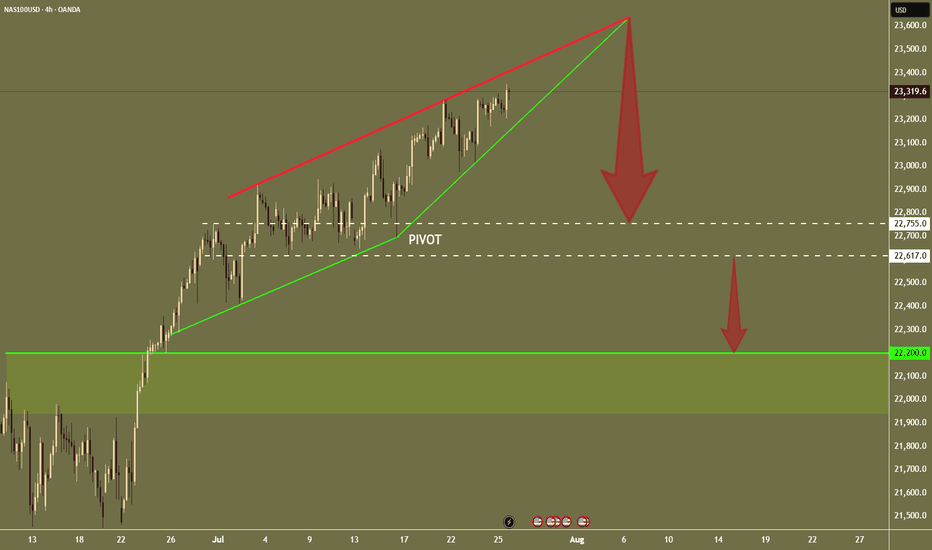

NAS100 - Potential TargetsDear Friends in Trading,

How I see it,

Insightful article: (The same principle applies to Nasdaq naturally)

1) Read the article first:

investinglive.com

2) Follow the link to watch the short video -

youtu.be

Keynote:

We are waiting for a decisive and very clear bearish signal

I promise you; we won't miss it.

It will be in our face, on a 4Hr grouping or a Daily grouping.

Most times it's 1 x Big Red signal on a high TF.

I sincerely hope my point of view offers a valued insight

Thank you for taking the time study my analysis.

NAS100 [Consolidating ] – Will It Break Higher or Pull Back?The NAS100 has maintained a bullish structure and is currently pressing against the resistance zone around 21,777.3. This area has acted as a ceiling several times in recent sessions. Price is showing consolidation just below resistance, suggesting either an imminent breakout or another rejection.

Currently trading at 21,777.3, with

Support at: 21,450.0 🔽

Resistance at: 22,230.7 🔼

🔎 Bias:

🔼 Bullish: A strong break and hold above 21,777.3 may drive price toward the next resistance at 22,230.7.

🔽 Bearish: Rejection from 21,777.3 could lead to a retracement toward 21,450.0, with deeper downside potential if that level fails.

📛 Disclaimer: This is not financial advice. Trade at your own risk.

