How We're Earning A 13%+ Yield Selling Puts On Rocket LabThe commercial space sector is booming, and Rocket Lab NASDAQ:RKLB stands out as one of the most promising players—not just another speculative startup or space tourism hype. But while the company is making strong operational strides, its stock valuation appears stretched, prompting a more strategic approach to investing.

📈 Strong Execution, Growing Opportunity

Rocket Lab continues to hit meaningful milestones. In Q1, the company:

Secured a U.S. Space Force contract for its upcoming Neutron heavy-lift rocket.

Won hypersonic-related contracts with the U.S. Air Force and the U.K. Ministry of Defense.

Successfully completed five Electron rocket launches and booked eight more.

Made a strategic acquisition for developing "Flatellites," enhancing vertical integration.

Revenue rose 32% year-over-year, with gross margins in the mid-30% range. Importantly, Rocket Lab has a $1 billion+ revenue backlog, with over half expected to convert in the next year, and a healthy mix of government and commercial clients across both its Launch and Space Systems divisions.

💰 Valuation: Big Potential, Bigger Price Tag

Rocket Lab's business is solid, but its valuation raises red flags. With a price-to-sales ratio near 55x (compared to SpaceX's ~14x), investors are paying a steep premium for future success. The company is still unprofitable, and the high valuation leaves little room for error. Simply put, the market may be rewarding Rocket Lab too early.

📊 The Smarter Move: Sell Put Options

Instead of buying shares at inflated levels, the better approach is to sell put options—a strategy that earns upfront cash and offers the opportunity to buy shares at a discount if the stock drops.

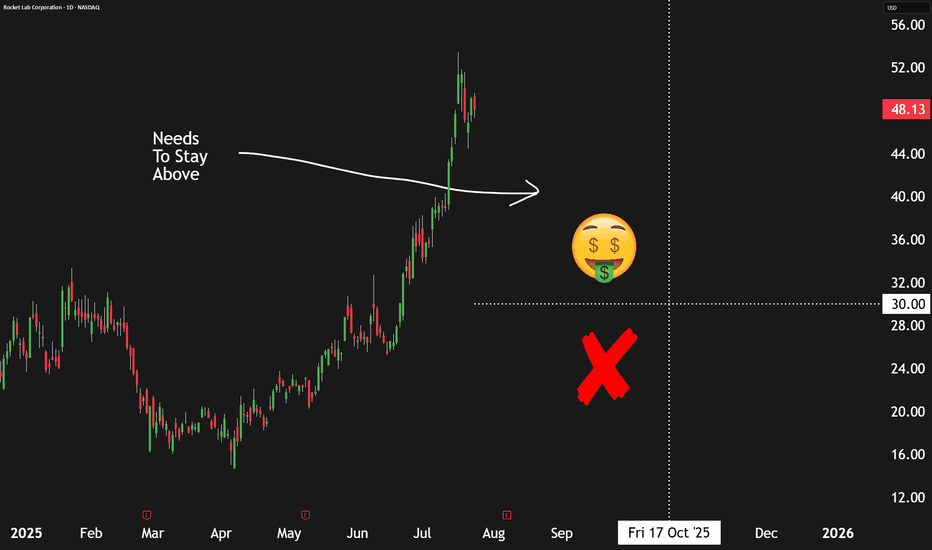

Recommended trade:

Sell October 17th $30 strike put options

Premium: ~$96 per contract

Required buying power: ~$2,904

Implied return: ~3.3% over 90 days, or ~13.4% annualized

This provides income now, while still giving investors potential exposure to Rocket Lab at a 40% discount to current prices.

⚠️ Risks to Consider

This isn’t risk-free. If Rocket Lab’s execution falters—especially with Neutron—shares could drop sharply. Selling puts means you may still be forced to buy at $30, even if the stock falls much lower. This strategy works best for investors comfortable owning RKLB long term at a lower entry price.

✅ Bottom Line

Rocket Lab is a strong business, but the stock looks overheated. Selling put options offers a more balanced way to participate in its growth story—earning income now while positioning to buy the stock later at a better value.

Rating: Buy (via options strategy)

RKLB trade ideas

$RKLB Overvalued asf! - NASDAQ:RKLB is overvalued. I will either stay on the sidelines or short the heck out of this POS.

- Company sells hopium which doesn't have meaningful materialization as of now and not even in the distant future.

