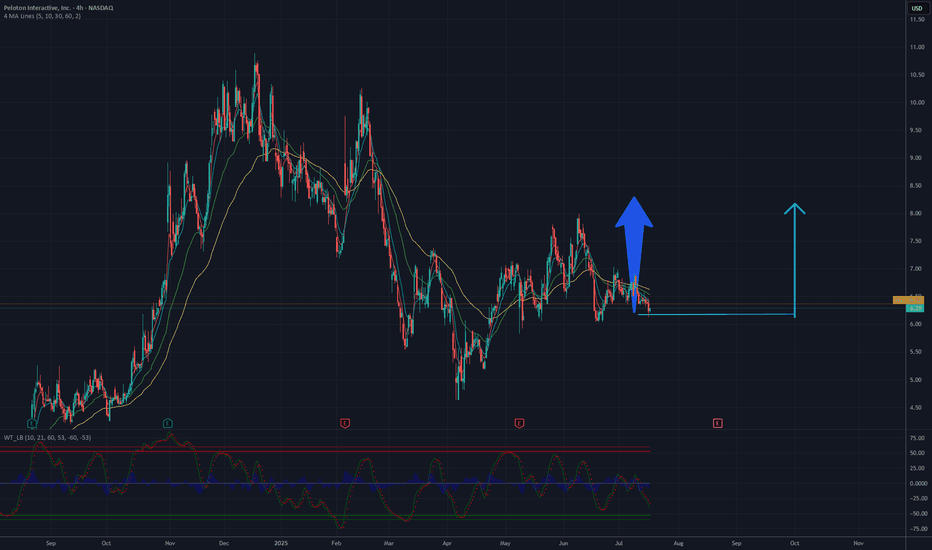

It's a time for Peloton Interactive, Inc. (PTON)-Target 8.20 $The chart analysis for Peloton Interactive, Inc. (PTON) suggests a potential rise with a target of 8.20 USD. The 4-hour chart indicates a recent downtrend from a peak around 10 USD, with the current price stabilizing near 6.30 USD. A key support level is observed around 6 USD, which could provide a strong base for an upward move. The 50-day and 200-day moving averages are converging, hinting at a possible trend reversal if buying pressure increases.

Breaking through the resistance at 6.50-6.70 USD, a recent consolidation zone, could trigger a rally. With rising volume and bullish candlestick formations, the price may aim for 8.20 USD, a significant resistance level based on prior highs. The RSI, currently in oversold territory, could support this upward movement if it starts to recover, indicating renewed momentum. However, a drop below 6 USD support could invalidate this outlook and lead to further declines.

Potential TP: 8.20 USD

PTON trade ideas

PTON is staging a potential long-term rebound. NASDAQ:PTON is looking very strong upside after it has broken out of the major downtrend line which started in Feb 2021 and the recent rebound was seen rebounding off strongly above 61.8% Fibonacci retracement level. NeXT, the stock is building up very aggressive uptrend channel with recent bullish morning star in the midst. Inverted head and shoulder is close to completion and prices have trend above all ichimoku indicators.

Long-term MACD is back to the neutral phase. Mid-term stochastic rose steadily, indicating healthy mid-term upside momentum and short-term 23-period ROC has rebounded above the zero line.

Volume remain healthy and Directional Movement index is showing early signs of bullish strength.

Target remain is at 13.20.

$PTON - LongNASDAQ:PTON in lower time frames is reversing. If momentum to upside continues, this would be a good trade for short-term.

* First Entry: $7, targeting the daily supply around ~$7.75

* Second Entry: ~$6, if price continues lower, with the same $7.75 targe if the first entry doesn't reach it.

PTON - 3 months HEAD & SHOULDERS══════════════════════════════

Since 2014, my markets approach is to spot

trading opportunities based solely on the

development of

CLASSICAL CHART PATTERNS

🤝Let’s learn and grow together 🤝

══════════════════════════════

Hello Traders ✌

After a careful consideration I came to the conclusion that:

- it is crucial to be quick in alerting you with all the opportunities I spot and often I don't post a good pattern because I don't have the opportunity to write down a proper didactical comment;

- since my parameters to identify a Classical Pattern and its scenario are very well defined, many of my comments were and would be redundant;

- the information that I think is important is very simple and can easily be understood just by looking at charts;

For these reasons and hoping to give you a better help, I decided to write comments only when something very specific or interesting shows up, otherwise all the information is shown on the chart.