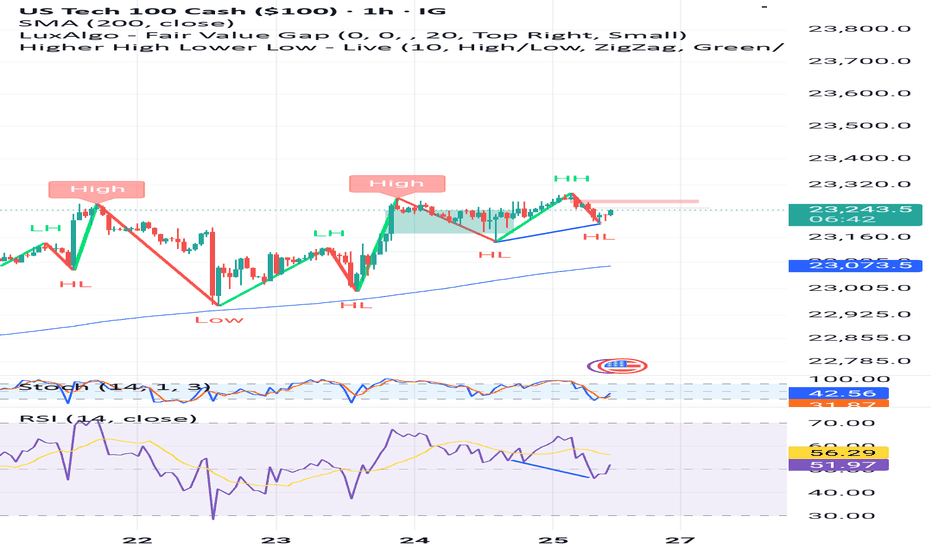

Nasdaq100 Bulls ready to drive the price to 23,300 handle With the choch on the market structure and with Key data released on Thursday, reflected strength in the U.S. economy. Stocks rose this Thursday, buoyed by fresh economic data reports and a slew of corporate earnings releases. The tech-heavy Nasdaq Composite has advanced 0.4%, and quarterly earnings reports released this week have exceeded Wall Street’s expectations, fueling investor confidence. I am expecting that by the end of this week or the beginning of next week will see the bulls drive the market to our 23,300 handle. I am with the bulls on this one

Tp1.23,300.

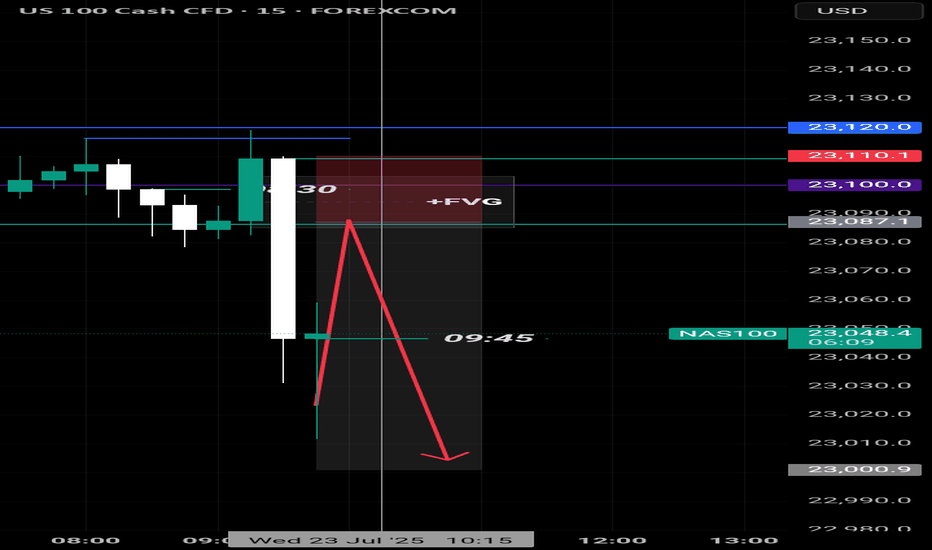

Nasdaq Bullish Flow | 5M OB Execution PendingPair: NAS100

Bias: Bullish

Timeframes: 30M / 5M

Price remains heavy bullish — structure aligning perfectly across the board. Ever since the 30M OB was mitigated, I’ve been following Nasdaq’s order flow step-by-step.

I was watching for full-bodied confirmations inside the 30M zone, but instead, price gave clarity through the lower timeframes. That 5M flip gave away smart money’s intent — showing me exactly where accumulation is happening.

Now waiting for price to tap into the 5M OB to shift into execution mode. This setup has been mapped with precision — no guessing. Once entry presents itself, I’ll follow through.

