NUWE trade ideas

NUWE - Nuwellis, Inc. Nuwellis, Inc. operates as a medical device company. It engages in the provision of products for the treatment of fluid overload. The firm's products include Aquadex FlexFlow System, which provides an ultrafiltration for the removal of salt and water in patients with hypervolemia, or fluid overload. It operates through Cardiac and Coronary Disease Products segment. The company was founded by Crispin Marsh and William S. Peters in November 1999 and is headquartered in Eden Prairie, MN.

Nuwellis, Inc.Nuwellis, Inc. operates as a medical device company. It engages in the provision of products for the treatment of fluid overload. The firm's products include Aquadex FlexFlow System, which provides an ultrafiltration for the removal of salt and water in patients with hypervolemia, or fluid overload. It operates through Cardiac and Coronary Disease Products segment. The company was founded by Crispin Marsh and William S. Peters in November 1999 and is headquartered in Eden Prairie, MN.

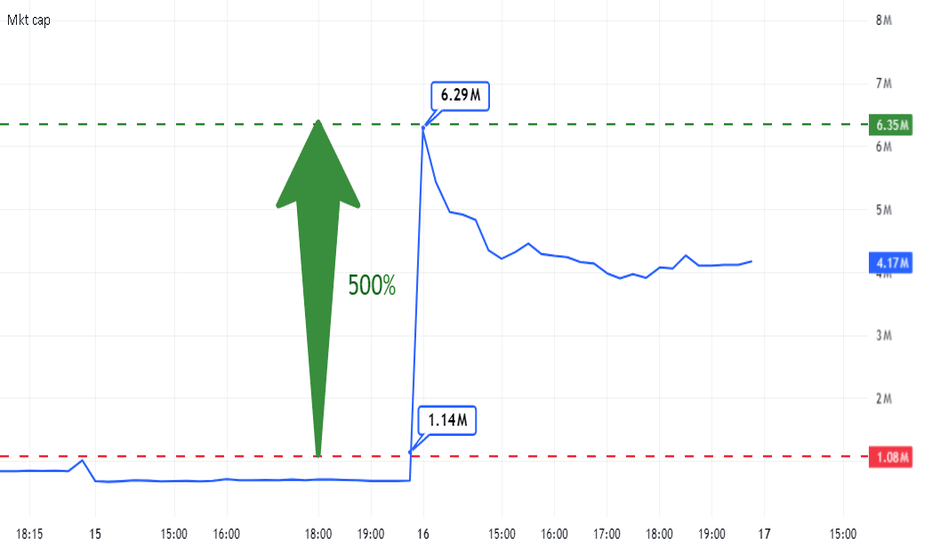

$NUWE Fundamentally UndervaluedAs far as undervalued plays go, Nuwellis, Inc. (NASDAQ: NUWE) could be one of the most undervalued stocks thanks to its cash balance which dwarfs its market cap. Additionally, NUWE has an FDA-cleared device which the company realizes revenues from. With the stock trading near its all-time low, NUWE stock could be one to watch closely in anticipation of a rebound.

NUWE Fundamentals

Cardiology is an extremely important branch of medicine given how essential the heart is. NUWE is a biotech company that specializes in developing cardiology treatments specifically those related to maintaining fluid balance in the heart. Currently, NUWE has a revenue-generating device also known as its Aquadex™ System. This device is approved and cleared for use by the FDA and currently provides NUWE with financial stability via revenue.

With a market cap of only $3.6 million, NUWE could be extremely undervalued especially since the company has $12.1 million in cash, cash equivalents, and marketable securities and has no debt. Considering that NUWE has 1.2 million shares outstanding, the company has nearly $10 in cash per share which makes NUWE stock extremely undervalued at its current valuation. Given that the stock is trading near its all-time low, NUWE could be setting up for a rebound as more investors take notice of this undervalued stock.

NUWE Financials

According to its Q1 report, NUWE’s total assets decreased from $24.6 million to $18.4 million QoQ as a result of its cash balance declining from $17.7 million to $11.5 million. On the other hand, NUWE’s liabilities decreased significantly from $12.3 million to only $4.8 million

NUWE’s revenues dipped slightly YoY from $1.9 million to $1.8 million and as a result, its gross profits dipped slightly as well from $1.1 million to $1 million. Meanwhile, operating costs increased YoY to $6.9 million from $5.5 million which contributed to NUWE’s net loss widening from $4.4 million to $6.4 million.

