7/29/25 - $sbet - What r u guys doing...?7/29/25 :: VROCKSTAR :: NASDAQ:SBET

What r u guys doing...?

- feels like i'm always in early, out early

- but here we are, buying AMEX:BMNR in the 30s post market, halving that in the run this AM... adding it back

- you all realize that NASDAQ:SBET 's mnav is pretty close to 1 right?

- i just don't get it, perhaps it's all these call options, negative gamma

- "yes" eth is expensive, could pullback got it

- but as a treasury vehicle, esp of this size, you'll likely see 2...3...4x mnav at end of cycle as borrow are in MSD rates and yield here ("ROE") in bank terms based on underlying CAGR is minimally DDs... but realistically in the 20s...30s...40s... e.g. justifying this 2+ x mnav

- so you do you

- but i'm back and buying all the way back to $15 and below where in my estimation you'd be buying eth at a discount? lol

V

SBET trade ideas

SBET – Holding the Key Zone for a Potential SqueezeSBET – Holding the Key Zone for a Potential Squeeze 🚀🔥

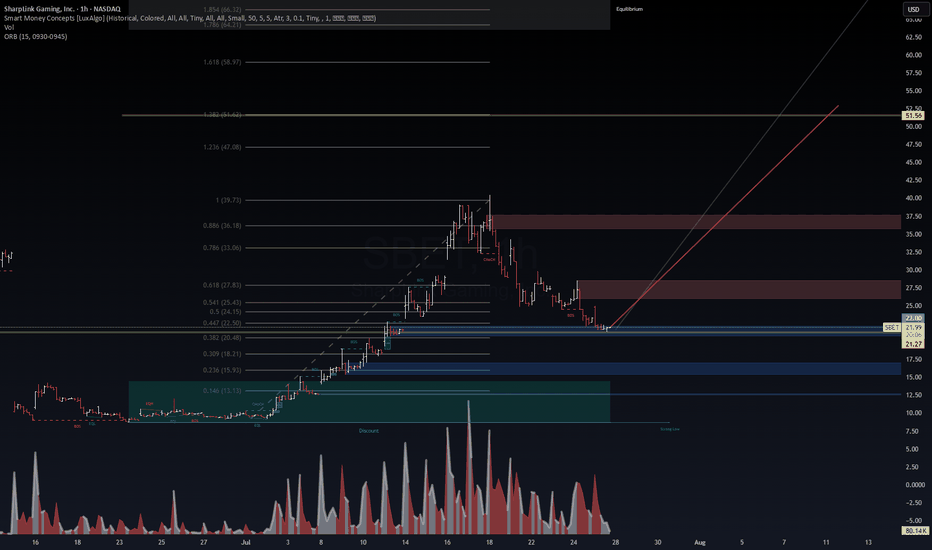

SBET is sitting at a critical support zone (21.0–21.3), right inside the 0.382 Fibonacci retracement. VolanX signals accumulation as volume cools down, setting up for a possible next leg higher.

Key Levels to Watch

Support: 21.0 – 21.3 (Fib 0.382 + structure base) 🛡️

Breakout Zone: 24.8 – 27.8 (Fib 0.5 – 0.618) ⚡

Targets: 33.0 – 36.0 🎯 | Long-term squeeze zone: 51.5 – 64.0 🏆

VolanX Signal

Bullish Bias: As long as 21 holds, liquidity favors upside.

Volume Clue: High spikes suggest prior distribution is cooling, potentially loading for a run.

Momentum Trigger: Close above 24.8 confirms buyers stepping in.

Risk Management

Stop-Loss: 20.4 (below structure) ⛔

Scale Strategy: Add on confirmation above 24.8 and 27.8 to ride the trend.

Profit Zones: 27.8 (TP1) → 33–36 (TP2) → 51+ (runner target).

Question: Are we seeing a base for another SBET explosion or just a pause before deeper discount?

#SBET #Fibonacci #VolanX #TradingView #BreakoutWatch #LiquidityFlow 🚀📊

SBET – VolanX Probabilistic Targets (1–3 week horizon)

For informational/educational purposes only. Not financial advice.

📈 Bullish Paths

P1: Bounce to 24.8–25.5 (Fib 0.5 / structure reclaim) → 58%

Trigger: 21.0–21.3 holds + momentum close above intraday VWAP.

P2: Extension to 27.8 (0.618) / first supply → 38%

Trigger: Clean acceptance >24.8 with rising volume & improving tape.

P3: Squeeze into 33–36 (0.786–0.886 + supply) → 24%

Trigger: Options/flow flip long (OTM calls clustering) + BOS over 27.8.

P4: Parabolic leg to 51.6–64.2 (1.382–1.786) → 10%

Trigger: Narrative + liquidity vacuum (low float + IV expansion).

