QQQ trade ideas

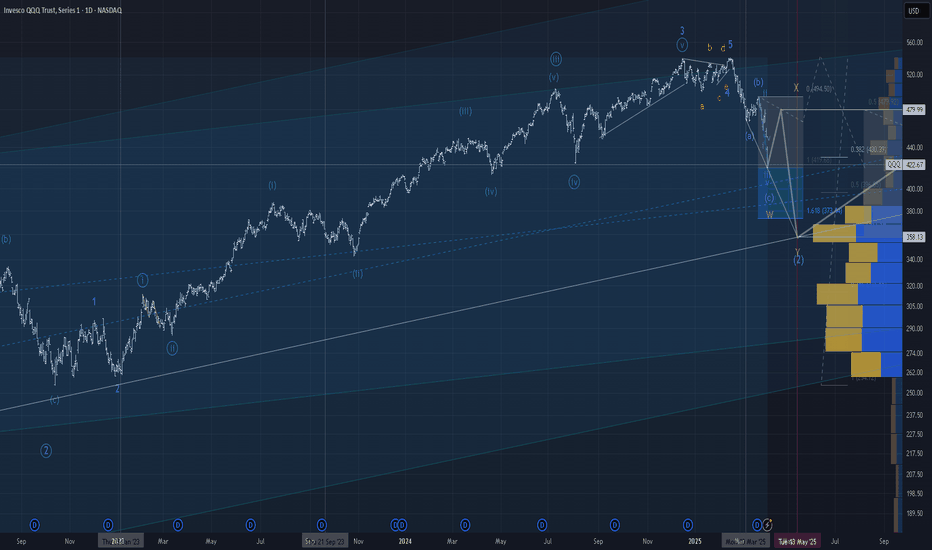

How bad will it get? Let's talk about it!🌟 My Market Probabilities: 🌟

1⃣ 15% chance of a V-Shape recovery with a bottom at $410–$425

2⃣ 45% chance of a COVID-like Flash Crash resolving at

$385–$400

3⃣ 33% chance of a 2022-level bear market down to

$330–$350

4⃣ 5% chance of a 2008-level crash hitting $250–$260

5⃣ 2% chance of a crazy Dot.com-level crash dropping to $90–$110

💡 No matter which scenario unfolds, it’s a blessing in disguise! These dips create incredible opportunities to invest in great companies or indexes like the AMEX:SPY or NASDAQ:QQQ paving the way for massive, life-changing wealth over the years and decades to come.

🚀 Think long-term as an investor, friends, and stay focused on the bigger picture!

QQQ Stock Chart Fibonacci Analysis 040525Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 423/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

QQQ: Tariff ReactionNASDAQ:QQQ As China strikes back with a 34% tariff on U.S. goods starting April 10, the global trade landscape could see some serious turbulence. This follows Trump's tariff moves, and the market's already feeling it: QQQ’s daily chart shows capitulation volume on the table, suggesting a potential bounce— IF tariffs ease.

But until these trade tensions subside, it's likely to be a rocky ride. Tariffs push prices up, inflation lingers, and the Fed finds itself boxed in. The outcome? A market crash, recession, and stagflation—yet, there's still hope for a bounce, depending on how these factors play out.

Manage the levels with us at ChartsCoach.

ONLY BULLISH short term wave count QQQPanic is now clear the question is todays drop a wave C in a zig zag or is it wave 3 of 3 Not sure I am taking long positions at 420 area if we break 416 then wave stucture should drop to 398/+or - 3.1for wave 3 of 3 to end . The 1987 decline took 55 days that drop was a full 38.2 % drop oct 19th that date would be april 15

Using Fibonacci/Measured Moves To Understand Price TargetThis video is really an answer to a question from a subscriber.

Can the SPY/QQQ move downward to touch COVID levels (pre-COVID High or COVID Low).

The answer is YES, it could move down far enough to touch the pre-COVID highs or COVID lows, but that would represent a very big BREAKDOWN of Fibonacci/ElliotWave price structure.

In other words, a breakdown of that magnitude would mean the markets have moved into a decidedly BEARISH trend and have broken the opportunity to potentially move substantially higher in 2025-2026 and beyond (at least for a while).

Price structure if very important to understand.