Technical Analysis

NUWE stock is in a neutral trend and is trading in a sideways channel between its support at 2.82, and its resistance at 3.13. Looking at the indicators, NUWE is trading below the 200, 50, and 21 MAs, however, it is testing both the 50 and 21 MAs as resistance. Meanwhile, the RSI is neutral at 50 and the MACD is neutral.

As for the fundamentals, NUWE could be considered undervalued since it has a cash balance worth more than its entire market cap. In this way, the stock could be poised for a rebound soon as more investors take notice of NUWE. Based on this, bullish investors could wait for the stock to retest its support before entering long positions in anticipation of a bounce in the near term.

NUWE Forecast

Given that NUWE is trading below cash level, the stock could be extremely undervalued at its current $3.6 million market cap since it has nearly $10 in cash per share. With an extremely low float of 1.2 million, NUWE could soar once more investors take notice of the company’s value especially since it already has a revenue-generating FDA-cleared device.

NUWE | Shhhhh! I Need to Add | LONGNuwellis, Inc., a medical device company, focuses on developing, manufacturing, and commercializing medical devices used in ultrafiltration therapy. The company's products are the Aquadex FlexFlow and Aquadex SmartFlow systems, which are indicated for the treatment of patients suffering from fluid overload who have failed diuretics. Its Aquadex FlexFlow system includes a console, disposable blood set, and catheter. The company sells its products to hospitals and clinics through its direct salesforce in the United States; and through independent specialty distributors primarily in Austria, Brazil, Czech Republic, Germany, Greece, Hong Kong, India, Israel, Italy, Romania, Singapore, Slovakia, Spain, Switzerland, Thailand, the United Arab Emirates, and the United Kingdom. The company was formerly known as CHF Solutions, Inc. and changed its name to Nuwellis, Inc. in April 2021. Nuwellis, Inc. was founded in 1999 and is headquartered in Eden Prairie, Minnesota.

Nuwellis Inc can't hack it. NUWEMore drops on NUWE incoming. Fractally an evident zigzag.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Confirmation level, where relevant, is a pink dotted, finite line. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe.

Nuwellis Inc 🧙Revenue for the first quarter ended March 31, 2021, was $1.9 million, an increase of 18 percent compared to the prior-year period

Increased Aquadex therapy utilization amongst strategic Critical Care accounts; highest levels seen in the past five quarters

Enrolled first pediatric patient into the clinical registry in April 2021

Received strong endorsements for Category III CPT code application from two major medical societies

Ended the quarter with $27.9 million in cash and no debt

“Following our most recent $20.9 million capital raise with net proceeds of $18.9 million on March 19, 2021, Nuwellis is in a strong position to execute against our long-term strategic growth plan,”

Revenue growth in the first quarter of 2021 was primarily driven by increased capital equipment sales and strong utilization within Critical Care. The Company also continued to see increasing utilization among established pediatric accounts during the quarter.

Gross margin was 50.4% for the first quarter 2021, compared to 51.2% in the prior year period. The decline in gross margins was primarily due to strong sales of capital equipment.

Selling, general and administrative (“SG&A”) expenses for the first quarter of 2021 were $5.2 million, an increase of 15% compared to the prior-year period. The increase in SG&A was primarily due to the timing of non-recurring administrative expenses and continued investment in sales and marketing activities. Research and development (“R&D”) expenses in the first quarter of 2021 were $0.9 million, an increase of 10% compared to the prior-year period. The increase in R&D expenses was driven primarily by clinical expenditures related to the pediatric registry.

The net loss for the first quarter of 2021 was $5.2 million, compared to a net loss of $4.6 million in the prior-year period.

Cash and cash equivalents were $27.9 million with no debt as of March 31, 2021. During the first quarter of 2021, the Company used $5.4 million of cash in operations. The Company also completed a $20.9 million capital raise with net proceeds of $18.9 million on March 19, 2021.

Nuwellis Inc 🧙Nuwellis Inc is a medical device company. Its solutions include Aquadex Smartflow System and RenalSense Clarity RMS. The Aquadex Smartflow System removes excess fluid from patients suffering from fluid overload who have not responded to medical management, including diuretics. Clarity RMS is a kidney monitoring system that continuously measures urine output and flow, automatically displaying real-time data to the medical staff.

If you want more trading ideas like this one ,🎯 press a thumb up! 👍 Have a question? Don't be shy to ask! 🤓 Interested to study how to analyze charts, follow me!