NVidia Long Lurking. 93% Win Rate.This morning I finished back testing NVidia from 1999. I used 25k as the start up capital but that is besides the point.

The Point is that indicators are pointing out that the next long around is "around the corner". Similar to TESLA but NVidia has bigger.

When can we expect this to happen?

So on average from when the indicators start whispering that a long position might be coming up is an average of 60 days. But following simply this methodology is risky on its own as some signals are produced 15 days and some at 160 days. There is also another approach that intrigues me. A handful of the signals are almost back to back which is great for multiple entries when you measure just these the average is about 240 days. This coincides with Crypto's ETH which has given its heads up signal, which is an average 241.5 days. This all speculation at the end of the day and the signal will come when it does.

So why post this if it could be that far ahead?

I thought I would let people know that indicators are whispering.

Here are some other indicators to take note of:

The higher timeframes are a bit more clearer at the moment. The snapshot as of now indicates some sort of move downwards. This could be 96-98 region in the shorter term especially if we are expecting 60 days before a buy signal is produced.

The back testing did also reveal that no signal was produced from 2011 to about 2018. It did catch the massive moves up but the exit signal did cut the party short in a few trades.

The last signal was in October 2022 which was the Covid Rally. So it could indicate something big is coming globally but let me put my tinfoil hat down.

Stay adaptable and Open minded.

NVDA trade ideas

BUBBLE RUN of global marketsTheory! I just like to visualize similar global market events.

NASDAQ:NVDA now vs. Cisco from 1991-2002 — it looks almost identical.

The years 2026-27 could mark the final stage of the current “bubble run”:

> an enormous number of crypto ETFs (even for worthless shitcoins)

> overleveraged funds, from small players to industry leaders

> AI projects with minimal revenue but insanely high infrastructure costs

> soaring Gold prices alongside a decade-long decline in the U.S. manufacturing index, all while the stock market remains expensive

> OpenAI, crypto exchanges, and AI companies with no real revenue planning IPOs in 2026+

I believe we are currently in a Bubble Run!

This could be great for Bitcoin, because historically, Gold (over the past 100 years) has reached all-time highs during the final phase of a stock market bubble and continued rising until the market’s final dip. Then, smart money starts a new bull cycle — selling gold to buy cheap stocks.

I HAVE A NEW STRATEGY! Watch it work for me. SAYS SELL🚨 Exclusive Trading Opportunity – Limited Time Only! 🚨

I've developed an amazing new trading strategy that’s completely unique and never seen before! It’s called the Skyline Scalping Strategy, and it’s designed to pinpoint market direction with extreme accuracy—something that can easily be back-tested by reviewing my previous predictions.

For a limited time, I’ll be posting daily trade signals based on this strategy, allowing you to see exactly where I anticipate the market will move next. Whether you're an amateur trader or a seasoned professional, this is your chance to witness something game-changing in action.

⚠️ Disclaimer: I’m not providing financial advice—just sharing the direction I am planning to make money. The Skyline Scalping Strategy works exclusively on the daily chart, so stay tuned and watch as the predictions unfold!

FOLLOW NOW and don’t miss out on these powerful insights! 📊🔥

Vertical lines are colored and placed to indicate the expected direction of the price. Just my thoughts.

Nvidia Partners With General Motors to Build Self-driving CarsNVIDIA Corporation, a computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally Partners With General Motors to Build Self-driving Cars.

Also in another news, IBM Taps NVIDIA AI Data Platform Technologies to Accelerate AI at Scale.