Measured moves happen all the time. They are part of Fibonacci Price Theory, Elliot Wave, and many of my proprietary price patterns.

Think of Measured Moves like waves on a beach. There are bigger waves, middle waves, smaller waves, and minute waves. They are all waves. But their size, magnitude, strength vary.

That is kind of what we are trying to measure using Fibonacci and Measured Move structures.

Watch this video. Tell me if you can see how these Measured Moves work and how to apply Fibonacci structure to them.

This is really the BASICS of price structure.

Get Some.

#trading #research #investing #tradingalgos #tradingsignals #cycles #fibonacci #elliotwave #modelingsystems #stocks #bitcoin #btcusd #cryptos #spy #gold #nq #investing #trading #spytrading #spymarket #tradingmarket #stockmarket #silver

The Bear Market Has Arrived - Key Levels to Watch SPY QQQ IWMIWM is the first of the major averages to enter into a technical bear market after falling over 20% from its recent highs. QQQ will likely be next followed by SPY. I think there's good potential for a short term bounce around this area, but I believe there's a lot more trouble ahead in the medium to long term and it could accelerate quickly if we don't see any quick relief here.

Time to buckle up, I'm afraid the worst is yet to come.

QQQ Slammed Below $465! Gamma Flip Confirmed QQQ Slammed Below $465! Gamma Flip Confirmed as Tariff Panic Grips Tech Sector

🌐 Macro Context (April 2, 2025)

Trump’s new tariff announcement this morning ignited fear of inflation returning and disrupted global trade expectations. That spooked big tech and growth-heavy indices like QQQ, triggering gamma-driven liquidation and a sharp intraday breakdown.

* Traders and dealers were not positioned for this headline — the rapid IV expansion and negative delta hedging caused a cascading sell-off.

* From a GEX perspective, today’s action triggered a flip below HVL ($471), with gamma accelerating downside volatility.

📉 Technical Breakdown – 1H Chart

Price Action:

* QQQ attempted to push through $475–$480, but got rejected violently.

* The huge red candle that nuked through $471 HVL and $469 confirmed a break of structure and bearish imbalance.

Support Zones:

* $455 – being tested now; psychological and options-related level

* $453.86 – today’s session low

* $450–$447 – likely short-term gamma target if weakness persists

Resistance Levels:

* $465 – 3rd PUT Wall

* $471 – HVL (now major resistance)

* $474–$477 – stacked CALL walls and former support

🔻 Options GEX & Dealer Positioning

GEX Flow:

* 🔴🔴🔵 = Short Gamma territory, and it’s growing more negative.

* Highest GEX support has disintegrated, with dealers hedging by shorting into the drop.

* Net GEX flipped negative below $471, increasing volatility.

* Dealer gamma continues to point down, with no major PUT walls until $450 zone.

Options Sentiment:

* IVR 38.4 / IVx avg 35.6 – slightly elevated vol, but with more room to rise

* PUTs 55.5% – bearish lean confirmed

* Expiry in 2 days + tariff panic = likely continuation or high chop volatility tomorrow

📌 Trade Setups

🐻 Bearish Continuation (Preferred Bias)

* Entry: Below $453.50

* Target: $450 → $447

* Stop: Above $458 reclaim

* Contract Idea: 0DTE or 2DTE $455P/$450P depending on risk appetite

* Note: Gamma trap zone from $455–$450 likely to accelerate price movement

🐂 Dead Cat Bounce Setup (Low Conviction)

* Only valid if QQQ reclaims $465+ with volume + positive options flow

* Target: $471–$474

* Play with small size or debit spreads due to risk of gamma reversal

🔍 Conclusion + My Thoughts

This tariff-triggered crash was unexpected, and it created a dealer short-gamma loop in QQQ. The break below $471 HVL turned the table fast. Unless QQQ quickly reclaims $465+, we're likely heading to test $450 levels in the coming sessions.

Tech tends to react aggressively to macro policy shifts, and the lack of near-term options support shows dealers are NOT stepping in. That opens the door for continued downside or extremely choppy relief rallies. Be fast. Be nimble.

