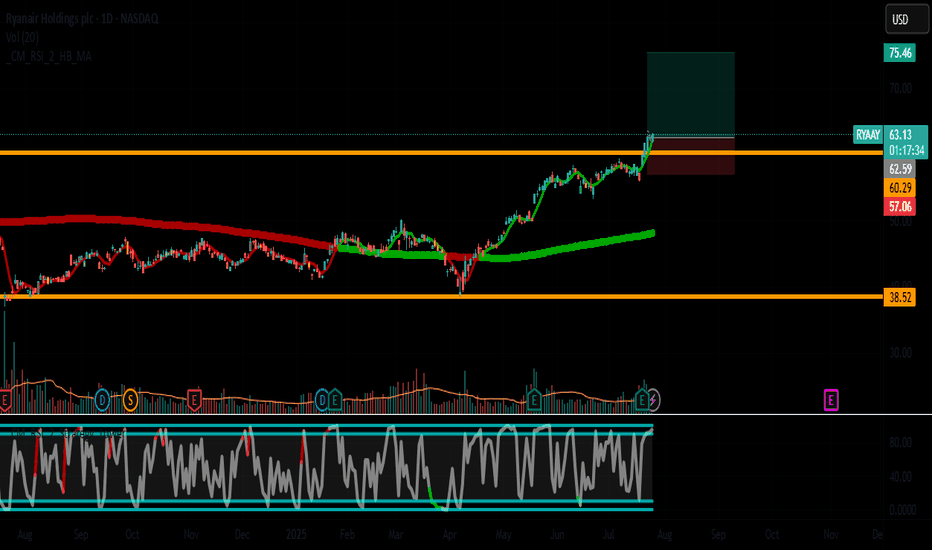

RYAAY (Ryanair Holdings) - Bullish Reversal Play🚀 Trade Idea: RYAAY (Ryanair Holdings) - Bullish Reversal Play

Entry: $63.00 | Stop Loss: $57.00 | Take Profit: $75.50

Risk/Reward Ratio: ~1:2.5

📈 Technical Setup

Trend Structure:

Breaking out from a 3-month consolidation range ($57-$63)

Daily chart shows higher highs forming after basing pattern

20 EMA ($60.50) crossing above 50 EMA ($59.20)

Key Levels:

Support: $57.00 (swing low & psychological level)

Resistance: $63.00 (breakout level) → $75.50 (2024 highs)

Momentum Indicators:

RSI(14): 58 and rising (room to run before overbought)

MACD: Bullish crossover with histogram expanding

Volume: 20% above average on breakout

✈️ Fundamental Catalyst

✅ Strong Summer Travel Demand:

Record Q2 passenger numbers (18.7m, +12% YoY)

Fuel costs stabilizing while fares remain elevated

✅ Valuation Case:

Trading at 12x forward P/E (below 5-yr avg of 15x)

35% EPS growth projected for FY2025

✅ Sector Tailwinds:

Jet fuel prices down 18% from Q1 peaks

EU travel recovery accelerating

🎯 Trade Management

Entry Strategies:

Aggressive: $63.00 (breakout entry)

Conservative: $61.50 (pullback to breakout level)

Profit Targets:

T1: $68.00 (partial 50%)

T2: $75.50 (full position)

Stop Placement:

Hard stop: $57.00 (-9.5%)

Trailing stop: Move to $60 after $68 reached

⚠️ Risk Considerations

Monitor oil prices (key cost driver)

Watch EUR/USD (currency exposure)

Next earnings: August 29 (event risk)

Alternative Scenario:

If $63 holds as resistance, wait for deeper pullback to $60 support

📌 What's Your Take?

Like if you're bullish on airlines! Any other levels you're watching?

#Airlines #Breakout #RYAAY #TravelStocks

(Chart shows clean breakout with volume confirmation. Trade with proper risk management!)

📢 Disclaimer:

This post and the information contained herein are for educational and entertainment purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy/sell securities. Trading stocks, options, and other financial instruments carries substantial risk of loss and is not suitable for all investors.

Do your own research (DYOR) before making any investment decisions.

Past performance is not indicative of future results.

The author may hold positions in mentioned securities at the time of writing.

Always consult a licensed financial advisor before making investment decisions.

By engaging with this content, you agree that you are solely responsible for your own trading decisions.

Trade at your own risk. 🚨

RYAAY trade ideas

Sell RyanairRyanair is now trading at close to its all-time highs. However, strong bullish sentiment could now be fading with traders/investors likely to take profits given the sharp appreciation over the past 12 months.

Ryanair levelled up 2.49% over the past 5 days.

In terms of returns, it has outperformed the Nasdaq by 142.46% so far this year.

Ryanair is currently trading with a market cap of $23.65 billion.

TRADING IDEA

Sell Ryanair at around $132 targeting $116 with a stop loss at $138.00.

$RYAAY with a Neutral outlook following its earnings #Stocks The PEAD projected a Neutral outlook for $RYAAY after a Negative over reaction following its earnings release placing the stock in drift C

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

$RYAAY posted negative earnings as projection followed suit$RYAAY posted negative earnings with the PEAD reflecting the results in its projections with a bearish outlook. price is currently trading around the upper boundary.

If you would like to see the Drift for another stock please message us. Also click on the Like Button if this was useful and follow us or join us.

