SBUX trade ideas

Starbucks Chart Fibonacci Analysis 080325Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point 86/61.80%

Chart time frame:B

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress:C

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

What The 3 Step Rocket Booster Strategy Is In Short SellingTrading is not easy at all.

But with practice you will get it.

These past few days have been horrible because

i was so stressed i nearly fainted away not only

my body but also my spirit.

Sleeping is your number one goal.

I dont care if you have money or not.YOU HAVE TO SLEEP.

Because of this personal sleeping campaign am

off coffee and tea.These beverages are high in caffeine.

Speaking of coffee this company NASDAQ:SBUX isn't

doing well in USA.

It looks like Gen- Z are not using coffee spots

to socailise. As a 4% decline in business

transactions was recorded.

Even-though in China this store has an

Increase of

about 6% Has been recorded

thanks to delivery options.

Gen Z Still wants to stay at home.They

dont want to go outside and mingle.

Either way look at this stock price.

The candle stick pattern looks like

the falling three soldiers.

This pattern has been favored by the MACD

crossover above the zero line

It has to be above the zero line because

It indicates that the price is in a selling season.

Another catalyst:

-Negative earnings report.

Also to put the hammer on the nail.

This price is following the rocket booster strategy

from the sell side.

SO what is the rocket booster strategy?

The price has to be below the 50 EMA

The price has to be below the 200 EMA

The price should gap down

Remember to place a limit sell stop order

@$88.34

below the lowest low of the day.

Market orders are too expensive in the long term.

Rocket boost this content to learn more.

Disclaimer:Trading is risky please learn

risk management and profit taking

strategies.Also use a simulation trading account

before before you trade with real money.

Starbucks: Sideways Trend Continues Starbucks shares have remained in a sideways range over the past two weeks. This does not alter our primary outlook: We continue to see the stock in the dark green wave , which is expected to peak near the resistance level at $117.46. After reaching this high, we anticipate a move lower, with the stock dropping below the support at $71.53. However, since the intermediate high has not yet been established, an alternative scenario remains on the table: With a 31% probability, the dark green wave alt. could take hold first, driving the price below the $71.53 mark ahead of schedule.

📈 Over 190 precise analyses, clear entry points, and defined Target Zones - that's what we do (for more: look to the right).

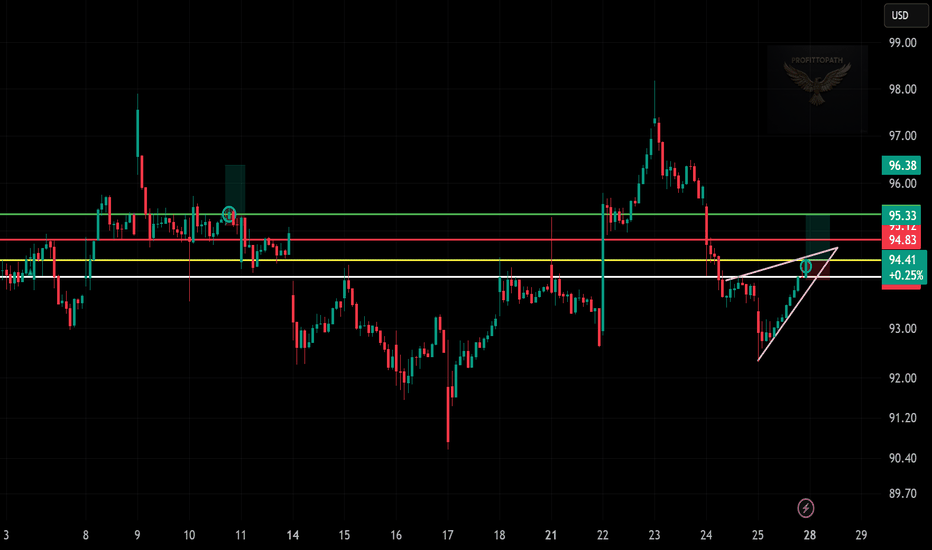

SBUX Long Trade Brewing! Caught a symmetrical triangle breakout☕t 📈

Momentum is building — this could push to $96+ if it clears resistance 🚀

📍 Entry: $94.46

📉 SL: $93.70

🎯 TP1: $95.31

🎯 TP2: $96.02

Let’s see how this cup fills up! 🔥

#SBUX #StarbucksStock #BreakoutTrade #TechnicalAnalysis #StockTrader #TradingView #ProfittoPath #BullishMomentum #SmartTrading

Cup and Handle with a shot of espresso: A bullish blendSince March, Starbucks ( NASDAQ:SBUX ) has been in a sustained downtrend, gradually rounding out a base. Now, the chart is showing early signs of a trend reversal.

Yesterday, price broke out of a bull flag formation on the daily chart and is now testing the $95.50 zone — a critical neckline level of a cup and handle pattern.

