Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−3.72 USD

−4.75 B USD

4.97 B USD

713.40 M

About Rivian Automotive

Sector

Industry

CEO

Robert Joseph Scaringe

Website

Headquarters

Irvine

Founded

2009

FIGI

BBG00741Y1N2

Rivian Automotive, Inc. engages in the design, development, and manufacture of category-defining electric vehicles and accessories. It operates through following segments: Automotive, Software and Services. The company was founded by Robert J. Scaringe in June 2009 and is headquartered in Irvine, CA.

Related stocks

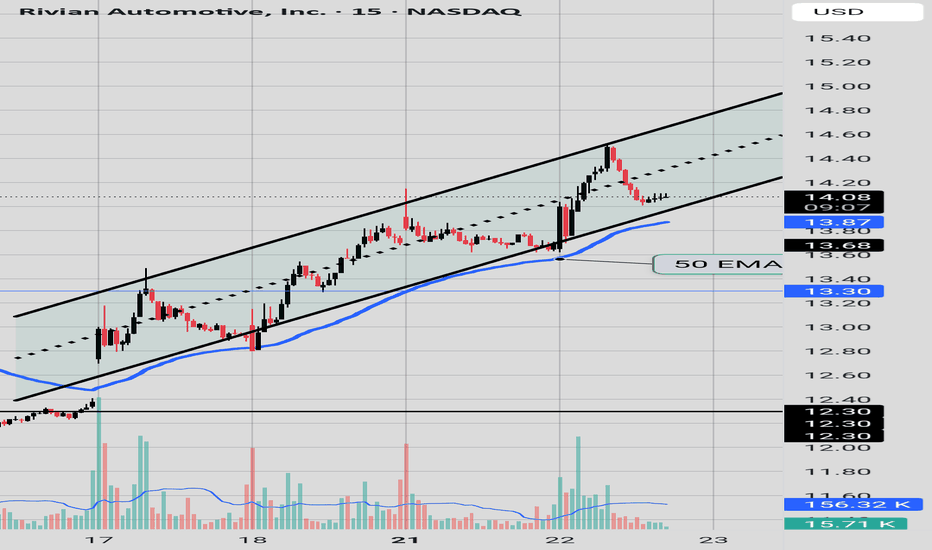

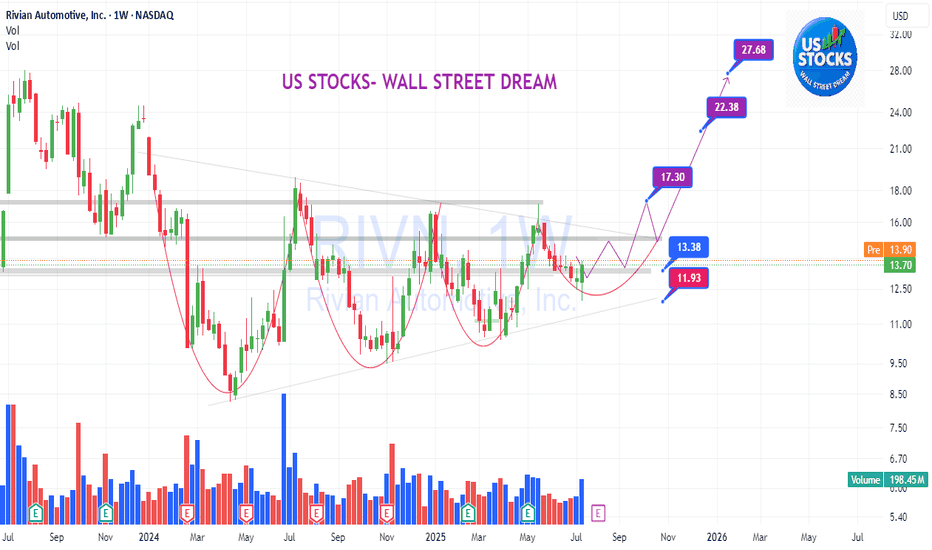

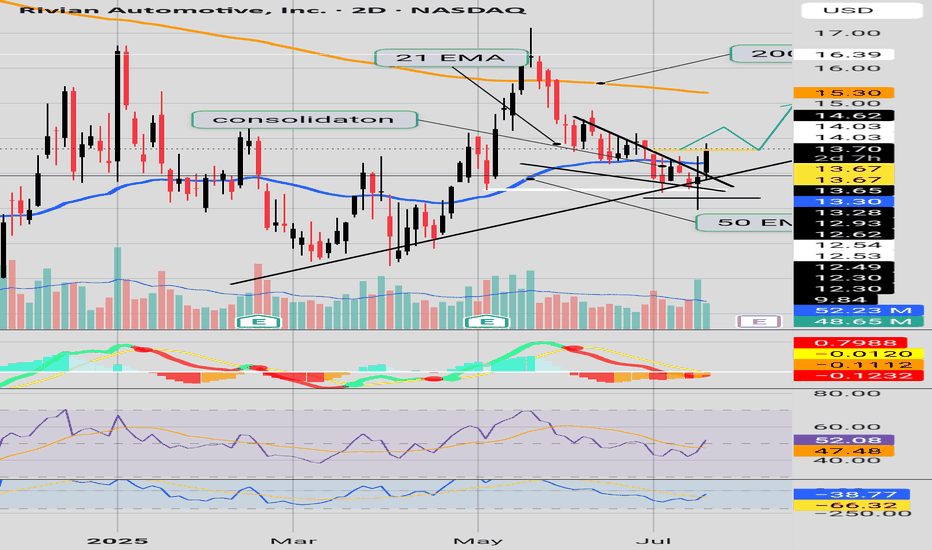

Heiken Ashi CandlesThis week Heiken Ashi candle gave a bullish close above the DOJI Heiken Ashi candle from last week. RSI is above 