Thank you all for your support

🔎🔎🔎 ALWAYS REMEMBER

"A pattern IS NOT a Pattern until the breakout is completed. Before that moment it is just a bunch of colorful candlesticks on a chart of your watchlist"

═════════════════════════════

⚠ DISCLAIMER ⚠

Breakout Area, Target, Levels, each line drawn on this chart and any other content represent just The Art Of Charting’s personal opinion and it is posted purely for educational purposes. Therefore it must not be taken as a direct or indirect investing recommendations or advices. Entry Point, Initial Stop Loss and Targets depend on your personal and unique Trading Plan Tactics and Money Management rules, Any action taken upon these information is at your own risk.

═════════════════════════════

Long Trade Setup Breakdown for (PTON) 30 Mins📊

🔹 Asset: Peloton Interactive, Inc. (PTON)

🔹 Timeframe: 30-Min Chart

🔹 Setup Type: Rising Wedge Breakout

🚀 Trade Plan (Long Position):

✅ Entry Zone: $10.14 (Breakout Confirmation)

✅ Stop-Loss (SL): $9.74 (Below Support)

🎯 Take Profit Targets (Long Trade):

📌 TP1: $10.64 (First Resistance)

📌 TP2: $11.11 (Extended Bullish Target)

📊 Risk-Reward Ratio Calculation:

📈 Risk (Stop-Loss Distance):

$10.14 - $9.74 = $0.40

📈 Reward to TP1:

$10.64 - $10.14 = $0.50

💰 Risk-Reward Ratio to TP1: 1:1.25

📈 Reward to TP2:

$11.11 - $10.14 = $0.97

💰 Risk-Reward Ratio to TP2: 1:2.4

🔍 Technical Analysis & Strategy:

📌 Breakout Confirmation: Strong buying momentum above $10.14 signals continuation.

📌 Pattern Formation: Rising wedge breakout, indicating a bullish move.

📊 Key Support & Resistance Levels:

🟢 $9.74 (Strong Support / SL Level)

🟡 $10.14 (Breakout Zone / Entry)

🔴 $10.64 (First Profit Target / Resistance)

🟢 $11.11 (Final Target for Momentum Extension)

🚀 Momentum Shift Expected:

If price stays above $10.14, it could push towards $10.64 and $11.11.

A higher volume breakout would confirm strength in the trend.

🔥 Trade Execution & Risk Management:

📊 Volume Confirmation: Ensure buying volume remains strong after breakout.

📈 Trailing Stop Strategy: If price reaches TP1 ($10.64), move SL to entry ($10.14) to lock in profits.

💰 Partial Profit Booking Strategy:

✔ Take 50% profits at $10.64, let the rest run to $11.11.

✔ Adjust Stop-Loss to Break-even ($10.14) after TP1 is hit.

⚠️ Fake Breakout Risk:

If price drops below $10.14, be cautious and watch for a retest before re-entering.

🚀 Final Thoughts:

✔ Bullish Setup – If price holds above $10.14, higher targets are expected.

✔ Momentum Shift Possible – Watch for volume confirmation.

✔ Favorable Risk-Reward Ratio – 1:1.25 to TP1, 1:2.4 to TP2.

💡 Stick to the plan, manage risk, and trade smart! 🚀🏆

🔗 #StockTrading #PTON #BreakoutTrade #TechnicalAnalysis #MarketTrends #ProfittoPath

1/7/25 - $pton - Ambiguous at $9, 2025 R/R poor1/7/25 :: VROCKSTAR :: NASDAQ:PTON

Ambiguous at $9, 2025 R/R poor

- have followed this yoga pants-wearing, starbucks guzzling, taylor swift blastin' name for some time

- first, the balance sheet/ net debt levels require some obvious cash flow generation to be neutralized... especially after a 2.5-3x move from floor

- on one hand the marginal change in sales (from -ve to +ve, probably in 4Q) is already baked in the calorie-free, guilt-free cake.