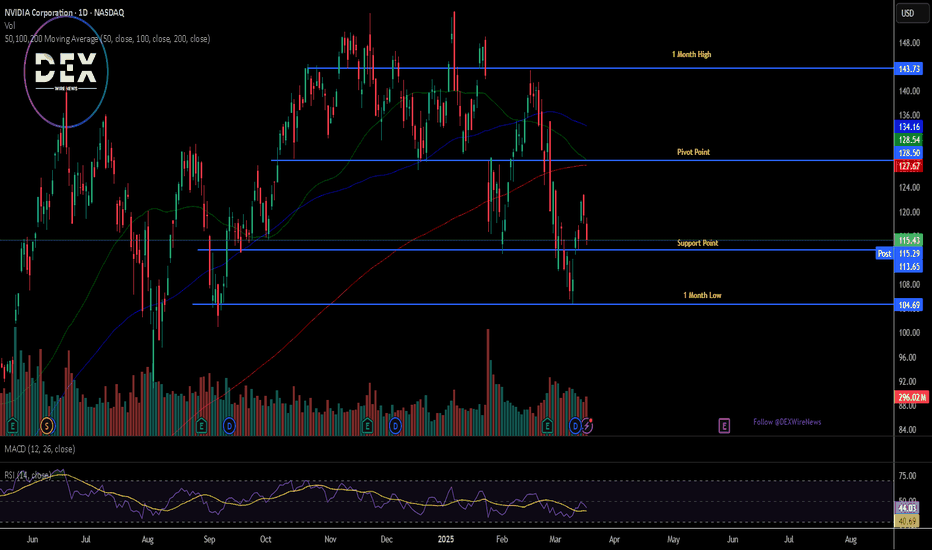

Apparently, shares of Nvidia (NASDAQ: NASDAQ:NVDA ) is undeterred by all this news presently down 3.43% trading with a weak RSI of 44.

The 78.6% Fibonacci retracement point is acting as support point for shares of NVidia a break below that pivot could lead to a dip to the 1-month axis. Similarly, a breakout above the 38.2% Fibonacci retracement point could catalyse a bullish renaissance for $NVDA.

Nvidia - That's Officially The Brutal End!Nvidia ( NASDAQ:NVDA ) is breaking all structure:

Click chart above to see the detailed analysis👆🏻

Following previous cycles, Nvidia has been rallying for more than 2 years, creating an overall pump of approximately +1.000%. But now, everything is literally pointing to a significant towards the downside and with a potential drop of -30%, bears are totally taking over Nvidia now.

Levels to watch: $70

Keep your long term vision,

Philip (BasicTrading)

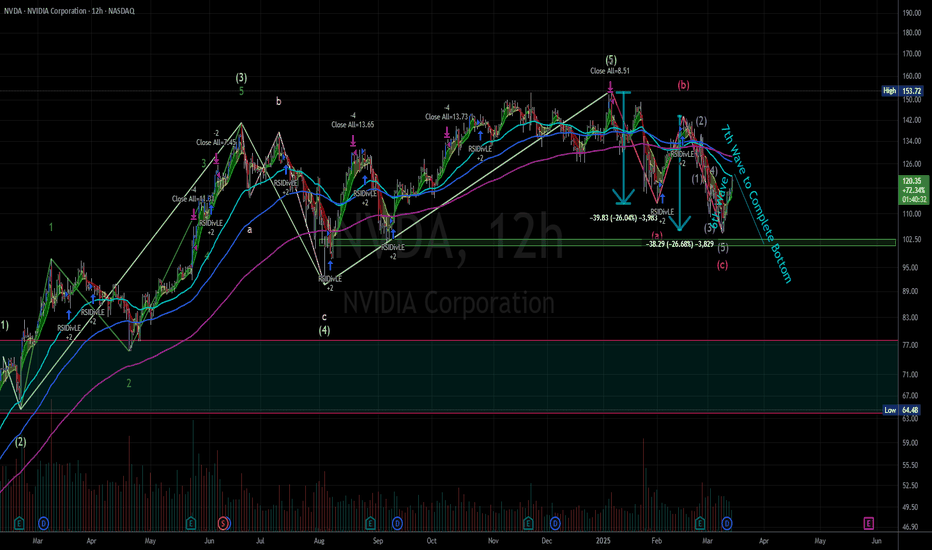

Going Long on NVDA !NVIDIA (NVDA) has been a powerhouse stock, riding the wave of AI, gaming, and data center demand. Recently, the stock experienced a correction, which might have caused some investors to hesitate. However, from an Elliott Wave 2.0 perspective, this pullback was nothing more than a natural ABC correction following a classic 1-2-3-4-5 impulse wave—a textbook setup for long-term bulls.

Understanding the ABC Correction in NVDA

In Elliott Wave theory, after a strong five-wave rally, the market typically experiences a three-wave pullback (ABC correction) before continuing its long-term uptrend. This correction serves to shake out weak hands, reset overbought conditions, and set the stage for the next bullish impulse.

The A-wave is the initial drop as profit-taking kicks in.

The B-wave is the temporary bounce, often mistaken for a continuation.

The C-wave completes the correction, offering smart investors an ideal entry point.

NVDA’s recent pullback aligns perfectly with this structure, meaning the next leg up could be just around the corner.

Why NVDA Remains a Strong Long-Term Bet

AI Dominance – NVIDIA is at the center of the AI revolution, with its GPUs leading the industry.

Data Center Growth – Demand for high-performance computing continues to surge.

Technical Reset – The stock has worked off overbought conditions and is finding new support levels.

