$RIOT / 45mRiot Platfroms has worked marching in place in two straight days, formed the double-bottom so far, and stating well an impending trend change in the various degrees!!

So the prior outlook remains intact >> bullish against the extreme low >> 7.24

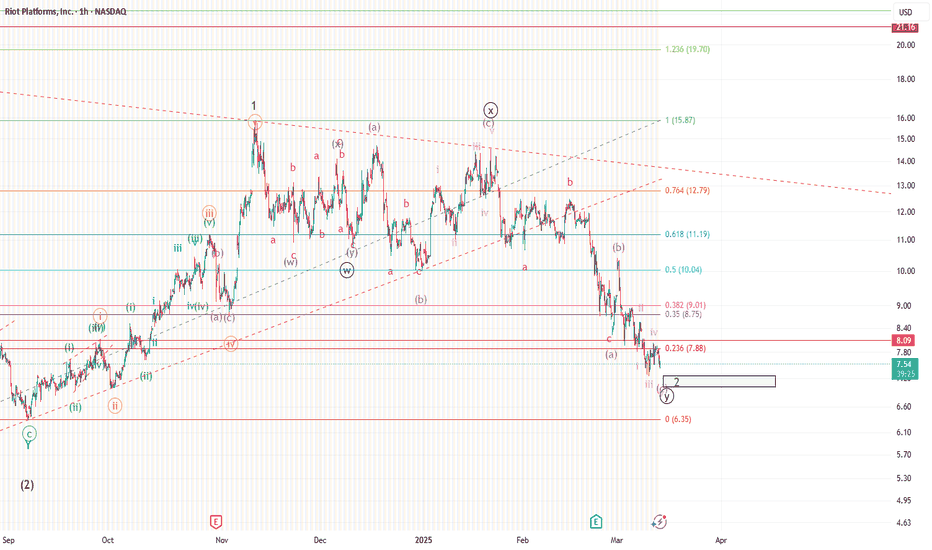

NASDAQ:RIOT seems to have concluded the entire correction in Minor degree wave 2 by an ending diagonal as wave (c). As illustrated on the 45m-frame above, the wave (c) diagonally reached very close the anticipated Fib-expansion target at 7.27

( where wave (c) = 1.618 wave (a) ). And it occurs twice, in a double bottom >>

NASDAQ:RIOT 's extreme-low at 7.24 might be well considered as a significant extreme & reversal point! Because of that the contracting diagonal wave (c) which's although aligned with the two larger various degrees downtrend, but also that may respected as an ending pattern in which state of turn into the uptrend lies in as well.

So, technically retracing up to origin of the ending diagonal wave (c) at 11.92 in an impulse(in a five-wave sequence) will highly confirm changing the NASDAQ:RIOT 's trend to the Upward!!

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT trade ideas

$RIOT / 45mNASDAQ:RIOT has worked marching in place above the double-bottom extreme level today.

So the prior outlook remains intact as well >> bullish against this level >> 7.24 | 7.25

NASDAQ:RIOT may have concluded the entire correction in Minor degree wave 2 by an ending diagonal as wave (c), and it might be stating an impending trend change in various degrees!!

As illustrated on the NASDAQ:RIOT 's 45m-frame above, the wave (c) diagonally has reached

very close to the anticipated Fib-expansion target at 7.27 ( where wave (c) = 1.618 wave (a) ). And it's twice, in a double bottom >>

All these are implying that the diagonal wave (c) would not be extended more. Hence, the extreme-low at 7.24 might be well respected as a significant extreme & reversal point! Because of that the ending diagonal wave (c) which's although aligned with the two larger various degrees downtrend, but indicates an impending trend reversal in the same degrees as well.

So, retracing up to origin of the ending diagonal wave (c) at 11.92 in an impulse(in a five-wave sequence) will highly confirm changing the NASDAQ:RIOT 's trend to the Upward !!

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / 45mNASDAQ:RIOT may have concluded the entire correction in Minor degree wave 2 by an ending diagonal as wave (c), and it might be stating an impending trend change in various degrees!!

As illustrated on the NASDAQ:RIOT 's 45m-frame above, the wave (c) diagonally has reached

very close to the anticipated Fib-expansion target at 7.27 ( where wave (c) = 1.618 wave (a) ). And it's twice, in a double bottom >>

All these are implying that the diagonal wave (c) would not be extended more. Hence, the extreme-low at 7.24 might be well respected as a significant extreme & reversal point! Because of that the ending diagonal wave (c) which's although aligned with the two larger various degrees downtrend, but indicates an impending trend reversal in the same degrees as well.

