$PLAY Shares Bounce From Existential DreadPLAY shares printed an RSI well under 10, which is historically unprecedented. But, like a lot of stocks right now, this is a balance sheet play. The company is pricing in a strong chance of liquidation and death. Watch for a very volatile range ahead, but know that shorts are plenty and vulnerable if the squeeze heats up.

PLAY trade ideas

$PLAY Is A $60 Stock In A Buyout$PLAY is breaking out on the news that investor KKR has taken an activist stake in the company. This is great news for shareholders and why we think higher prices are in store.

KKR (NYSE:KKR) reports holding a 6.3% stake in Dave & Buster's Entertainment (NASDAQ:PLAY).

KKR says it has held talks with D&B management about strategy and is considering further talks with shareholders about transactions and board changes.

Shares of PLAY are up 12.58% to $47.37 vs. the 52-week trading range of $37.20 to $59.60.

Worth noting is that 21.45% of the float is short, so expect short-covering to continue.

If KKR does take $PLAY private, look for a price north of $60. $PLAY has 20% revenue per share growth (maybe more), 20% earnings per share growth, and a real p/e of about 6.

As always, trade with caution and use protective stops.

Good luck to all!

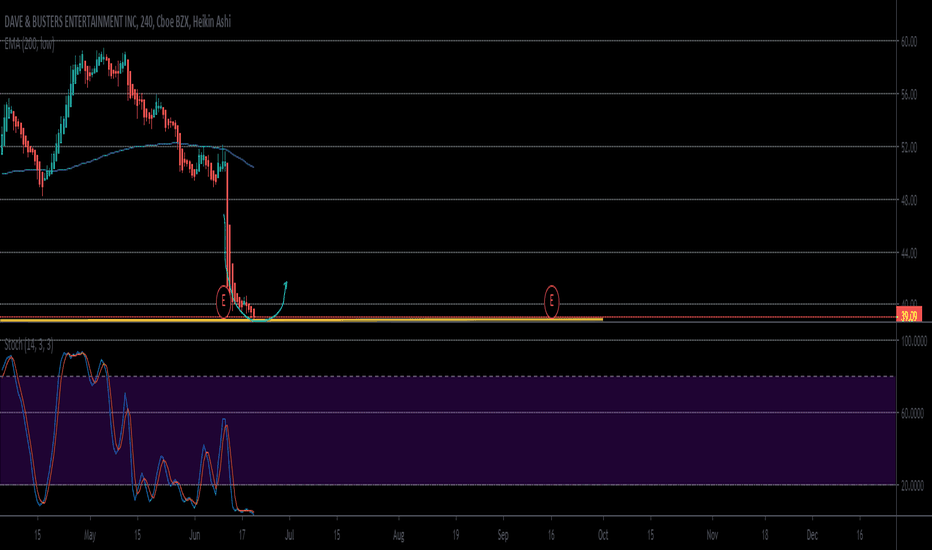

PLAY - for a short play

PLAY- from the services industry, is in a negative momentum.

A month has passed since the last Play’s earnings report, the stock have lost about 3.2% during that time.

Scheduling for Short when breaking 39 level.

First target is 38.

All of the above, of course, at your discretion, your generally accepted trading rules, trading strategies and your preferred business management. This is not a recommendation to buy/sell.

Goodluck...

$Play LongTradingView

Open position at $39

Stop loss at $37

Take profit at $42

Dave and Buster looks pretty bottom out on the daily time frame, it's near a triple bottom and pretty much can't go down further unless market tanks.

We might enter a bullrun so this would be a pretty good long shot play.

PLAY Short on Disappointing Earnings for a Day Trade PLAY has a nice bearish daily chart, below all major moving averages fallen below the trendline (blue color), gaping all the way down from $52 to $41. The Earnings were below expectations and premarket now is gaping down below the major daily pivots I have drawn on the Daily chart which are $45.47 and the other major one $42.50. Provided that it stays close to the $42.50 pivot and doesn't fade too much premarket, it has a good high probability Short opportunity and room to fade until $37.43 and then $34.24. It needs good volume at the market open (min 500,000 shares in first 5 minutes of market open) and it should stay below $42.50 pivot.

$PLAY Dave & Buster's is a Good company but Bad stock to hold.The stock of PLAY has 10 buy ratings and 1 overweight rating but it just keeps disappointing investors, SEEMINGLY IN CORRECTION SINCE JULY 2017, and it doesn't look like it is over. The stock has been selling off in quite high volume into earnings so investors are nervous regarding results and the chart technically is very BEARISH. Having lost all support from they MA'S it looks very vulnerable to a drop out of what could be interpreted as a bear flag formation. We think any bounce in the stock will be short lived and more downside is needed, to complete the overall C wave of the correction back to the $38-$34 region.

AVERAGE ANALYSTS PRICE TARGET $63

AVERAGE ANALYSTS RECOMMENDATION BUY

SHORT INTEREST 17.44%

P/E RATIO 17.25

COMPANY PROFILE

Dave & Buster's Entertainment, Inc. is an owner and operator of entertainment and dining venues under the name Dave & Buster's. Its concept is to offer its customers the opportunity to Eat Drink Play all in one location, through a full menu of casual dining food items and a full selection of non-alcoholic and alcoholic beverage items together with an extensive assortment of entertainment attractions, including skill and sports-oriented redemption games, video games, interactive simulators and other traditional games. The company was founded by David O. Corriveau and James W. Corley in 1982 and is headquartered in Dallas, TX.

Dave n Busters earnings Bullish earnings playPLAY is going up on good earnings because it almost always does for the April report.

The history is full of a double bottoms before earnings, then a breakout to the upside after.

Plus, I went there a few times over the holidays, and everybody knows that I only do things if everybody else is doing them. Based on this nonsense, I predict that Dave n Busters is going to report a very nice quarter.

The 50/51 april debit call spread for about .50 looks like fun.

Play..resistant cleared.Today we are going to look at Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) to see whether it might be an attractive investment prospect. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

Understanding Return On Capital Employed (ROCE)

ROCE measures the amount of pre-tax profits a company can generate from the capital employed in its business. All else being equal, a better business will have a higher ROCE. Ultimately, it is a useful but imperfect metric. Renowned investment researcher Michael Mauboussin has suggested that a high ROCE can indicate that ‘one dollar invested in the company generates value of more than one dollar’.

lets play PLAY!Today we are going to look at Dave & Buster’s Entertainment, Inc. (NASDAQ:PLAY) to see whether it might be an attractive investment prospect. Specifically, we’ll consider its Return On Capital Employed (ROCE), since that will give us an insight into how efficiently the business can generate profits from the capital it requires.

Firstly, we’ll go over how we calculate ROCE. Second, we’ll look at its ROCE compared to similar companies. Last but not least, we’ll look at what impact its current liabilities have on its ROCE.

PLAY pullback buy position startedPullback to support

Channel S&R: yes, rising up trend.

MA S&R: no. market in correction

>200ma: yes

Volume confirmation: yes, today buy vol > last 5 days down vol.

Candle Confirmation: no

Reg Trendline > 85: n/a

Shrs Float:37M

Short Float: 12%

Risk / Reward: 3:1

Zacks Rank: 2-Buy 2 Style Scores: B Value | B Growth | B Momentum | A VGM Industry Rank: Bottom 41%(150 out of 255) Industry: Retail - Restaurants

Recent Analyst commentary:

Dave & Buster's initiated with a Buy at Gordon Haskett Gordon Haskett analyst Jeff Farmer initiated Dave & Buster's with a Buy rating and $70 price target. Farmer sees the return of SSS growth in Q4 as a "multiple expansion catalyst."