PSEC trade ideas

Purchase of bonds by Prospect Capital Corp. due in 2025- Issuer: Prospect Capital Corporation

- ISIN: US74348GKE97

- Coupon: 5.5% (in US dollars), paid twice a year

- Repayment: December 15, 2025

- Yield to maturity: 11.7%

- Rating: BBB-

- Premium: About 6 basis points for securities of similar quality

Justification of the purchase:

Prospect Capital Corporation** (PSEC) is one of the largest players in the medium-term loans segment for medium-sized businesses, offering structured loans, share buybacks and secured loans. In 2024, the company showed positive financial results, despite certain legal and financial challenges.

Key financial indicators:

- Revenue: $861.66 million, an increase of 1.11% compared to the previous year.

- Operating profit: $580.08 million.

- Net profit: $262.83 million, but it was partially reduced due to losses from the sale of investments.

- Debt: reduction of debt–to-assets ratio to 30.5% and equity ratio to 44.7%.

- Free cash flow: $279.98 million.

The reasons for the discount:

1. Law risks: Prospect Capital Corporation has been involved in several lawsuits, including a dispute with the law firm Morgan Lewis & Bockius LLP over the issue of subordination, as well as an investigation by the US Department of Justice related to the company's medical assets. These factors put pressure on the company's reputation and assets.

2.Financial problems: Issues identified during the investigation made it difficult to sell some assets, which also affected investor confidence.

Growth prospects:

Prospect Capital intends to restructure its portfolio, focusing on senior secured loans. The key advantage of the company is a $2.1 billion credit line, which provides high liquidity and the ability to flexibly respond to market changes.

Conclusion:

We recommend the purchase of Prospect Capital Corporation bonds maturing in 2025, as the current discount and high yield of 11.7% per annum provide an attractive opportunity for investors who are ready for moderate risks.

Prospect Capital - Prospecting in Red. PSECAnother bearish setup for a Capital corporation. It seems we have done a five wave impulse and are now correcting. Indicators confirm dropping momentum and divergence on oscillators also present on multiple timeframes.

We are not in the business of getting every prediction right, no one ever does and that is not the aim of the game. The Fibonacci targets are highlighted in purple with invalidation in red. Fibonacci goals, it is prudent to suggest, are nothing more than mere fractally evident and therefore statistically likely levels that the market will go to. Having said that, the market will always do what it wants and always has a mind of its own. Therefore, none of this is financial advice, so do your own research and rely only on your own analysis. Trading is a true one man sport. Good luck out there and stay safe!

TrendsThis is one I have admired for some time. The recovery of this stock from the COVID affect was impressive.

Keeping an eye on your market value versus historical returns from dividends is always a good thing to do.

Recommend this one inside of an IRA for tax reasons.

Here we have been seeing a shelf form due to complacency of market direction probably.

This, in my opinion, is a high price range if considering historical values. Now this doesn't matter all that much if you are in for dividends (as you probably should be), but for those just looking for shorter returns, your top occurred quite some time ago

Will be interesting to see where this goes. A catalyst is needed to bump in either direction.

Not investment advice, please do your own DD & research.

Long $Psec , just dipped ! good buy nowWhat is the support and resistance for Prospect Capital (PSEC) stock price?

PSEC support price is $5.03 and resistance is $5.39 (based on 1 day standard deviation move). This means that using the most recent 20 day stock volatility and applying a one standard deviation move around the stock's closing price, stastically there is a 67% probability that PSEC stock will trade within this expected range on the day.

RSI indicating a buy signal as well!

prediction: 5.50 near end of the week.

hopefuly stock can break resistance.

I will buy some stocks now at 5.08cent and hope it goes to 5.50!

$PSEC long term dividend. This is one of my dividend holdings that I picked up on Friday (1,000 shares). It pays an 11% annual dividend, but also enjoys movements of quick bearish drops and equally quick recoveries.

Full details of this play at https://wingtrades.com!