🎯 Key Levels Recap:

🔴 HVL $471 Former support → resistance

🔻 Support $455 / $453.86 Price and psychological

🚨 GEX Target $450 / $447 Dealer hedging likely

🔼 Resistance $465–$471 Gamma ceiling now

📢 Final Tip: Watch VIX, bond yields, and /NQ overnight — any panic escalation may turn this into a larger gamma-driven flush.

Disclaimer: For educational purposes only. Not financial advice. Always manage your risk and position sizing accordingly.

QQQ: Recent Rally has not Changed Downward Trend The data speaks for itself—recent upward rallies in #QQQ haven’t changed the downward trajectory, with little sign of a meaningful upward shift.

📉 The bullish trend that began in 2023 has reversed, forming a lower high at 490 (200-day MA), signaling a major downturn.

QQQ is Breaking the Trendline – Could the Tech Rally be started?Market Structure & Price Action:

QQQ has broken out of a descending channel and printed a CHoCH to the upside around $471, shifting structure into a bullish stance. The breakout follows a clean reversal from the red demand zone near $463, suggesting institutional interest around that area. Price is now consolidating near $473.5–$474 after a strong 3-bar rally and retest of prior highs.

Supply & Demand Zones:

* Demand Zone (Support): $463–$465

* Supply Zone (Resistance): $495–$497 (unmitigated upper green zone)

Support & Resistance Levels:

* Immediate Resistance: $474 (minor psychological level, aligning with trendline retest zone)

* Major Resistance: $495–$497 (overhead supply)

* Support Levels: $470 > $465 > $463

Indicators:

* MACD: Still bullish, but showing some slowing momentum – histogram flattening.

* Stoch RSI: In overbought territory – may suggest short-term consolidation or pullback.

* Volume: Rising on the breakout, confirming strength.

Options GEX + Sentiment Analysis:

* Gamma Walls:

* CALL Wall (Resistant): $472 (64.62%) – Price is currently sitting above this wall.

* Next Gamma Cluster: $474–$476 (GEX9/GEX10) – Potential short-term magnet.

* PUT Wall Support:

* $465–$463 zone aligning with strong GEX put support and HVL (0DTE) – strong defense.

* IV Rank (IVR): 40.6

* Implied Volatility vs Average (IVx avg): IV is above avg at 3.27%

* Sentiment: PUTS 52.6% | GEX shows 🟢🟢🟢🟡 (Bullish leaning but hedged)

Trade Scenarios:

* Bullish Scenario:

* If QQQ holds above $472 and sustains above the GEX CALL Wall, we may see a move toward $476–$480.

* A breakout above $480 could open the door for a test of the $495–$497 upper supply zone.

* Bearish Scenario:

* Rejection at $474 and failure to hold $470 could push price back toward the $465–$463 demand zone.

* Breakdown below $463 would invalidate the bullish thesis in the short term.

Conclusion:

QQQ is showing strength after breaking the descending structure, and options positioning supports a slow grind higher unless it gets rejected at $474. Watch for consolidation or a clean breakout to confirm momentum continuation. Bulls want to defend $470 on any pullback.

QQQ Call (Big Picture)Just marking up QQQ to look for an entry long-term. Looking at the big picture from the monthly, pulled out the Fibster to get my retracement levels. After breaking the trendline, looks like it can head down to 38.2% and head back up or further down to the 52W L. My prediction is that it will bounce from the support I see in the past, which is where I have it marked as an entry point. Let me know your thoughts if you see this.

QQQ - Double Top BreakdownQQQ has formed a double top, a classic bearish reversal pattern indicating potential trend exhaustion. The price has broken below the neckline, confirming the pattern and signaling further downside. If selling pressure continues, we could see a move toward the target zone.

This breakdown suggests that bulls are losing momentum, and unless QQQ can reclaim the neckline, the bearish bias remains intact. However, false breakdowns can occur, so it's important to watch for a potential retest of the neckline before further downside.

📊 Key Levels:

🔵 Entry: Breakdown confirmation below support

🔴 Stop Loss: 524.65 🔻 (Invalidation level if price reclaims this zone)

🟢 Target: 458.59 ✅ (Measured move from the pattern)

🔎 Watch for:

📌 A retest of the neckline as resistance

📌 Increased volume confirming the breakdown

📌 Possible continuation if sellers remain in control

This setup presents a strong risk-to-reward opportunity for bears, but staying cautious of any reversals is key.

