ROIV: A Speculative Biotech Play with Cash in the Bank and CatalRoivant Sciences (NASDAQ: NASDAQ:ROIV ) is one of the more intriguing speculative plays in the biotech sector right now. Trading around $11.45, the stock offers exposure to a deep pipeline of clinical-stage assets through its decentralized “Vant” model—subsidiaries focused on specific therapeutic areas like Immunovant (autoimmune), Pulmovant (pulmonary), and Priovant (inflammatory and dermatological conditions).

The company went public via SPAC in 2021 and has maintained a capital-efficient approach, acquiring and spinning off promising drug candidates. What sets Roivant apart is its incredibly strong balance sheet: nearly $5 billion in cash and equivalents with minimal debt. That translates to about $7 per share in net cash, giving it one of the strongest financial positions in the biotech sector and a long operational runway.

Roivant’s upcoming earnings call on August 7 (after market close) will be closely watched. Investors are particularly focused on late-stage clinical data expected in the second half of the year, including Phase III readouts for brepocitinib (Priovant) and updates from Immunovant’s FcRn inhibitor programs. These results could serve as major price catalysts.

Financially, Roivant is still burning cash, as expected at this stage. The most recent quarterly earnings showed an EPS loss of –$0.29, missing analyst expectations. Revenue came in at $7.6 million—above estimates but significantly below the prior year’s figure of $28.9 million. Free cash flow was –$844 million for the year, but with a current ratio over 30 and a healthy reserve, the company is in no danger of running out of capital in the near term.

Technical Outlook: Holding Range, Eyes on Breakout

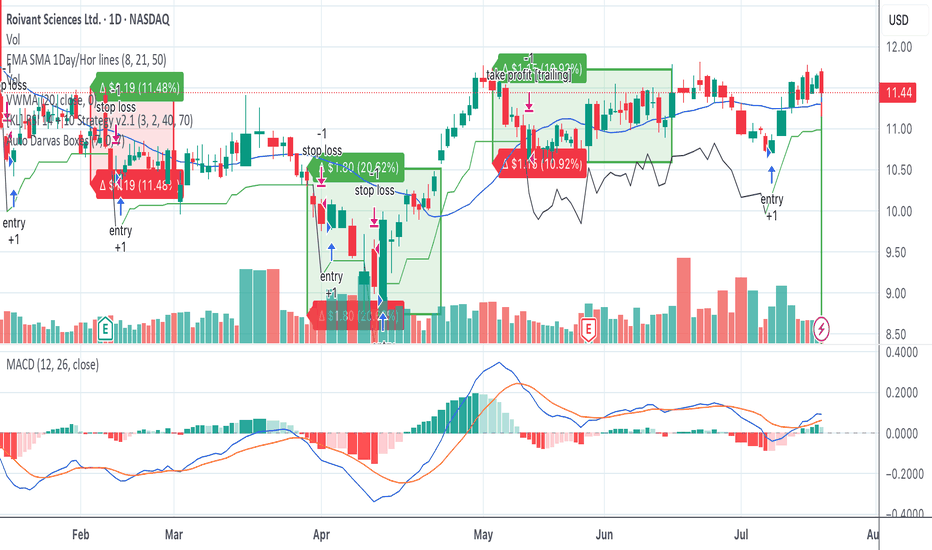

The daily chart shows ROIV in a tight $10.80–$11.80 range, consolidating after a solid run. While the short-term 15-min chart showed a recent pullback, support held at $11.40 and triggered a fresh entry signal in our system. MACD is flattening and could curl bullish again soon. On the daily, MACD remains bullish with room to run if volume enters.

A break above $11.70–$11.80 could trigger the next leg toward $12+, and ultimately the psychological and options-heavy $13 level.

Options Activity: Big Bet on October $13 Calls

What’s catching serious attention is unusual options flow on the October $13 call contracts. Over 17,000 contracts are open, with recent trades in the $0.45–$0.55 range—showing real speculative interest in a move above $13 by Q4. That’s about a 13% move from current levels, well within range for biotech on a good catalyst.

I like the $12 August call for ROIV offers a more conservative upside play than the $13 strike, with less distance to break-even and still attractive risk/reward. Trading around $0.20–$0.25, it only requires an ~5% move to be in the money, making it a more realistic target if momentum builds post-earnings or on positive trial news. With less premium risk and higher probability, it’s a smart middle ground. And it's not a bad buy at $12 heading into Q4.