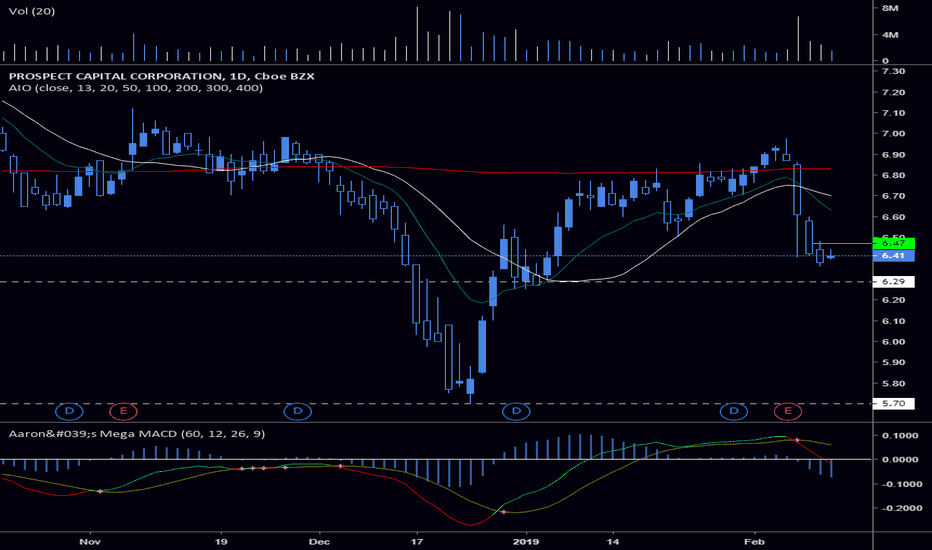

My entry of 1,000 shares was at $6.47 on Friday, February 8, 2019.

PSEC overbought much?PSEC is looking like a falling knife incoming.

Three black crows, and heavily overbought on stochastic and stochastic RSI.

Dividend is past exdiv, and earnings were good. Looks like it may be time to scoop up profits and wait for the knife to fall.

Stochastic is the blue and orange lines and stochastic RSI are the red and green Areas

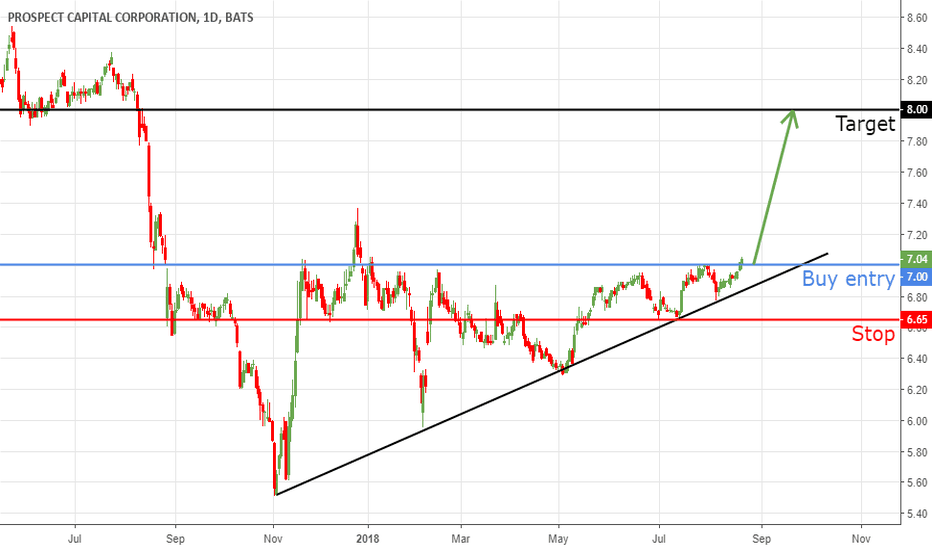

PSEC- Time 2 BuyFor rest of 2017 it is buy time. On 11/21/17, four insiders bought 2,613,260 shares for $6.70. When cluster of insiders buy, strongly consider buying, jumping on same train.Insider buying, especially cluster buying is a strong LEADING indicator of future price action. I think that PA will hit $8.00 by end of this year.

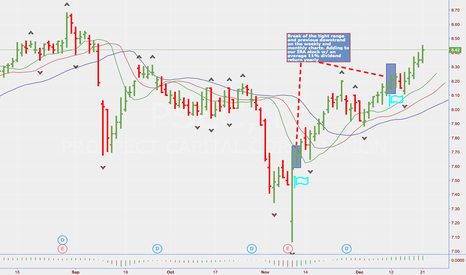

Could get a pop in PSECAny EW'ers out there, I'd appreciate your input into PSEC and the rest of the BDCS composite ETF.

There may be a C wave up termination as an Ending Diagonal completing in PSEC. Lots of overlap throughout the structure.

I'm anticipating one final motive rally pattern up, perhaps an Ending Diag as wave 5 of C.

Targeting 8.87 or as high as 9.61.

Currently, the last 2 legs are a very strange looking pattern with odd proportions to each other.

But things are still objectively trending upward within a channel, albeit broken down wider in Sept.