50. MACD (Chris Moody) look like it may have a bullish cross over soon. Stochastic RSI is getting ready to curl up. What do you think team? do you think the bulls maybe entering their se

Alert for the Bears Hope for the BullsBears could not bring price below 12.54, bulls have kept the momentum. It seems price has broken out of the consolidaton. Bulls need more momentum and for more levels over 50 on RSI. Bulls need to make Higher Highs and Higher Lows from 13.70 with good RSI levels to keep victory going, if not then la

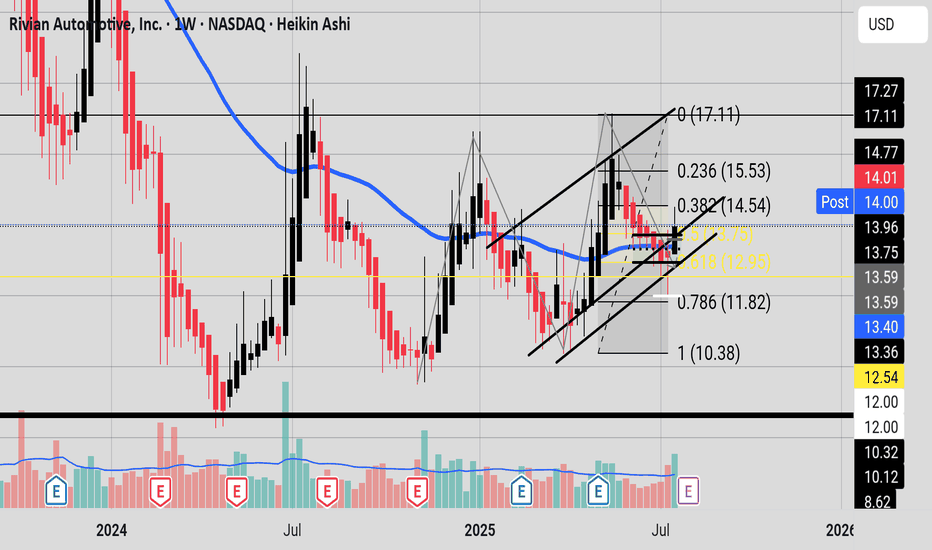

High Wave Candle on the weeklyWe have a High Wave Candle on the Weekly chart.

The candle is at the support of the upward parallel channel.

The candle is also under the 50 EMA.

The candle is at the vicinity of the 0.618 Fibonacci level.