(Probabilities are conditional—each higher target assumes confirmation of the one before it.)

📉 Bearish Paths

N1: Slip under 21 → 18.2–19.0 (0.309/discount shelf) → 27%

Trigger: Failure to defend 21 with increasing sell volume.

N2: Deeper flush to 16.6 (0.236) zone → 17%

Trigger: Persistent risk-off / liquidity drain, IV spike without demand.

N3: Capitulation toward 13.1 (0.146) / prior demand → 6%

Trigger: Macro shock or failed financing/newsflow, liquidity gap.

🧠 VolanX Read (today)

Bias slightly bullish as long as 21.0–21.3 holds. The engine scores Path P1 > P2 > N1. Expect chop → impulsive move once 24.8 is cleanly reclaimed or 20.4 is lost.

🛡️ Risk Management

Invalidation (swing): Daily close < 20.4.

Sizing: 0.5–1.0% account risk; micro-cap jump risk.

TP ladder: 24.8 ➜ 27.8 ➜ 33–36 ➜ leave runner for 51+.

Adjust: Move to BE after 24.8 reclaim; trail under last 4h HLs.

SBET Break Out!SharpLink Gaming (SBET) is an under-the-radar play in the evolving sports betting and iGaming infrastructure sector, and while it's a micro-cap with high risk, the upside is significant if the company continues to execute. My bullish case rests on three pillars:

1. Niche Focus in Affiliate Conversion

SBET is positioning itself not as a sportsbook, but as the tech bridge between sports content and betting platforms. Its proprietary platform, C4, uses behavioral data to optimize how users are funneled toward legal betting operators. As regulatory clarity grows in more U.S. states, that funnel becomes more valuable — and scalable. I'm betting that affiliate efficiency and direct-response performance marketing will become critical differentiators, and SBET has a first-mover advantage in this niche.

2. Possible Acquisition Target

Given the trend of consolidation in the sports betting ecosystem (e.g., PointsBet/Fanatics, Penn/Barstool/ESPN), I see SBET as a low-cost acquisition candidate for a mid-size sportsbook or media operator looking to vertically integrate conversion tools. A buyout at even modest valuation multiples could offer 5x–10x upside from current levels.

3. Improved Balance Sheet & Strategic Refocus

SBET recently completed divestitures and restructurings that reduced liabilities and sharpened its operational focus. With a cleaner cap table and more targeted business model, I believe the risk-reward profile has meaningfully shifted. Any uptick in licensing agreements, user metrics, or affiliate revenues could catalyze a re-rate from the current sub-$10M market cap.

Unusual Volume Surge in $SBET — What’s Going On?NASDAQ:SBET is up 24.11% today, but the accumulation pattern seems... off. Volume looks suspiciously inflated.

Is this just a short-term squeeze or is there something deeper brewing behind the scenes?

Anyone familiar with the fundamentals or insider activity on this name? Drop insights below — curious to see what others are picking up on.

Let me know if you want:

A more technical tone (with indicators like OBV or Acc/Dist)

A follow-up chart analysis

A life-changing SBET long ideaSBET stock presents an amazing long opportunity that has a potential to do over 100x. After the break out of a down trend line, price retraced to the support, with price closing above this support level.

To advantage of this long opportunity, you can buy from the current market price while the exit can be at $1.34 and the targets can be at $123.70, $178.48, $541.22, $1041.90 and the final target at $2155.20.

Confluences for the long opportunity are as follows:

1. Break out of down trendline

2. Retest of the down trendline and support level.

3. Bullish divergence signal from awesome oscillator.

Disclaimer: This is not a financial advice. The outcome maybe different from the projection. Don't take the signal if you're not willing to accept the risk.

$30 easy by 2026I'm holding the 1/16/26 25C those are the highest and furthest out options you can get on hood. Bought at 1.55 on 7/2 now worth 3.30 good entries if eth pulls back would be 12 and 10 best case. I see this running quick I will sell atleast half at 30. They hold and are staking over 500M worth of eth largest amount for any publicly traded company, yeild will be great for them but they are obviously selling shares to purchase eth so there's plenty of risk company only has 5 employees according to hood still under 1B last time I checked. 50ma is around 16 should be a clear path to 30 maybe psychological resistance at 20.

7/2/25 - $sbet - Another way to juice sbet orange7/2/25 :: VROCKSTAR :: NASDAQ:SBET

Another way to juice sbet orange

- in this giddy money printer go brr expectation tape and back to ATH on the index, it's an interesting point to look for names where you'd own it... but where it might be non-obvious and where IV is high

- as a point of reference, take $sbet. 1.5x mnav ETH treasury w/ some gaming ops, biggest treasury outside of eth foundation, eth is probably actually underwrite-able (not a word i know) from a convert/ perferred perspective, where a treasury *really* gets yield on it's stack

- I can sell the $10 strike aug 15 calls for $1.8 rn (and have started doing this, most of that volume today is me lol)

- point here is...

