SMCI WEEKLY CALL SETUP (07/28/25)

### 🔹 SMCI WEEKLY CALL SETUP (07/28/25)

**Bullish Flow + Strong RSI = 🚀 Call Opportunity at \$62**

---

### 📊 TECHNICAL SNAPSHOT

* **RSI (Daily + Weekly):** ✅ Above 55 — clear bullish strength

* **Weekly Close:** 🔼 Broke prior highs — momentum continuation likely

* **Volume Ratio:** Slightly we

Key facts today

Super Micro Computer (SMCI) expects an 11% revenue rise to $5.893 billion for Q4 2025, up from $5.31 billion last year. Results will be reported on August 5, 2025.

Next report date

—

Report period

—

EPS estimate

—

Revenue estimate

—

2.04 USD

1.15 B USD

14.99 B USD

512.67 M

About Super Micro Computer, Inc.

Sector

Industry

CEO

Charles Liang

Website

Headquarters

San Jose

Founded

1993

FIGI

BBG000MYZDJ3

Super Micro Computer, Inc. engages in the distribution and manufacture of information technology solutions and other computer products. Its products include twin solutions, MP servers, GPU and coprocessor, MicroCloud, AMD solutions, power supplies, SuperServer, storage, motherboards, chassis, super workstations, accessories, SuperRack and server management products. The company was founded by Charles Liang, Yih-Shyan Liaw, Sara Liu, and Chiu-Chu Liu Liang in September 1993 and is headquartered in San Jose, CA.

Related stocks

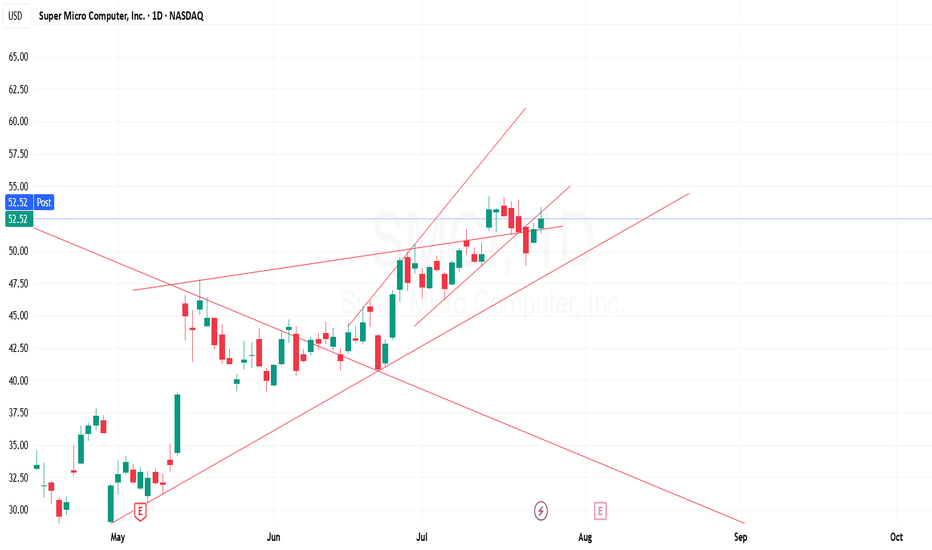

SMCI Short-Term Put PositionSMCI is currently struggling to break past a key historical trend line around $62–$63, a level that acted as resistance multiple times over the past year. The stock briefly broke above $60, but failed to hold the breakout, signaling potential exhaustion. Price is approaching overbought territory wit

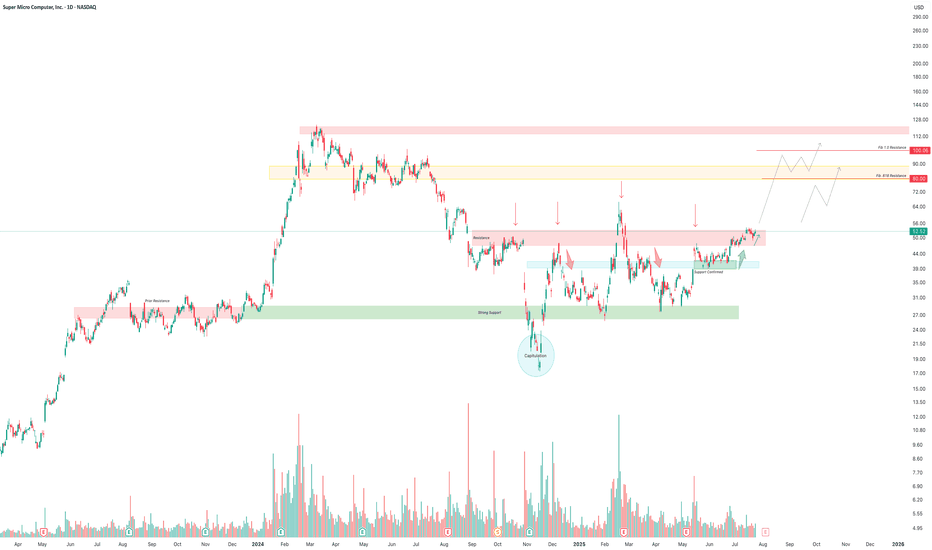

SMCI to Previous Highs!Super Micro Computer Inc. (SMCI) has formed a well-defined accumulation base between $26 and $46 after a major downtrend and capitulation event in late 2024. Price action has since transitioned from panic selling to structured accumulation, confirmed by:

Strong support at $26–28, tested multiple ti

SMCI is at 60$ USD WE have made it. TXSGanG- 📈 The current price is around $60.11, so it’s very close to the trigger.

- 🧭 Technical indicators (based on TradingView): Moving averages and oscillators are neutral to slightly bullish.