So, retracing up to origin of the ending diagonal wave (c) at 11.92 in an impulse(in a five-wave sequence) will highly confirm changing the NASDAQ:RIOT 's trend to the Upward !!

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / 3hNASDAQ:RIOT 's correction in Minor degree wave 2 may still remain in very late stage of its progress. Hence, an ultimate decline just by 6% or 7% would likely lie ahead, and it might be in next day!

NASDAQ:RIOT might be searching for its significant extreme low around converging the

Fib 1.618 expansion level & ending diagonal's boundary line.

The ultimate Fib-target >> 6.86

Redline >> Exceeding 6.36

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / 2hNASDAQ:RIOT may have concluded the entire correction in Minor degree wave 2, and might be stating an impending trend change in various degrees!!

Accordance with the prior wave analysis on the NASDAQ:RIOT 's 2h-frame, the wave (c) diagonally achieved the anticipated Fib-expansion target at 7.27 ( where wave (c) = 1.618 wave (a) ).

And It's implying that the diagonal wave (c) would not be extended more. Hence, the last day's extreme-low at 7.24 could be well considered as a significant extreme & reversal point! Because of that the ending diagonal wave (c) which's aligned with the two larger various degrees downtrend, but indicates an impending trend reversal in the same degrees as well.

So, retracing up to origin of the ending diagonal wave (c) at 11.92 in an impulse(in five-wave structure) will highly confirm changing the NASDAQ:RIOT 's trend to the Upward !!

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / 45mAs illustrated on the NASDAQ:RIOT 's 45m-frame above, an ultimate decline by 9% would be likely lie ahead over the next day.

Accordance with the NASDAQ:RIOT 's prior analysis on the 4h frame last day, an ending diagonal could be considered as wave (c) which now seems to be remained in very late stage. And so its ongoing 5th wave down should be expanded in a three-wave structure. Hence, technically! further decline would be expected yet.

The Ultimate Target >> 7.07

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / 2hNASDAQ:RIOT might be stating an impending trend reversal!!

Today' decline unfolded an ending diagonal that's well taken form since the mid-Feb high at 11.92.

The three-wave structure of wave v of ending diagonal (c) seems to be complete, but also the accurate Fib-target at 7.27 remains intact.

NASDAQ:RIOT might well conclude the entire correction in Minor degree wave 2, on converging its

Fib-expansion levels (1.618 & 1.272 on the Fib channel).

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT / HourlyAn Impending Trend Change In Various Degrees!

NASDAQ:RIOT ended the week with finding its new extreme low below 7.95 >> 7.92 that's surrounding the Fib 1.272 expansion level on the channel, as anticipated on the prior NASDAQ:RIOT 's analysis.

So the various degrees declines of the waves v, (c), ((y)) and 2 should have likely concluded. And so, today's intraday low at 7.92 might be respected as a significant extreme & reversal point.

And as illustrated on this hourly frame, the double bottom on the converging Fib 1.272 expansion levels would likely state an impending trend reversal as well.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT / HourlyNASDAQ:RIOT seems to be concluding well, the entire correction in Minor degree wave 2 that's framed just the last subdivision as its wave y(circled) in this hourly chart.

Currently, the final decline in ongoing 5th wave of wave v of wave(c) of ((y)) might be searching for its extreme low on the Fib 1.272 expansion level on the channel on the next day!

The Ultimate Fib Target >> below the morning low at 7.95

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT to Lead Bitcoin Miners Higher in March ($11+ Price Target)Riot Platforms NASDAQ:RIOT is a stock that I've held common shares of since 2017, and as of now, it's also the largest call options position in the WAVE$ Portfolio. 🔥🥇

I think that NASDAQ:RIOT will re-test that line of broken support as new resistance (orange) by the 21st of March. My money is where my mouth is. 💰🎯

The macro economic backdrop favors CRYPTOCAP:BTC far more than equities at the moment (in my view), and I think that miners like NASDAQ:RIOT and NASDAQ:MARA can act as diamonds in the rough even if the major indices ( AMEX:SPY NASDAQ:QQQ ) struggle. 👑💎⛏️

Let's keep this momentum alive team! 🌊🌊🏆

-Royce

$RIOT / HourlyNASDAQ:RIOT has achieved the cluster of anticipated Fib targets on its differing time frames.