- and EBITDA mgn already forecasted at DD for this year and next, with not much expansion on the top line (which will at this stage take at LEAST 2-3 Q's - probably more - to get visibility on and materially alter real mkt consensus).

- so even if i assume 200 mm in 2026 fcf (another 20% bump to already likely bullish #s, i can only get to mid 3's - and for a lot of risk on a stretched out maxed out dopamine busted consumer). "yes" their B2B biz is awesome - top of the line - i love it. i do think mgmt gets a B+ all in...

- but friends don't let friends buy high teens EBITDA multiples for low DD's EBITDA growth on tough balance sheets, a name that's already worked (just don't chase it!) and a not-need-to-own name. if u like consumer discretionary just own NYSE:YETI , which is hard enough to own in this environment, but such a low-key sleep-at-night no bears in yo food middle of the night name).

as you can tell it's late. i'm reviewing some oldies i've never written up. maybe a bit more wit. excuse the hyperbole (i'm not restricted in terms of my investment committee anymore so i let it rip these days).

be well <3

V

PTON Analysis: Dark Pool Levels & Trade SetupsThis chart analysis focuses on Peloton Interactive, Inc. (PTON), observed on the daily timeframe, with a strong emphasis on institutional activity highlighted by Dark Pool Levels (represented by white dashed lines). The stock is currently at a critical juncture, where the price action is consolidating near a significant dark pool level ($9.38). This suggests a potential setup for a decisive move, either continuing the bullish trend seen earlier or reversing into a bearish correction.

By integrating key technical indicators—such as Exponential Moving Averages (8 EMA and 21 EMA), pivot levels, and volume analysis—this analysis aims to provide a clear trading plan, including profit targets and stop-loss levels, for both bullish and bearish scenarios. The focus is on aligning with institutional behavior and leveraging price action around pivotal levels to make well-informed decisions.

Trend and Price Action

The stock experienced a bullish breakout in early September, as the price moved above the 8 EMA and established a strong uptrend.

The bullish momentum was further confirmed by the price staying consistently above the 21 EMA, signaling institutional interest and strong upward momentum.

Recently, the price has entered a consolidation phase, trading within a range near the critical dark pool level of $9.38, suggesting indecision or accumulation by larger players.

Key Indicators

8 EMA and 21 EMA:

The 8 EMA (yellow line) has acted as a reliable support throughout the uptrend. It remains a critical level to watch for trend continuation.

The 21 EMA (blue line) serves as a secondary support and trend confirmation tool. A break below this level may signal a trend reversal.

Pivot Points:

Resistance Levels:

R1 ($10.53): The first major resistance, where the price has struggled to break through during the consolidation phase.

R2 ($11.28) and R3 ($12.49): Potential targets if the bullish trend resumes.

Support Levels:

S1 ($8.10): Key support below the current price. A breakdown here could trigger a bearish move.

S2 ($7.35) and S3 ($6.13): Deeper support levels for potential downside targets.

Dark Pool Levels:

The white dashed lines represent areas of significant institutional activity. These levels often act as zones of support or resistance, with the current level at $9.38 being a key area to watch.

Volume:

Volume spikes during November indicate strong participation by institutional traders, likely around dark pool levels.

Current volume shows signs of normalization, suggesting a period of consolidation or preparation for the next big move.

Patterns Observed

The chart shows a rising channel (from September to November), indicating steady bullish momentum. However, the price has broken out of this channel and entered a sideways consolidation near $9.38.

The consolidation near a dark pool level is often a precursor to a breakout or breakdown, as institutional traders accumulate or distribute their positions.

Bullish and Bearish Scenarios

Bullish Scenario:

Key Factors:

The price remains above the $9.38 dark pool level and the 8 EMA, showing bullish momentum.

A breakout above R1 ($10.53) could trigger a run toward R2 ($11.28) and potentially R3 ($12.49).