Entry Zone: 5M OB

Target: 5M highs

Mindset Note: Still in analysis mode — patience until price hits my zone. Smart money doesn’t rush, it accumulates. So do I. 💼

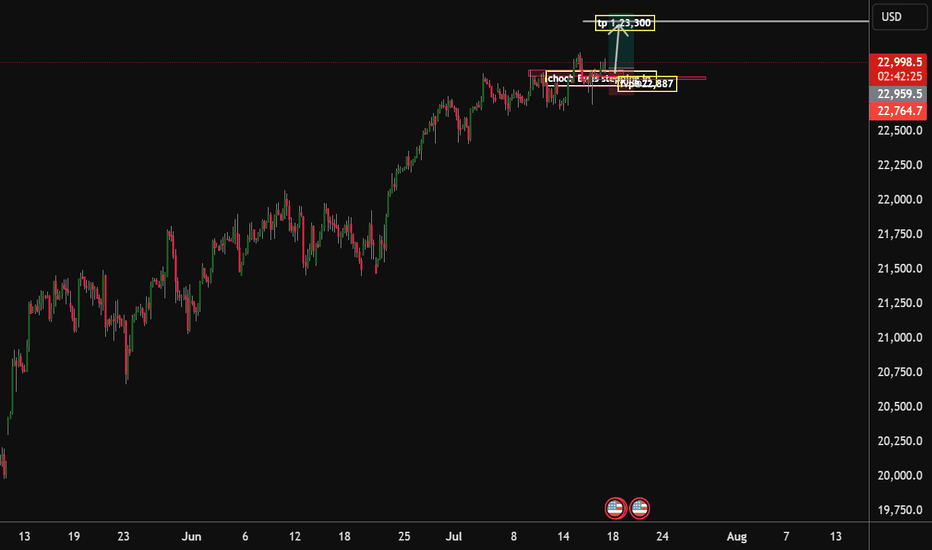

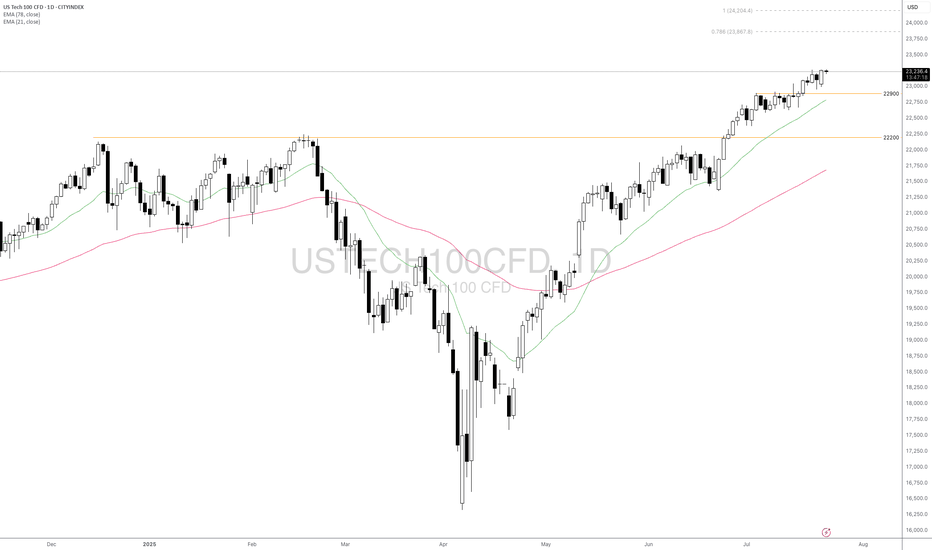

Will USTEC Continue Its Rallies Amid Better Market Sentiment?Macro approach:

- USTEC advanced modestly this week, supported by upbeat corporate earnings and resilience in economic data amid ongoing policy uncertainty.

- The index benefited from strong expected results in major tech firms such as Microsoft (MSFT) and Nvidia (NVDA), as top giant AI leadership, helping to bolster sentiment despite lingering concerns about tariffs and Fed policy direction.

- US macro data showed sticky inflation in key categories, robust retail sales, and falling jobless claims. This prompted the Fed to retain its cautious stance on rate cuts while markets reassessed policy expectations. Policy-related headlines and manufacturing sector developments also partly drove market volatility.

