PBYI/USD – 30-Min Long Trade Setup !📌🚀

🔹 Asset: PBYI (Puma Biotechnology, Inc.)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Bullish Breakout Trade

📌 Trade Plan (Long Position)

✅ Entry Zone: Above $3.58 (Breakout Confirmation)

✅ Stop-Loss (SL): Below $3.37 (Invalidation Level)

🎯 Take Profit Targets:

📌 TP1: $3.86 (First Resistance Level)

📌 TP2: $4.16 (Extended Bullish Move)

📊 Risk-Reward Ratio Calculation

📉 Risk (SL Distance): $3.58 - $3.37 = $0.21 risk per share

📈 Reward to TP1: $3.86 - $3.58 = $0.28 (1:1.3 R/R)

📈 Reward to TP2: $4.16 - $3.58 = $0.58 (1:2.7 R/R)

🔍 Technical Analysis & Strategy

📌 Ascending Triangle Breakout: Price has formed an ascending triangle, a bullish continuation pattern.

📌 Bullish Momentum Building: A breakout above $3.58 with strong volume confirms the move.

📌 Volume Confirmation Needed: Ensure high buying volume when price breaks $3.58 to confirm upward momentum.

📌 Momentum Shift Expected: If the price holds above $3.58, a move toward $3.86 and then $4.16 is likely.

📊 Key Support & Resistance Levels

🟢 $3.37 – Stop-Loss / Support Level

🟡 $3.58 – Breakout Level / Long Entry

🔴 $3.86 – First Resistance / TP1

🔴 $4.16 – Final Target / TP2

📉 Trade Execution & Risk Management

📊 Volume Confirmation: Ensure high buying volume above $3.58 before entering.

📉 Trailing Stop Strategy: Move SL to entry ($3.58) after TP1 ($3.86) is hit.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $3.86, let the rest run toward $4.16.

✔ Adjust Stop-Loss to Break-even ($3.58) after TP1 is reached.

⚠️ Fake Breakout Risk

❌ If the price fails to hold above $3.58 and drops back, exit early to avoid losses.

❌ Wait for a strong bullish candle close above $3.58 before entering aggressively.

🚀 Final Thoughts

✔ Bullish Setup – Breaking above $3.58 could lead to higher targets.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.3 to TP1, 1:2.7 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀📈

🔗 #StockTrading #PBYI #LongTrade #TechnicalAnalysis #MomentumStocks #ProfittoPath #TradingView #StockMarket #SwingTrading #RiskManagement #ChartAnalysis 📈🔥

PBYI trade ideas

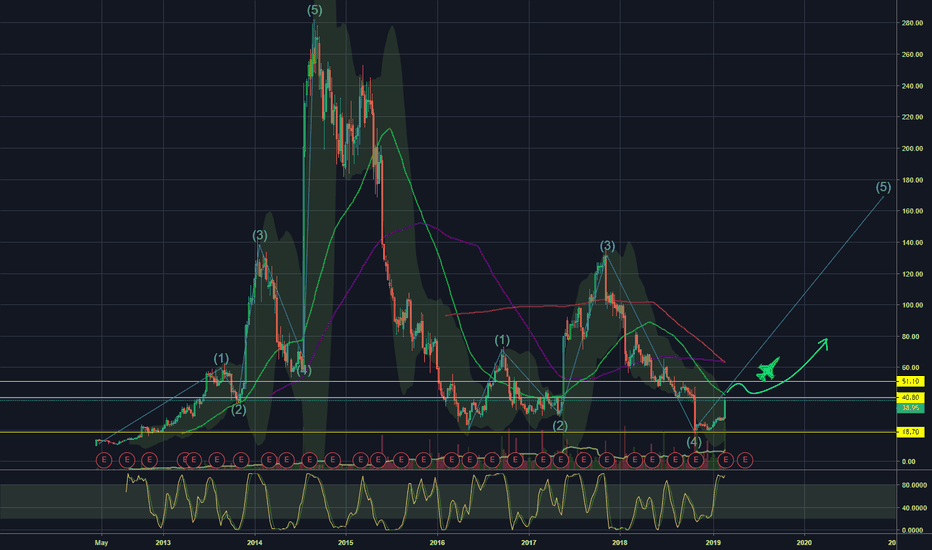

Puma Biotechnology | Chart & Forecast SummaryKey Indicators On Trade Set Up In General