Entry Point:

Enter a long position above $9.50, confirming a bounce off the dark pool level.

Profit Targets:

First target: $10.53 (R1).

Second target: $11.28 (R2).

Stretch target: $12.49 (R3).

Stop Loss:

Place a stop-loss below $9.00, as a breach would invalidate the bullish setup.

Bearish Scenario:

Key Factors:

A sustained breakdown below the $9.38 dark pool level and the 8 EMA, with volume confirmation, would indicate bearish pressure.

A break below S1 ($8.10) could lead to a deeper decline toward S2 ($7.35) or even S3 ($6.13).

Entry Point:

Enter a short position below $9.30, confirming a breakdown.

Profit Targets:

First target: $8.10 (S1).

Second target: $7.35 (S2).

Stretch target: $6.13 (S3).

Stop Loss:

Place a stop-loss above $9.50, as it would invalidate the bearish setup.

Conclusion

PTON is at a critical juncture, consolidating near a dark pool level at $9.38. A breakout above $10.53 could reignite the bullish momentum toward higher resistance levels, while a breakdown below $9.38 could trigger a bearish move to key support zones. This setup offers a clear trading plan with well-defined entry points, profit targets, and stop-loss levels, allowing for strategic risk management.

Peloton Short - Thanks for the rideStoryline: CFO sold shares + (bad economic data incoming?)

Chart: Weekly high broken, retrace due as usual.

Question: Was that whole pump really reasonable?

You can bet that the majority of retail investors bought (as always) on the very top during this wonderful pump and now just patiently waits to feel the real pain of retracement. I doubt in general, that this was a major turnaround for the company, yet.

PTON Peloton Interactive Options Ahead of EarningsAnalyzing the options chain and the chart patterns of PTON Peloton Interactive prior to the earnings report this week,

I would consider purchasing the 3.50usd strike price Calls with

an expiration date of 2024-8-23,

for a premium of approximately $0.24.

If these options prove to be profitable prior to the earnings release, I would sell at least half of them.

Peloton Shares Spike 21% As Turnaround Plan Takes Hold

Overview

The Bike and Tread maker has been working to improve its balance sheet and looks to be more focused on profitability than growth.

The connected fitness company posted quarterly results that came in well ahead of expectations and delivered a mixed outlook for the year ahead.

Peloton (NASDAQ: NASDAQ:PTON ) has returned to sales growth for the first time in nine quarters.

Peloton (NASDAQ: NASDAQ:PTON ) said on Thursday It is digging itself out of the red and making progress out a slight sales increase for the first time in nine quarters as it slashed its overall losses.

The beleaguered connected fitness company, which two board members have run since former CEO Barry McCarthy resigned earlier this year, saw sales grow by 0.2% during its fiscal fourth quarter. While only a modest uptick, it’s the first time Peloton (NASDAQ: NASDAQ:PTON ) posted year-over-year revenue growth since its 2021 holiday quarter.

Peloton (NASDAQ: NASDAQ:PTON ) likewise indicated it’s ready to focus on profitability over growth with significant cuts to its marketing and sales spending and meaningful increases to free cash flow and adjusted EBITDA. Those cuts helped Peloton (NASDAQ: NASDAQ:PTON ) narrow its quarterly losses to $30.5 million from $241.1 million in the year-ago period.

Peloton (NASDAQ: NASDAQ:PTON ) shares rose more than 21% in Thursday's trading.

based on a survey of analysts by LSEG, Here’s how the Bike and Tread maker performed compared with what Wall Street was anticipating:

Loss per share: 8 cents vs. 17 cents expected

Revenue: $644 million vs. $631 million expected

For the three-month period that ended June 30, Peloton (NASDAQ: NASDAQ:PTON ) significantly narrowed its losses. The company posted a loss of $30.5 million, or 8 cents per share, compared with a loss of $241.8 million, or 68 cents per share, a year earlier.