- USTEC could remain sensitive to incoming tech earnings, the 29-30 Jul Fed meeting, and potential US tariff announcements in early Aug. Persistent inflation and any surprises in central bank communication may drive volatility in the sessions ahead.

Technical approach:

- USTEC trended higher and created a new record high. The price is above both EMAs, indicating a strong bullish momentum.

- If USTEC stays above the support at 22900, the price may continue toward the 78.6% Fibonacci Extension at around 23867.

- On the contrary, breaking below the support at 22900 and EMA21 may prompt a deeper correction to retest the following support at 22000.

Analysis by: Dat Tong, Senior Financial Markets Strategist at Exness

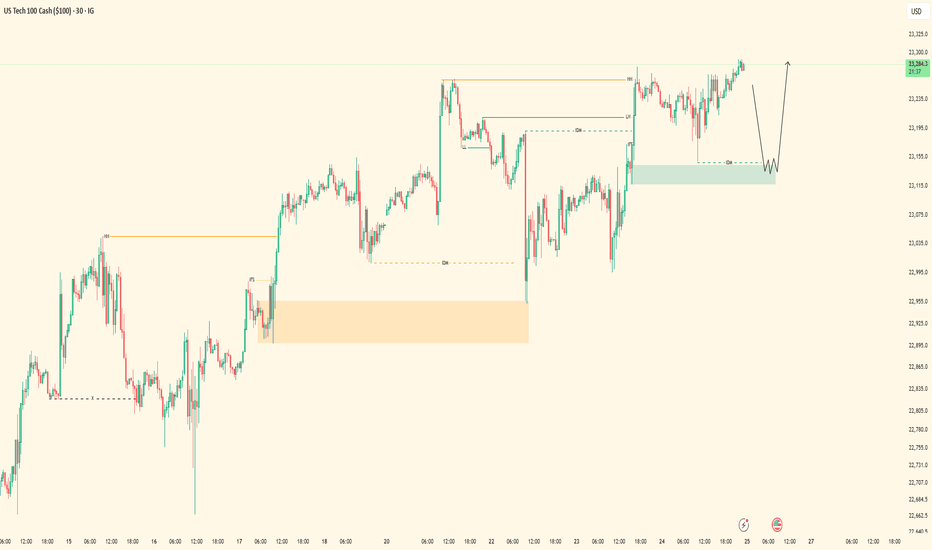

NASDAQ100| - Bullish Bias RemainsPrice didn’t give me the deep candle retrace into my 30M OB — just a wick tap — but that was enough. That wick shows me smart money touched in.

Dropped to the LTF and got my shift in structure confirming bullish intent.

Now I’m locked in, watching for price to sweep a 5M sell-side liquidity pocket into a clean LTF order block for the next entry.

🎯 Target: Short-term 5M highs

🚀 Bias: Still bullish unless structure breaks

This is a patience game now — execution only after confirmation.