Fundamentally,

2025 | 2026 | 2027 | 2028

-0.32 | -0.08 | 0.17 | 0.47

Revenue:

576.83M | 905.01M | 1.21B | 1.69B

- Market cap of NASDAQ:RKLB currently sits at 24.61B as of July 17, 2025.

- People who are buying now are buying someone else bag and are in for a horrible ride.

- Consider buying it under $15 if you are super bullish

Is Rocket Lab the Future of Space Commerce?Rocket Lab (RKLB) is rapidly ascending as a pivotal force in the burgeoning commercial space industry. The company's vertically integrated model, spanning launch services, spacecraft manufacturing, and component production, distinguishes it as a comprehensive solutions provider. With key operations and launch sites in both the U.S. and New Zealand, Rocket Lab leverages a strategic geographic presence, particularly its strong U.S. footprint. This dual-nation capability is crucial for securing sensitive U.S. government and national security contracts, aligning perfectly with the U.S. imperative for resilient, domestic space supply chains in an era of heightened geopolitical competition. This positions Rocket Lab as a trusted partner for Western allies, mitigating supply chain risks for critical missions and bolstering its competitive edge.

The company's growth is inextricably linked to significant global shifts. The space economy is projected to surge from $630 billion in 2023 to $1.8 trillion by 2035, driven by decreasing launch costs and increasing demand for satellite data. Space is now a critical domain for national security, compelling governments to rely on commercial entities for responsive and reliable access to orbit. Rocket Lab's Electron rocket, with over 40 launches and a 91% success rate, is ideally suited for the burgeoning small satellite market, vital for Earth observation and global communications. Its ongoing development of Neutron, a reusable medium-lift rocket, promises to further reduce costs and increase launch cadence, targeting the expansive market for mega-constellations and human spaceflight.

Rocket Lab's strategic acquisitions, such as SolAero and Sinclair Interplanetary, enhance its in-house manufacturing capabilities, allowing greater control over the entire space value chain. This vertical integration not only streamlines operations and reduces lead times but also establishes a significant barrier to entry for competitors. While facing stiff competition from industry giants like SpaceX and emerging players, Rocket Lab's diversified approach into higher-margin space systems and its proven reliability position it strongly. Its strategic partnerships further validate its technological prowess and operational excellence, ensuring a robust position in an increasingly competitive landscape. As the company explores new frontiers like on-orbit servicing and in-space manufacturing, Rocket Lab continues to demonstrate the strategic foresight necessary to thrive in the dynamic new space race.

Rocket Lab to new all time highs as more things go to spaceRocket Lab build rockets. CEO has an extremely bright aura. Hard to find a better story-driven pure space play with SpaceX being private. I like Rocket Lab and invested because as more and more things fly and go to space, it has the wind at its back.

