RRGB trade ideas

RRGB - Great price action so far (buy the next dip)RRGB has the hallmarks of a stock that could potentially be a great winner. It broke out of it's base formation on 1st March on earnings beat with a strong breakaway gap (Breakaway gaps signify the beginning of a new trend and does not get filled in the near term).

It then proceeded higher over the next few days before pulling back to the breakup level @ 10.60 on 14 Mar, and then bounced right off again from there. This classic "break up and retest" establishes the neckline as the new "resistence turned support".

If one had been watching this stock, going long shortly after this "retest" would have been ideal.

However, since it is likely the trend is still in early stage, any near term dip (eg to fib retracement levels of 38-50%, or formation of bull pennant or flag etc) would still be a good opportunity to long. Let's see if the opportunity presents soon.

Disclaimer: Just my 2 cents and not a trade advice. Kindly do your own due diligence and trade according to your own risk tolerance and don't forget that money management is important! Take care and Good Luck!

Red Robin Gourmet Burger $RRGBLet's have some fun!

This hamburger joint chart looks juicier than most others. Clean setups across the board:

👉Nasty downtrend (actually goes back to ~$92)

👉~8 months of compression at historic lows

👉Ran the all time lows before breaking up

👉Clear 🎯's, though obvious battles will likely need to be fought at each level.

Invalidation: New lows kill the setup imo.

Red Robin should to return to its prepandemic levels soonRed Robin should be able to return to their 12% margins soon, their cost of goods and services should be lowered by an overall trend of lower beef and agricultural prices. This combined with more freely opened stores in major markets should allow them to profitability for Q3.

RRGB Setting Up?RRGB getting support from previous resistance and the 20-day EMA while contending with the 50-day SMA. Aggressive traders can take entries here but I'd rather see a green day to confirm the support before putting money on the line. 26% short interest so this thing can really move if it catches a bid.

Red Robin Potential targets Red Robin Gourmet Burgers, Inc. develops, operates, and franchises full-service restaurants North America. It serves a variety of salads, soups, appetizers, entrees, seafood and desserts. The company was founded in September 1969 and is headquartered in Greenwood Village, CO.

Red Robin Risky trade into earnings Stock has built a nice base throughout 2019

Possibility of a short squeeze with 24.65% held short

Company profile

Red Robin Gourmet Burgers, Inc. develops, operates, and franchises full-service restaurants North America. It serves a variety of salads, soups, appetizers, entrees, seafood and desserts. The company was founded in September 1969 and is headquartered in Greenwood Village, CO.

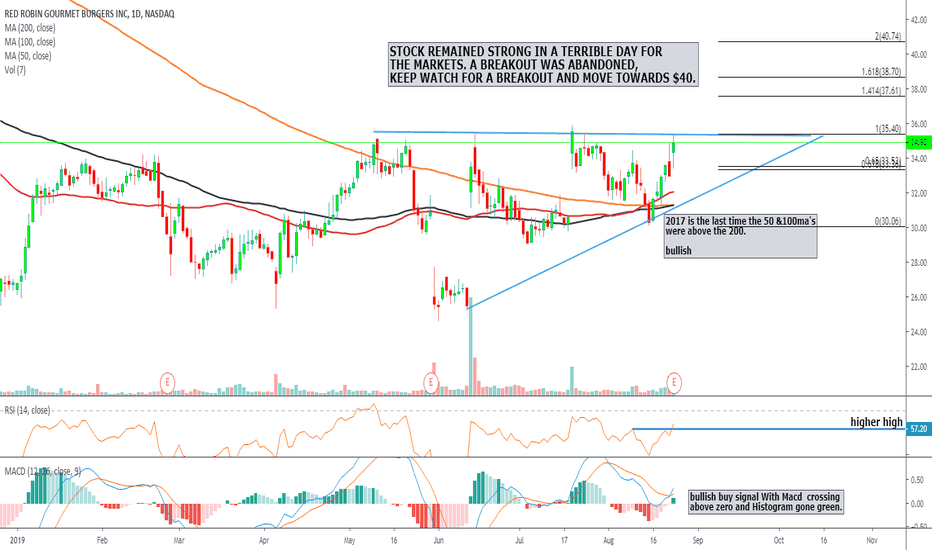

Expecting a breakout next week in Red Robin Gourmet Burger. NASDAQ:RRGB is a extremely shorted stock, if the market had been better today a major breakout would have possibly played out.

AVERAGE ANALYSTS PRICE TARGET $32

AVERAGE ANALYSTS RECOMMENDATION HOLD

P/E RATIO

SHORT INTEREST 30%

COMPANY PROFILE

Red Robin Gourmet Burgers, Inc. develops, operates, and franchises full-service restaurants North America. It serves a variety of salads, soups, appetizers, entrees, seafood and desserts. The company was founded in September 1969 and is headquartered in Greenwood Village, CO.

$RRGB BREAKOUT POSSIBLE ON RED ROBIN EARNINGS ======PRICE TARGET $40======

BREAKOUT RESISTANCE $35.

UPSIDE POTENTIAL 15%.

We believe a break to the upside is imminent and tomorrows earnings will be the catalysts to do it.

Stock is extremely volatile.

COMPANY PROFILE

Red Robin Gourmet Burgers, Inc. develops, operates, and franchises full-service restaurants North America. It serves a variety of salads, soups, appetizers, entrees, seafood and desserts. The company was founded in September 1969 and is headquartered in Greenwood Village, CO.