✅ Bullish Scenario:

A clean break and hold above $95.50 would confirm the cup-and-handle breakout.

If confirmed, this setup could target a measured move that eventually retests all-time highs.

More conservative traders may want to wait for a back test of the $95.50 neckline as confirmation, especially given its past historical significance.

⚠️ Bearish Invalidation:

A break and hold below $95.50 would invalidate the cup-and-handle pattern, suggesting the breakout has failed.

📌 This is a purely technical idea. No fundamentals involved.

As always, Happy Hunting!

This is not financial advice. Always do your own due diligence

Consumers sentiments changing direction in ChinaFor quite some years, it was the novelty, foreign and luxury brands that sits well with many Chinese who aspires a different kind of lifestyle, thanks to the western social media influence.

Fast forward years later, with the continuing depressed property market, tepid job market and deflationary environment where many middle income consumers are reluctant to spend more than necessary on the things they like.

Take for example, coffee. China was a tea drinking culture country but Starbucks managed to overturn the tide and slowly influence many youngsters especially those in tier 1-2 cities to switch to coffee. And they succeeded...........until recently............

Looking at the chart , we can see that Luckin coffee has rally while Starbucks is fighting hard to maintain its market shares, especially in China.

Same taste but cheaper , why not ? Consumers are practical when face with uncertainties especially in the job market. They will still spend money but want to stretch the dollar unlike before. This shift in consumer sentiments means a lot to the marketeers who need to change their pricing, promotional strategies...

PDF-RDF-LDT-BBA perceived fibonacci pattern was fulfilled when SB stock was at 117USD, seeing a drop that could have given us liquidation in a matter of a month, reaching a trend line waiting for a price change fulfilling a fibonacci retracement when the price reached 76USD, giving us liquidation to buy for two months and counting

Starbucks Breakout: Bullish Triangle Targets $94.90" 🚀📈"

📝 Caption/Description:

✅ Long Trade Setup on SBUX (30-min Chart)

🔹 Entry: $91.45

🔹 Stop Loss: $90.26

🔹 Target: $94.90

🔹 R:R Ratio: ~1:2.8

🔸 Breakout from symmetrical triangle with bullish momentum

🔸 Watch resistance around $93.10 for partial profits

📊 Strategy: Breakout + Trend Continuation

🦅 Powered by ProfittoPath

Starbucks Stock Chart Fibonacci Analysis 051225Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 85/61.80%

Chart time frame: D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

Starbucks Wave Analysis – 2 May 2025

- Starbucks reversed from support zone

- Likely to rise to resistance levels 85.00 and 90.00

Starbucks recently reversed up from the support zone between the key support level 76.20 (which stopped the previous wave A at the start of April) and the lower daily Bollinger Band.

The upward reversal from this support zone stopped the C-wave of the previous intermediate ABC correction (2) from the start of March.

Given the strength of the support level 76.20 and the bullish divergence on the daily Stochastic, Starbucks can be expected to rise to the next resistance levels 85.00 and 90.00.

Starbucks Stock Chart Fibonacci Analysis 042825Trading Idea

1) Find a FIBO slingshot

2) Check FIBO 61.80% level

3) Entry Point > 82.3/61.80%

Chart time frame:D

A) 15 min(1W-3M)

B) 1 hr(3M-6M)

C) 4 hr(6M-1year)

D) 1 day(1-3years)

Stock progress: A

A) Keep rising over 61.80% resistance

B) 61.80% resistance

C) 61.80% support

D) Hit the bottom

E) Hit the top

Stocks rise as they rise from support and fall from resistance. Our goal is to find a low support point and enter. It can be referred to as buying at the pullback point. The pullback point can be found with a Fibonacci extension of 61.80%. This is a step to find entry level. 1) Find a triangle (Fibonacci Speed Fan Line) that connects the high (resistance) and low (support) points of the stock in progress, where it is continuously expressed as a Slingshot, 2) and create a Fibonacci extension level for the first rising wave from the start point of slingshot pattern.

When the current price goes over 61.80% level , that can be a good entry point, especially if the SMA 100 and 200 curves are gathered together at 61.80%, it is a very good entry point.

As a great help, tradingview provides these Fibonacci speed fan lines and extension levels with ease. So if you use the Fibonacci fan line, the extension level, and the SMA 100/200 curve well, you can find an entry point for the stock market. At least you have to enter at this low point to avoid trading failure, and if you are skilled at entering this low point, with fibonacci6180 technique, your reading skill to chart will be greatly improved.

If you want to do day trading, please set the time frame to 5 minutes or 15 minutes, and you will see many of the low point of rising stocks.

If want to prefer long term range trading, you can set the time frame to 1 hr or 1 day.

SBUX Earnings📉 SBUX – Descending Flag Breakdown Confirmed

The Selloff Structure is Set. The Next Leg May Be Swift.