1/ i think in the next 6-18 mo. ETH will be probably $4-5k. does this mean it doesn't go to $1.5-2k in the meanwhile? and this thing could trade at 1x mnav in the immediate term? if that were the case, say $2.5k eth (so -20% plus or minus) and then 1.5x mnav to 1x mnav = another 30% on top of this. so you're looking at -50% (or more) so a $5/shr stock. would i buy it there? hell yeah. bottom w/ upside leverage w/o any expiry. it's like a call option that never expires at that point

- but in the meanwhile... do i have conviction this thing apes higher to the teens? 20s? no way jose.

- so i can buy a pile of shares here at $9.5, "sell" $10 strike for $1.8/shr and collect about 20% (1.8/9.5) for a month and a half. if thing goes to 20s... oh well, i am able to take bigger size at this stage than i'd otherwise be willing to take... bc my basis goes to $7.7/shr (9.5-1.8) and therefore my "downside" is a more reasonable 35%

- "V 35% downside is horrendous"

- lol - welcome to my probability mindset. I don't mind 20-40% max drawdown if i have visibility to multiple X's and also believe i would be adding in that drawdown instead of saying "shoot need to cut" ... and thinking it could do -60% or more on my basis. i don't ever like putting myself in a situation where i require more than 1x to breakeven

- therefore, let's play the market marker game. sit on our hands for the next month and a half. collect some premium. wish the best to our friends at SBET but be a bit unconcerned about the ST price action

V

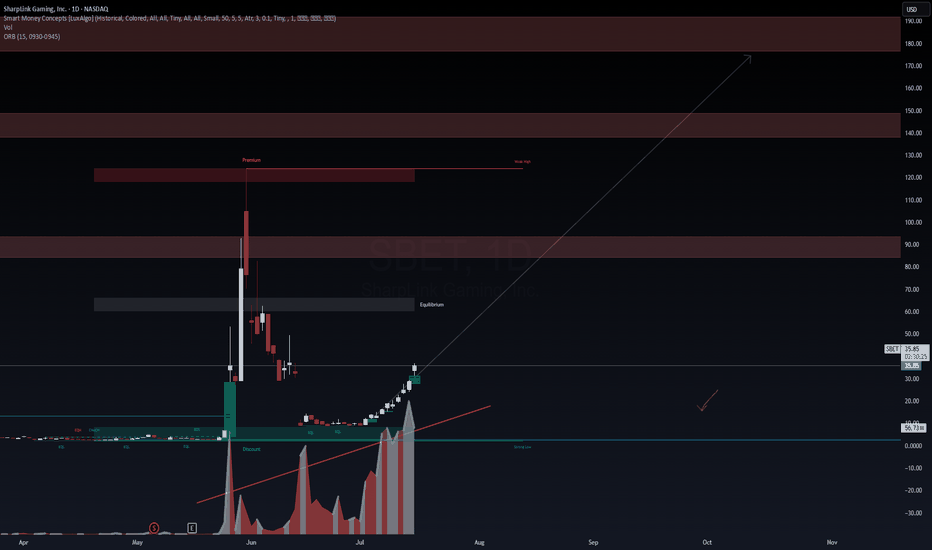

SharpLink Gaming Inc (SBET) - Falling Wedge & Inverse H&S🚀 SharpLink Gaming ( NASDAQ:SBET ) – Ethereum, Joe Lubin & a Bullish Setup

SharpLink Gaming has undergone a bold transformation: the company is now the largest public holder of Ethereum (ETH), with ~198,000 ETH acquired since June 2025. Over 95% of it is staked, already earning 200+ ETH in rewards – turning ETH into a yield-bearing treasury asset.

Driving this shift is Joe Lubin, co-founder of Ethereum and CEO of ConsenSys, who recently became Chairman of SharpLink. Under his leadership, SBET is betting big on Ethereum as “digital capital”, aiming to merge iGaming and Web3.

📊 Technical Setup:

SBET is forming a falling wedge and an inverse head and shoulders – both classic bullish reversal patterns. After a post-announcement retracement, the chart suggests growing potential for a breakout as fundamentals strengthen.

🧠 My thesis: This is MicroStrategy playbook 2.0 – but with ETH instead of BTC. SharpLink gives equity exposure to Ethereum + staking yield + visionary leadership.

🔔 Worth watching closely.

⚠️ Always do your own investment research and make your own decisions before investing.

