ROKU seems great-The moving average lineup is fairly balanced. If the current price is maintained, the 120MA is trending downwards, the 60MA is staying constant, and the 20MA is trending upwards, it might form a bullish moving average alignment.

-If the price breaks through the resistance level, I will buy.

ROKU trade ideas

Is ROKU ready to reverse and recover?ROKU here is on a one hour chart. IT has trended down from from its supply/ resistance area

of 65-68 and has dipped into its demand/ support zone of 52-53 per the Luxalgo indicator.

Price is presently far below the high volume area of the volume profile which shows the

the highest volume at 64. At this point, short sellers are buying to cover and take profit.

Price is now at the lowermost VWAP bands in the deep undervalued area. Bargain hunters

such as myself now have an interest. Fundamentally, the last earnings report was

reasonably favorable given the context of the general market and the economy.

I see ROKU as a long-trade candidate at this point. It should follow AAPL, TSLA, META GOOG

and other mega-caps and begin an uptrend. ROKU has high volume high liquidity and

relatively narrow spreads. I will take a call option trade striking $50 with a

DTE of 30-45 days. IF it performs well, at 21-30 days I will roll it into another.

Roku: Is it going to turnaround or fail from here?Roku made almost a V shape recovery from December low and then stalled out again. Profitability is still out of reach and other than Ark Invest, there is not much enthusiasm for the stock. Elliott wave has both on bullish or bearish counts, but in both cases, there could be some short and medium term upside before farther downside. Right now, stock can make another spike down to touch the 38.2 retrace level at $50 and create three touches of RSI bullish divergence and take off to the upside from there. Or it could start climbing up now. Next stop should be between $90-105. At that point for the bearish case, if price action collapses, then there is a chance it can go down to retest December 2022 lows or even break below. If price consolidates and eventually moves above $108 then the bull case is more likely. That does not mean it will be a smooth sailing. The price action will be choppy and volatile for quite a while. Right now I will be looking for another push higher fairly soon after this pullback is over. In case price breaks down below $50, it might play out a wonky H&S pattern back down to the lows. Have to keep that in mind and keep an eye on RSI not to break down below 36.

More Pain for Roku?Roku fell sharply in late 2021 and the first half of 2022 as growth stocks collapsed. Now, after a period of consolidation, traders may look for the bearish move to continue.

The first pattern on today’s chart is the 200-day simple moving average (SMA). Prices tested this long-term trend marker over the last three months without breaking through it. ROKU slid back under the 200-day SMA in late April and has remained there since, a potential sign its long-term downtrend remains in effect.

Second, notice how the 100-day SMA never crossed above the 200-day SMA. That’s also consistent with a longer-term downtrend.

Third, a triangle formed and resolved to the downside. Bollinger Bandwidth widened at the same time, a sign of prices starting to move after compressing. MACD has also turned bearish.

TradeStation has, for decades, advanced the trading industry, providing access to stocks, options, futures and cryptocurrencies. See our Overview for more.

Important Information

TradeStation Securities, Inc., TradeStation Crypto, Inc., and TradeStation Technologies, Inc. are each wholly owned subsidiaries of TradeStation Group, Inc., all operating, and providing products and services, under the TradeStation brand and trademark. TradeStation Crypto, Inc. offers to self-directed investors and traders cryptocurrency brokerage services. It is neither licensed with the SEC or the CFTC nor is it a Member of NFA. When applying for, or purchasing, accounts, subscriptions, products, and services, it is important that you know which company you will be dealing with. Please click here for further important information explaining what this means.

This content is for informational and educational purposes only. This is not a recommendation regarding any investment or investment strategy. Any opinions expressed herein are those of the author and do not represent the views or opinions of TradeStation or any of its affiliates.

Investing involves risks. Past performance, whether actual or indicated by historical tests of strategies, is no guarantee of future performance or success. There is a possibility that you may sustain a loss equal to or greater than your entire investment regardless of which asset class you trade (equities, options, futures, or digital assets); therefore, you should not invest or risk money that you cannot afford to lose. Before trading any asset class, first read the relevant risk disclosure statements on the Important Documents page, found here: www.tradestation.com .

$ROKU SymmetricalAfter its earnings report, Roku seems to be forming a symmetrical pattern. I drew the trendlines to fit most of the tops and bottoms but you will adjust accordingly with price action. It looks like we're getting into the narrow straits of the trendlines so I'm looking for a breakout with high volume in either direction today or tomorrow. If you look at their earnings, I'm leaning towards a breakout on the long side but I'll let the chart decide. Let me know what you guys think!

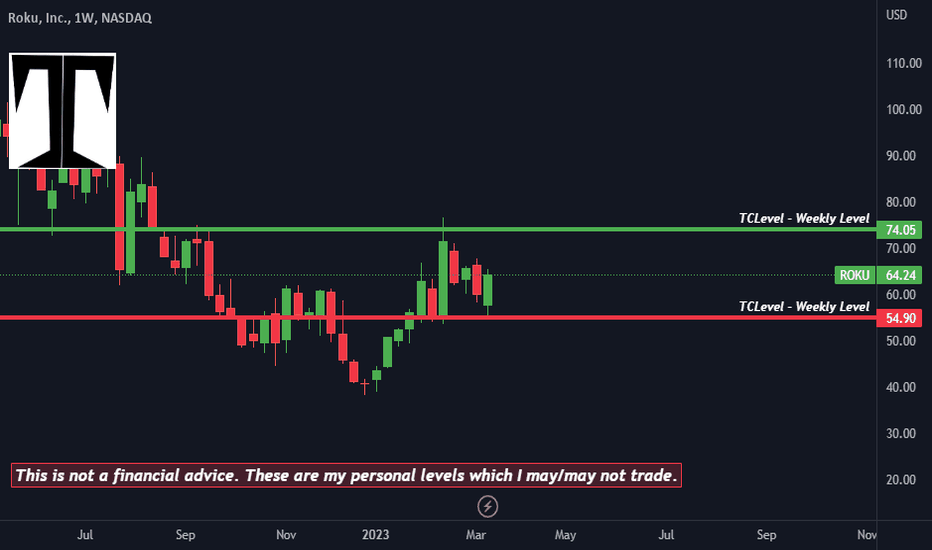

ROKU : Chart updateThe price is now shaking between $68 and $54.50.

Less important level at about BMV:60

To see a first signal of bulls after the strong downtrend The price must close and hold at least $68. Much better would be 76.50.

If bears are still in control, the price will easily record a new low soon, below $54.5

ROKU ROKU - Where Are You? 🔍 Analysis #32/50Hello TradingView Family / Fellow Traders. This is Richard, also known as theSignalyst.

on WEEKLY: Left Chart

ROKU is stuck inside a range around support and round number 50.0 so we will be looking for buy setups on lower timeframes.

on DAILY: Right Chart

🏹 For the bulls to take over, we need a momentum candle close above the last major high in gray around 75.0

Meanwhile, until the buy is activated, ROKU can still trade lower till the 50 support again.

📚 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck!

All Strategies Are Good; If Managed Properly!

~Rich

ROKU: It is done falling into infinity?While some are sure Roku is dead, there might be signs of a turnaround. Weekly DI is now in bullish territory, with green DI being above 20 and red DI below. ADX turning down also signifies that the massive down move might have ended and a new phase is starting. I will be closely watching the retrace of the latest bounce to hold 50% fib level and create some kind of an inverse head and shoulders pattern along with the trendline breakout retest. If all of that plays out, it will be the sign to jump back in it for a crazy move up.