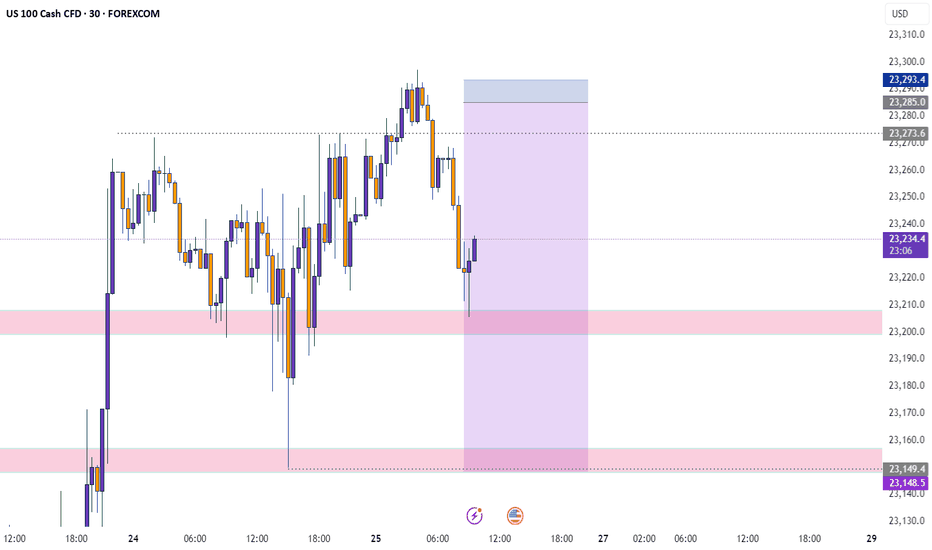

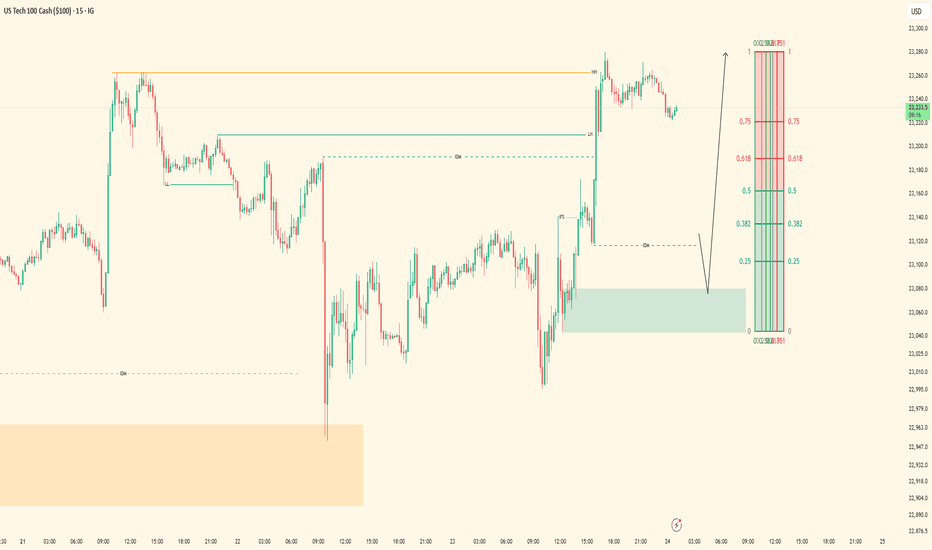

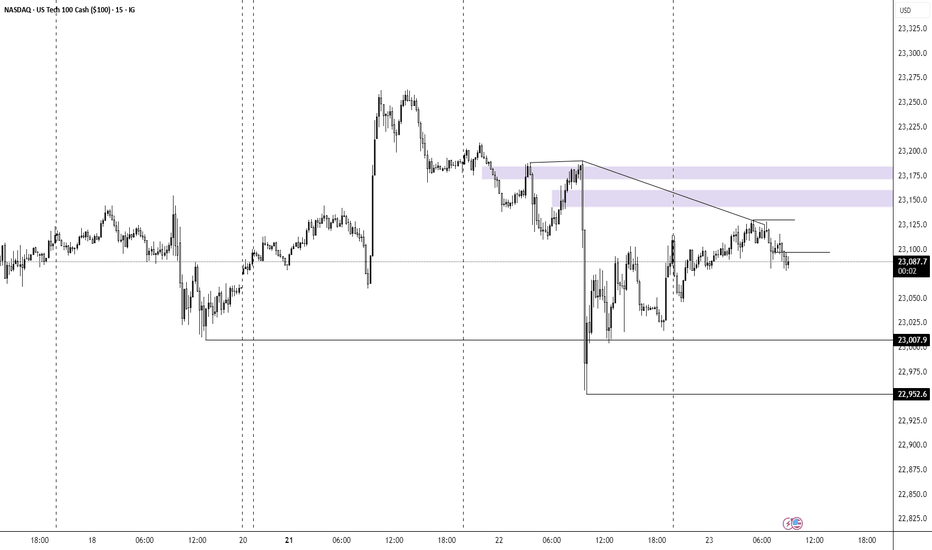

US100 Analysis Report (15m Chart)1. 🔍 Liquidity Grab (Sell-side taken)

Price swept below 23,040 and sharply reversed from 22,978, clearing out weak sellers.