🎯 Sell Zone: $65 to $73 USD

- 🟡 $65: A middle-ground target for those looking to optimize without too much

SMCI: When a chart says it’s time to reconnect with the AI hypeOn the daily chart, Super Micro Computer Inc. (SMCI) is showing a clean bullish setup. Price broke out of a descending trendline (green dashed), confirmed it with a retest, and is now consolidating above the breakout zone. The golden cross — where the MA50 crossed above the MA200 — confirms a long-t

SMCI - Uptrend resumingNASDAQ:SMCI is looking at a return of the uptrend after breaking above its corrective downtrend line and buying pressure is seen resuming. Overall major trend is on the upside and strong.

Momentum:

Long-term MACD: histogram is positive and signal line is rising steadily

Stochastic Oscillator:

Looking at monthly chart on SCMI I see 3 white soldiers to $100Not that much to describe as the three white soldiers on the monthly candle chart are pretty self explanatory. One of the more basic readings for good times ahead. That’s aside from the fundamentals of having most of the ai data centers using its liquid cooled state of the art chassis’ designed for

SMCI going to breakout soon, targeting $200NASDAQ:SMCI hasfound support at $28, it is currently trading around the $46 level. It is attempting to test the $50-$61 range for the third time and will likely turn this level into support with a breakout.

$200 could be a good psychological target. The relative strength against the SP:SPX is a

See all ideas

Summarizing what the indicators are suggesting.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

An aggregate view of professional's ratings.

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Neutral

SellBuy

Strong sellStrong buy

Strong sellSellNeutralBuyStrong buy

Displays a symbol's price movements over previous years to identify recurring trends.

SMCI6004752

Super Micro Computer, Inc. 2.25% 15-JUL-2028Yield to maturity

−0.45%

Maturity date

Jul 15, 2028

SMCI6021416

Super Micro Computer, Inc. 0.0% 01-MAR-2029Yield to maturity

−2.45%

Maturity date

Mar 1, 2029

See all SMCI bonds

Frequently Asked Questions

The current price of SMCI is 56.64 USD — it has decreased by −3.95% in the past 24 hours. Watch Super Micro Computer, Inc. stock price performance more closely on the chart.

Depending on the exchange, the stock ticker may vary. For instance, on NASDAQ exchange Super Micro Computer, Inc. stocks are traded under the ticker SMCI.

SMCI stock has risen by 8.61% compared to the previous week, the month change is a 20.03% rise, over the last year Super Micro Computer, Inc. has showed a −19.61% decrease.

We've gathered analysts' opinions on Super Micro Computer, Inc. future price: according to them, SMCI price has a max estimate of 70.00 USD and a min estimate of 15.00 USD. Watch SMCI chart and read a more detailed Super Micro Computer, Inc. stock forecast: see what analysts think of Super Micro Computer, Inc. and suggest that you do with its stocks.

SMCI reached its all-time high on Mar 8, 2024 with the price of 122.90 USD, and its all-time low was 0.36 USD and was reached on Nov 13, 2008. View more price dynamics on SMCI chart.

See other stocks reaching their highest and lowest prices.

See other stocks reaching their highest and lowest prices.

SMCI stock is 7.08% volatile and has beta coefficient of 3.26. Track Super Micro Computer, Inc. stock price on the chart and check out the list of the most volatile stocks — is Super Micro Computer, Inc. there?

Today Super Micro Computer, Inc. has the market capitalization of 33.80 B, it has increased by 5.68% over the last week.

Yes, you can track Super Micro Computer, Inc. financials in yearly and quarterly reports right on TradingView.

Super Micro Computer, Inc. is going to release the next earnings report on Aug 5, 2025. Keep track of upcoming events with our Earnings Calendar.

SMCI earnings for the last quarter are 0.31 USD per share, whereas the estimation was 0.41 USD resulting in a −24.46% surprise. The estimated earnings for the next quarter are 0.44 USD per share. See more details about Super Micro Computer, Inc. earnings.

Super Micro Computer, Inc. revenue for the last quarter amounts to 4.60 B USD, despite the estimated figure of 5.01 B USD. In the next quarter, revenue is expected to reach 5.98 B USD.

SMCI net income for the last quarter is 108.78 M USD, while the quarter before that showed 320.60 M USD of net income which accounts for −66.07% change. Track more Super Micro Computer, Inc. financial stats to get the full picture.

No, SMCI doesn't pay any dividends to its shareholders. But don't worry, we've prepared a list of high-dividend stocks for you.

As of Aug 2, 2025, the company has 5.68 K employees. See our rating of the largest employees — is Super Micro Computer, Inc. on this list?

EBITDA measures a company's operating performance, its growth signifies an improvement in the efficiency of a company. Super Micro Computer, Inc. EBITDA is 1.42 B USD, and current EBITDA margin is 8.35%. See more stats in Super Micro Computer, Inc. financial statements.

Like other stocks, SMCI shares are traded on stock exchanges, e.g. Nasdaq, Nyse, Euronext, and the easiest way to buy them is through an online stock broker. To do this, you need to open an account and follow a broker's procedures, then start trading. You can trade Super Micro Computer, Inc. stock right from TradingView charts — choose your broker and connect to your account.

Investing in stocks requires a comprehensive research: you should carefully study all the available data, e.g. company's financials, related news, and its technical analysis. So Super Micro Computer, Inc. technincal analysis shows the buy rating today, and its 1 week rating is strong buy. Since market conditions are prone to changes, it's worth looking a bit further into the future — according to the 1 month rating Super Micro Computer, Inc. stock shows the buy signal. See more of Super Micro Computer, Inc. technicals for a more comprehensive analysis.

If you're still not sure, try looking for inspiration in our curated watchlists.

If you're still not sure, try looking for inspiration in our curated watchlists.