Bears want to see the close of the next candle below 12.45, then the next price target at 11.8

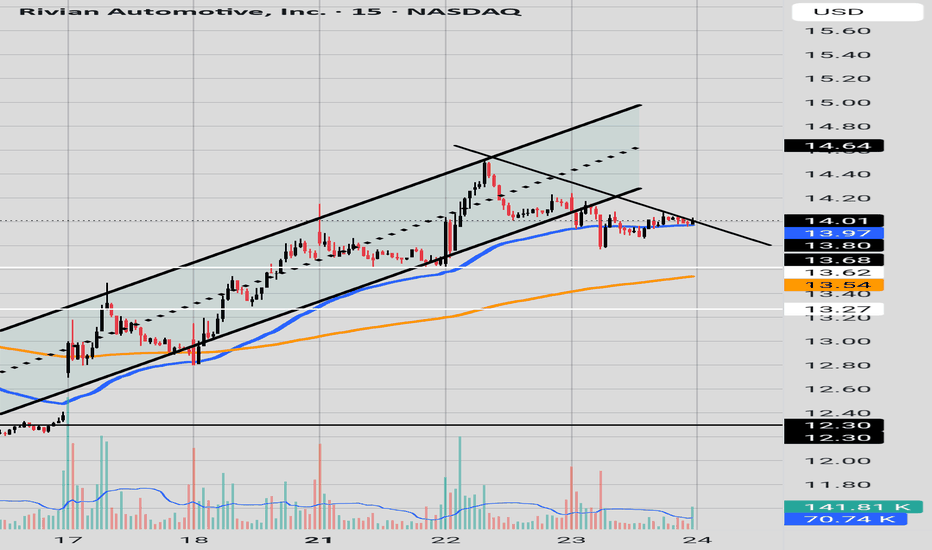

$RIVN - Long Setup BrewingRivian just broke out of a long-term downtrend and is now retesting that previous resistance as support. Price is coiling inside a falling wedge, sitting right above a key structure zone around $13. This area held strong in the past and could act as a launchpad if momentum steps in.

A breakout abov

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

RIVN5919556

Rivian Automotive, Inc. 3.625% 15-OCT-2030Yield to maturity

5.77%

Maturity date

Oct 15, 2030

RIVN5776027

Rivian Automotive, Inc. 4.625% 15-MAR-2029Yield to maturity

3.63%

Maturity date

Mar 15, 2029

See all RIVN bonds

Curated watchlists where RIVN is featured.

Frequently Asked Questions

The current price of RIVN is 14.01 USD — it has increased by 1.37% in the past 24 hours. Watch Rivian Automotive stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Rivian Automotive stocks are traded under the ticker RIVN.

RIVN stock has risen by 7.52% compared to the previous week, the month change is a 0.90% rise, over the last year Rivian Automotive has showed a −12.38% decrease.

We've gathered analysts' opinions on Rivian Automotive future price: according to them, RIVN price has a max estimate of 23.00 USD and a min estimate of 7.05 USD. Watch RIVN chart and read a more detailed Rivian Automotive stock forecast: see what analysts think of Rivian Automotive and suggest that you do with its stocks.

RIVN reached its all-time high on Nov 16, 2021 with the price of 179.47 USD, and its all-time low was 8.26 USD and was reached on Apr 16, 2024. View more price dynamics on RIVN chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

RIVN stock is 4.85% volatile and has beta coefficient of 1.07. Track Rivian Automotive stock price on the chart and check out the list of the most volatile stocks — is Rivian Automotive there?

Today Rivian Automotive has the market capitalization of 16.06 B, it has decreased by −6.98% over the last week.

Yes, you can track Rivian Automotive financials in yearly and quarterly reports right on TradingView.

Rivian Automotive is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

RIVN earnings for the last quarter are −0.41 USD per share, whereas the estimation was −0.77 USD resulting in a 46.35% surprise. The estimated earnings for the next quarter are −0.65 USD per share. See more details about Rivian Automotive earnings.

Rivian Automotive revenue for the last quarter amounts to 1.24 B USD, despite the estimated figure of 997.71 M USD. In the next quarter, revenue is expected to reach 1.29 B USD.

RIVN net income for the last quarter is −545.00 M USD, while the quarter before that showed −744.00 M USD of net income which accounts for 26.75% change. Track more Rivian Automotive financial stats to get the full picture.

No, RIVN doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 27, 2025, the company has 14.86 K employees. See our rating of the largest employees — is Rivian Automotive on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Rivian Automotive EBITDA is −2.91 B USD, and current EBITDA margin is −73.60%. See more stats in Rivian Automotive financial statements.

Like other stocks, RIVN shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Rivian Automotive stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Rivian Automotive technincal analysis shows the buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Rivian Automotive stock shows the neutral signal. See more of Rivian Automotive technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.