7/1/25 - $sbet - How I'm trading this7/1/25 :: VROCKSTAR :: NASDAQ:SBET

How I'm trading this

- tl;dr, this is the first *larger* eth "treasury" attempts

- while the world is focused on AMEX:BMNR today at 10x NAV, this sits quietly at 1.5x nav

- there are two ways shareholders who would buy, say, at today's price would make an "eth yield"

- 1/ co raises debt, converts, prefs etc. any flavor and uses this to buy ETH and ETH appreciates in excess of this yield. my sense is this is more difficult "today" given the institutional view of BTC remains *hard enough* (even tho, really, it's not). but with stable coins becoming more in focus, this gives important life to eth narrative in coming cycle (more on this below)

- 2/ the mNAV is allowed to expand. if i raise at say 1.5x MNAV and then the stock appreciates toward say 3x MNAV and i raise there again to buy eth... the original holders essentially got a pro-rata distribution in excess of their initial stake. where the logic, here, fails... is that if this is your *only* way to raise $... eventually you collapse back to mnav, essentially... the inverse is also true. if you buy at 3x mnav and stock goes to 2x mnav, uh oh. it requires ever-increasing mnav. we know from BTC treasuries this might be up to 5x (mstr) and up to 10x (metaplanet) and really just depends on your story, size, mgmt, ability to raise outside of just equity etc. etc.

- now with this all being said... we look at something like AMEX:BMNR today and there are two main outcomes

- 1/ 10x mnav is too high and likely they're advantaged to raise here and dilute current shareholders to buy ETH and in essence it's tough to imagine much more mnav acceleration (but we *are* in that whacky tape and people are just trading price -- i know this from some comment i read today). fair. if this is the case, flows to NASDAQ:SBET should be very positive

- 2/ mnav from AMEX:BMNR start to collapse toward say 5x and this affects sentiment for other "eth treasury" co's, namely NASDAQ:SBET and this thing goes to 1.2x mnav vs. say 1.5x today... no bueno

-3/ there are others (two others), but above is 80% I think of pie

so why eth? aren't you a BTC only guy V?

- mm yeah BTC is the only commodity

- but i also trade stocks, tech etc. and that's just want these other things are Eth, Sol etc.

- with NASDAQ:HOOD launching their L2 on LSE:ARB the other day, tokenizing stocks, with the realization that banks will want to float and distribute their own stables across crypto rails sooner vs. later (and legislation that's allowing for it... more stables = stronger dollar and USD dominance globally)... CRYPTOCAP:ETH will earn the lionshare of the upside here.

- of course flows will eventually find their way into $sol... CRYPTOCAP:SUI , NYSE:SEI , etc. etc. but for now CRYPTOCAP:ETH is probably the lowest-risk way to play this

- I'm not ruling out that our garden variety pullback sends BTC back to $90k and you know what happens when BTC sneezes... everyone else catches a flu. So that could really hamper CRYPTOCAP:ETH action short term.

- But I like the idea of playing not only CRYPTOCAP:ETH at a *reasonable* valuation here (you do pay 50% more! keep that in mind), but there seems to be a willingness to overpay (as AMEX:BMNR shows). so i'm content to neck out here to capture a 50-100% move. but small enough to either size up, look elsewhere and/or close with a loss without any flesh wounds.

tl;dr... if u like $bmnr... u should like NASDAQ:SBET more.

V

SBET | I'll Bet On This One | LONGSharpLink Gaming Ltd. operates as an online technology company that connects sports fans, leagues, and sports websites to sports betting and iGaming content. It operates through Affiliate Marketing Services United States, Sports Gaming Client Services, Enterprise Telecom Expense Management, and Affiliate Marketing Services International segments. The company collects information on potential U.S. domiciled sports bettors, connects them with contextual sports betting content, and converts them to paying sports betting customers, as well as offers sports betting data to sports media publishers. It also provides development, hosting, operations, maintenance, and service of free-to-play games and contests; and solutions for telecommunications expense management, enterprise mobility management, call usage, and accounting software, as well as iGaming and affiliate marketing network, which focuses on delivering quality traffic and player acquisitions, and retention and conversions to global iGaming operator partner worldwide. The company was founded in 2019 and is headquartered in Minneapolis, Minnesota.

SBETSharplink Gaming Ltd (NASDAQ:SBET) I really like this stock, although the price sits at lows, I feel it deserves a much higher valuation. Volume looks healthy, and we are seeing up days on heavy volume and down days on very low volume, which is clearly a good sign that the stock is under institutional accumulation.

SBET Technical AnalysisSBET is a low float (<2m) sports betting company. With college and NFL football right around the corner, this stock is a steal at these prices. There was a solid rally at the end of the day today and will be looking for a big push come next week. There is clear resistance at 7.00 and could retrace and hopefully find support at the fib line below. Low volume= likely rejection. After a 7.00 break we can look to aim much higher.