What we’re seeing here is a classic case of nested bearish structure across multiple timeframes:

🔻 Descending Flag (Daily & 4H)

— Continuation patterns stacked on each other

— Lower highs, lower lows compressing price toward collapse

📊 Volume Confirms

— Volume tapering inside flag = exhaustion

— Delta volume: –23.5% → distribution is real, not a fade

⚠️ No Bullish Divergence

— Momentum remains bearish

— No MACD support, no RSI rebound — nothing to slow the slide

🎯 Price Map

$83.86 = current

$64 = next major structure

$59 → ultimate support test

$53 → breakdown zone if earnings disappoint

🧠 Thesis:

This isn’t a random dip — it’s a systematic unwind.

Franchise closures, margin compression, and retail tightening are feeding a fundamental downgrade beneath a clean technical signal.

I'm positioned for further breakdown.

Earnings could be the trigger.

And I don’t want the reversal. I want the flush.

🧱🦅📉

Let the structure do its job.

#SBUX #ShortSetup #BearishFlag #BreakdownTrade #TradingViewAnalysis

Frothy FOMO Coffee: Why Starbucks May Face a Harsh ReckoningWe may be staring down a considerable downside in Starbucks’ share price — and I suspect the decline could be severe. When a genuine recession hits — not the softened, cosmetically massaged versions we've seen bandied about — discretionary spending is the first casualty. And let us be honest: a $7 small latte, regardless of its oat milk or seasonal syrup, is the very definition of discretionary.

Inflation over the past four years has not been a natural occurrence. It is the predictable consequence of reckless fiscal policies and excessive monetary accommodation — in plain English, wasteful government spending and money printing. These policies have inflated prices across the board, and coffee is no exception.

What is perhaps underappreciated by most analysts is the brewing effect of tariffs. Come September, we will begin to see the real impact of trade friction on coffee imports from major producers such as Brazil and Colombia. Coffee futures already hit all-time highs in February. Although prices have since pulled back, I view that retreat not as relief, but as the first ominous sign that something is amiss.

Starbucks operates globally, but its margins are still vulnerable to supply chain shocks and input cost inflation. As the economic pain spreads, we should expect average consumers — not just in the US, but in Europe, Asia, and elsewhere — to make different decisions. The morning coffee ritual may remain, but the $7 takeaway will be replaced by home-brewed alternatives and budget-conscious behaviour.

I foresee the possibility of a bear flag pattern luring investors back in with a short-term rally — a classic trap, falsely interpreted as recovery. But please, do not be fooled by this. I believe Starbucks stock could drop sharply later this year, with a potential downside target around $57.80.

This will not be a gentle correction. I expect it to be brutal — marked by layoffs, store closures, and perhaps a reckoning of Starbucks’ business model itself, which is built upon the illusion of small luxuries being affordable in all seasons.

For the rational investor, this is not a time for sentiment or brand loyalty. It is a time for analysis, discipline, and preparation.

This is not investment advice. Do your own research. I could be wrong.

Starbucks Corporation coffe?!Yes ! 100 Stock please ! (I just bought 100 shares)

Looks like Trump do not like coffe but nevertheles Starbucks are in Sweeden , France and other countries. First stock hit it get from taxes, but it will not affect the taste of the coffee

Large containers in the Netherlands and Germany are unloading fragrant coffee beans and transporting them all over Europe!

Coffee consumption will not be affected! We are addicted to delicious coffee, so the price of coffee on the stock exchange will rise again!

Wait for Starbucks will climb back up to 90.50 EUR per share. Just wait and order a onther sweet drink !

Chears !

OptionsMastery: Breakout Setup on SBUX!🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

Starbucks (SBUX) Brewing a Breakout? Don’t Miss This $100 BattleStarbucks (SBUX) 2-Hour Chart Breakdown

Hey traders, let’s dive into Starbucks (SBUX) on the 2-hour chart and see what’s cooking. The price is sitting at $99.65 right now, up a tiny 0.01%, but don’t let that small move fool you—this chart has been a wild ride lately, and I think we’re at a really interesting spot for a potential trade.

What’s Been Happening with the Price?

If you look at the chart, you’ll see Starbucks hit a high of $112.38 back on March 17th. That was the peak, and man, did it come crashing down after that! The price tanked all the way to $97.34 by early April, a pretty steep drop. Since then, though, things have calmed down a bit, and we’ve been stuck in this tight range between $97.34 and $100.00. Lately, the price has been pushing toward the upper end of that range, and it’s got my attention.

Let’s Talk Trends

From mid-March to early April, we were in a clear downtrend. You can see it on the chart—lower highs, lower lows, and a descending trendline that kept the price in check as it slid down. It was a bear’s paradise, and there’s even a sell signal marked on the chart from that $112.38 peak that caught a massive 27.96% profit on the way down. Not bad at all!