1. Push Set Up

2. Range Set up

3. Break & Retest Set Up

Notes On Session

# Puma Biotechnology

- Double Formation | Downtrend

* Triangle Subdivision

- HH & HL | Uptrend Infliction

- Entry Bias Hypothesis | 012345

- Retracement | Wave Confirmation

Active Sessions On Relevant Range & Elemented Probabilities;

London(Upwards) - NYC(Downwards)

Conclusion | Trade Plan Execution & Risk Management On Demand;

Overall Consensus | Buy

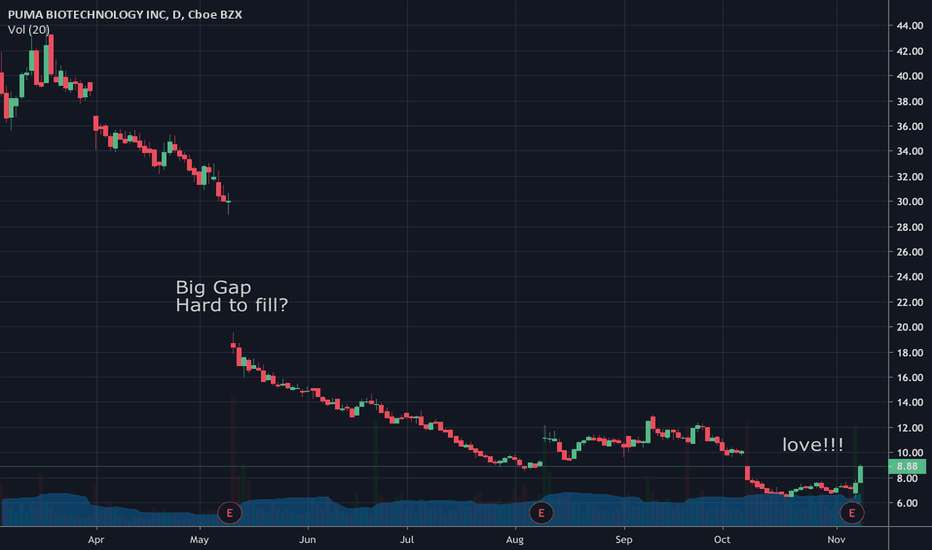

PBYI a speculative biotech LONGPBYI according to the recent earnings as no earnings nor revenue. This is typical in the biotechnology sector.

This 4H chart shows a consistent downtrend with a couple of minor pullback corrections shown with a Doji followed

by a green engulfing candle but with low volume and the K/D lines of the MACD did not on the histogram.

In the present, the volume pattern shows relatively high selling volume then reversed to buying volume which is above the

moving 50 period average shown as the green horizontal line. Moreover, in this episode, the MACD/Signal lines have crossed

and curled up. The histogram has sent positive after being negative since early February.

I interpret this as being an early reversal now ripe for entry. Just like in nature, the early bird gets the worm.

Buyer beware biotechnology stocks that have market cap based on high potentials are speculative but potentially

offer high rewards. I see a reasonable target as a 50% retracement of the downturn or about $ 3.50 ( this is

less than the upside of some analysts ) PGYI is up 10% today. the train is leaving the station with momentum.

I see a potential takeover or a low float short squeeze.

(See also the link below )

Puma Biotech in Red. PBYIStart of new zigzag is confirmed. Conservative Fib extension will actually show like end of next downward A Wave. We have reason to believe that there is much more room for Puma to pounce much, much lower.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

PBYI, Aroon Indicator entered a Downtrend on June 29, 2020.For the last three days, Tickeron A.I.dvisor has detected that PBYI's AroonDown red line is above 70 while the AroonUp green line is below 30 for three straight days. This move could indicate a strong downtrend ahead for PBYI, and traders may view it as a Sell signal for the next month. Traders may consider selling the stock or exploring put options. Tickeron A.I.dvisor backtested this indicator and found 259 similar cases, 238 of which were successful. Based on this data, the odds of success are 90%.

Downward (Re-test All time Low?) - Monthly Interval - PBYIHello Successful Investors,

The stock (PBYI) presents a worrisome investor consensus as enough there have been minimal price jumps, the overall trend is quite significantly negative (bearish). Considering this month's bearish trend, there may be an opportunity to cultivate all time lows. Await confirmation prior to entering the market.

Resistance Level 2 - (135.00 - 136.25) 1.25 cent interval

Resistance Level 1 - (77.50 - 78.75) 1.25 cent interval

Key Price Zone (KPZ) - (50.25 - 60.25) 1.00 dollar interval

Support Level 1 - (16.00 - 17.25) 1.25 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only (Be Conscientious and Stick To Your Trading Plan)***

-LionGate