Sales rose to $643.6 million, up about 0.2% from $642.1 million a year earlier. That’s only a $1.5 million increase, but Peloton (NASDAQ: NASDAQ:PTON ) did it at a time when sales are typically a bit slower for the company, because the quarter bleeds into the summer when people are more focused on going out and traveling than working out. The last time Peloton (NASDAQ: NASDAQ:PTON ) delivered YoY sales growth was during its holiday season in 2021, which is typically the company’s strongest quarter so far.

Secondary Market Gains

During the quarter, sales for Peloton’s pricy connected fitness hardware fell about 4%, continuing a trend for the company. But subscription revenue rose by 2.3%, and the segment’s gross margin increased by 1 percentage point.

Though hardware sales were down, Peloton (NASDAQ: NASDAQ:PTON ) is growing its subscription revenue through the secondary market where people can buy used stationary bikes for a fraction of the cost of a new one. During the quarter, subscription revenue from hardware purchased on the secondary market grew 16% year over year.

While hardware sales have hurt Peloton’s overall performance, sales for its Tread are growing after it overcame a costly recall. During the quarter, sales from Peloton’s treadmill portfolio grew 42% YoY.

Peloton (NASDAQ: NASDAQ:PTON ) is also seeing some positive omens in its Bike rental program, which allowed it to clear through a glut of inventory. During the quarter, average net monthly paid subscription churn for rentals was down 1.1 percentage points. Demand has been so steady, it no longer has the refurbished inventory levels necessary to supply that side of the program. The company ceased offering its original Bike rental program on Aug. 1 and since then, has seen demand grow for its Bike+ rental, refurbished original Bike sales and financed new Bike sales.

“These alternative programs have stronger unit economics than original Bike rental, with more cash paid upfront and a stronger retention profile,” the company said in its shareholder letter.

Ever since Peloton’s pandemic heyday came to an end, the company has struggled to generate free cash flow and ensure it has enough assets on its balance sheet to cover its many liabilities. Earlier this year, it announced a sprawling restructuring plan that included cutting 15% of the company’s global workforce to achieve $200 million in annualized cost savings by the end of fiscal 2025.

Those efforts are starting to bear fruit.

During the quarter, Peloton (NASDAQ: NASDAQ:PTON ) delivered adjusted EBITDA and free cash flow for the second consecutive quarter – a feat it had not pulled off since the height of the Covid-19 pandemic. It posted $70 million of adjusted EBITDA, far more than the $53 million that analysts had expected, according to StreetAccount. That metric was up $105 million compared with the year-ago period and $64 million quarter over quarter.

The company also generated $26 million in free cash flow, compared with negative $74 million in the year-ago period and $8 million in the prior quarter.

Improvements to Peloton’s balance sheet come after the company completed massive refinancing of its debt that staved off a looming liquidity crunch and pushed out its debt maturities by several years.

Peloton (NASDAQ: NASDAQ:PTON ) noted that the search for its next CEO is “top of mind for all stakeholders.” “The process is well underway and we look forward to sharing more when we have an announcement,” it said.

Profit over growth

For the year ahead, Peloton (NASDAQ: NASDAQ:PTON ) is planning to invest in its hardware and software to deliver a better user experience, among other initiatives. However, its guidance assumes that investments in these new initiatives “will not deliver subscriber growth within the fiscal year,” indicating Peloton (NASDAQ: NASDAQ:PTON ) may finally be shifting its focus away from growth in favor of profitability and free cash flow generation.

That’s evidenced by its reductions to sales and marketing spending — an expense that has long dragged down Peloton’s balance sheet and has been criticized as being too high for the company’s size.

During the quarter, Peloton (NASDAQ: NASDAQ:PTON ) cut sales and marketing spending by $25.5 million, or 19% year over year. It said it expects to continue to make reductions to its marketing budget throughout fiscal 2025.

For the current quarter, Peloton (NASDAQ: NASDAQ:PTON ) is projecting sales to be worse than Wall Street expected but is guiding to higher-than-forecast adjusted EBITDA. The company said it anticipates sales to be between $560 million and $580 million, compared with estimates of $609 million, according to LSEG. It’s expecting to post adjusted EBITDA of $50 million to $60 million, compared with estimates of $45 million, according to StreetAccount.