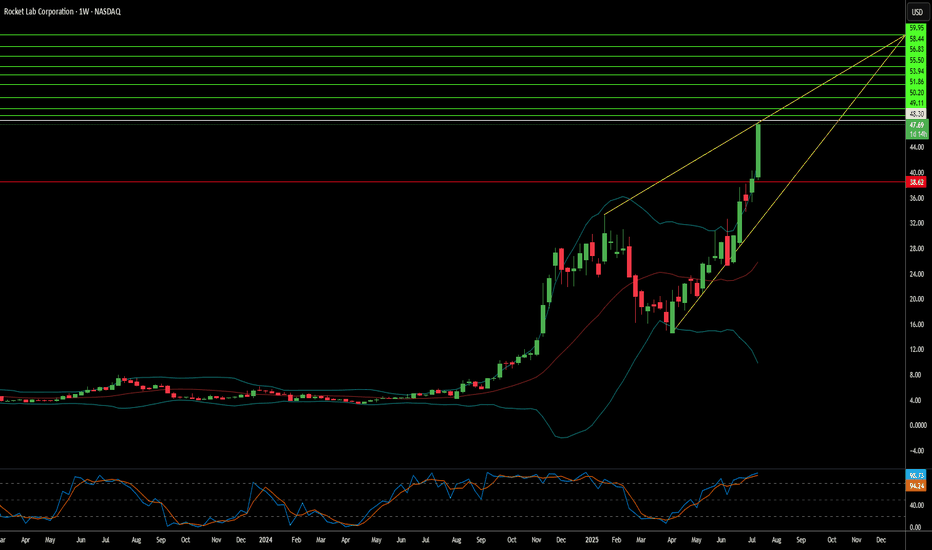

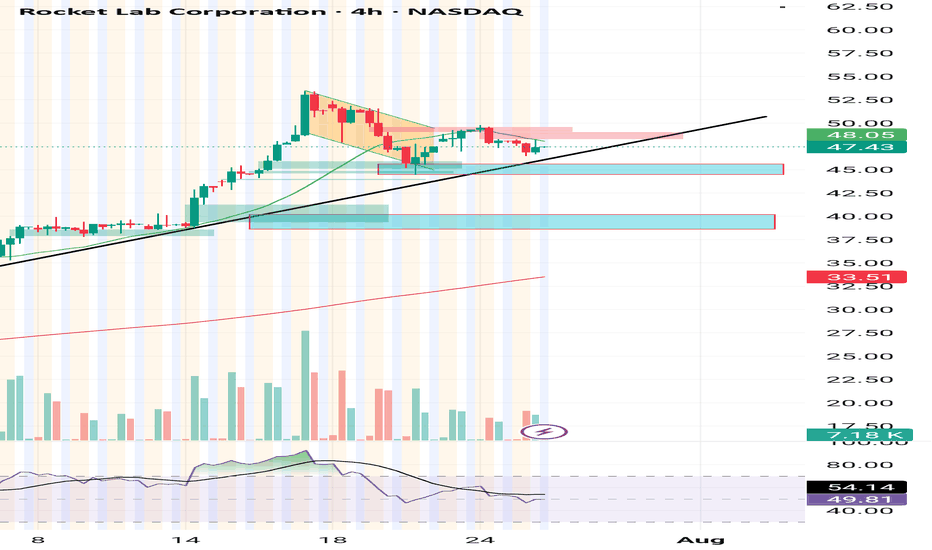

RKLB - LTF Cooling OffWe are currently starting to see the first signs of trend reversal for RKLB. From April we saw a massive 150%+ surge towards $38. After forming a 4H doji (LTF signal) we are starting to see sellers come in.

If selling pressure does continue our first zone to watch for support would be our white box ($30-32). Then the levels of $28 and $23.

If price is able to continue this uptrend and close a 4H candle body above where the doji printed then we could see new highs.

My RKLB for the rest of 2025 before sell offI believe we are going through these 2 scenario drawn out on my chart

1) we have a head and shoulder sell off. target $48-55

2) we go higher following the orange line neutron and really good news. target $95-124

good luck to all may u have success in all your trading setup

Rocket (RKLB) From Launch Innovator to Space Systems PowerhouseCompany Evolution:

Rocket Lab NASDAQ:RKLB is transforming into a vertically integrated space and defense systems company, leveraging its launch heritage to build long-term, diversified revenue streams.

Key Catalysts:

Rapid Launch Cadence 🛰️

3 Electron launches in 24 days demonstrate operational agility and scalability.

Meets rising demand for high-frequency satellite constellation deployments.

Strategic GEOST Acquisition 🛡️

$275M deal expands into electro-optical and infrared payloads, key for defense/ISR.

Boosts margin profile, backlog durability, and government contract appeal.

Validated Execution & Recurring Revenue 💼

100% mission success rate and multi-launch contract with Japan's iQPS reinforce credibility.

Positions RKLB for long-term cash flow stability and multiyear contract wins.

Investment Outlook:

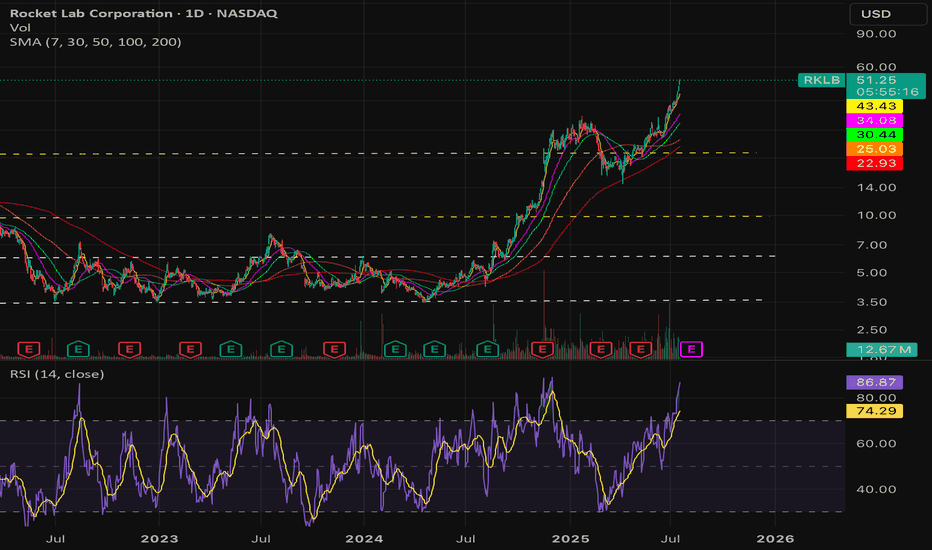

📈 Bullish above $23.00–$24.00, backed by high reliability and strategic expansion.

🎯 Price Target: $42.00–$43.00, reflecting an expanding TAM, defense sector momentum, and vertically integrated execution.

🌠 RKLB is no longer just reaching orbit—it's building the infrastructure of space. #RKLB #SpaceStocks #DefenseGrowth

Rocket Lab (RKLB) Offers Full Launch To Space ServicesRocket Lab Corporation (RKLB) is an aerospace company that provides small- to medium‑lift launch services and spacecraft systems. Their Electron rocket supports commercial satellite deployments while the forthcoming Neutron vehicle targets larger payloads. The company also develops satellite components and the Photon satellite bus, and recently expanded into satellite manufacturing with the Flatellite platform—positioning itself as an end‑to‑end space company with national security contracts.

On the chart, RKLB recently showed a confirmation bar accompanied by rising volume and moved above the .236 Fibonacci level—entering the momentum zone. This suggests growing buyer confidence and sets up potential for an extended upward move. Traders may use the .236 Fibonacci level as a trailing stop via the Fibonacci snap tool to manage risk while staying aligned with the trend.

This one is speculative, but it could be a moon shot for a flipSo this one is a little riskier than most trades I take, but the juice has been historically worth that squeeze. Historically, this setup has never produced a losing trade on RKLB, so I don't expect this time to break that streak. In addition to having a perfect record, it also has stellar (no pun intended) daily rates of return. It's also in the midst of a solid uptrend, making the trade a little less risky than it otherwise might be.

The average trade using this signal lasted 15 days and gained 6.2% - a .41% per day return (10x the long term market daily average return). However, that number was skewed by a few long trades. The median was 4% in 6 days (15x the average daily market return) and almost 1 in 4 trades produced a gain of > 10%. I don't expect that kind of gain here, but it'd be nice if it happened.

This one is also a stock that tends to produce multiple signals in succession, so I am prepared to add to the position if that occurs. I may or may not use FPC depending on the return on the FPC day.

As always - this is intended as "edutainment" and my perspective on what I am or would be doing, not a recommendation for you to buy or sell. Act accordingly and invest at your own risk. DYOR and only make investments that make good financial sense for you in your current situation.

$RKLB: Early Entry Ignites as Momentum Builds🚀 NASDAQ:RKLB – Rocket Lab USA | Breakout Watch

Chart Notes:

Rocket Lab is showing impressive strength after successfully holding its 200-day moving average, even as broader markets pulled back. That type of resilience often points to institutional support.

Today’s move delivered a low-cheat early entry backed by strong volume, a key sign of accumulation. We’re also seeing the moving averages start to stack, signaling that momentum is building.

The recent earnings report is behind us, removing near-term volatility risk—and the market’s positive reaction to that report is another bullish signal. In terms of industry positioning, Rocket Lab is part of the emerging commercial space sector, which continues to attract investor interest and capital as a high-growth frontier.

This stock is of the higher-octane variety, and with more and more growth names breaking out recently, conditions look favorable for RKLB to follow suit.

Trade Plan:

Entry Zone: 23.76 – 24.95

Stop: 7% below entry

Target: 2:1 minimum reward-to-risk or 14%+ upside

We’ll be watching for continued strength or additional entry points as it pushes toward the top of its base. Keep this one on your radar—it could live up to its name and rocket to new highs.