The Opportunity: A Strategic Long Entry

Now that the ABC correction has played out, NVDA presents an excellent long entry for those looking to ride the next bullish wave. With strong fundamentals and a technical reset, the stock is primed for another 1-2-3-4-5 impulse move, potentially leading to new all-time highs.

For traders who understand market structure, this is a golden opportunity to go long before the next explosive rally begins. 🚀

NVIDIA’s crushing it as the undisputed king of AI chipsNVIDIA’s crushing it as the undisputed king of AI chips, owning a jaw-dropping 70-95% market share. Their GPUs are the beating heart of data centers worldwide, powering the AI revolution with unstoppable momentum. Last four quarters? A cool $80B in revenue—growth that’s pure rocket fuel. Net margins at +56% scream profitability, while a forward P/E of 23.3 (cheaper than Starbucks!) makes it a steal for this kind of dominance. EPS projected to soar +29% annually over the next five years? That’s long-term winning vibes.

Their Blackwell Ultra chip, set to drop at GTC today, is about to flex even more muscle, and the Vera Rubin superchip’s got tech heads buzzing. Zero debt worries, industry-leading margins, and a massive addressable market—NVIDIA’s fundamentals are a fortress. Sure, trade war noise and a 10% YTD dip spook some, but this oversold gem (RSI 34) is primed to rally hard. Jensen Huang’s a visionary steering this beast, and with AI demand exploding, NVDA’s not just hot—it’s molten. Time to ride this wave, Freund!

I HAVE A NEW STRATEGY! Watch it work for me. SAYS BUY🚨 Exclusive Trading Opportunity – Limited Time Only! 🚨

I've developed an amazing new trading strategy that’s completely unique and never seen before! It’s called the Skyline Scalping Strategy, and it’s designed to pinpoint market direction with extreme accuracy—something that can easily be back-tested by reviewing my previous predictions.

For a limited time, I’ll be posting daily trade signals based on this strategy, allowing you to see exactly where I anticipate the market will move next. Whether you're an amateur trader or a seasoned professional, this is your chance to witness something game-changing in action.

⚠️ Disclaimer: I’m not providing financial advice—just sharing the direction I am planning to make money. The Skyline Scalping Strategy works exclusively on the daily chart, so stay tuned and watch as the predictions unfold!

FOLLOW NOW and don’t miss out on these powerful insights! 📊🔥

Vertical lines are colored and placed to indicate the expected direction of the price. Just my thoughts.

$NVDA down Nvidia's inaugural Quantum Day, scheduled for March 20 during its GTC 2025 conference, underscores the company's commitment to advancing quantum computing. This event brings together industry leaders to discuss current capabilities and future potential, highlighting Nvidia's recognition of quantum technology's growing significance.

Impact on Technology Stocks:

The announcement of Quantum Day has already influenced the stock market. Quantum computing companies like D-Wave Quantum, Rigetti Computing, and IonQ have experienced notable stock price increases, reflecting investor optimism about upcoming developments and collaborations that may be unveiled during the event.

Implications for Quantum Computing and AI:

By dedicating a day to quantum computing, Nvidia signals its intent to integrate quantum advancements with artificial intelligence (AI). This integration could lead to significant breakthroughs in processing capabilities, enabling more complex AI models and applications. The focus on quantum computing at GTC 2025 suggests that Nvidia aims to position itself at the forefront of this convergence, potentially accelerating the commercialization of quantum technologies in AI.

In summary, Nvidia's Quantum Day signifies a strategic move to embrace and promote quantum computing, with anticipated positive effects on technology stocks and the future landscape of AI and computational technologies.

Consider a Long Position: Nvidia Poised for AI-Driven Growth- Key Insights: Nvidia remains a robust choice for investors seeking exposure to

AI technology innovation. The stock recently advanced by over 5%, indicative

of strong positive momentum in the semiconductor sector. Nvidia's strategic

positioning in AI and computing technologies, along with the backing of

seasoned investors, bodes well for its future trajectory. The GTC conference

may serve as a pivotal catalyst for further appreciation in Nvidia’s market

value.

- Price Targets: For the upcoming week, consider the following levels for a long

position. Target 1 (T1) is set at $127, and Target 2 (T2) is at $135. Stop

Level 1 (S1) is $116, and Stop Level 2 (S2) is conservatively placed at

$112. These targets account for Nvidia's recent performance, market

momentum, and anticipated technical challenges.

- Recent Performance: Nvidia has demonstrated remarkable resilience, aiding in

the semiconductor sector's recovery with a noteworthy rise in its stock,

particularly over the past week. This performance underscores its pivotal

role in the AI chip market and its capacity to drive growth during broader

market rebounds.