Street Account analysts had expected the number of connected fitness subscribers to be 2.96 million during the current quarter, but Peloton projects a range of 2.88 million to 2.89 million instead. According to LSEG, for the full year Peloton ( NASDAQ:PTON ) expects sales to be between $2.4 billion and $2.5 billion, compared with estimates of $2.7 billion.

Technical Outlook

As of the time of writing, Peloton (NASDAQ: NASDAQ:PTON ) stock has experienced a significant increase of 24%. This rise has led to the stock being currently overbought, as indicated by its Relative Strength Index (RSI), which stands at 71. The daily price chart shows a gap up pattern, which is a strong indicator of a potential bullish reversal in the stock's performance.

Furthermore, the Moving Average Convergence Divergence (MACD) is recorded at 0.097, which points to a slight bullish momentum in the market. This suggests that there is some upward pressure on the stock, reflecting a positive sentiment among investors. In addition to these indicators, it is noteworthy that Peloton's stock is trading above both the 50-day and 100-day moving averages, reinforcing the notion that the stock is currently in a strong upward trend. This combination of factors highlights the current bullish outlook for Peloton in the market.

PELETON - Could benefit Amazon's Prime Day

NASDAQ:AMZN 10th annual Prime Day is set to take place on July 16-17.

Amazon is offering up to 30% discounts on select Peloton products during Prime Day 2024, similar to previous promotional campaigns. This is expected to drive increased activity for Peloton.

Technical levels ( PT s ) above 4.02 $ are mentioned by the green horizontal lines.

PTON Peloton Buyout or Short Squeeze PotentialPTON Peloton Interactive is currently under the spotlight due to a significant uptick in call options activity.

This increased activity is focused on the $4 and $5 strike prices, with expirations on June 21 and July 19.

Market analysts and investors are buzzing with speculation that this might signal an imminent buyout, takeover, merger, or even a short squeeze.

Over the past week, Peloton has seen a notable surge in call options volume at the $4 and $5 strike prices. This heightened activity suggests that traders are betting on a substantial upward movement in Peloton's stock price in the very near term.

June 21 Expiration: Calls expiring this Friday indicate that some traders are expecting a major announcement or significant stock price movement within days.

July 19 Expiration: The larger volume of calls expiring next month shows longer-term optimism, potentially linked to upcoming strategic moves by the company.

Technically, Peloton’s chart is exhibiting highly bullish patterns that support the possibility of a breakout:

Falling Wedge: The stock is at the end of a falling wedge pattern, a technical indicator often associated with impending bullish reversals.

Double Bottom Pattern: Additionally, Peloton is forming a double bottom, another bullish pattern that indicates strong support and a potential for a significant upward movement.

These patterns suggest a robust technical setup for a breakout, with targets potentially as high as $6.50.

Buyout or Merger Speculation

The speculation surrounding a potential buyout by AAPL, AMZN, NKE, or a merger, is not unfounded. Peloton, despite its struggles in the past year, remains a highly attractive acquisition target due to its strong brand and substantial user base. A buyout or merger could provide the necessary capital infusion and strategic direction to reinvigorate the company’s growth trajectory.

Short Squeeze Potential

Adding fuel to the speculative fire is the potential for a short squeeze. If the stock begins to rise rapidly due to buyout rumors or technical breakouts, short sellers may be forced to cover their positions, driving the stock price even higher in a feedback loop of buying pressure.

PTON potentials for future investmentIn my experience, a stock trader should have a watchlist that is set up in weekly timeframe and so he/she has enough time to monitor them and get the concept of movements and its investors and many many other aspects till the due time that want to enter a position. I never trader in zoomed in views and trapped in small timeframes unless I had counted from upper degrees.

Another point I consider about a security or instrument to put it in my watch list is the consistency, harmony and gaps of it that shows my the manner and psychology of its investors and traders. (There are enough instrument in the market that you can ignore ugly ones).

So as a good sample you can put PTON in your watch list.

As it is beautifully obvious it has been finishing a long time declined impulse wave in that shape of Expanding Diagonal and I will monitor it for its future movements and in the due time will get in it.

Thanks