RKLB Long Trade Setup – Breakout in Motion!🚀

✅ Trade Type: Long

🕒 Timeframe: 30-Minute

🎯 Entry Zone:

$28.76 (Breakout candle from ascending triangle)

🔻 Stop-Loss (SL):

$27.22

Placed below key support and trendline – smart risk placement

🎯 Target Zones:

TP1: $30.70 (Red line – short-term resistance)

TP2: $33.28 (Green line – higher resistance zone / previous supply)

📊 Risk-Reward Ratio:

Strong (Estimated R:R ≈ 1:2.5+)

🔍 Chart Analysis Notes:

Breakout from ascending triangle with bullish momentum

Volume spike confirms buyer participation (+13.14%)

Clean trendline break + horizontal resistance flip potential

Yellow line may act as a retest or confirmation level

Update on Nuclear Stocks SMR, OKL0 + NEW IDEAS VRT, TSLA OKLO, SMR going through the roof. NNE is trailing today. Sold out most of the RKLB.

Lets go over the SPY, QQQ which are flagging now after holding support.

Liking this VRT and LTBR AND LUNR for potential swings along with HIMS!

Lets dig into the charts and see whats up!

Rocket Lab (RKLB) – Breakout Setup With 22.95% UpsideRocket Lab (NASDAQ: RKLB) is setting up for a potentially explosive move. The price just closed above the Ichimoku Cloud with a bullish Kumo breakout, reclaiming the pivot level at $22.42. We're also seeing confirmation from multiple technical signals:

🔍 Technical Breakdown:

✅ Price above the cloud (bullish confirmation)

✅ Strong bounce off Tenkan-sen (conversion line) acting as support

✅ Bullish momentum building after weeks of consolidation near the cloud top

✅ Break above recent highs with room to run to R1 at $28.80

This setup has a clear entry and stop with strong R/R dynamics:

Entry: $23.41

Target: $28.80 (22.95% upside)

Stop: $21.55 (7.96% downside)

Risk/Reward Ratio: 2.68

Size: 3,763 shares | Reward: $48,172 | Risk: $21,000

📡 Fundamental Bull Case:

Rocket Lab is one of the few pure-play space launch and satellite companies publicly traded. It's essentially a mini SpaceX with recurring revenue from satellite deployment, space systems, and a strong contract pipeline with NASA and defense partners.

🛰️ Recently won key government and defense contracts

💵 Revenue is growing YoY; expanding margins in Q1

🌎 Strong tailwinds from global satellite/defense expansion

🔋 Potential long-term upside from Neutron rocket program and vertical integration

This trade setup is backed by both technical momentum and macro tailwinds in the space sector. RKLB is quietly gaining traction as a Tier 2 space player with massive optionality.

RKLB Gap Down Earnings Reversal Play + Flag BreakoutTwo powerful setups are in play here, and both are primed for action:

🔹 Setup 1: Earnings Gap Down Reversal (Kicker Candle)

Post-earnings flush, buyers stepped in hard — this has been a relentless pattern in this market.

Even on earnings misses, buyers are aggressive. We saw the same setup work beautifully on NASDAQ:TEM and NYSE:HIMS recently.

This is a kicker candle setup — strong reversal signal after a gap down flush.

🔹 Setup 2: Flag Breakout at $23.50

Price is coiling into a tight flag, with a breakout level at $23.50.

Risk is defined, with stops at $22, keeping the trade tight.

🔹 My Trading Plan:

1️⃣ Initial Position: Buying May 30th $25 Calls today.

2️⃣ Risk Management: Stop at $22 for the calls and underlying stock.

3️⃣ Add Size: On a clean breakout over $23.50.

🔹 Why This Setup is Hot:

The earnings gap down reversal has been a killer setup in this market — buyers are dominating.

Dual setup means two chances to win: Reversal + Flag Breakout.

Tight risk, with a clear invalidation at $22.

⚠️ Risk Management: Tight stop at $22 — this is a LOW-risk, high-reward setup.

ROCKET LAB establishing its long-term Support to $32.00It's been too long (September 30 2024, see chart below) since we last took a trade on one of our stock gems, Rocket Lab (RKLB), which smashed through our $14.50 Target:

The price is now trading sideways for the past 2 weeks, establishing the 1D MA50 (blue trend-line) as the new Support. Having made the Trade War bottom on its 1D MA200 (orange trend-line), it got its much needed overbought technical harmonization and created new long-term demand.

The pattern is similar to the 1D MACD Bearish Cross in late May 2024, which also made the price trade sideways before eventually almost testing the previous Resistance. As a result, we expect to see $32.00 in July before the stock breaks to a new All Time High.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