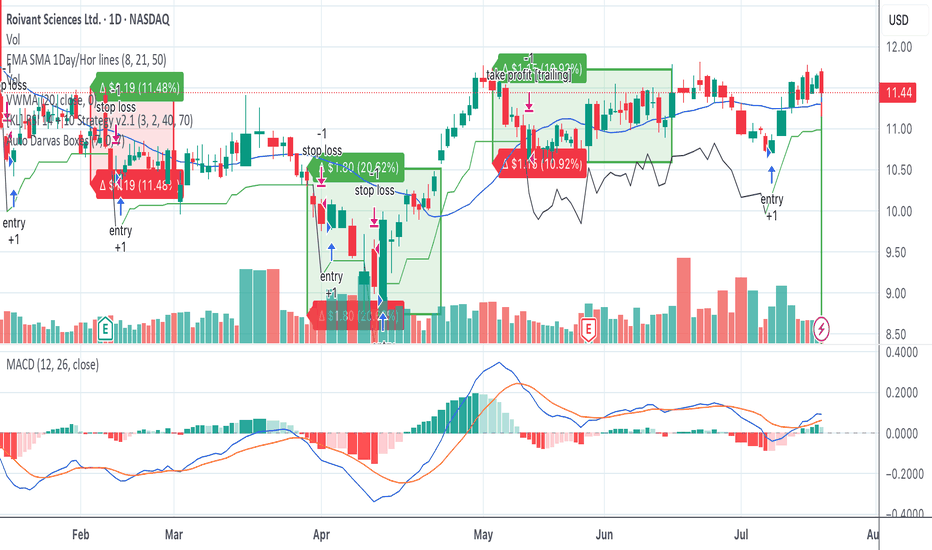

ROIV: A Speculative Biotech Play with Cash in the Bank and CatalRoivant Sciences (NASDAQ: NASDAQ:ROIV ) is one of the more intriguing speculative plays in the biotech sector right now. Trading around $11.45, the stock offers exposure to a deep pipeline of clinical-stage assets through its decentralized “Vant” model—subsidiaries focused on specific therapeutic a

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

−0.24 USD

−171.98 M USD

29.05 M USD

401.30 M

About Roivant Sciences Ltd.

Sector

Industry

CEO

Matthew Gline

Website

Headquarters

London

Founded

2021

FIGI

BBG007STW2B8

Roivant Sciences Ltd. engages in the biopharmaceutical business, which engages in the development of transformative medicine. Its product portfolio includes Vtama, Batoclimab, Brepocitinib, Namilumab, and RVT-2001, which aims to treat psoriasis, atopic dermatitis, thyroid eye disease, and other illnesses. The company was founded by Vivek Ramaswamy on April 7, 2014 and is headquartered in London, the United Kingdom.

Related stocks

The Short Story of a 15% DeclineWe find ourselves in a challenging situation. Over the past two years, the stock has been in a sustained upward trend. However, over the past month, we have been testing the current support level extensively, which raises concerns about the stock's resilience at this point. The formation of a double

Roivant Sciences (ROIV): A Multibagger Stock Opportunity

Roivant Sciences (ROIV) is poised for significant growth with a strong pipeline, including potential blockbusters like Batoclimab and Brepocitinib in the autoimmune space. Recent deals, including the $5.2B sale of Telavant, have strengthened their balance sheet and set the stage for future profitab

Sorry Vivek... this does not look good for you :/Price target 1 - $7

Price target 2 - $5

This has nothing to do with Vivek personally, but this is very clearly setting up for a LARGE move down.

If all is untrue with my analysis and earnings are promising, I can see a pop to $15 per share.

Earnings for a company that has a 7.8 billion dollar

ROIV – 20% Trading RangeNASDAQ:ROIV is trading near all time highs, and I just don’t see any good investment opportunity here. However, I do like that there is a nice trading range between the red and green trendlines with 20% swings. I would definitely trade these swings, it looks like there was a recent opportunity that

A bit confused...It's really hard to say what's going to be. But I can say, this momentum is very important, and in the next days will form a new direction.

The uncertainty of the situation is big. There is a bullish trend, and the RSI signs the break of the bearish trend. But something's not right, maybe the 12.00

ROIV - BioTech reporting 2/13 as a LONG earnings tradeRoivant Scientes, on the 15 minute chart is experiencing increase volatility and volume now two

days out from its earnings report. The MACD with zero lag shows a bullish inflection in the lines

On the daily chart, ROIV gained 38% in 2023 but has been down 4 %YTD. The volume and

volatility show

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

Frequently Asked Questions

The current price of ROIV is 11.55 USD — it has increased by 1.49% in the past 24 hours. Watch Roivant Sciences Ltd. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Roivant Sciences Ltd. stocks are traded under the ticker ROIV.

ROIV stock has fallen by −1.28% compared to the previous week, the month change is a −0.77% fall, over the last year Roivant Sciences Ltd. has showed a 7.44% increase.

We've gathered analysts' opinions on Roivant Sciences Ltd. future price: according to them, ROIV price has a max estimate of 19.00 USD and a min estimate of 12.00 USD. Watch ROIV chart and read a more detailed Roivant Sciences Ltd. stock forecast: see what analysts think of Roivant Sciences Ltd. and suggest that you do with its stocks.

ROIV reached its all-time high on Dec 20, 2021 with the price of 16.76 USD, and its all-time low was 2.52 USD and was reached on May 12, 2022. View more price dynamics on ROIV chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

ROIV stock is 2.60% volatile and has beta coefficient of 0.73. Track Roivant Sciences Ltd. stock price on the chart and check out the list of the most volatile stocks — is Roivant Sciences Ltd. there?

Today Roivant Sciences Ltd. has the market capitalization of 7.85 B, it has increased by 2.55% over the last week.

Yes, you can track Roivant Sciences Ltd. financials in yearly and quarterly reports right on TradingView.

Roivant Sciences Ltd. is going to release the next earnings report on Aug 18, 2025. Keep track of upcoming events with our Earnings Calendar.

ROIV earnings for the last quarter are −0.29 USD per share, whereas the estimation was −0.26 USD resulting in a −10.05% surprise. The estimated earnings for the next quarter are −0.25 USD per share. See more details about Roivant Sciences Ltd. earnings.

Roivant Sciences Ltd. revenue for the last quarter amounts to 7.57 M USD, despite the estimated figure of 54.07 M USD. In the next quarter, revenue is expected to reach 7.30 M USD.

ROIV net income for the last quarter is −206.47 M USD, while the quarter before that showed 169.38 M USD of net income which accounts for −221.90% change. Track more Roivant Sciences Ltd. financial stats to get the full picture.

No, ROIV doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Jul 26, 2025, the company has 750 employees. See our rating of the largest employees — is Roivant Sciences Ltd. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Roivant Sciences Ltd. EBITDA is −1.12 B USD, and current EBITDA margin is −3.81 K%. See more stats in Roivant Sciences Ltd. financial statements.

Like other stocks, ROIV shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Roivant Sciences Ltd. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Roivant Sciences Ltd. technincal analysis shows the strong buy rating today, and its 1 week rating is buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Roivant Sciences Ltd. stock shows the buy signal. See more of Roivant Sciences Ltd. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.