But now, things are starting to shift. After hitting that $97.34 low, the price has been consolidating, and just recently, it broke above that descending trendline. That’s a big deal because it tells me the bears might be losing their grip. We’re not in a full-on uptrend yet, but the momentum feels like it’s tilting toward the bulls, especially with the price testing that $100.00 level.

Key Levels to Watch

Let’s zoom in on the levels that matter here. On the downside, $97.34 has been a rock-solid support. The price has bounced off that level a couple of times in early April, so it’s a spot I’m keeping an eye on. If we drop back down, that’s where I’d expect buyers to step in again.

On the upside, $100.00 is the big resistance we’re testing right now. The price has struggled to break through here before, so it’s a critical level. If we can get a clean break above it, I think we could see a nice move higher. The next big resistance after that would be around $107.00, which was a swing high from late March, and then up toward $111.00 or even that $112.38 peak if things really get going.

What the Past Signals Tell Us

The chart has a couple of trade signals marked, which give us some context. That sell signal at $112.38 was a home run, as I mentioned—27.96% profit as the price collapsed. Then there’s a buy signal at the $97.34 low on April 5th, but that one only managed a peak profit of 0.27%. Not exactly a big win, and it makes sense because the price has been stuck in this range since then. It’s like the market’s been taking a breather, trying to figure out its next move.

Digging into the Technicals

Alright, let’s get into the nitty-gritty of what’s happening on the chart. That break above the descending trendline is a bullish sign for me. It’s like the price is saying, “I’m done with this downtrend, let’s try something new.” We’re also in this consolidation range between $97.34 and $100.00, and when I see a range like that, I know a breakout is usually coming. The question is, which way?

One thing that’s catching my eye is the potential for a double bottom pattern. We’ve got two tests of that $97.34 support, and if we can break above $100.00, that would confirm the pattern. If that happens, I’d measure the height of the pattern and project it upward, which could take us toward $107.00 as a first target. That’s something to watch for.

I’d love to see volume on this chart to confirm the breakout, but from the price action alone, it feels like there’s some buying interest building as we push toward $100.00. If we get a strong candle closing above that level, I’ll be a lot more confident in the bulls.

How I’d Trade This Setup

So, what’s the play here? I see a few ways to approach this, depending on what the price does next.

First, let’s talk about the bullish case. If we get a solid break above $100.00—ideally with a strong 2-hour candle and some good volume—I’d be looking to go long. My first target would be $107.00, and if we get some momentum, maybe even $111.00 or $112.38. I’d set my stop loss just below the recent swing low around $98.00 to protect myself in case this breakout fails. That trendline break and the potential double bottom make me think the bulls have a shot here.

On the flip side, if the price gets rejected at $100.00—and I’ll be watching for something like a shooting star or a bearish engulfing candle—I’d consider a short. If we drop back down, $97.34 is the first target, and if that support breaks, we could even see $94.00, which is a psychological level and a spot where I’d expect some buyers to show up. For a short, I’d set my stop loss just above $100.65 to give it a little room.

If you’re more of a scalper, you could play the range while we’re stuck in it. Buy near $97.34, sell near $100.00, and use tight stops outside the range—say, below $97.00 for longs and above $100.65 for shorts. It’s a decent way to grab some quick profits while we wait for the bigger move.

A Word on Risk

One thing I always remind myself is to keep risk in check. Starbucks has been volatile—look at that 27.96% drop from the peak! So, I’d be careful with my position size and aim for at least a 1:2 risk-reward ratio on any breakout trade. Also, keep an eye out for any news that might shake things up, like earnings reports or big economic data releases. Starbucks is in the consumer discretionary sector, so things like consumer spending trends or even coffee prices could move the stock.

The Bigger Picture

Speaking of the broader market, Starbucks can be influenced by how the NASDAQ 100 is doing, since it’s listed there. If the overall market is feeling optimistic, that could help push SBUX higher. On the other hand, if there’s a risk-off vibe, we might see that $100.00 resistance hold strong. It’s always good to check the bigger picture before jumping into a trade.

Wrapping It Up

So, where does that leave us? Starbucks is at a really interesting spot right now, testing that $100.00 resistance after breaking above the descending trendline. I’m leaning toward a bullish breakout, especially with that potential double bottom pattern, but I’ll be watching closely to see if we get confirmation above $100.00. If we do, I think $107.00 is a realistic target, with $111.00 or higher in play if the bulls really take control. But if we get rejected here, $97.34 is the level to watch on the downside.

For now, I’d say be patient and wait for the price to show its hand. Whether you’re looking for a breakout or playing the range, there’s definitely an opportunity here. Just make sure to manage your risk and stay on top of any news that might move the stock. Let’s see how this plays out I’ll be watching this one closely!