- Expert Analysis: Analysts continue to express a bullish stance on Nvidia,

emphasizing its technological leadership and potential for long-term growth.

Despite recent market corrections, the general sentiment reflects confidence

in Nvidia's trajectory. Industry voices like Brad Gersner view current

valuations as an appealing entry point for heightened future returns, driven

by the company’s advancements in AI and ecosystem integration.

- News Impact: Nvidia's participation in upcoming key events like the GTC

conference has the potential to bolster market sentiment significantly.

Announcements on next-generation AI developments and products could catalyze

further stock appreciation. Additionally, Nvidia’s recognition in AI circles

and strategic innovations solidify its competitive edge amidst global

technological challenges and geopolitical factors. The entry of new

competitors like Deep Seek, however, adds an element of market complexity

that investors should watch closely.

NVDA Heating Up! Is a Breakout Incoming? Mar 17 weekChecking NVDA on the 4-hour chart for some actionable trade setups.

📈 Technical Analysis (TA):

* NVDA clearly broke through its descending wedge, hinting at a bullish reversal.

* Noticed a Change of Character (CHoCh) which signals the momentum shifting upwards.

* Current resistance (supply zone) around $122–$126 is the key level to watch.

* Major support at the recent BOS around $104.35; keep an eye here if price retraces.

* Upper supply zone around $143 could act as a strong resistance if the breakout continues.

📊 GEX & Options Insights:

* Highest positive NET GEX and call resistance at $126—crucial gamma wall here.

* Strongest PUT support around $110, marking the lower boundary clearly.

* IV Rank at 36.1% suggests moderate premium pricing—consider credit spreads or debit spreads strategically.

* CALL ratio at 28.4% indicating slightly bearish options sentiment.

💡 Trade Recommendations:

* Bullish Play: Wait for NVDA to confidently close above $126; aim calls towards the $140 range. Keep stops tight around $120.

* Bearish Play: Look for rejection at $126. Consider puts targeting the $110–$104 zone.

* Neutral traders can implement Iron Condors or spreads between clear ranges ($110–$126).

🛑 Risk Management: Stick to disciplined trades, and manage your risk carefully given moderate volatility.

Happy trading, team!

Disclaimer: This analysis is for educational purposes only and does not constitute financial advice. Always do your own research and manage your risk before trading.

Nvidia (NVDA) Bullish Opportunity – GTC 2025 & AI GrowthCurrent Price: $121.67

✅ TP1: $130 – (short-term resistance, +7%)

✅ TP2: $145 – (medium-term breakout target, +19%)

✅ TP3: $175 – (analyst target, +43%)

🔥 Why Bullish?

1️⃣ GTC 2025 Conference (March 17-21)

CEO Jensen Huang’s Keynote (March 18) is expected to unveil:

Blackwell Ultra (B300 series): Next-gen AI GPU with 288GB memory.

Rubin GPU Preview: NVIDIA’s roadmap beyond 2026.

Quantum Day (March 20): NVIDIA’s first quantum event, showcasing its role in quantum simulation despite earlier skepticism—potentially broadening its tech leadership.

Market Sentiment: High anticipation for AI & chip updates, with some seeing 30%-50% upside if AI demand is reaffirmed (e.g., new contracts, backlog growth).

2️⃣ Analyst Ratings & Price Targets

Strong Buy Consensus from analysts.

Average 12-Month Price Target: $174.79 → +43.59% upside.

Price Target Range: $120 (low) to $220 (high).

3️⃣ Technical Setup – Breakout Potential

Falling Channel Formation – Price is bouncing from strong support (~$115).

MACD Bullish Crossover – Momentum is shifting in favor of buyers.

Breakout Level: Above $130 would trigger stronger upside.

Another Leg down for NVDAHello Traders,

If we do not see NVDA rise about the $121-$124 level for a large amount of volume... we should see another leg down from this area... I am expecting NVDA to drop below $100 in the next 2 weeks. I personally believe by April this stock will see its bottom around $75. It may happen faster. Good luck.

NVDA - what to expecthi traders,

In this analysis we will have a look at NVDA on 1D time frame.

As we can see, the price found support at 105$ and we got a rejection to the upside.

However, we should be realistic with our expectations.

2 scenarios that I expect to play out:

1. The price gets rejected at the downsloping resistance line and the price will revisit the area of 110-105$ which will be an entry zone for longs.

Stop loss should be placed below 105$.

2. If the price closes below 105$, it should go to the buy zone 2 presented on the chart.

In both scenarios, I expect a new all-time high for NVDA.

Buying at buy zone 2 would be a great entry for a swing traders and long-term investors.