My Position

I’ve taken a very small position in near-term calls to test the setup and stay engaged. The combination of:

A strong cash runway

Upcoming catalysts

Technical setup near breakout

And rising options interest

makes ROIV a name to watch closely.

The Setup: Binary Risk, Asymmetrical Reward

For those considering the October contracts, this is a classic biotech setup:

Defined risk (premium paid)

Asymmetrical upside if catalysts hit

A clear breakout level to monitor ($13+)

And a high cash floor that provides downside cushion

This fits perfectly into a broader strategy of small speculative bets with high return potential.

Roivant isn’t without risk—trial results and sentiment shifts matter—but it’s one of the better-positioned clinical-stage plays heading into the second half of 2025. Watch for updates on Priovant and Immunovant, track the $13 level, and monitor volume and MACD crossovers for clues. If this stock breaks out, October could be the window.

ROIV trade ideas

The Short Story of a 15% DeclineWe find ourselves in a challenging situation. Over the past two years, the stock has been in a sustained upward trend. However, over the past month, we have been testing the current support level extensively, which raises concerns about the stock's resilience at this point. The formation of a double top is particularly noteworthy, as this pattern often signals a potential reversal.

This stock has historically exhibited highly consistent and conservative behavior, closely adhering to technical patterns. As such, I do not anticipate any unexpected deviations. Based on the current analysis, I foresee a 15% probability of a decline within the next month.

Roivant Sciences (ROIV): A Multibagger Stock Opportunity

Roivant Sciences (ROIV) is poised for significant growth with a strong pipeline, including potential blockbusters like Batoclimab and Brepocitinib in the autoimmune space. Recent deals, including the $5.2B sale of Telavant, have strengthened their balance sheet and set the stage for future profitability. Upcoming Q4 catalysts, a $1.5B buyback program, and a solid focus on pulmonary hypertension therapies make ROIV an undervalued gem at its current price.

Personal Note: Hi, I'm sharing insights on stocks with strong catalysts like ROIV. Follow me for more deep dives and stock picks.

Sorry Vivek... this does not look good for you :/Price target 1 - $7

Price target 2 - $5

This has nothing to do with Vivek personally, but this is very clearly setting up for a LARGE move down.

If all is untrue with my analysis and earnings are promising, I can see a pop to $15 per share.

Earnings for a company that has a 7.8 billion dollar market cap, BETTER deliver.

SHORT IT... I'm sorry Vivek, I really like you but stocks don't care about our feelings.

ROIV – 20% Trading RangeNASDAQ:ROIV is trading near all time highs, and I just don’t see any good investment opportunity here. However, I do like that there is a nice trading range between the red and green trendlines with 20% swings. I would definitely trade these swings, it looks like there was a recent opportunity that was missed. But I’ll track ROIV to look for the next setup.

A bit confused...It's really hard to say what's going to be. But I can say, this momentum is very important, and in the next days will form a new direction.

The uncertainty of the situation is big. There is a bullish trend, and the RSI signs the break of the bearish trend. But something's not right, maybe the 12.00 tops, or the temptation of the 8.30 level.

Stay informed, and watch the chart, something very important will happen.

ROIV - BioTech reporting 2/13 as a LONG earnings tradeRoivant Scientes, on the 15 minute chart is experiencing increase volatility and volume now two

days out from its earnings report. The MACD with zero lag shows a bullish inflection in the lines

On the daily chart, ROIV gained 38% in 2023 but has been down 4 %YTD. The volume and

volatility show both are heightened in the pre-earnings run- up. The last report in November

was a double beat which is good prognosis for the one upcomings. This is a risky earnings

play, ROIV does not yet make money. However, because it lost less than forecasted, buyer

interest has increased. The call option for 2/16 for a strike of $12.50 is priced at $ 5.00

per contract. I suspect a long trade in shares may gain to $ 11.50 targeting the double top

at the turn of the year for a projected gain upside of about 7% (with a stop loss of 2.5%).

Considering that ROIV has gained 12% this past week, 7% in the next two days is about the

same trend angle. As to the call contract, I have considered 100% return as my expections

for the two days before the earnings. If earnings disappoint trader expectations and price fades

I will sell to close the contract. If earnings is as expected, I will roll the contract forward into

the March monthly and add a bit more capital into the trade.