But the market selloff in last hour today, and exceeding the targets would suggest to analyzing the wave structure of the current decline in hourly frame as well.

So as depicted on the chart below, with respect to the wave structure in a barrier triangle as the correction in wave (b) properly reveals a five-wave impulse on the following decline as wave (c) which now its 5th wave in a final decline would likely remain in the late stage.

The final Fib target >> 8.08

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT Stock Chart Fibonacci Analysis 022625Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 8.9/61.80%

Chart time frame: B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

$RIOT / 2hNASDAQ:RIOT may conclude the entire correction in Minor degree wave 2 on cluster of the anticipated Fib targets.

Technically, the wave structure of corrective wave 2 in a wxy double zigzag seems to be completed well now. And also exceeding the Fib channel & cluster of the expected Fib targets indicate the current level at 8.70 should be respected likely as a significant low.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

RIOT next BTC to bull 🐂 road map I already provided RIOT analysis ⏰ successfully top 🔝 & correction completed 🚀

Unfortunately 😬 my 2 posts got disconnected against trading view rules 📌

Again making complete analysis for next bull run 🐂

Before entering pls #DYOR

Below this post I will update you everything 🙂

So just follow and share post and save it by boosting 🚀 it 🙌

So if I updated anything in this macro correction or exit or crucial things u get updated 📌

Let's get started 📌

🧵👉

RIOT: One more leg down or only UP from here?Right now, it is very difficult say if the Feb 3 low is THE low. So far, the move up looks like an abc zigzag. If that is the case, then we should see one last move down the swipe the December low, shake out all stop losses and start the real wave 3. Price can still move up towards $14 and make another lower high and then crash again. But, if price keeps makings higher highs and higher lows and somehow can come out of the downward channel in a complete 5 waves, then wave 1 of 3 is most likely. I will wait for the reload. Either start accumulating on the next leg down or wait for 5 waves to complete and buy on the retrace of wave 2 of 3. In the meantime, selling secured calls and puts in the trading range to keep things interesting....

$RIOT / WeeklyNASDAQ:RIOT

Accordance with this bullish trend analysis, RIOT would be likely concluding a series of first and second waves (which started on March 2020) that all depicted well on this weekly frame.

So after completing the correcting down in wave 2 around 9.00 (22% decline in 7 weeks ahead), the following series of impulsive waves in 3 of (3) of ((3)) will be expanded on the uptrend to the fibo extension levels, as shown on the weekly chart above.

>> The fibo targets would be around 40.00 at first, then >> towards 100.

#CryptoStocks #RIOT #BTCMining #Bitcoin #BTC

$RIOT, a setup for a comeback- Showing some strength on the pre market, RIOT is bullish above 12.30.

- while I am not expecting the move to be bigger than 12.50 on the day, keeping with momentum, we can see it at 13.70 by next week.

- a larger move to 14.20-15 may still on be on the table.

- Trade is risk off bellow 11.60.

RIOT: not sure what to make of the recent price actionFor now, I have Jan 22 low as subminuette degree wave 2. But the price action since then, even though made higher highs and higher lows, doesn't seem to be an impulsive move. It can either be a b wave, which means wave 2 is not over yet; or it could be an expanding leading diagonal. If a Y wave is in progress, I hope not to go too deep as price already dipped into minuette wave 1 once. This week will be crucial for BTC as well as miners to keep the support intact and bounce to new higher highs to keep the bull run intact. Falling below recent lows will make things significantly harder to keep things moving.

Will History Rhyme for Riot Platforms $RIOT (+120% Rally)?History doesn't always repeat itself, but it does tend to rhyme! The stars are aligning for Bitcoin CRYPTOCAP:BTC , and if the Crypto King officially enters the next WAVE of this bull market cycle, then I wouldn't be surprised to see NASDAQ:RIOT rally +120% in the month(s) ahead. We've seen it before... There's no reason we couldn't see it again! 😏🔮🚀

Also, I just posted a YouTube video covering CRYPTOCAP:BTC NASDAQ:RIOT NASDAQ:MARA and NASDAQ:COIN if you want to check it out. 🤙🏼🎬🎥