2. 📈 Break of Structure (BOS)

A bullish BOS occurred after price broke above 23,162, confirming short-term bullish intent.

3. 🟪 Rejection Zone

Price is now testing 23,287.42 — a supply/resistance zone. Watch for signs of rejection or breakout.

4. 📊 Bullish Scenario

If price breaks 23,287 cleanly, expect next moves towards 23,387 and then 23,482.

5. 📉 Bearish Setup Possibility

Rejection from 23,287 could pull price back to 23,162 or 23,040 before the next move.

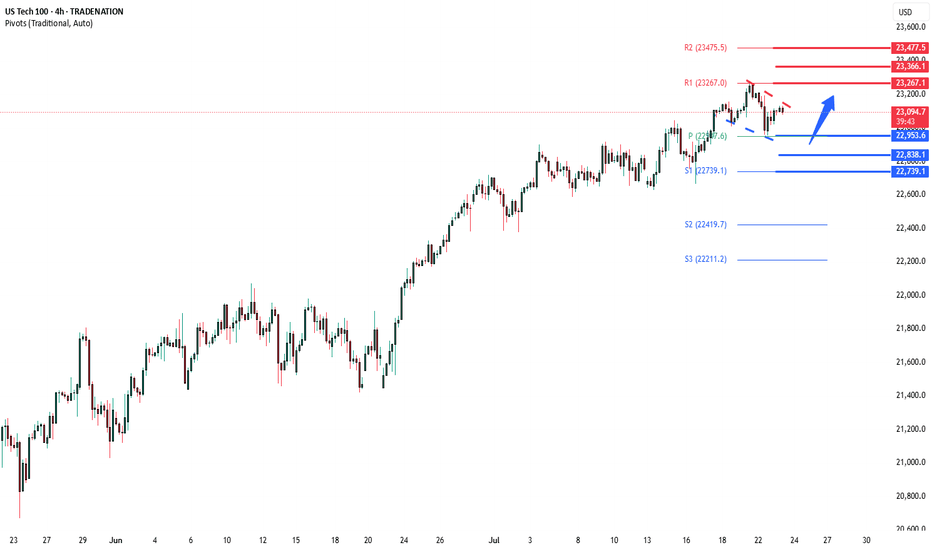

NSDQ100 another bullish flag developing ?Donald Trump has agreed a new trade deal with Japan, setting 15% tariffs on US imports like cars and launching a $550 billion fund to boost investment in the US. This is lower than his earlier 25% tariff threat. Other allies saw mixed outcomes—the Philippines got a small tariff cut, while Canada’s talks stalled. Goldman Sachs now expects the US baseline tariff rate to rise to 15%.

Trump also suggested that Fed Chair Jerome Powell may not stay in his role much longer, and he’s considering removing capital gains tax on home sales, which could affect the housing market.

Separately, a Chinese-linked cyberattack breached the US nuclear weapons agency, though no classified data was stolen. Meanwhile, SpaceX’s investor documents flagged Elon Musk’s political activity as a potential risk as the company targets a $400 billion valuation.

Conclusion for Nasdaq 100:

The Nasdaq 100 faces short-term uncertainty due to rising trade tariffs, Fed leadership questions, and geopolitical risks. While some US-focused investments could benefit, traders should stay cautious as policy and global tensions evolve.

Key Support and Resistance Levels

Resistance Level 1: 23265

Resistance Level 2: 23670

Resistance Level 3: 23480

Support Level 1: 22953

Support Level 2: 22840

Support Level 3: 22740

This communication is for informational purposes only and should not be viewed as any form of recommendation as to a particular course of action or as investment advice. It is not intended as an offer or solicitation for the purchase or sale of any financial instrument or as an official confirmation of any transaction. Opinions, estimates and assumptions expressed herein are made as of the date of this communication and are subject to change without notice. This communication has been prepared based upon information, including market prices, data and other information, believed to be reliable; however, Trade Nation does not warrant its completeness or accuracy. All market prices and market data contained in or attached to this communication are indicative and subject to change without notice.