$140 - $150 are imminent for NVDANVIDIA Stock Analysis & Forecast

Price Outlook: $140 - $150 in Sight

NVIDIA (NVDA) has consistently been one of the most rewarding stocks for investors, delivering substantial returns over the past few years. However, following its all-time high (ATH) of approximately $153 on January 7, 2025, the stock experienced a notable pullback, declining to around $105.

Since that dip, NVDA has shown signs of recovery, with the current price stabilizing at $121.67. This upward momentum suggests a potential rally toward the $140 - $150 range in the near term.

Investment Strategy

Long-Term Perspective: Given NVIDIA’s strong fundamentals and market dominance, accumulating shares for long-term investment remains a solid strategy.

Short-Term Trading: For traders, technical indicators suggest potential entry and exit points. Refer to my chart for the accompanying chart for detailed technical analysis (TA) insights.

While the stock has shown resilience, monitoring key support and resistance levels will be crucial in determining the next phase of its movement.

Nvidia Rises Over 4.5% and Reclaims $120 ZoneBy the end of the week, Nvidia's stock has surged to $120 , with the strong bullish movement likely driven by positive results from its largest supplier. Taiwanese company Hon Hai Precision Industry (Foxconn) reported revenues exceeding $30 billion and announced plans to establish the world's largest chip manufacturing plant in Mexico, aimed at improving supply efficiency for its main client, Nvidia. This news has restored investor confidence in the short term, and if this positive momentum persists, the bullish pressure surrounding the stock could intensify further.

Large Bearish Channel:

Despite the recent confidence in Nvidia, it is important to note that since early January, the stock has been forming a large bearish channel, and its current price remains midway within that channel. This suggests that the short-term buying momentum still has room to grow, but it has not yet been strong enough to break the dominant bearish formation.

RSI Indicator:

The RSI indicator has started showing an upward slope, and the RSI line is preparing to cross the neutral 50 level. This could indicate that buying momentum may begin to take control, especially if the RSI line continues to move consistently above this neutral level in the upcoming sessions.

MACD Indicator:

The MACD histogram is showing a similar pattern, as it is currently testing the neutral 0 line. If a crossover occurs, it would suggest that the moving average trends are turning bullish, potentially reinforcing buying confidence in the following sessions.

Key Levels:

$130 – Significant Resistance: This level coincides with the bearish trendline and the 38.2% Fibonacci retracement level. A breakout above this level could challenge the current bearish channel and pave the way for stronger buying momentum.

$115 – Near-term Support: This level aligns with the 61.8% Fibonacci retracement barrier. If bearish oscillations push the price below this level, it could completely negate the current buying sentiment and extend the long-term bearish trend that has persisted for weeks.

By Julian Pineda, CFA – Market Analyst

NVDA - Forming a local bottom? Looking at potential local bottom being formed, new to this but this is my thesis.

To me it looks like the 6th wave is starting to complete, then it going to roll over to form the 7th wave before I would consider it being the bottom. It might pass or meet its recent low(bottom of 6th wave 106-102 range). If it holds there, then I would watch for an accumulation to form. Before it tries to go back up and retest the ATH.

Let me know what you think. Time will educate us on what its going to do.

NVDA Bearish Channel Structure TradeNVDA has been respecting this bearish channel since Nov '24 with 5 touches on the lower trendline and 4 touches on the upper.

NVDA most recently bounced off the lower support, making the 5th touch, and gapped up with the indicies to reclaim the midpoint of the channel. With the midline acting as support, movement towards the upside of $127-$130 is much more likely.

Significant resistance might be met at the $125-$126 level but past that the runway is relatively clear for full retracement of the structure.

Structure trade can be easily invalidated by broader macro factors, tariff revisions, & tweets.

$NVDA double-bottom bull flag long...This is the daily of NVDA with a 150 EMA. In my opinion, we are seeing the formation of a double-bottom bull flag. Since most trends continue, I view this as a high-probability to enter or add to a long position on NVDA. With GTC happening next week as a potential bullish catalyst, this adds to my long conviction. Great trading, everyone.

-MrJosephTrades

NVDA Short Term BuyPrice is currently consolidating within a tight range, and a breakout appears imminent. I am looking for a clean break above resistance, followed by a retest of the breakout level, which could provide a strong buy opportunity. If this setup plays out, the next key target would be the $135 level.

However, this move is likely to be a short-term retracement within a larger downtrend. If price struggles to sustain momentum above $135 and shows signs of weakness, it could indicate a continuation of the broader bearish trend. Confirmation will come from price action signals and volume dynamics on the retest.