To catch a knife... QQQOk, I'm a little bummed I didn't make an idea sooner because my dowsing (as in with a pendulum) nailed the high on both SPY & QQQ. It is documented online, however, so I'm not making this up after the fact fyi.

I had mentioned at the time (around 2/23) 11 days to hit the lower target in SPY (I'll do an idea for it as well). Wednesday is the deadline, though I don't put a ton of faith in these things, dates typically are things to watch in my work and can be reversals.

On 2/26 I worked on what to expect for the first week in March. The message was it goes down, but there's a "scene of the crime" trade, spike down and low on... Wednesday the 5th! When I ask what does this look like, I get "v-bottom".

My dowsing now keeps repeating there will be a small move up to sell into if we get a significant move away from the 503-04 area.

I did my best to get levels, but obviously this is some woo woo kinda stuff, so it can be miraculous at times, and others a complete cluster. Definitely watch Wed. & the 468 area. Ideally, the time and price align for higher odds I'm correct. If we bounce, I'll try to find an upside target. There is also a lower target around 432, but I didn't dig into that much.

3/31/25 - $qqq - Correlation 1... no more protection 4 me3/31/25 :: VROCKSTAR :: NASDAQ:QQQ

Correlation 1... no more protection 4 me

- bought back all my (covered calls) on the "rental" book, which is NYSE:VST , NYSE:UBER , NYSE:DECK , NASDAQ:BLDE , NASDAQ:GAMB as i'd rather take the 15-20% downside on what I believe are stocks that have at least 2x this in terms of upside into YE at this pt. esp in a quarter-end tape that simply looks "scared"

- and i hear you guys that r saying "Bessent" told you more pain to come and "yes", but we shouldn't be believing anyone at this stage, friends. Think critically. here are some pts:

- on my S&P math, the average stock is now down 20% from it's peak. i've writtent extensively about VIX mgmt and mag7 as a component of this equation. we've seen diff sectors, stocks and most importantly mag7 rotate seats (from cold to hot) at varying points in order to smooth the index. therefore, the index is the illusion here. "only an 8% correction" is meaningful in the above context.

- i've reviewed all 500 of the S&P stocks in the last month, and on my thinking, about 80% of them are pretty obvious buys from a MT (nevermind LT context), let's describe MT as 12-18 months. that's not to say there isn't more downside, but buying the index at this pt (to low-IQ and chill) means you'll probably enter pretty well here

- and the narrative/ thinking around AI is probably correct that "a lot of things are going to get demonetized especially software". but the mkt is currently confusing a few things. when we are correlation 1... the market says "all AI-related plays are losers" and that's objectively false. perhaps there will be more losers than winners, because this game of scale is one we haven't seen before. but when you're, say, selling something like NVDA that can't even meet it's chip demand for the next 2 years, trading at 4% FCF yield and growing >20% a year (probably 30-40% CAGR on my conservative math) versus a 10Y being forced lower and you tack on reinvestment risk to trying to "time" the NVDA bottom (which is *probably* at most 15-20% lower)... i'd contend - you're doing it wrong - or you think you're god. nobody times the bottom. we risk manage upside and downside risks with the book.

- so acknowledging tariffs matter, rates matter, short term speech drives emotion. take a step back. i'd argue we're much closer to the bottom than the MSM will let on, as they're index-only thinkers.

- what i'm really looking for is an open below lows (like we had today) and a massive red to green reversal. those have marked all major bottoms. again. we might have a few of these b/c we are in a whacky tape, but that sort of move should be taken into account.

- one more point. seeing my favorite position NASDAQ:NXT dump nearly 6% at the open on "flows" and get rebid basically non-stop until i'm currently writing this... tells me most of what you're seeing is quarter-end balancers, so don't lose the signal through the noise.

- i bought more OTC:OBTC today to top off too, even tho volume light (i'm probably 100% of that volume today already). limits only on this thing.

- most importantly keep your head screwed on. last man standing without getting emotional wins, always. been here, done this. it never gets easier. but you learn to control your emotions. so take a step back. if you're sweating, take some exposure off, you're too big. but if you've made it this far, don't give up. assets > liabilities in this world. and the USD is ultimately a liability. never forget that. the goal isn't to accumulate dollars, but assets.

V