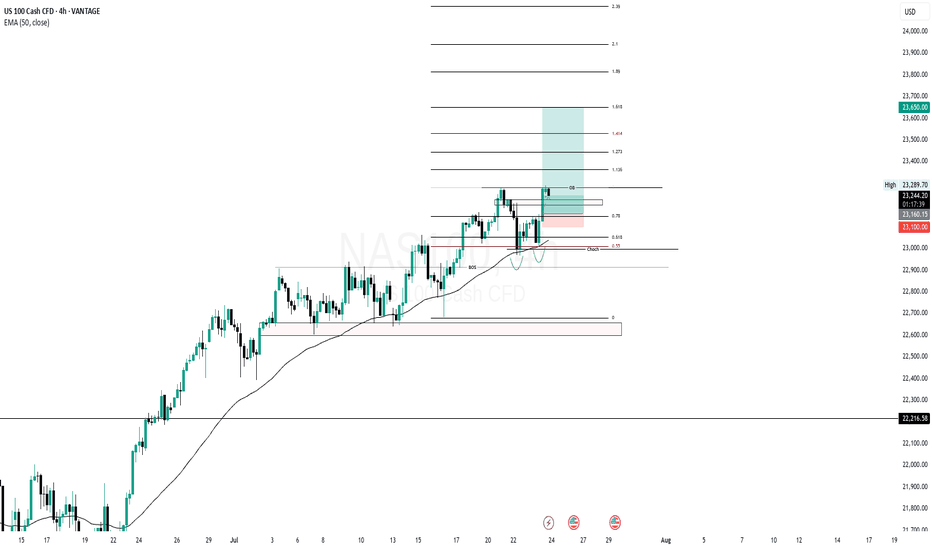

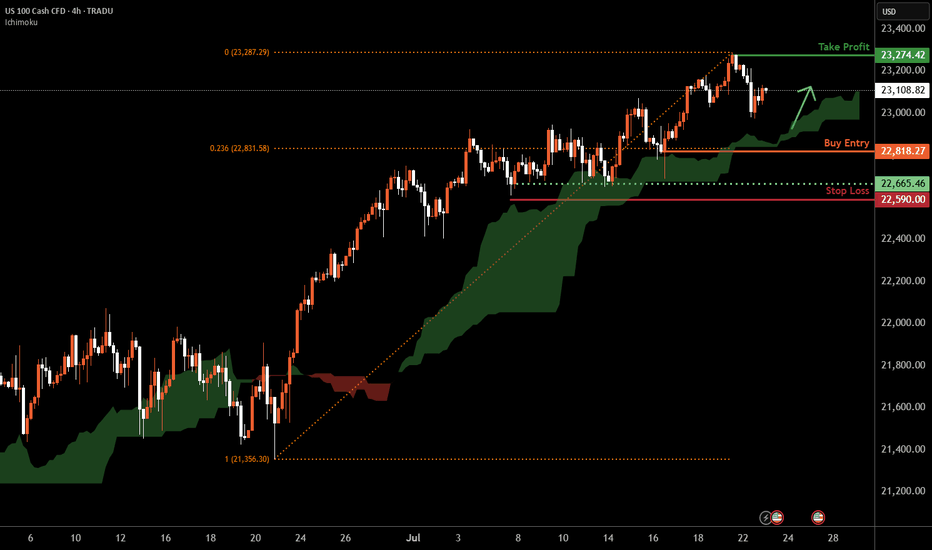

Nasdaq-100 H4 | Bullish uptrend to extend higher?The Nasdaq-100 (NAS100) is falling towards a swing-low support and could potentially bounce off this level to climb higher.

Buy entry is at 22,818.27 which is a swing-low support that aligns with the 23.6% Fibonacci retracement.

Stop loss is at 22,590.00 which is a level that lies underneath a multi-swing-low support.

Take profit is at 23,274.42 which is a swing-high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.