7/11/24 - $psmt - Another beat; LT buy <$807/11/24 :: VROCKSTAR :: NASDAQ:PSMT

Another beat; LT buy <$80

- You like NASDAQ:COST at 50x fwd EPS and low teens (at best) EPS growth?

- In the same vein as my comment on NASDAQ:LULU > $NKE... you own the smaller co that's proven itself/ it's niche and is growing faster at a more attractive valuation (always). usually you pay MORE for this once you reach validation

- NASDAQ:PSMT is the costco of central america (+ colombia + some islands). they are growing EPS at mid teens and valuation is in the high teens PE.

- stock has done the exact same donk move the last two BEATS (see green arrows) and proceeded to march higher

- this also follows my strategy of identifying potential smaller caps that will run in the coming weeks/ months/ year ahead which require 1) good balance sheet 2) growing 3) reasonable valuations

- this is not an obvious *pop* play like some of my recent dip buy rec's ( NASDAQ:OLPX , NASDAQ:TXG , NYSE:OLO come to mind)... but something you can DCA into and likely earn a nice 15%+ annualized. it's a compounder esp how they're executing and beating earnings (multiple WILL go up in time).

- my theoretical take profit here is in the low 90s, perhaps i rent some upside selling C's here. maybe i sell the whole thing and like other opportunities. maybe it goes up 5% in the coming days (it was up 7% pre market!) and i decide that's good enough to have rented the stock for some short period of time. i don't beholden myself to anything. water my friends... be like water as mr. bruce lee says.

lmk if u see it differently or agree

V

PSMT trade ideas

Pricesmart Inc. (PSMT:NASDAQ) Q3 Earnings ReportPricesmart Inc. Q3 Earnings Report: Analyst Predictions and Outlook

Introduction:

Pricesmart Inc., a leading warehouse club operator, is set to release its Q3 earnings report on July 10th. This article provides an informative overview of analyst predictions and expectations for Pricesmart's earnings, including earnings per share (EPS) and sales figures for the quarter. Investors can monitor the stock price in real-time ahead of the earnings release.

I. Analyst Predictions for Q3 Earnings

EPS Forecast:

Analysts have predicted an EPS of $0.852 for Pricesmart's Q3 earnings, versus $0.620 per share in the same quarter of 2022. The anticipated increase suggests a positive growth trajectory for the company with scope for the stock's price to rise.

Sales Growth:

Analysts expect Pricesmart to report sales of $1.10 billion for Q3, reflecting a 6.82% increase compared to the same period last year. This growth is indicative of the company's ability to capture consumer demand and expand its market presence.

II. Fiscal Year Outlook

EPS Expectations:

Analysts project that Pricesmart's EPS for the full fiscal year will be $3.72, compared to $3.38 in the previous year. This projected growth suggests a positive outlook for the company's profitability over the long term.

Revenue Outlook:

On average, analysts anticipate Pricesmart's revenue for the fiscal year to reach $4.38 billion, compared to $4.07 billion in the previous year. This projected increase reflects the market's confidence in the company's ability to drive sales growth and leverage its competitive position.

Conclusion:

With Pricesmart's Q3 earnings report scheduled for release on July 10th, analysts are forecasting an EPS of $0.852 and a sales increase of 6.82% compared to the previous year. The fiscal year outlook indicates expected growth in both earnings per share and revenue. Investors can monitor the stock price in real-time to stay updated on market sentiment leading up to the earnings announcement.

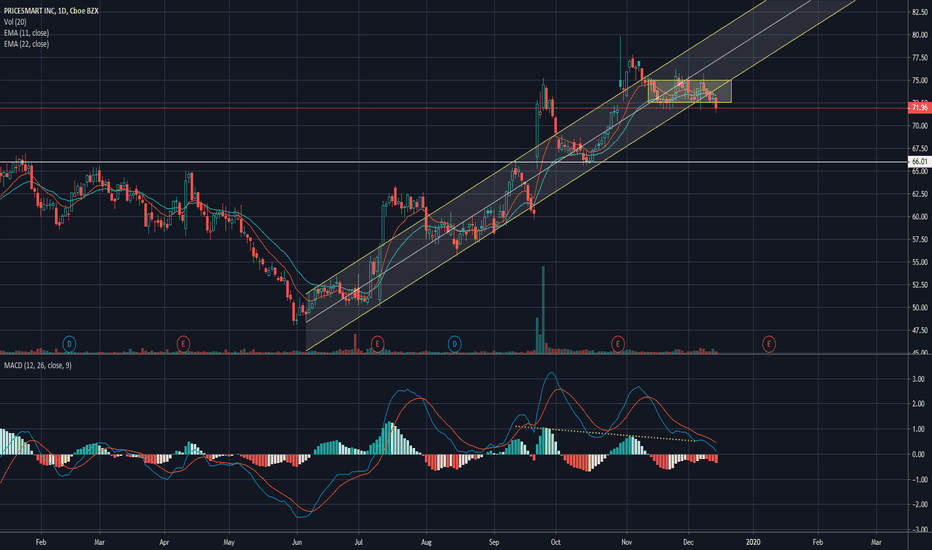

PSMTComplete nonsense for myself. But guess though as the divergence created a bottom and start of new trend. Would expect it to work back to a more neutral reading and smaller bounce with another reset before next leg back to top of green range box and hopefully over. Personal guess for BS purposes.

Earnings ignites a very Bullish reversal in Pricesmart.TODAYS UPGRADE

PriceSmart upgraded to Outperform from Sector Perform at Scotiabank. Scotiabank analyst Rodrigo Echagaray upgraded PriceSmart to Outperform from Sector Perform and lowered its price target to $82 from $86.

Read more at: The Fly

AVERAGE ANALYSTS PRICE TARGET $78.67

AVERAGE ANALYSTS RECOMMENDATION OVERWEIGHT

P/E RATIO 26.31

SHORT INTEREST 4.58%

COMPANY PROFILE

PriceSmart, Inc. engages in the international management and operation of membership warehouse clubs. It operates through the following geographical segments: United States Operations, Central American Operations, Caribbean Operations, and Colombia Operations. The United States Operations covers include distribution centers and corporate offices. The Central America Operations segment f covers Panama, Guatemala, Costa Rica, El Salvador, Honduras, and Nicaragua. The Caribbean Operations segment includes Dominican Republic, Aruba, Barbados, Trinidad, U.S. Virgin Islands, and Jamaica. The company was founded by Sol Price and Robert E. Price in 1994 and is headquartered San Diego, CA.

Quarterly Earnings - Monthly Interval - PSMTHello Successful Traders,

The stock (PSMT) will be releasing Q2Es today (April 9th). Considering the prevalent breakout towards the downside (be cautious), there could a further push (trend continuation). Acknowledge that while fundamentals are a viable approach to entering and exiting the market, it is still an immense risk (so utilize a viable risk management itinerary).

Resistance Level 2 - (127.55 - 127.85) 30 cent interval

Resistance Level 1 - (126.90 - 127.20) 30 cent interval

Key Price Zone (KPZ) - (81.50 - 81.75) 25 cent interval

Support Level 1 - (55.40 - 55.65) 25 cent interval

Support Level 2 - (10.50 - 10.80) 30 cent interval

Not Investment Advice. For Educational and Analytical Purposes Only. (Be Conscientious and Stick To Your Trading Plan)***

-LionGate