Ryanair Holdings Plc Cuts capacity by 80%Ryanair Holdings Plc engages in the provision of low fares airline-related services. It includes scheduled services, internet, and other related services to third parties across a European route network. It also offers various ancillary services, and other activities connected with its core air passenger service, as well as non-flight scheduled services, internet-related services, and the in-flight sale of beverages, food, and merchandise. The company was founded on June 5, 1996 and is headquartered in Dublin, Ireland.

Ryanair on verge of break above Golden Pocket resistant. Irish Airline Ryanair is never far from controversy, a summer of strikes by pilots within Europe has almost passed by and looks like the company won the war having lost a few battles.

The collapse of Thomas Cook travel over the weekend has added more positive fuel to the recent rally in Ryanair , it is inevitable that passenger numbers will increase and there may be a case for increased routes rather than the decreases that was announced earlier in the summer.

Boeing has been a major thorn in the side of Ryanair as having a very large order of planes delayed, it has placed some restrictions on the airlines capacity.

Technically the chart is at a real pivot point, after a strong reversal since August, currently held by golden pocket resistance and the declining 100ma, a break above $65 could easily see a rally to the mid $70's.

P/e ratio 16

Company profile

Ryanair Holdings Plc engages in the provision of low fares airline-related services. It includes scheduled services, internet, and other related services to third parties across a European route network. It also offers various ancillary services, and other activities connected with its core air passenger service, as well as non-flight scheduled services, internet-related services, and the in-flight sale of beverages, food, and merchandise. The company was founded on June 5, 1996 and is headquartered in Dublin, Ireland.

RYANAIR takes aim at BOEING after Portuguese base exit.Ryanair was flying high one year ago, but things have went into a tailspin for multiple reasons, many related to Brexit and foreign exchange implications of that turmoil.

Most recently CEO Mr O Leary blasted Boeing for its inability to supply much needed planes that were on order, some days after the company announced layoffs and termination of their contract with FARO Airport due to their inability to meet requirements.

Next week staff are going on strike to protest pay and working conditions, at the most hurtful time during peak season.

It is obvious the Boeing MAX issues are having widespread implications worldwide and liabilities/compensation for Boeing are mounting.

RYANAIR 1D DESCENDING TRIANGLEDescending Triangles, Triangles, Ascending Triangle and Ranges are repeatable trading chart patterns.

Triangles and ranges are consolidation chart patterns that can breakout either direction.

Ascending and descending chart patterns will have a directional bias depending on the previous incoming trend.

Each chart pattern will have defining trendlines of the support/resistance levels creating the pattern.

What ever time frame you are trading this chart pattern, wait for a candle close outside of the trendline in the direction of the breakout candle. (Our time frame preference is the Daily chart).

Add volume indicator - Volume is the amount of $ that went into a particular candle or in Forex the # of trades that took place.

Add ATR indicator - Volatility is the amount of price movement that occurred. Use the ATR to measure the price movement.

When you see descending volume bars and descending atr line (which indicates volatility) this shows

a dis-interest in traders to invest in this pair creating consolidation which creates the chart pattern.

Trade Management after there is a breakout candle close.

1 - Position size (compare volume bar to volume ma line).

a - Breakout candle must be 100% of average volume for a full position size.

b - If 75% of average volume then ½ position size.

2 - Enter two trades.

3 - SL for both trades will be 1.5 x ATR.

4 - 1st trade TP will be 1 x ATR.

5 - No TP on 2nd trade – letting profit run and adjusting SL to follow price.

6 - When 1st TP hit – move 2nd trade SL to breakeven.

7 - Adjust the 2nd trade SL to follow price.

*8 - When breakout candle is more than 1 ATR from breakout candle open.

a - Enter 1st trade at candle close with ½ position size.

b - Enter 2nd trade with a pending limit order that is 1 ATR of breakout candle open.

c – Price should pullback to that pending limit order for 2nd trade.

d – If Price returns back into chart pattern close trade before SL is hit.

Bearish Descending Triangle on Ryanair (RYAAY)Ryanair (RYAAY) is showing a descending triangle with declining volume and volatility suggesting decreasing trader interest. We anticipate a descending triangle to break explosively to the downside.

Trade Plan: Sell a daily close below 61.82 if the volume equals or exceeds the volume average. Use 1/2 size to reduce risk if the volume is at least 75% of the average.

The Stop Loss 1.5 x ATR on the breaking candle above the entry.

The First Target will be 1.0 x ATR on the breaking candle below the entry.

If, after entry and before the first target, a candle closes back in the triangle, close the trade (don't wait for it to hit the stop loss.)

At first target, close 1/2 of your position and move stop loss to break even on the remainder.

Follow the stops as long as the trade continues in your direction.

WTB overextended selloff (3)RYAAY struggled at the highs and now is breaking down, will it be a standard 20% cut and then consolidation? maybe. I want to buy lower because it gives the counterbounce more space before hitting the previous highs.

Timing = 1 ( i think the overall market is in consolidation and overextended selloff are more likely)

Volume = 0 (the volume has been big on this selloff so it has force behind it)

Group strength = 0 (the airlines seem to be weak at the moment, it would make me thing the counterbounce could be weaker then normal)

Entry = 1 (if the stock falls below 90$ within a short time the selloff would be overextended)

Fractal = 1 (Fractal supports a consolidation or breakdown at this time)